Tax Deduction On Tuition Fees Under Section 10 The Government of India provides some exemptions in order to reduce your income tax burdens Section 10 of the Income tax Act 1961 talks about those exemption provisions and the terms and conditions on which one can avail a

First under section 10 you can structure your salary by including child education allowance Again under section 80C you can claim tuition fee paid for your children Deduction under section 10 for Child education allowance Plan your Save income tax by claiming for tax exemption under Section 10 14 and Section 80C for tuition fee and hostel fees for up to two children Section 10 14 of the Income Tax allows exemption from taxable income in respect of Children education allowance and Hostel Allowance

Tax Deduction On Tuition Fees Under Section 10

Tax Deduction On Tuition Fees Under Section 10

https://hi-static.z-dn.net/files/dbc/211b60e62b671c2debf731de99ef588c.jpg

Tuition And Fees Tax Deduction Just Got Killed For 2017 Money

https://img.money.com/2017/01/170105_tuitiontaxcredit.jpg?quality=85

Tax Benefits On Tuition Fees School Fees Education Allowances

https://www.alerttax.in/wp-content/uploads/2017/02/Tax-Benefits-on-Tuition-Fees-School-Fees-Education-Allowances.png

As per section 10 14 of Income tax children education allowance and Hostel Expenditure Allowance are eligible for deduction available to individuals employed in India Children Education Allowance Up to Rs 100 per month per child up to a maximum of 2 children is exempt Individuals paying tuition fees for the education of their children can claim a tax deduction under Section 80C provided they meet certain conditions outlined below Eligible Applicants This deduction is available exclusively to parents

Tax benefits for tuition fees of children are available under following two sections of the Income Tax Act Section 10 Tax exemption for tuition fee of up to Rs 1 200 Rs 100 per month per child for a maximum of two children Section 10 14 of the Income Tax Act 1961 allows taxpayers who are employed in India to claim a deduction for tuition fees paid for their children s full time education at a school college or university in India

Download Tax Deduction On Tuition Fees Under Section 10

More picture related to Tax Deduction On Tuition Fees Under Section 10

Tax Deduction Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5_og.png

Learn About Tuition Fees Deduction What Is Tuition Fees 80c Under

https://khatabook-assets.s3.amazonaws.com/media/post/2022-05-17_080415.1687730000.webp

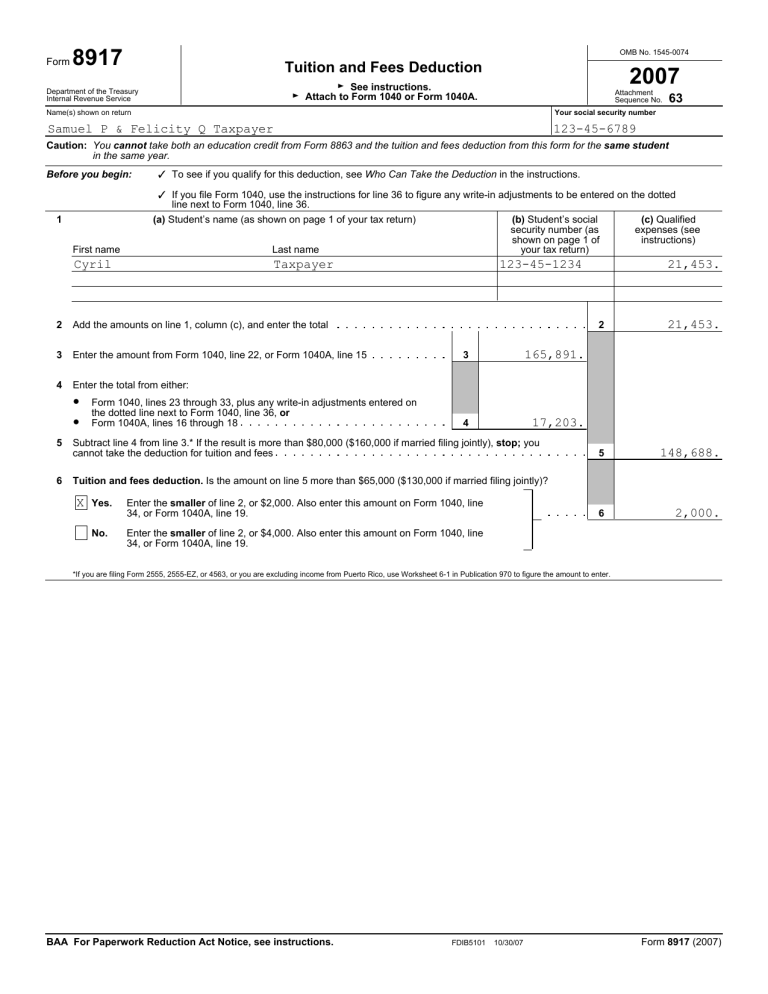

Tuition And Fees Deduction

https://s3.studylib.net/store/data/008152713_1-72e16aa99977aecf381f4b26c7bbc191-768x994.png

Offers tax exemptions such as tuition fee for children s education travel allowance rent allowance gratuity and many more to reduce the tax burden Total amount of tax liability of salaried professionals is analysed for calculating total income Section 80 Deductions A complete guide on Income Tax deduction under section 80C 80CCC 80CCD 80D Find out the deduction under section 80c for FY 2023 24 AY 2024 25

The Government of India has made various provisions for the taxpayer to claim tax reductions on the expenses on their child s education This includes children s education allowance exemption under Section 10 14 as well as under children s education tuition fees sec 80C As per the provisions of the Income Tax Act 1961 a taxpayer Qualified expenses are amounts paid for tuition fees and other related expense for an eligible student that are required for enrollment or attendance at an eligible educational institution You must pay the expenses for an academic period that starts during the tax year or the first three months of the next tax year

Tuition Fees Deduction Under Section 80C School Fees Deduction In 80C

https://i.ytimg.com/vi/EVGdLQMvyLU/maxresdefault.jpg

Budget 2023 Expectation Will Govt Hike Income Tax Deduction On Tuition

https://cdn.zeebiz.com/sites/default/files/2023/01/23/222920-section-10-tuition-fee.jpg

https://cleartax.in

The Government of India provides some exemptions in order to reduce your income tax burdens Section 10 of the Income tax Act 1961 talks about those exemption provisions and the terms and conditions on which one can avail a

https://www.knowyourgst.com › blog › tution-fee-and...

First under section 10 you can structure your salary by including child education allowance Again under section 80C you can claim tuition fee paid for your children Deduction under section 10 for Child education allowance Plan your

Tax Deduction On Tax And Secretarial Fee 2022 THK Management Advisory

Tuition Fees Deduction Under Section 80C School Fees Deduction In 80C

Tuition Wiseowl Academy

Every Single Tax Deduction You Could Possibly Ask For Page 26 Of 40

Tuition And Fees Deduction Vs Education Credit What Are The

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

How To Claim Tax Benefit On Tuition Fees Under Section 80C DOP Core

Section 80C Deductions List To Save Income Tax FinCalC Blog

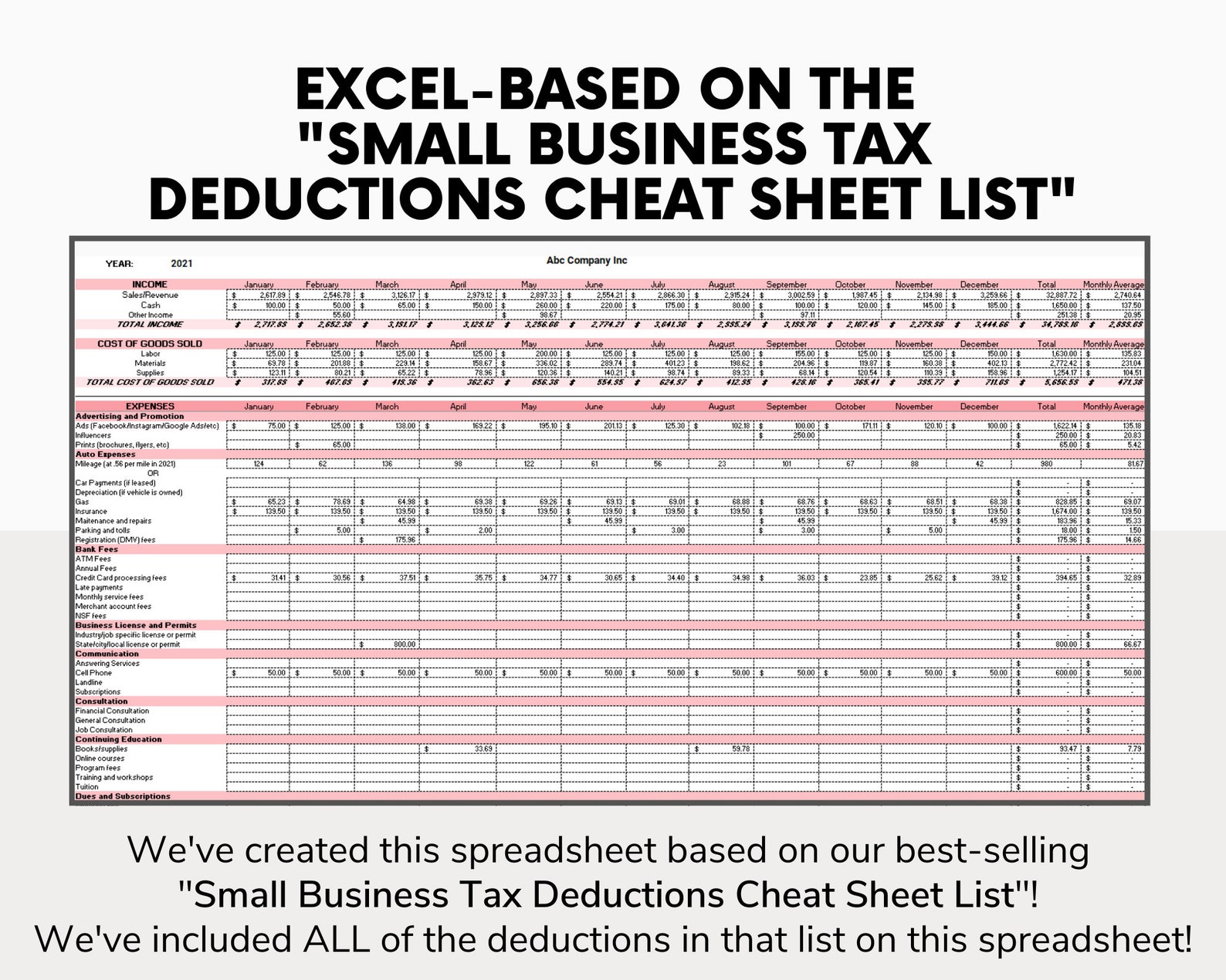

Business Tax Deductions Cheat Sheet Excel In PINK Tax Etsy

Tax Deduction On Tuition Fees Under Section 10 - Section 10 14 of the Income Tax Act 1961 allows taxpayers who are employed in India to claim a deduction for tuition fees paid for their children s full time education at a school college or university in India