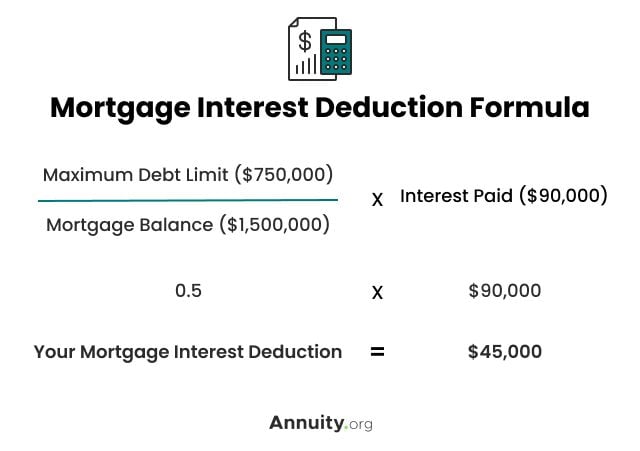

Tax Deduction On Mortgage Interest Canada Web In some cases you can deduct 100 of the mortgage interest In other cases you can only deduct a portion of the interest you paid The percentage deduction depends on how much of the

Web 1 Feb 2022 nbsp 0183 32 Generally mortgage interest for primary residences is not considered tax deductible in Web 25 Juli 2023 nbsp 0183 32 For homeowners in Canada this interest is not tax deductible But any capital gains that a homeowner realizes when they sell the home are tax exempt But there is a way Canadians can

Tax Deduction On Mortgage Interest Canada

Tax Deduction On Mortgage Interest Canada

https://www.taxslayer.com/blog/wp-content/uploads/2023/02/Tax-Breaks-for-Homeowners-and-Renters-min-8.jpg

There Is No Such Thing As The Standard Expat Mortgage FVB De Boer

https://fvbdeboer.nl/wp-content/uploads/2022/10/precondo-ca-uJ7NOEbTd80-unsplash-1-scaled.jpg

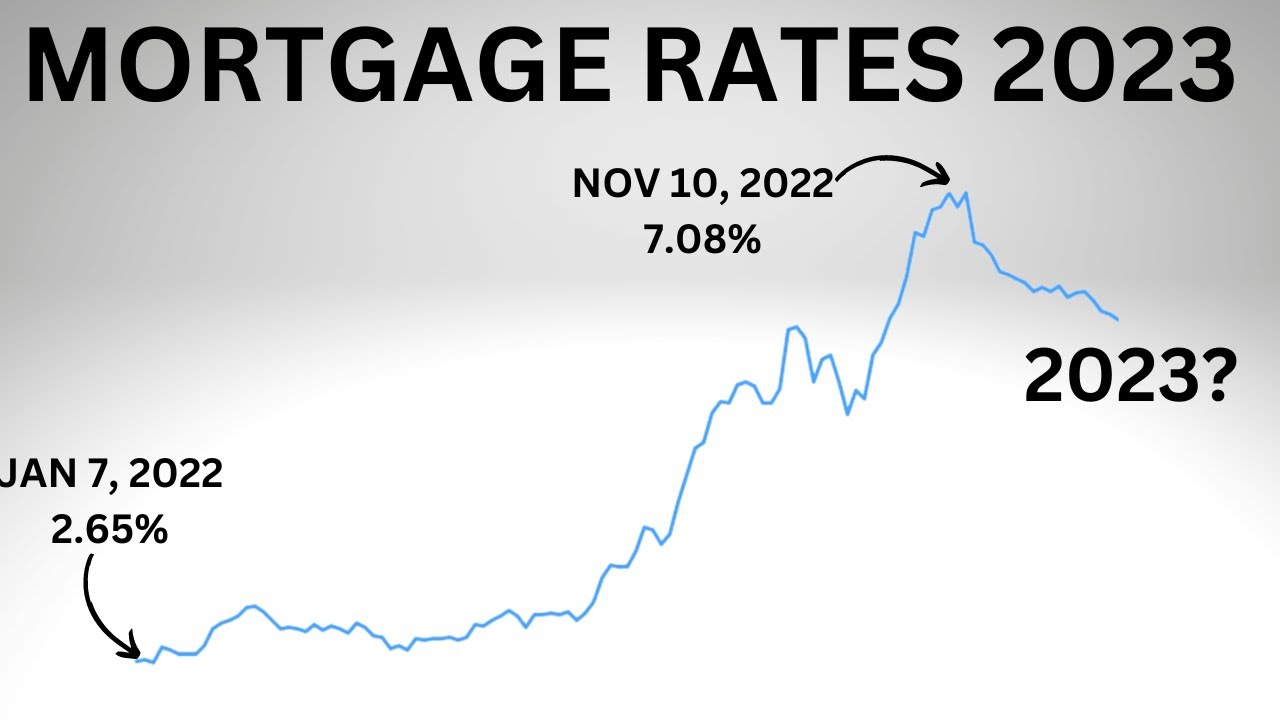

What Will Mortgage Rates Do In 2023 Mortgage Interest Rate Predictions

https://i.ytimg.com/vi/HBvSEGh4Zcg/maxresdefault.jpg

Web Deduct 20 100 divided by the 5 years equals 20 in the current tax year and 20 in each of the next 4 years The 20 limit is reduced proportionally for fiscal periods of less than 12 months If you repay the loan before the end of the 5 year period you can deduct the remaining financing fees then Web 20 Nov 2023 nbsp 0183 32 Some of the interest you pay on your mortgage loans or credit cards may be deductible on your tax return Whether interest is deductible depends on how you use the money you borrow Interest you pay on money used to generate income may be deductible if it meets the Canada Revenue Agency criteria You have to keep track of

Web 2 Aug 2023 nbsp 0183 32 Is Mortgage Interest Tax Deductible in Canada A Clear and Straightforward Answer You might be wondering if you can deduct mortgage interest from your taxes in Canada especially if you hear about this practice in other countries The simple answer for most Canadian homeowners is no it s generally not an option for Web 20 Nov 2019 nbsp 0183 32 Only the interest portion of the mortgage is deductible and the interest is only deductible in the original term of the loan If a lump sum amount was paid to reduce the interest rate on a mortgage only a pro rated portion of that lump sum is deductible in the tax year it was paid

Download Tax Deduction On Mortgage Interest Canada

More picture related to Tax Deduction On Mortgage Interest Canada

Potentially Bigger Tax Breaks In 2023

https://static.fmgsuite.com/media/InlineContent/originalSize/984f6148-60aa-49b7-971c-fb3554606b40.jpg

Mortgage Interest Tax Deduction What Is It How Is It Used

https://www.annuity.org/wp-content/uploads/mortgage-interest-deduction-formula-640x0-c-default.jpg

Mortgage Interest Rate Forecast

https://www.usatoday.com/money/blueprint/images/uploads/2023/01/31082516/mortgage-rates-predictions-2023-e1690806381742.jpg

Web 23 Nov 2021 nbsp 0183 32 Mortgage interest is not always going to be tax deductible For most homeowners who simply use their property as a residence you will not be able to deduct mortgage interest but there are other situations where you as the property owner can deduct your mortgage interest payments Web 10 Mai 2023 nbsp 0183 32 Step 2 Refinance the home to 80 95 of the property s total value Step 3 Take this additional equity the difference between your original investment and the refinanced amount and purchase an investment that is intended to provide income There you have it a series of transactions that now allows you to deduct mortgage interest

Web From a tax perspective there are two ways to make a mortgage interest tax deduction depending on the property type In this article we will focus on the following cases The Property Is Generating Rental Income According to the Canadian government tax deductions are only applicable to mortgage interest payments in case the property Web 30 Aug 2022 nbsp 0183 32 The total amount of your mortgage interest is only tax deductible if you rent out your entire property for the entire year If this is not the case only the portion of the property and the portion of the year you rent it out e g six months might qualify for tax deductions for interest payments

No Tax Deduction On Life Insurance Premium Impacting The Insurance

https://i.ytimg.com/vi/LoiwfmdzfCU/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGBMgPCh_MA8=&rs=AOn4CLA69XV6btLq4zNdKz1B9rnPz9R9Qw

20k Deduction For electrifying Your Business Cotchy

https://cotchy.com.au/wp/wp-content/uploads/2023/10/89435805_m_normal_none.jpg

https://money.ca/taxes/is-mortgage-interest-tax-deductible-in-ca…

Web In some cases you can deduct 100 of the mortgage interest In other cases you can only deduct a portion of the interest you paid The percentage deduction depends on how much of the

https://www.nesto.ca/.../is-mortgage-interest-tax-deductible-in-can…

Web 1 Feb 2022 nbsp 0183 32 Generally mortgage interest for primary residences is not considered tax deductible in

Rental Property Tax Deductions A Comprehensive Guide Credible Cash

No Tax Deduction On Life Insurance Premium Impacting The Insurance

What Is Mortgage Interest Tax Deduction Basics And Process NSKT Global

10 Standard Deduction Worksheet For Dependents 2020 Worksheets Decoomo

Important Changes To The Mortgage Interest Deduction Tax Rules

Is The Mortgage Interest Deduction In Play B Logics

Is The Mortgage Interest Deduction In Play B Logics

Standard Deduction For Assessment Year 2021 22 Standard Deduction 2021

KTP Company PLT Audit Tax Accountancy In Johor Bahru

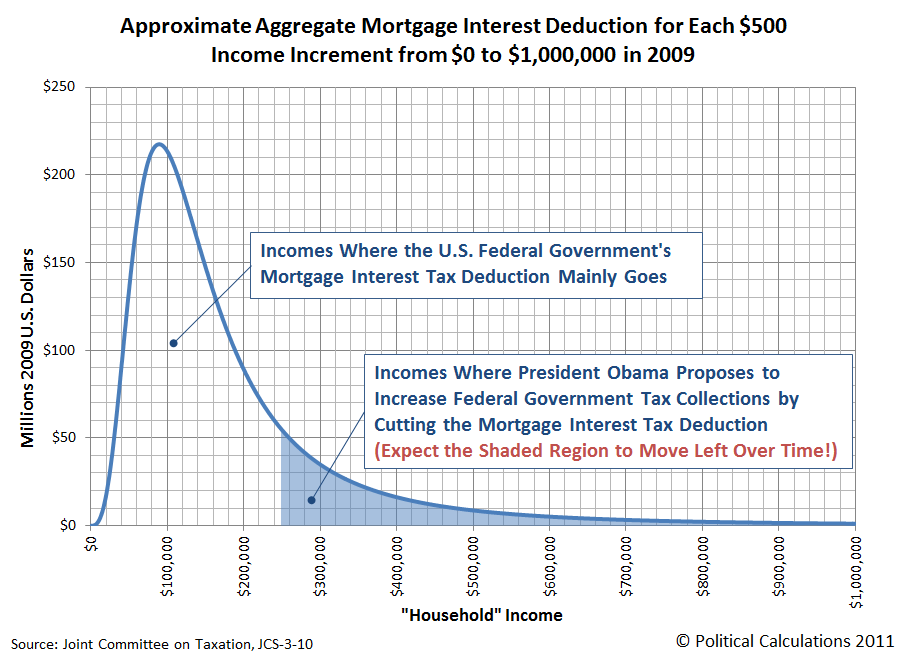

YIN YANG ZONE The U S Mortage Interest Deduction By Income Level

Tax Deduction On Mortgage Interest Canada - Web 9 Aug 2021 nbsp 0183 32 According to Canada Revenue Agency CRA most interest you pay on money you borrow for investment purposes can be deducted but generally only if you use it to try to earn investment