Tax Deduction In Germany Web Your guide to tax deductions in Germany for 2022 Filing your tax return in Deutschland Find out which expenses are tax deductible Plus learn about a practical tool designed to make your 2021 tax return a breeze 01 March 2023

Web 28 Dez 2023 nbsp 0183 32 There are six tax classes Steuerklassen in Germany The combination of tax class 3 and 5 is only possible for married couples if both spouses live in Germany Web If you are living in Germany and earning a gross annual salary Bruttogehalt of 49 260 or 4 105 per month the total amount of taxes and contributions that will be deducted from your salary is 17 348 This means that your net income or salary after tax Nettogehalt will be 31 912 per year 2 659 per month or 614 per week

Tax Deduction In Germany

Tax Deduction In Germany

https://germansuperfast.com/wp-content/uploads/2022/06/21-Types-of-Tax-Deduction-in-Germany.jpg

Tax Deductions In Germany 10 Deductible Expenses

https://qonto.com/blog/images/512e2befbc2330117aa668b5641cc9dd.png

Germany Tax Law Amendments 2023 Eclear Ag

https://eclear.com/wp-content/uploads/germany-relief-economy.png

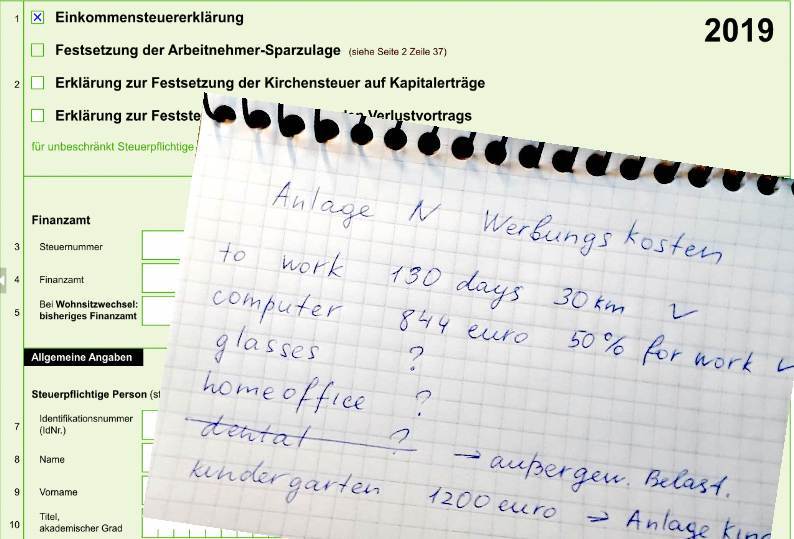

Web 3 Sept 2023 nbsp 0183 32 For the second home at the place of employment you can deduct up to 1 000 per month for rent ancillary costs and double home tax This is how you do it for your tax deductions There are a lot of ways available to save tax These are often separated into personal and professional categories Web 25 Okt 2022 nbsp 0183 32 German tax law allows for numerous lump sums tax allowances and deductions that you can use to decrease your taxable income and generate huge tax savings Many of them don t even require proof or receipts and sometimes you can deduct the full amount even if your expenses aren t that high

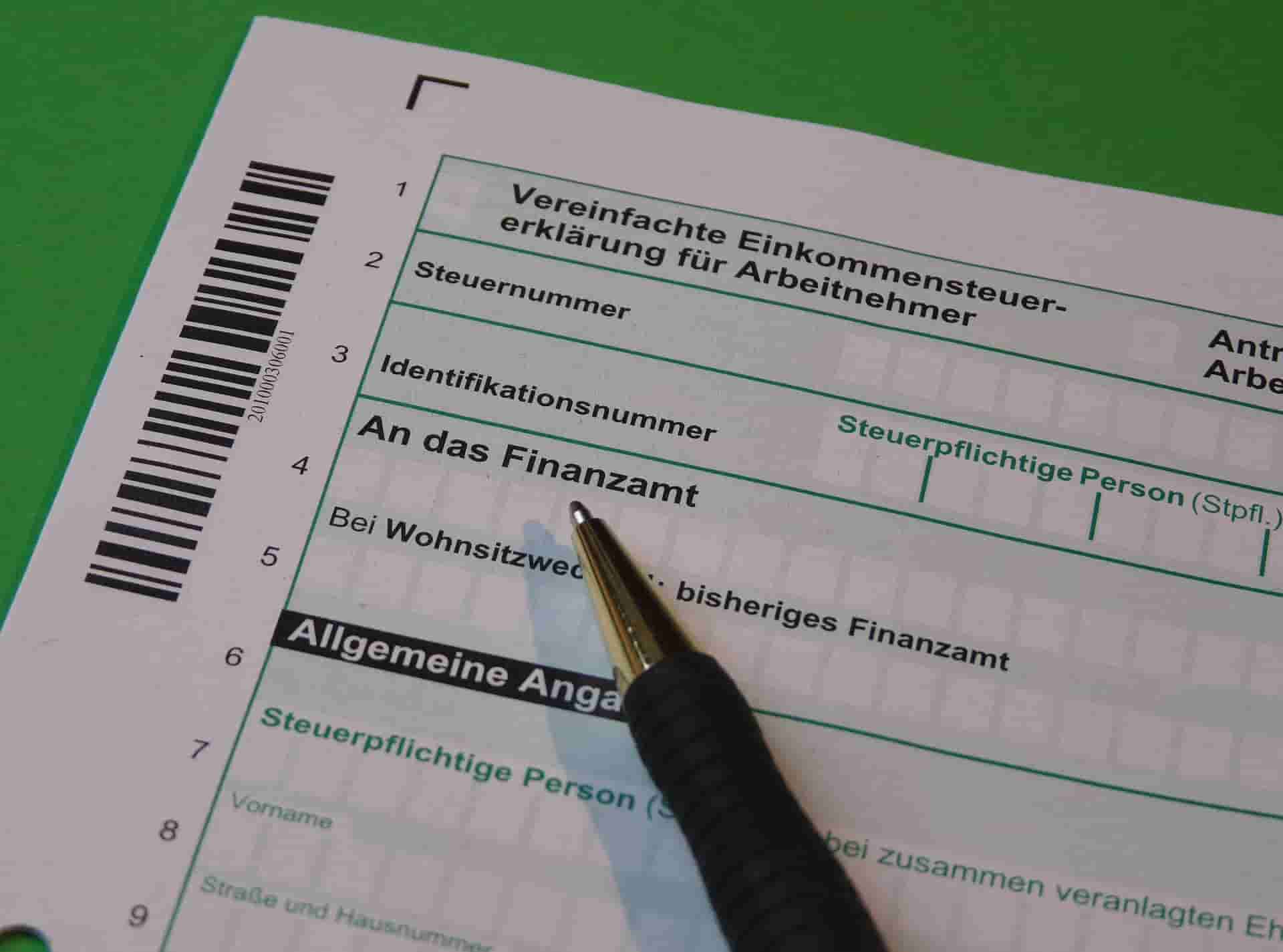

Web 15 Juli 2021 nbsp 0183 32 After submitting your tax return in Germany the tax office Finanzamt determines how much tax you have to pay as a taxpayer Furthermore the Finanzamt will determine whether you still owe money to the tax authorities or whether you should get money back depending on your expenses and type of income New Web 14 Dez 2023 nbsp 0183 32 To calculate the German income tax you owe on your wages you can use the SteuerGo tax calculator Personal tax allowance and deductions in Germany Making the most of the tax allowances and deductions

Download Tax Deduction In Germany

More picture related to Tax Deduction In Germany

All Income Tax Deduction in German Tax Return A D

https://expat-in-germany.com/wp-content/uploads/2021/01/return_tax.jpg

Free Tax Deduction Business 3d Illustration Rendering 11629341 PNG With

https://static.vecteezy.com/system/resources/previews/011/629/341/original/tax-deduction-business-3d-illustration-rendering-png.png

Overview Of The Almighty Tax Deduction For Small Businesses RACOMI

https://www.racomi.org/wp-content/uploads/2023/08/overview-of-the-almighty-tax-deduction-for-small-businesses.png

Web Tax deductions in Germany Most people submitting a tax return will take advantage of tax deductions in order to reduce their overall tax liability and increase the likelihood that they will receive a refund Under the German tax system it is possible to claim many different types of payments as tax exempt Web To apply for tax deductions The tax service has sent a letter requesting a return In Germany taxpayers file a tax return annually with their local tax office You can find out to which branch of the tax office you have to submit your tax information by contacting the municipality where you are registered

Web Below is the latest German Income Tax Calculator 2023 which can be used to calculate income tax social security and church taxes etc which form part of the typical payroll deductions in Germany Note this is for quick salary calculations for maore advanced features and detailed payroll features use the German Salary and Payroll Web 16 Juni 2020 nbsp 0183 32 Even though tuition fees are relatively low in Germany it can amount to a few hundreds or thousands of euros per year Those costs are considered tax deductible in Germany limited to a maximum of 6000 per year when this is your first degree undergraduate degree

Tax deduction checklist Etsy

https://i.etsystatic.com/37903484/r/il/61e14b/5462529921/il_1588xN.5462529921_cvyy.jpg

Tax Return In Germany 2022 English Guide My Life In Germany

https://www.mylifeingermany.com/wp-content/uploads/2019/05/tax_salary-in-Germany_are-you-getting-paid-enough_my-life-in-germany_hkwomanabroad-min.jpg

https://n26.com/en-de/blog/guide-to-tax-deductions

Web Your guide to tax deductions in Germany for 2022 Filing your tax return in Deutschland Find out which expenses are tax deductible Plus learn about a practical tool designed to make your 2021 tax return a breeze 01 March 2023

https://www.simplegermany.com/tax-class-germany

Web 28 Dez 2023 nbsp 0183 32 There are six tax classes Steuerklassen in Germany The combination of tax class 3 and 5 is only possible for married couples if both spouses live in Germany

Premium Photo Tax Deduction

Tax deduction checklist Etsy

Restaurant Tax Deduction Checklist Template In Word Apple Pages 70875

Tax Deduction Planner Graphic By Watercolortheme Creative Fabrica

Example Tax Deduction System For A Single Gluten free GF Item And

Kurzstudie Tax Deduction Scheme Belgien EUKI

Kurzstudie Tax Deduction Scheme Belgien EUKI

How To Calculate Standard Deduction In Income Tax Act Scripbox

A Look At The Tax Deduction Potential Of Strata Rates

EXCEL Of Tax Deduction Form xlsx WPS Free Templates

Tax Deduction In Germany - Web 2 Dez 2023 nbsp 0183 32 This Tax Class is crucial for determining how much taxes withheld income tax is deducted from the pay of an employee as well as in assessing the worth of a range of social benefits so that the taxpayer might be qualified A tax class can assign an employee to a class by authorities according to marital status and other factors