Tax Deduction Rental Property Calculator Rental income from residential and other property You must report the rental income you receive and the expenses of renting The income you receive as you rent out your investment property is treated as capital income taxed at the tax rate in force The rate for capital income tax is 30 up to 30 000 and it rises to 34 for amounts

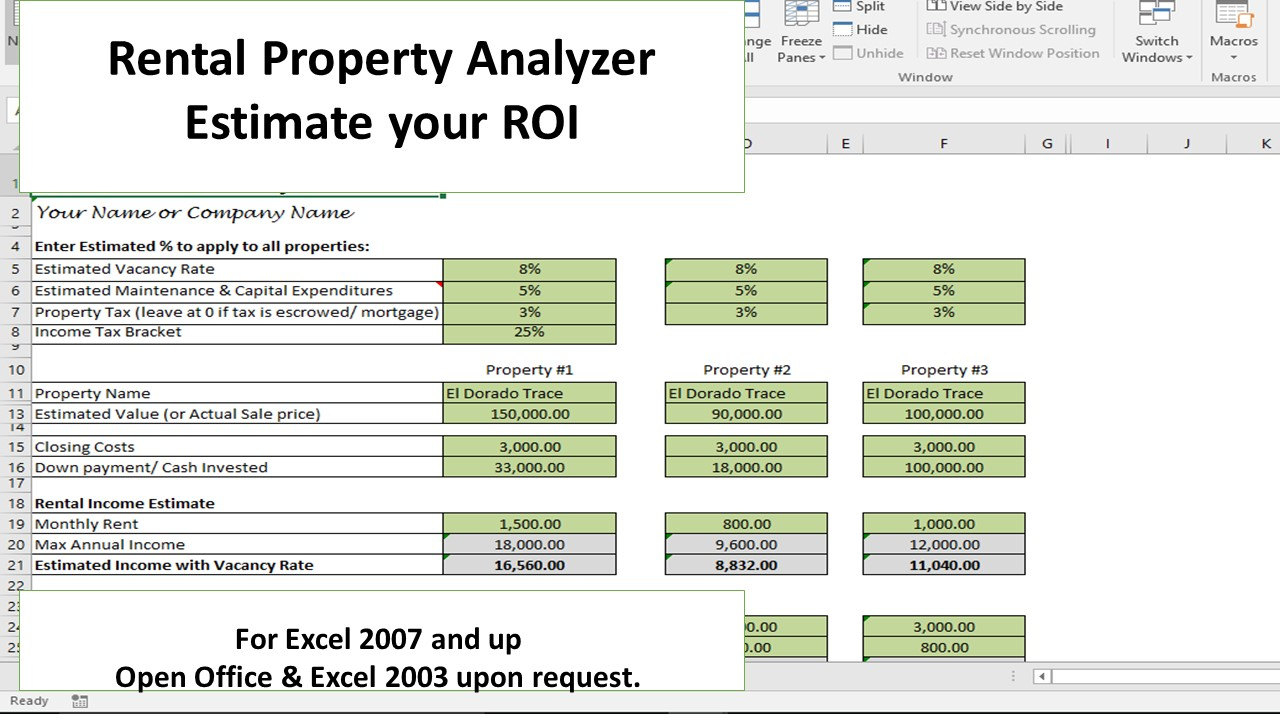

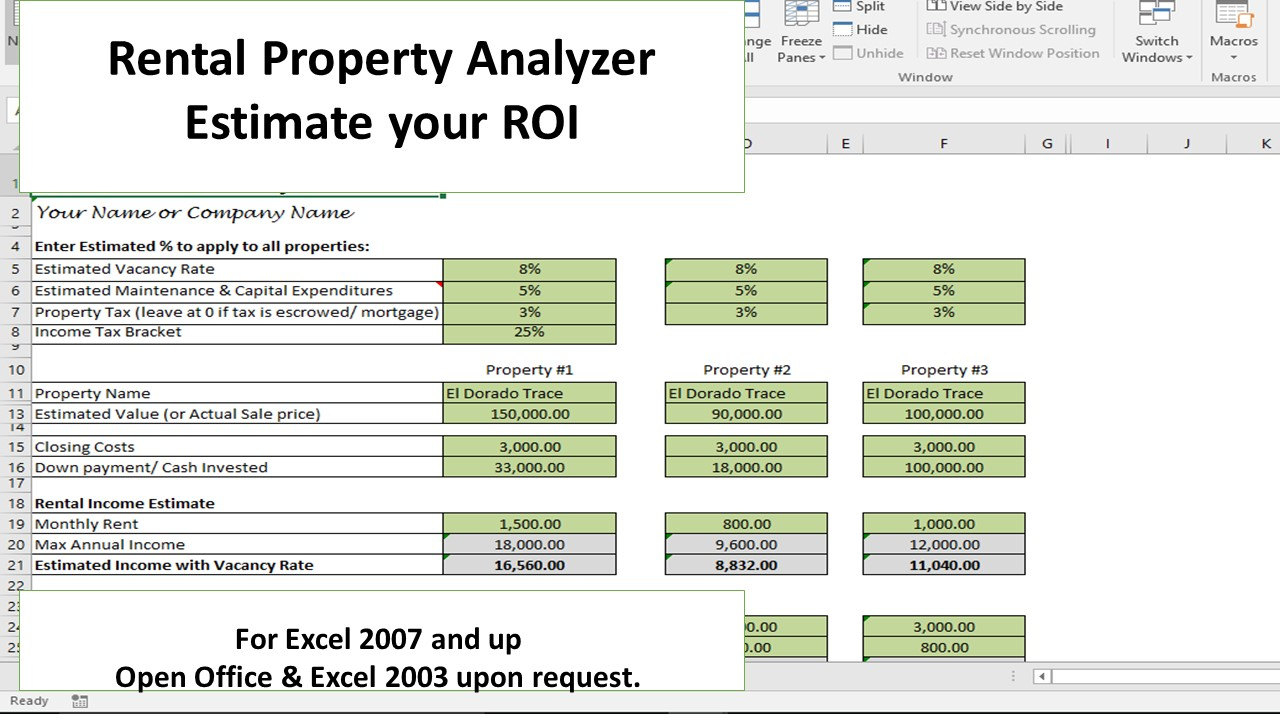

Rental property returns and income tax calculator Use our free rental property calculator to estimate your returns and cash flow Here s the math we used to calculate that tax payment 5 000 x 22 1 100 The Rental Property Calculator can be used to discover invaluable information about your potential rental property in an instant

Tax Deduction Rental Property Calculator

Tax Deduction Rental Property Calculator

https://www.negativegearingcalculator.com.au/images/free-rental-property-management-spreadsheet-individual.jpg

![]()

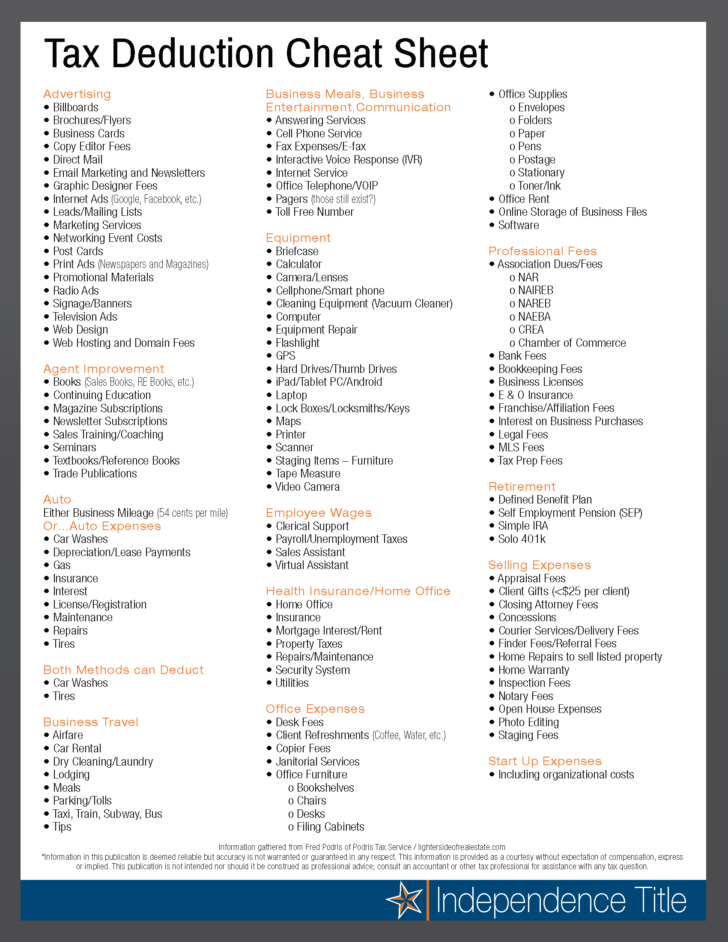

Download Printable Simple Tax Deductions Tracker Template PDF

https://onplanners.com/sites/default/files/template-images/printable-simple-tax-deductions-tracker-template-template.png

Investment Property Tax Deductions Investment Property Tax Flickr

https://live.staticflickr.com/5774/20834629678_2909a269c9_b.jpg

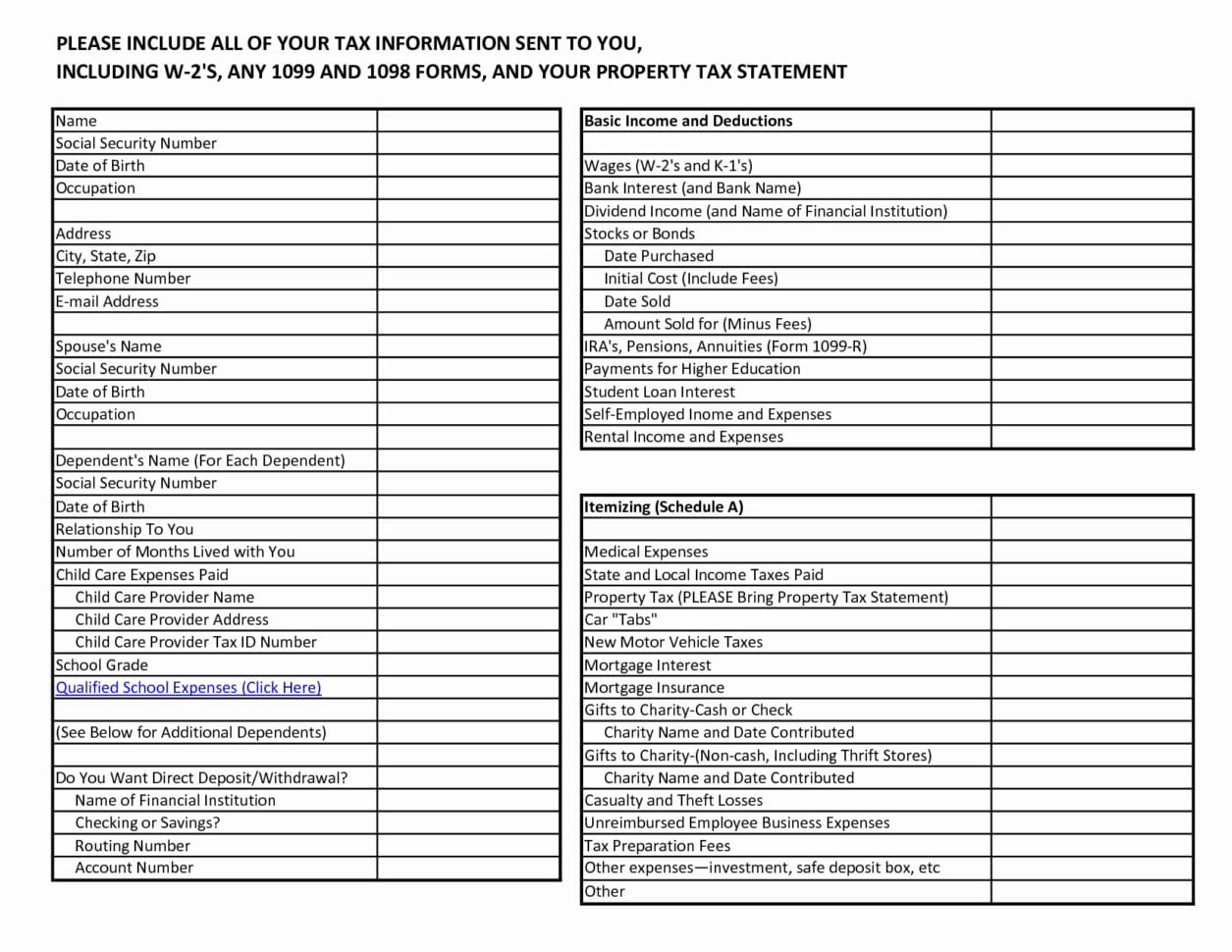

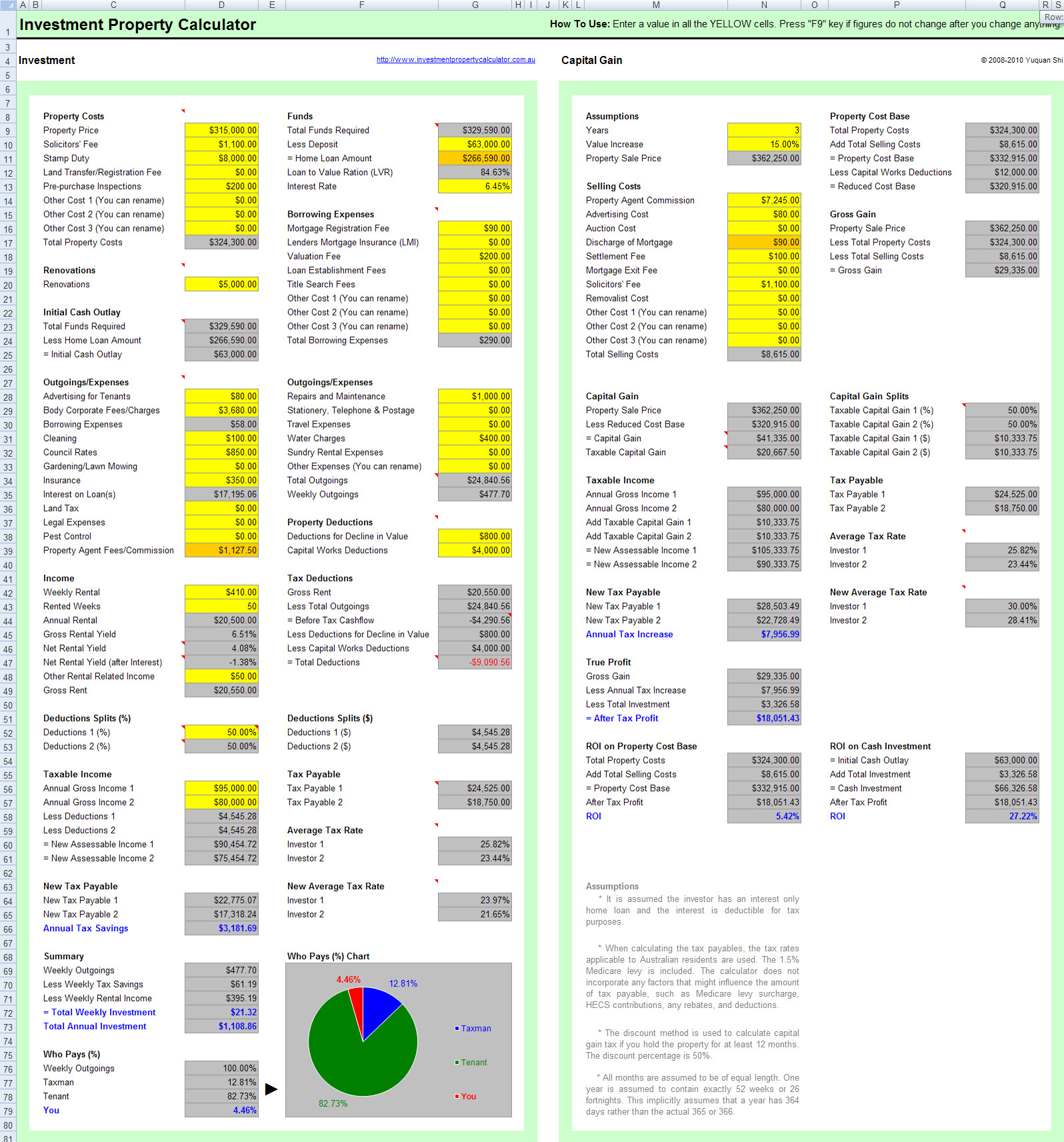

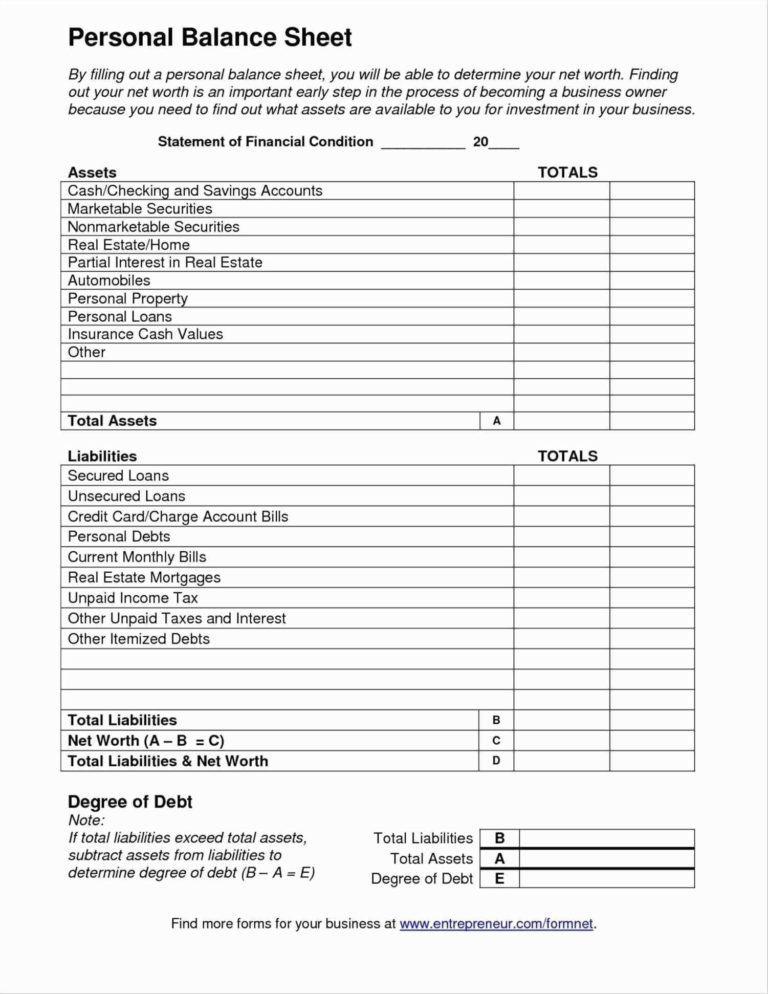

You can deduct expenses from your rental income when you work out your taxable rental profit as long as they are wholly and exclusively for the purposes of renting out the property If you receive rental income from the rental of a dwelling unit there are certain rental expenses you may deduct on your tax return These expenses may include mortgage interest property tax operating expenses depreciation and repairs

If you own a rental property the IRS allows you to deduct expenses you pay for the upkeep and maintenance of the property conserving and managing the property and other expenses deemed necessary and associated with property rental With more than two dozen potential rental property expenses keeping track of every tax deduction a real estate investor is entitled to can be a job in and of itself Manually entering income and expenses on a spreadsheet might work at first

Download Tax Deduction Rental Property Calculator

More picture related to Tax Deduction Rental Property Calculator

Tax Calculation Spreadsheet In 2022 Excel Spreadsheets Spreadsheet

https://i.pinimg.com/originals/23/67/ea/2367ea11fa5b6e4b672957c202e6196e.jpg

Special Tax Deduction Rental Reduction Apr 26 2022 Johor Bahru JB

https://cdn1.npcdn.net/image/16509811738797fb919a40c799c028bf66c6715af5.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1190&new_height=1000&w=-62170009200

2019 Form GA Hampton Tax And Financial Services Rental Property Income

https://www.pdffiller.com/preview/534/947/534947155/large.png

If you own rental property you can take advantage of several deductions to offset rental income and lower taxes Broadly you can deduct qualified rental expenses e g mortgage interest You can deduct property taxes you incurred for your rental property for the period it was available for rent For example you can deduct property taxes for the land and building where your rental property is situated For more information go to Vacant land and Construction soft costs

The IRS allows you to deduct a specific amount typically 3 636 from your taxable income every full year you own and rent a property Key Takeaways Rental property owners can use Our rental property income tax calculator is the most advanced estimator of your deduction Whether you need to estimate your rental income allowable deductions depreciation or overall tax liability this calculator simplifies the process for both short term rentals or long term rentals

5 Itemized Tax Deduction Worksheet Worksheeto

https://www.worksheeto.com/postpic/2010/07/schedule-c-tax-deduction-worksheet_449335.png

Rental Property Calculator Most Accurate Forecast

https://cosmic-s3.imgix.net/84aa9000-5165-11ec-9aff-3d50541531a0-250K-Cal.png?auto=format&w=859&h=397&ixlib=react-9.0.2&h=397&w=859&q=20&dpr=5

https://www.vero.fi/en/individuals/property/rental_income

Rental income from residential and other property You must report the rental income you receive and the expenses of renting The income you receive as you rent out your investment property is treated as capital income taxed at the tax rate in force The rate for capital income tax is 30 up to 30 000 and it rises to 34 for amounts

https://www.mynd.co/rental-return-calculator

Rental property returns and income tax calculator Use our free rental property calculator to estimate your returns and cash flow

ClassifiedAccomplished Rental Property Tax Deductions Worksheet

5 Itemized Tax Deduction Worksheet Worksheeto

Free Tax Deduction Worksheet

Rental Property Tax Deductions realestate taxes deduction Rental

Rental Property Tax Deductions Worksheet New Tax Prep Db excel

Rental Property Spreadsheet Template Free In Download Free Rental

Rental Property Spreadsheet Template Free In Download Free Rental

Free Investment Property Calculator Spreadsheet

Itemized Deductions Spreadsheet In Business Itemized Deductions

Special Tax Deduction On Rental Reduction Latest Updated 28 April

Tax Deduction Rental Property Calculator - You can deduct expenses from your rental income when you work out your taxable rental profit as long as they are wholly and exclusively for the purposes of renting out the property