Tax Deduction Japan The basic calculation is based on your Annual Salary minus the Employment Income Deduction minus any deductions you can claim have a look at the official Guide to Metropolitan Taxes for those Take 10 of this amount

Japan has several tax deductions that allow you to save money on taxes However keep in mind that most tax deductions are reviewed frequently and may change over time You can always check with your local tax office or visit the National Tax You may deduct the items indicated below from your amount of income However if you are a non resident throughout the year 2021 who have income subject to the aggregate taxation only the basic exemption the deduction for casualty losses and

Tax Deduction Japan

Tax Deduction Japan

https://hrmasia.com/wp-content/uploads/2021/12/150668841_m-1.jpg

Individual Income Tax Return Filing In Japan For Foreigners Latest

https://shimada-associates.com/en/wp-content/uploads/tokyo-1121870_1920.jpg

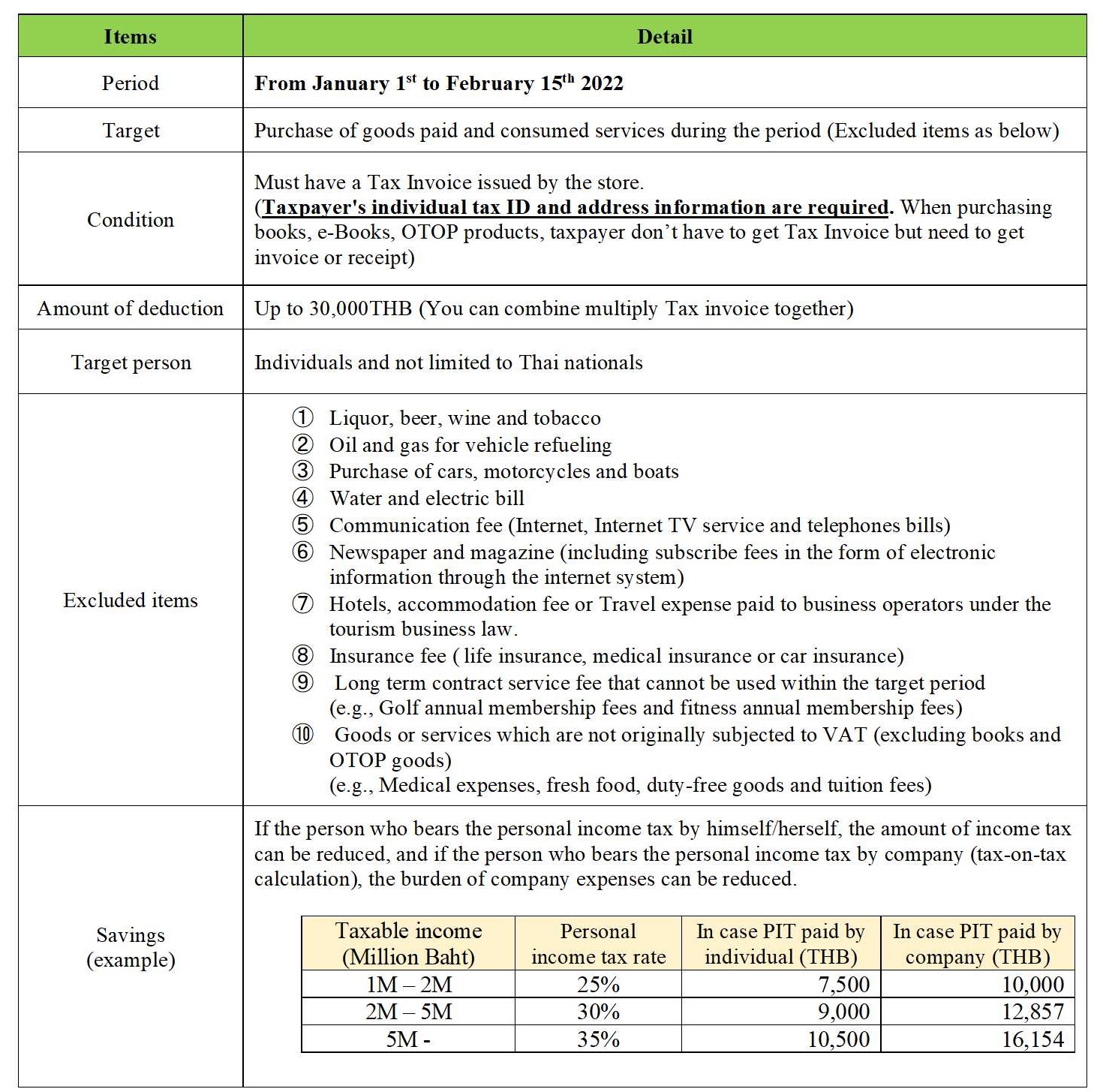

THAILAND Up To 30 000THB Deduction From Personal Income Tax For 2022

https://www.asahinetworks.com/asahi/wp-content/uploads/2022/01/226_ANT_shopping-deduction_2022Jan_EN-1.jpg

For tax purposes in Japan you ll need to report income from your salary benefits and bonus payments Many non monetary benefits like employer provided accommodation are also treated as taxable A non resident taxpayer s Japan source compensation employment income is subject to a flat 20 42 national income tax on gross compensation with no deductions available This rate includes 2 1 of the surtax described above 20 102 1 20 42

Outline of Japan s Withholding Tax System Related to Salary For Those Applying for an Exemption for Dependents etc with Regard to Non resident Relatives Application Form for Income Tax Convention etc Application Form for Certificate of Residence in Japan For the purpose of claiming tax treaty benefits PDF 207KB Use our Japan Salary Calculator to find out your net income after deducting all taxes from your gross salary Income Tax Social Insurance Residence Tax

Download Tax Deduction Japan

More picture related to Tax Deduction Japan

PIC Enhanced Tax Deduction Part 2 Tax Made Easy

https://www.taxmadeeasy.sg/wp-content/uploads/2015/10/PIC-Enhanced-dedution-PArt-2.jpg

Special Tax Deduction On Renovation Extension Jan 20 2022 Johor

https://cdn1.npcdn.net/image/164268488608eb2865a0692287fabecd75401ae768.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1000&new_height=1000&w=-62170009200

Section 179 Tax Deduction

https://lifttrucksupplyinc.com/wp-content/uploads/2016/05/12369179_537911586377015_8736271735998525545_n.png

Structure of Income Tax of Japan illustrative purposes only Types and Outlines of Personal Deductions Outline of Other Income Deductions Income Tax Tax Rate Structure of Income Tax Easy to use Japan income tax calculator for assessing your tax liability in Japan including residence tax plus social and health Insurances

Individual Sample personal income tax calculation Last reviewed 09 July 2024 National tax JPY Gross taxable income 10 000 000 Earned income deduction 1 950 000 Income after earned income deduction Structure of Income Tax of Japan illustrative purposes only Types and Outlines of Personal Deductions Outline of Other Income Deductions Income Tax Tax Rate Structure of Income Tax

Tax Deduction Stock Photo Photo By LendingMemo Under CC 2 Flickr

https://live.staticflickr.com/4856/32641508108_4eef691caa_b.jpg

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-11.jpg

https://japantaxcalculator.com

The basic calculation is based on your Annual Salary minus the Employment Income Deduction minus any deductions you can claim have a look at the official Guide to Metropolitan Taxes for those Take 10 of this amount

https://argentumwealth.com/tax-deductions-in-japan...

Japan has several tax deductions that allow you to save money on taxes However keep in mind that most tax deductions are reviewed frequently and may change over time You can always check with your local tax office or visit the National Tax

What Will My Tax Deduction Savings Look Like The Motley Fool

Tax Deduction Stock Photo Photo By LendingMemo Under CC 2 Flickr

What Are The Top 10 Pre Tax Deduction List For Maximizing Savings In

Tax Deductions In Japan Here Is How To Save Money

2022 Federal Tax Brackets And Standard Deduction Printable Form

A Quick Guide To Taxes In Japan GaijinPot

A Quick Guide To Taxes In Japan GaijinPot

How To Fully Maximize Your 1099 Tax Deductions Steady

Tax Deduction Tax Deduction 1040 IRS Tax Return Form And C Flickr

Maximising Tax Benefits Your Guide To Claiming A Rental Property

Tax Deduction Japan - Pay attention to regulations on the Common Reporting Standard CRS relevant information for accountholders and financial institutions Procedures of National Tax Payment Available to Taxpayers Overseas