Tax Deduction On Interest Earned Any interest earned on a savings account is taxable income Your bank will send you a 1099 INT form for any interest earned over 10 but you should report any interest earned even

Tax deductible interest is a borrowing expense that a taxpayer can claim on a federal or state tax return to reduce their taxable income Several types of interest Interest earned outside tax wrappers like ISAs or pensions can be liable for tax In this article we explain whether you should be paying tax on your savings interest how to go about it and whether you can lower your tax bill Personal savings allowance explained Interest on your savings is paid to you gross

Tax Deduction On Interest Earned

Tax Deduction On Interest Earned

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5_og.png

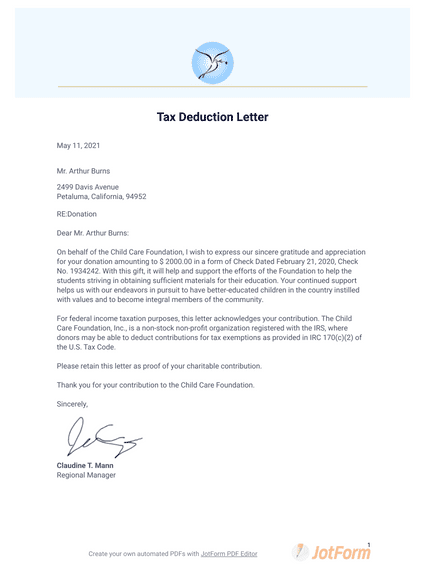

Tax Deduction Letter PDF Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-c1c1da39f77a424f295c2df1cb0f2b87.png

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

From a tax perspective whether an interest cost can be claimed as a deduction against a taxpayer s taxable income will primarily depend on the use of the borrowed money including how the money is used and to what extent To deduct interest you paid on a debt review each interest expense to determine how it qualifies and where to take the deduction When you prepay interest you must allocate the interest over the tax years to which the interest applies You may deduct in each year only the interest that applies to that year

How Is Interest Income Taxed 7 Min Read Sep 6 2023 By Ramsey Learn more about how interest income is taxed and how to report that income in three easy steps when you sit down to file your taxes Personal Finance Taxes Earnings from high yield savings accounts or CDs are subject to income tax Here s how that works Written by Tanza Loudenback Updated Aug 30 2023 2 33 PM PDT

Download Tax Deduction On Interest Earned

More picture related to Tax Deduction On Interest Earned

IRS Provides Tax Inflation Adjustments For Tax Year 2022 Income Tax

https://www.mondaq.com/images/article_images/1132100a.jpg

Tax Deductions You Can Deduct What Napkin Finance

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

Can You Claim A Deduction On Interest Borrowed To Pay Your Tax Debt

https://www.ptam.com.au/wp-content/uploads/2017/06/Interest-on-Tax-Debts-1080x675.jpg

All of your high yield savings account interest is taxable Your financial institution will send you a Form 1099 INT once you earn more than 10 in interest However the IRS still However did you realize that the interest earned on your savings account is not just a small financial benefit but is also subject to tax Indeed interest from savings accounts is taxed under Income from other sources Under Section 80TTA of the Income Tax Act 1961 you can claim a deduction of up to INR 10 000 on thi top of page

The personal savings allowance allows you to earn up to 1 000 of interest tax free on top of the starting rate for savers The allowance varies depending on your income tax bracket Basic rate taxpayers 1 000 Higher rate taxpayers 500 Additional rate taxpayers 0 All earned interest needs to be reported on your tax returns as income Most all earned interest is taxable at both the federal and state levels in the year that it is earned An exception to this rule would be if you earned interest in a tax deferred account such as an IRA

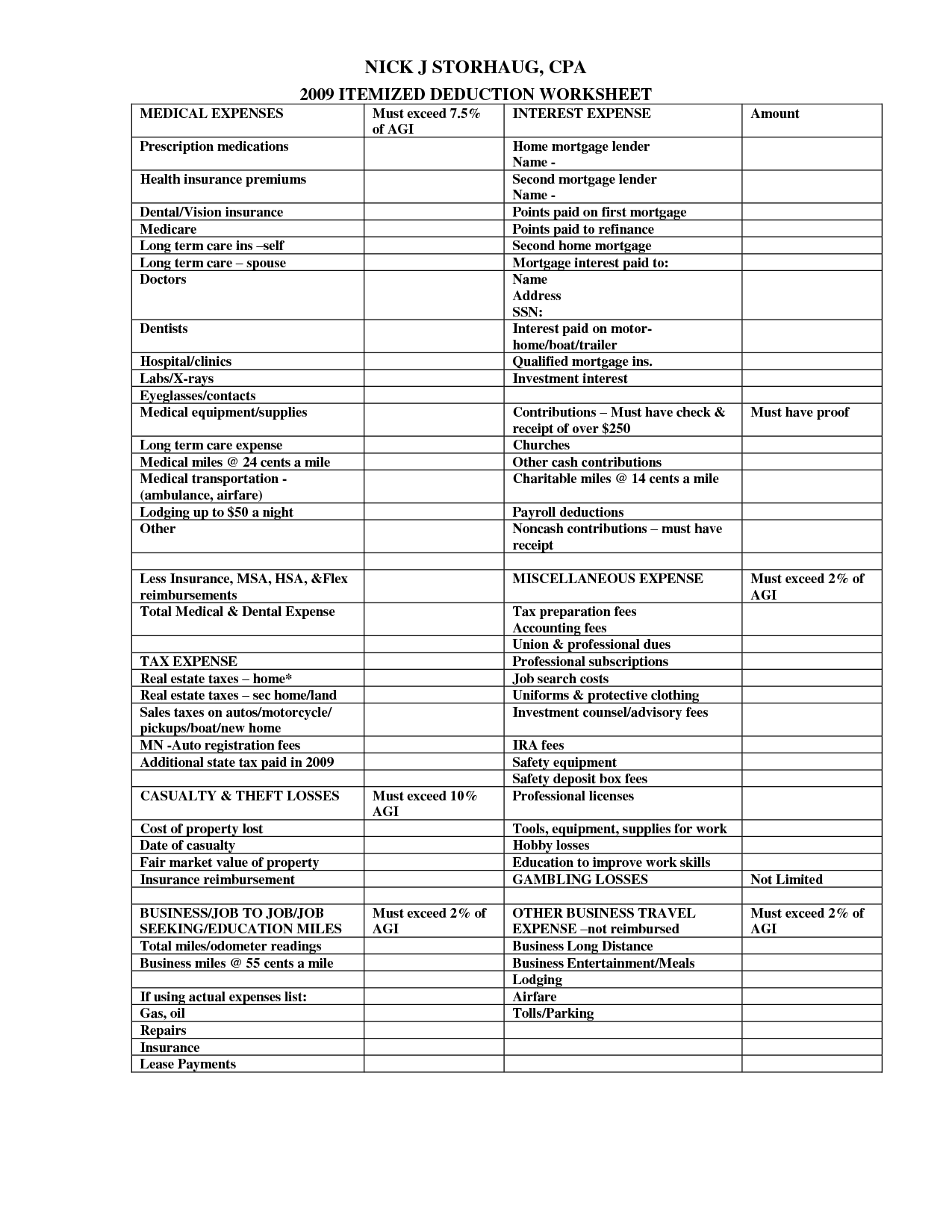

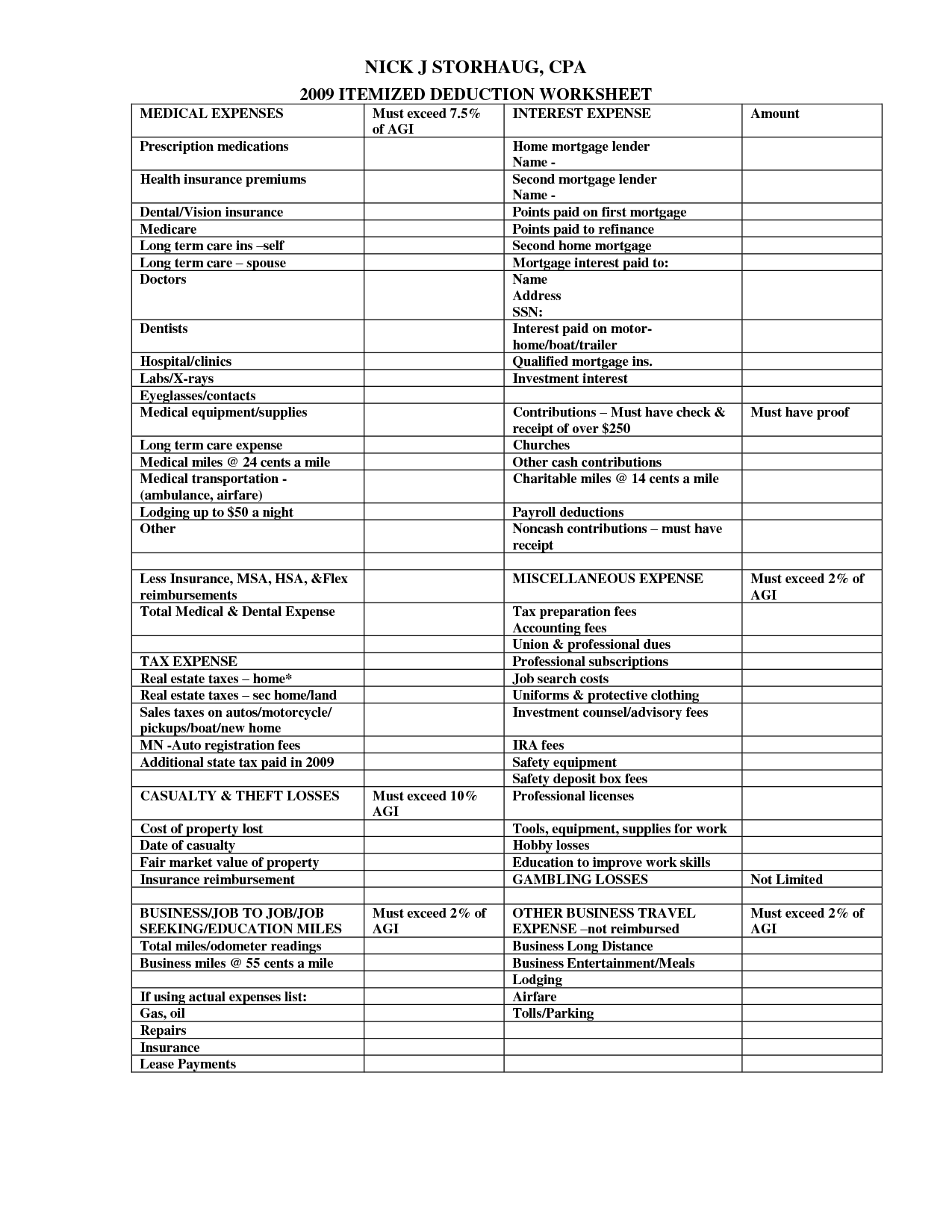

16 Insurance Comparison Worksheet Worksheeto

https://www.worksheeto.com/postpic/2010/06/tax-itemized-deduction-worksheet_615535.png

Tax Deduction On Interest Makes Home Loan Cheaper The Economic Times

https://img.etimg.com/thumb/msid-5568233,width-1070,height-580,overlay-etpanache/photo.jpg

https://www.investopedia.com/ask/answers/052515/...

Any interest earned on a savings account is taxable income Your bank will send you a 1099 INT form for any interest earned over 10 but you should report any interest earned even

https://www.investopedia.com/terms/t/tax-deductible-interest.asp

Tax deductible interest is a borrowing expense that a taxpayer can claim on a federal or state tax return to reduce their taxable income Several types of interest

Standard Deduction 2020 Self Employed Standard Deduction 2021

16 Insurance Comparison Worksheet Worksheeto

Standard Deduction For 2021 22 Standard Deduction 2021

Income Tax Deductions For The FY 2019 20 ComparePolicy

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

Income Tax Deduction On Interest Of Saving Account U s 80TTA

Income Tax Deduction On Interest Of Saving Account U s 80TTA

Section 194K Tax Deduction On Income From Mutual Fund Units

Income Tax Deduction Allowable On Housing Loan

Deduction On Interest Income Earned From Co Operative Bank U s 80P 2 d

Tax Deduction On Interest Earned - As per current tax laws TDS is deducted if the interest earned on FDs exceeds Rs 40 000 per annum for individuals under 60 years of age and Rs 50 000 per annum for senior citizens above 60 years of age