Tax Deduction On Donations Ready to give Here s your guide to understanding how and when your charitable donations might be tax deductible

Section 80G of the Indian Income Tax Act allows a tax deduction for contributions to certain relief funds and charitable institutions Thus you can claim tax The Internal Revenue Service has a special new provision that will allow more people to easily deduct up to 300 in donations to qualifying charities this year even if they don t

Tax Deduction On Donations

Tax Deduction On Donations

https://i.pinimg.com/736x/7a/7d/33/7a7d330c4c789872bfd01ffe7d16483c.jpg

150 tax Deduction On Donations To Culture Gonzi Associates Advocates

https://gonzi.com.mt/app/uploads/2020/04/peter-feghali-XURJBJi_wDE-unsplash.jpg

Tax Deductions On Donations

https://img.indiafilings.com/learn/wp-content/uploads/2021/11/12003509/about.jpg

The tax deduction you receive for donations to charities is based on the fair market values of the items donated Here s a guide to check the values If you plan on claiming your donations on your taxes you ll want to The tax goes to you or the charity How this works depends on whether you donate through Gift Aid straight from your wages or pension through a Payroll Giving scheme

For a summary of this content in poster format see Gifts and Donations PDF 264KB This link will download a file When a gift or donation is deductible You can only claim a tax For example single taxpayers who took the standard deduction rather than itemize were allowed an up to 300 deduction for charitable cash contributions 600 for those married filing jointly

Download Tax Deduction On Donations

More picture related to Tax Deduction On Donations

Bunching Up Charitable Donations Could Help Tax Savings

https://www.gannett-cdn.com/-mm-/3b8b0abcb585d9841e5193c3d072eed1e5ce62bc/c=0-30-580-356/local/-/media/2018/01/02/USATODAY/usatsports/donate-charity-coin-cash-tax-give-deduction-getty_large.jpg?width=3200&height=1680&fit=crop

Get 300 Tax Deduction For Cash Donations In 2020 2021

https://cdn.aarp.net/content/dam/aarp/money/taxes/2020/12/1140-online-donation-screen.imgcache.rev9aad3c0f802258a825bf512a713d6041.jpg

:max_bytes(150000):strip_icc()/tax-deduction-for-charity-donations-3192983_FINAL-9f9aa78932ec47ac960c8bacad155a17.gif)

Tax Deductions For Charitable Donations

https://www.thebalanceai.com/thmb/Iv3JmDfVlOYV3g14ZuockNA4g9o=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/tax-deduction-for-charity-donations-3192983_FINAL-9f9aa78932ec47ac960c8bacad155a17.gif

For your charitable contribution to be eligible for a deduction the nonprofit organization you are donating to must be registered with the IRS under section 501 c 3 Charitable contributions or donations are gifts of goods or money to a qualified organization These contributions may be deducted on your tax return if you itemize to

The charitable contributions deduction allows taxpayers to deduct donations of cash and property given to qualified charitable organizations There are Tax law requires that deductions are allowed only for contributions that serve a charitable purpose A recipient organization must qualify for tax exempt status

How Small Donations Still Make A Huge Difference

https://www.thewowstyle.com/wp-content/uploads/2020/10/AdobeStock_287056552.jpeg

Tax Deduction Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5_og.png

https://money.usnews.com/money/pers…

Ready to give Here s your guide to understanding how and when your charitable donations might be tax deductible

https://cleartax.in/s/donation-under-section-80g-and-80gga

Section 80G of the Indian Income Tax Act allows a tax deduction for contributions to certain relief funds and charitable institutions Thus you can claim tax

Guide To Tax Deduction For Charitable Donations Backpacks USA

How Small Donations Still Make A Huge Difference

What Will My Tax Deduction Savings Look Like The Motley Fool

How To Maximize Your Charity Tax Deductible Donation WealthFit

10 Business Tax Deductions Worksheet Worksheeto

What Are Pre tax Deductions Before Tax Deduction Guide

What Are Pre tax Deductions Before Tax Deduction Guide

5 Itemized Tax Deduction Worksheet Worksheeto

Give A Donation Craigieburn Trails

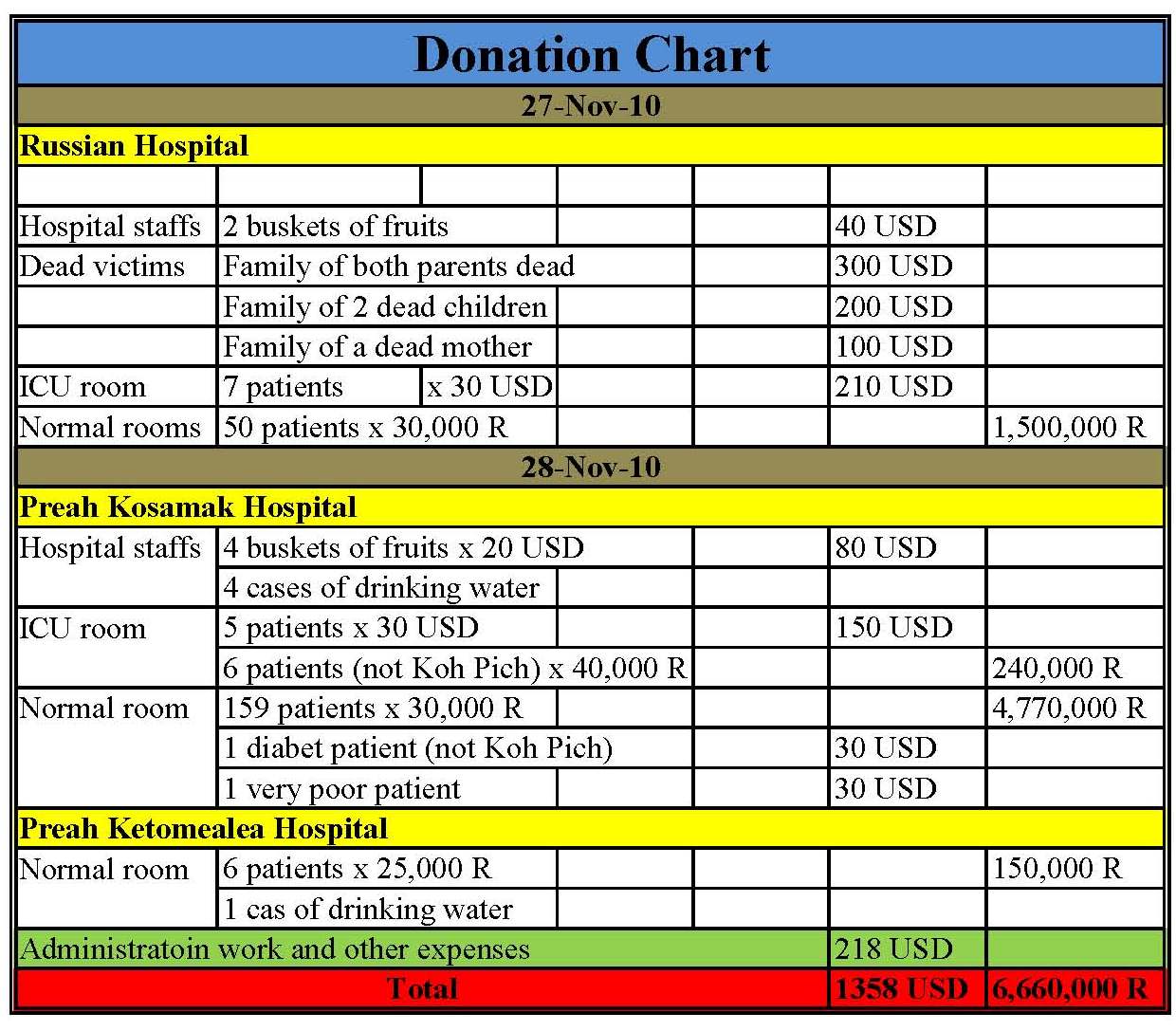

Donation Chart Template

Tax Deduction On Donations - A tax deductible donation allows you to deduct cash or property you transfer to a qualified organization such as clothing or household items A qualified