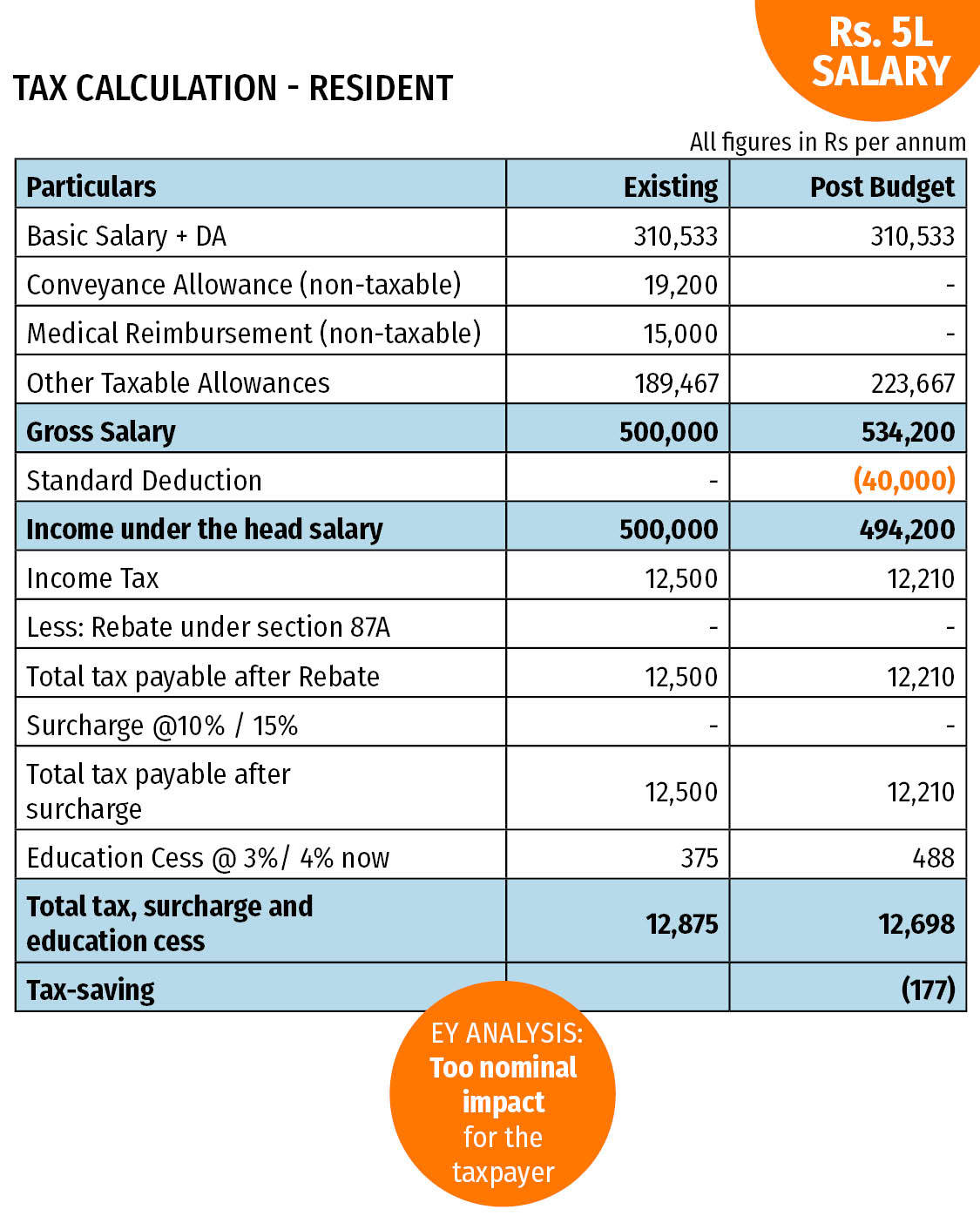

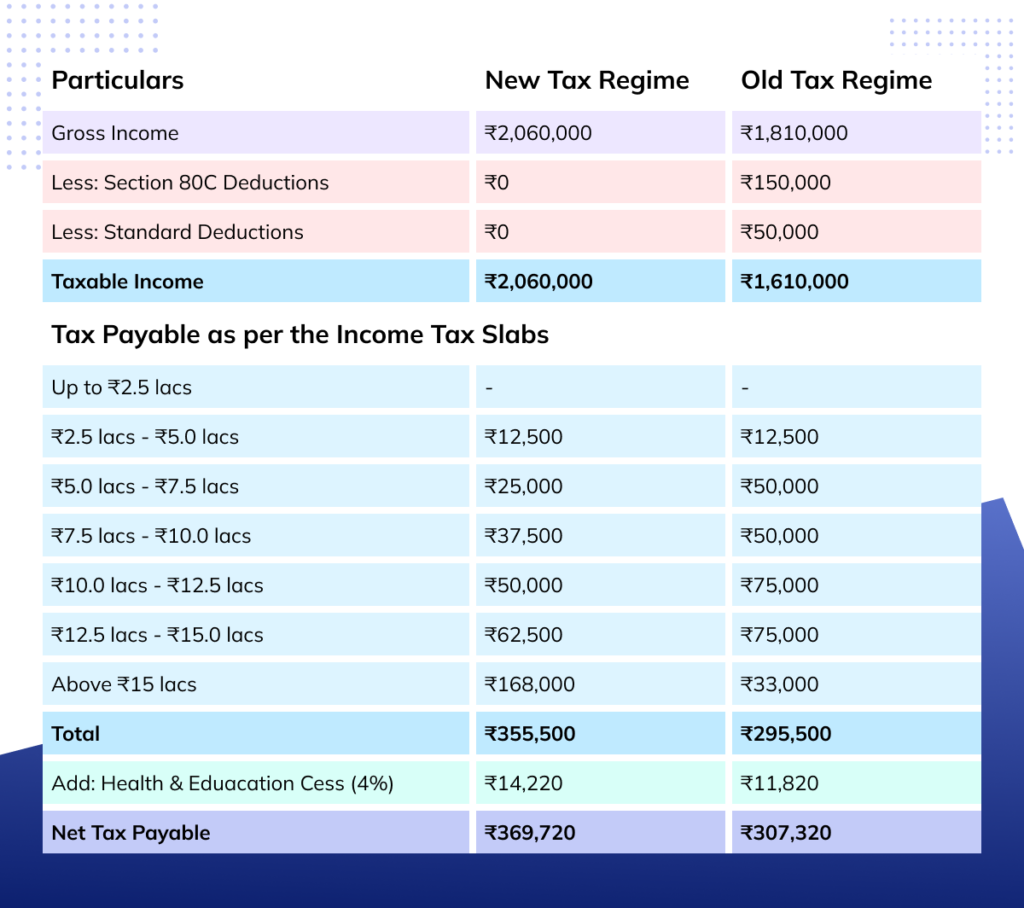

Tax Deduction In India The article explains the concept of income tax slabs under old and new regimes the revised tax rates for FY 2024 25 how to calculate income tax meaning of surcharge budget updates impact and

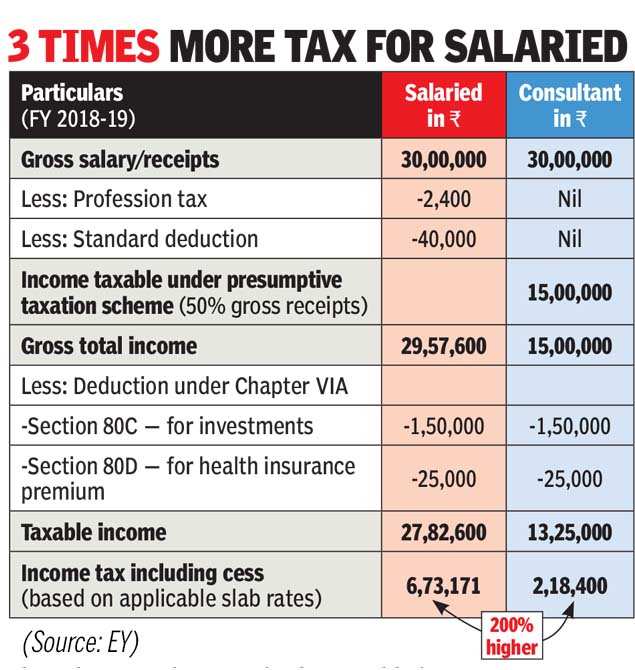

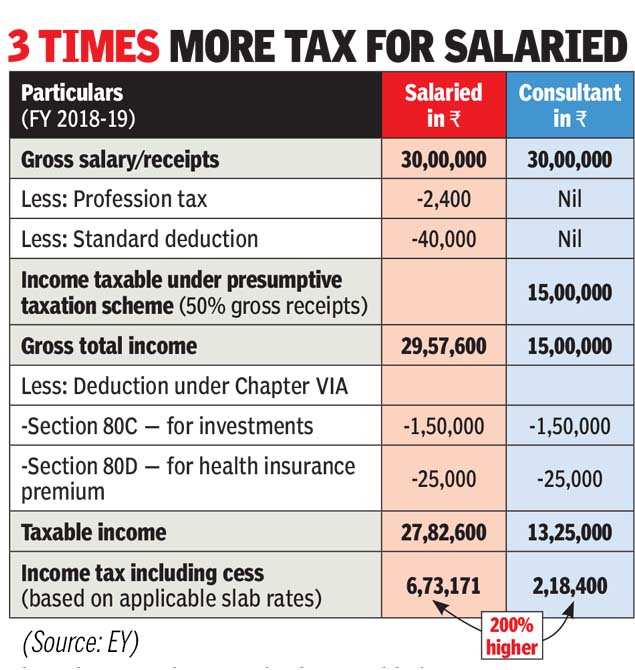

Section 80 Deductions A complete guide on Income Tax deduction under section 80C 80CCC 80CCD 80D Find out the deduction under section 80c for FY 2023 24 AY 2024 25 The Indian Income Tax Act provides for various deductions under sections 80C to 80U which can be claimed by an individual or a business entity while calculating

Tax Deduction In India

Tax Deduction In India

https://qph.fs.quoracdn.net/main-qimg-b5b49c904e4981c9a9f0ed28353fcafa

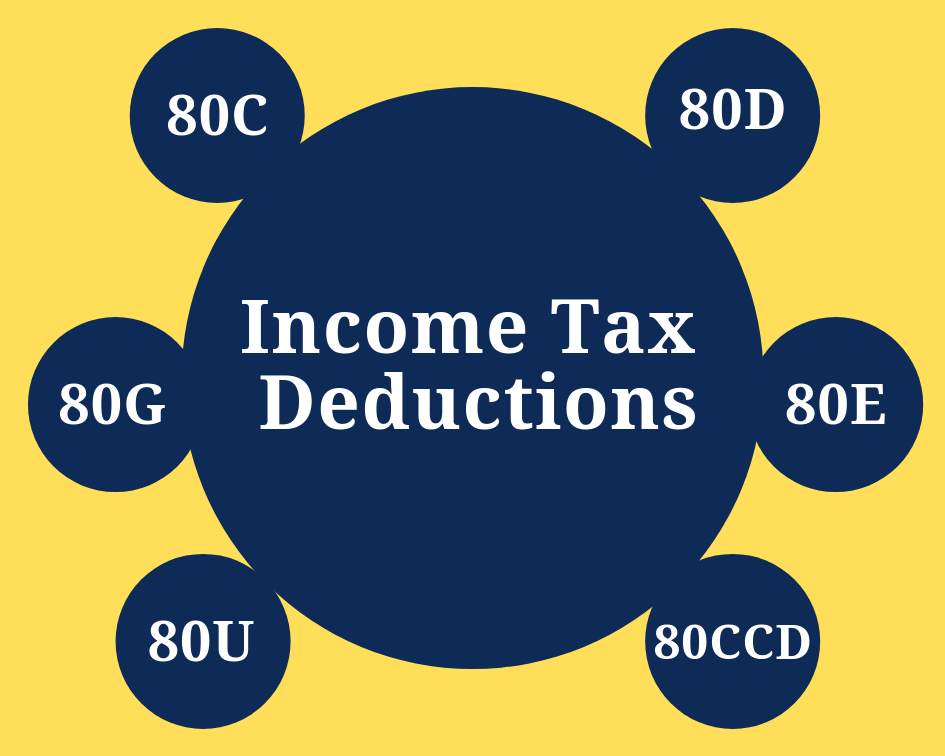

Union Budget 2019 Why Salaried Indians Need A Big Hike In Standard

https://static.toiimg.com/photo/imgsize-121969,msid-70000090/70000090.jpg

Income Tax Deductions In India Capitalante

https://capitalante.com/wp-content/uploads/2019/02/Income-Tax-Deductions-In-India.png

Calculate the tax on your income in India in a few simple steps through online income tax calculator Also check tax slabs tax regimes and how to calculate tax with examples Employment expenses A standard deduction of INR 50 000 is available while computing the taxable salary income Deduction from total income Personal deductions No

The Income and Tax Calculator service enables both registered and unregistered e Filing users to calculate tax as per the provisions of Income Tax Act Income tax rules Notifications etc by providing inputs with In India the total income tax deduction allowed depends on various factors such as investments expenses and contributions made during the financial year Common

Download Tax Deduction In India

More picture related to Tax Deduction In India

How Does Tax Deduction Work In India Tax Walls

https://img.etimg.com/photo/msid-62914496/resident_gti_5l_salary-std-ded.jpg

Online Salary Tax Calculator MckenzyJoani

https://razorpay.com/learn-content/uploads/2022/02/Facebook-post-17-1024x908.png

How Can NRIs Claim tax Deduction In India

https://images.livemint.com/img/2022/12/20/960x540/pexels-dziana-hasanbekava-7063765_1671508464916_1671509056902_1671509056902.jpg

Income Tax Calculator is a useful tool to determine tax liability with respect to income tax slabs and deductions available Use online income tax calculator available at Groww to The standard deduction on salary is a vital tax benefit for salaried individuals reducing taxable income and simplifying tax filing Its fixed amount and wide applicability offer

Viewers are advised to ascertain the correct position prevailing law before relying upon any document Disclaimer The above calculator is only to enable public to have a quick and Calculating income tax in India can be complex and intimidating especially for salaried individuals However it s a crucial aspect of managing personal finances

2018 Standard Deduction Chart

https://www.relakhs.com/wp-content/uploads/2018/04/Impact-of-Standard-Deduction-Rs-40000-on-income-tax-calculation-tax-liability-tax-savings-benefit-additional-tax.jpg

A Complete Guide On Tax Deduction In India Ebizfiling

https://ebizfiling.com/wp-content/uploads/2023/11/Understanding-Tax-Deductions.png

https://cleartax.in/s/income-tax-slabs

The article explains the concept of income tax slabs under old and new regimes the revised tax rates for FY 2024 25 how to calculate income tax meaning of surcharge budget updates impact and

https://cleartax.in/s/80c-80-deductions

Section 80 Deductions A complete guide on Income Tax deduction under section 80C 80CCC 80CCD 80D Find out the deduction under section 80c for FY 2023 24 AY 2024 25

Is There Any Benefit Of Tax Deduction In India On The Interest Paid On

2018 Standard Deduction Chart

Bank Interest Tax

What Are The Ways To Maximize The tax Deduction In India Quora

Proforma For Calculation Of Income Tax For Tax Deduction Income Tax

Applicability Of Tax Deduction At Source Under Section 195 On Payment

Applicability Of Tax Deduction At Source Under Section 195 On Payment

Should You Take The Standard Deduction On Your 2021 2022 Taxes

Tax deduction checklist Etsy

Tax Prep Checklist Tracker Printable Tax Prep 2022 Tax Checklist Tax

Tax Deduction In India - In India the total income tax deduction allowed depends on various factors such as investments expenses and contributions made during the financial year Common