Tax Deduction On Fd Interest In India The interest earned on a Fixed Deposit FD is subject to tax based on the income tax slab you fall into There is TDS Tax Deducted at Source on FD interest along with

Any investor can claim a deduction of a maximum of Rs 1 5 lakh per annum by investing in a tax saving fixed deposit account Some of its features are A lock in Yes all interest income on FDs is subject to Taxation The TDS is deducted only if the income from interest exceeds Rs 40 000 per annum as amended in Finance

Tax Deduction On Fd Interest In India

Tax Deduction On Fd Interest In India

https://i.ytimg.com/vi/z1EzdQ_GHPs/maxresdefault.jpg

List Of Banks That Hiked FD Interest Rates In The First Week Of January

https://images.livemint.com/img/2023/01/08/original/pnb_fd_jan_2023_1673143966645.png

Tax Deduction Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5_og.png

FD holders have the option to claim TDS deduction on fixed deposits under a suitable provision of Income Tax Act For instance FD holders can apply for TDS waiver on their Discover whether the interest earned on fixed deposits FDs in India is taxable Get a understanding of FD taxation rules in this blog guide Read Now

This guide explores how interest in Fixed Deposits is taxed in India Learn the 40 000 limit TDS deduction ways to potentially avoid tax on FD interest income The interest income on FD is subject to TDS deduction under section 194A Every payer of FD interest must deduct TDS at a rate of 10 at the time of

Download Tax Deduction On Fd Interest In India

More picture related to Tax Deduction On Fd Interest In India

Tax Deduction Letter PDF Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-c1c1da39f77a424f295c2df1cb0f2b87.png

SBI Hikes Interest Rates On Fixed Deposits FDs Across Tenors By Up To

https://images.livemint.com/img/2022/10/15/original/sbi_fd_rates_oct_1665824387872.png

EXCEL Of Tax Deduction Form xlsx WPS Free Templates

https://newdocer.cache.wpscdn.com/photo/20191025/a893d00e6a764d2f9dbbb7838baa295d.jpg

The interest earned from FDs is a taxable income and is subject to tax deductions This deduction of tax is known as Tax Deducted at Source TDS It is Income Tax Exemption on FD Depositors can claim income tax exemptions on the FD interest of FCNR and NRE accounts However one can claim a tax

Section 80TTA of Income Tax Act offers deduction on interest income earned from savings bank deposit of up to Rs 10 000 for FY 2023 24 AY 2024 25 Tax on FD Interest Interest earned on FDs is considered income from other sources and is taxable in India TDS on FD Interest Banks or NBFCs deduct TDS tax

Business Tax Deductions Cheat Sheet Excel In PINK Tax Etsy

https://i.etsystatic.com/24598192/r/il/e3c7c0/3985544266/il_570xN.3985544266_82sm.jpg

Can Fixed Deposit Double In 5 Years In India Updated 2022 Stable

https://i0.wp.com/stableinvestor.com/wp-content/uploads/2022/06/Historical-FD-Rates-SBI.png?w=776&ssl=1

https://www.icicibank.com/blogs/fixed-deposits/tax...

The interest earned on a Fixed Deposit FD is subject to tax based on the income tax slab you fall into There is TDS Tax Deducted at Source on FD interest along with

https://cleartax.in/s/tax-saving-fd-fixed-deposits

Any investor can claim a deduction of a maximum of Rs 1 5 lakh per annum by investing in a tax saving fixed deposit account Some of its features are A lock in

Tax Rates Absolute Accounting Services

Business Tax Deductions Cheat Sheet Excel In PINK Tax Etsy

Income Tax On Interest On Savings Bank FD Account In India Fintrakk

Section 80C Deductions List To Save Income Tax FinCalC Blog

Everything You Need To Know About TDS On FD Interest In India

PNB Vs SBI Vs ICICI Bank Vs BoB Check Senior Citizens Fixed Deposit

PNB Vs SBI Vs ICICI Bank Vs BoB Check Senior Citizens Fixed Deposit

KTP Company PLT Audit Tax Accountancy In Johor Bahru

SOLVED 1 Write A Java Program Using Method one For Interest And Bonus

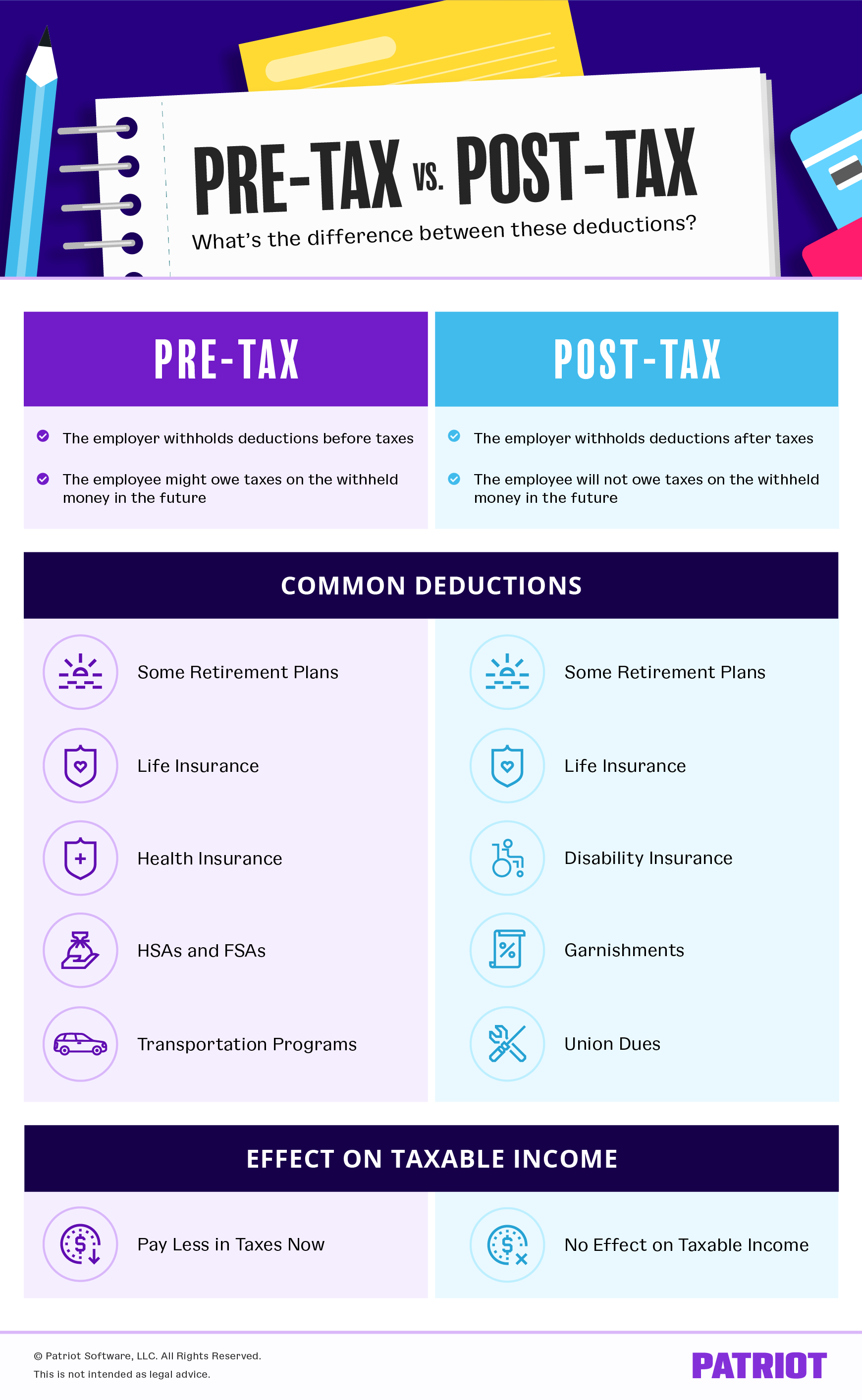

Pre tax Vs Post tax Deductions What s The Difference

Tax Deduction On Fd Interest In India - Interest income from FDs is taxable and banks follow Tax Deduction at Source TDS for this purpose Pay attention to the deadline for tax payments and