Tax Deduction Income Calculator Use our United States Salary Tax calculator to determine how much tax will be paid on your annual Salary Federal tax state tax Medicare as well as Social Security tax allowances are

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions It will confirm the deductions you include on your Use our Canada Salary Calculator to find out your take home pay and how much tax federal tax provincial tax CPP QPP EI premiums QPIP you owe

Tax Deduction Income Calculator

Tax Deduction Income Calculator

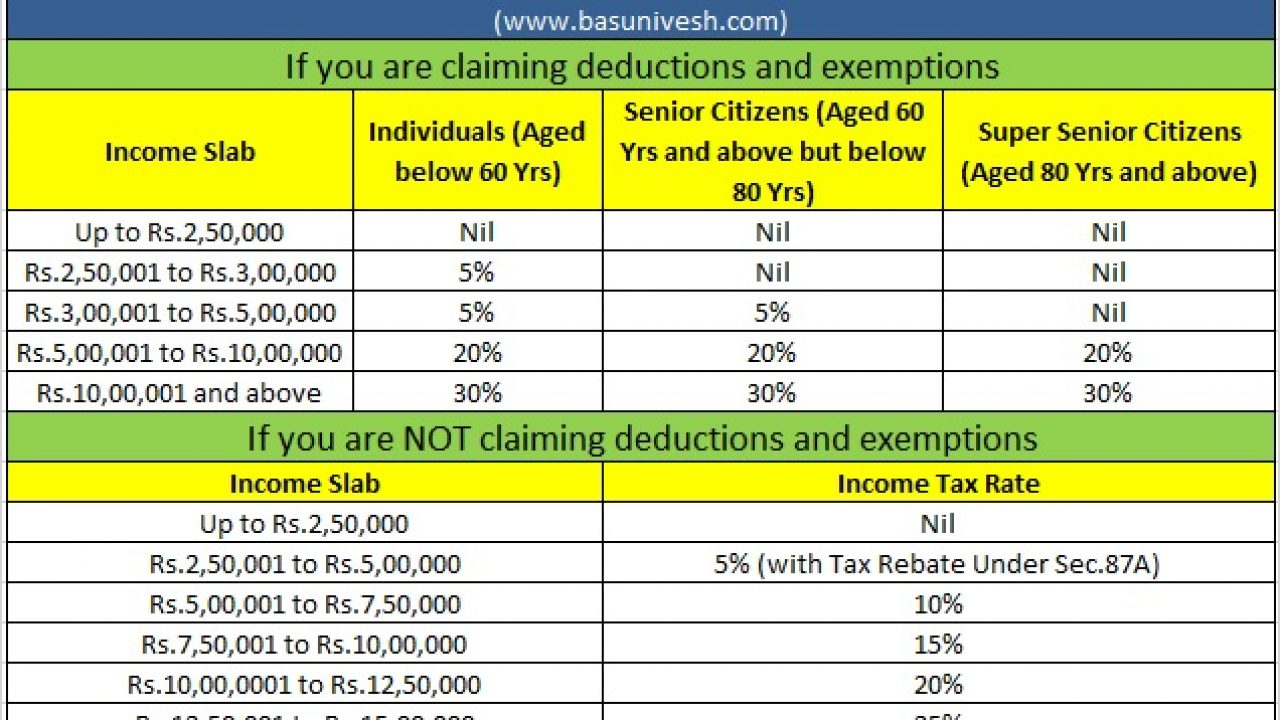

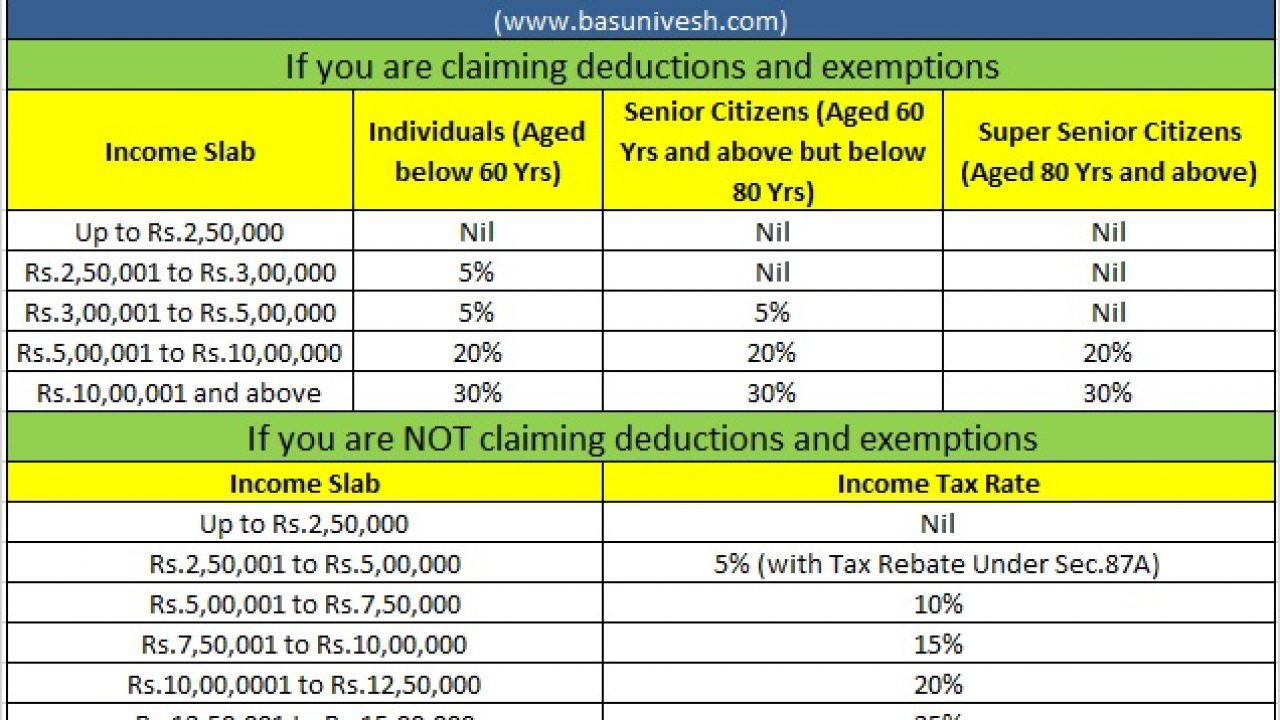

https://taxwithholdingestimator.com/wp-content/uploads/2021/08/standard-deduction-for-salary-ay-2021-22-standard.jpg

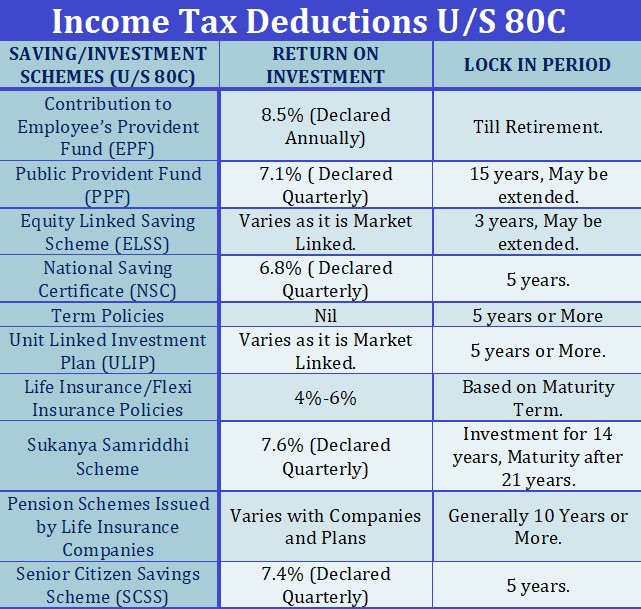

Income Tax Deductions While Filling ITR In India RJA

https://carajput.com/blog/wp-content/uploads/2017/03/Income-Tax-Deductions-Financial-Year-2020-21..jpg

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

https://i.etsystatic.com/34842725/r/il/d7a013/4058712943/il_fullxfull.4058712943_8i57.jpg

Estimate how much Income Tax and National Insurance you can expect to pay for the current tax year 6 April 2024 to 5 April 2025 The take home salary calculator considers the tax deductions such as PF contributions professional tax insurance benefits etc However to estimate the income tax on the basis of

Discover Talent s income tax calculator tool and find out what your payroll tax deductions will be in Canada for the 2024 tax year This BIR Tax Calculator helps you easily compute your income tax add up your monthly contributions and give you your total net monthly income The Tax Caculator Philipines 2024

Download Tax Deduction Income Calculator

More picture related to Tax Deduction Income Calculator

Tax deduction checklist Etsy

https://i.etsystatic.com/37903484/r/il/61e14b/5462529921/il_1080xN.5462529921_cvyy.jpg

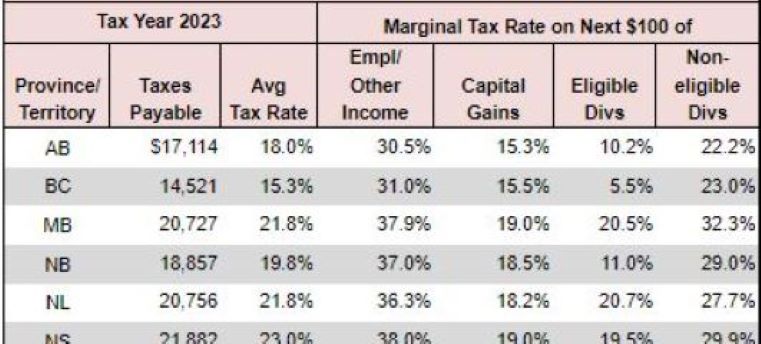

26 Pa Taxes Calculator DarmaveerShiv

https://www.taxtips.ca/calculators/enhanced-basic/2023-basic-tax-calculator-rates.jpg

2021 Federal Tax Brackets Withholding Federal Withholding Tables 2021

https://federal-withholding-tables.net/wp-content/uploads/2021/07/2020-income-tax-brackets-pasivinco.png

SmartAsset s hourly and salary paycheck calculator shows your income after federal state and local taxes Enter your info to see your take home pay Calculate your take home pay given income tax rates national insurance tax free personal allowances pensions contributions and more

Salary tax calculator is designed for calculating tax payable to Nepal government on the salary earned in a given year The calculation is based on Nepal Government Tax Policy Free online income tax calculator to estimate U S federal tax refund or owed amount for both salary earners and independent contractors

What Will My Tax Deduction Savings Look Like The Motley Fool

https://g.foolcdn.com/editorial/images/436120/tax-deduction_gettyimages-515708887.jpg

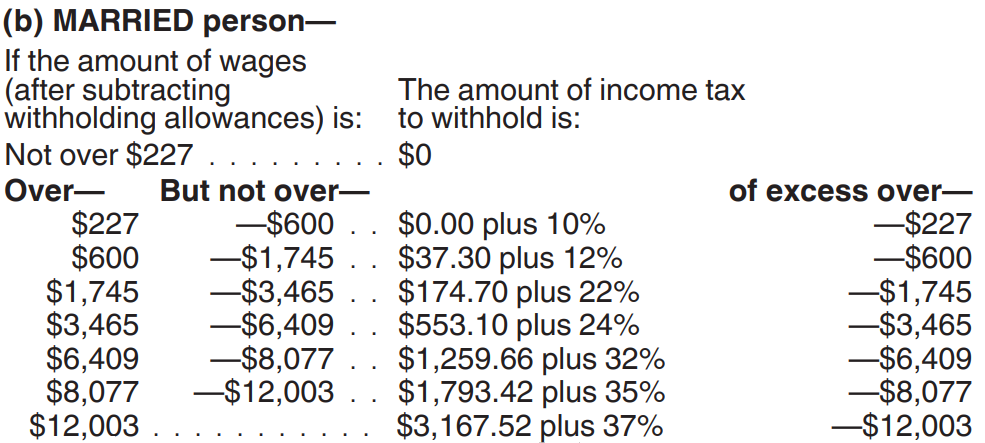

Payroll Deduction Tables 2017 Alberta Brokeasshome

https://www.groupmgmt.com/media/articulate-import//2019/04/PercentageMethodChartExample-clean.png

https://goodcalculators.com/us-salary-tax-calculator

Use our United States Salary Tax calculator to determine how much tax will be paid on your annual Salary Federal tax state tax Medicare as well as Social Security tax allowances are

https://www.canada.ca/.../payroll-deductions-online-calculator.html

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions It will confirm the deductions you include on your

Weekly Deduction Tables 2021 Federal Withholding Tables 2021

What Will My Tax Deduction Savings Look Like The Motley Fool

Example Tax Deduction System For A Single Gluten free GF Item And

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

Your First Look At 2023 Tax Brackets Deductions And Credits 3

5 Itemized Tax Deduction Worksheet Worksheeto

5 Itemized Tax Deduction Worksheet Worksheeto

Standard Deduction Gennadiy

What Are Pre tax Deductions Before Tax Deduction Guide

Calculate My Income Tax SuellenGiorgio

Tax Deduction Income Calculator - The take home salary calculator considers the tax deductions such as PF contributions professional tax insurance benefits etc However to estimate the income tax on the basis of