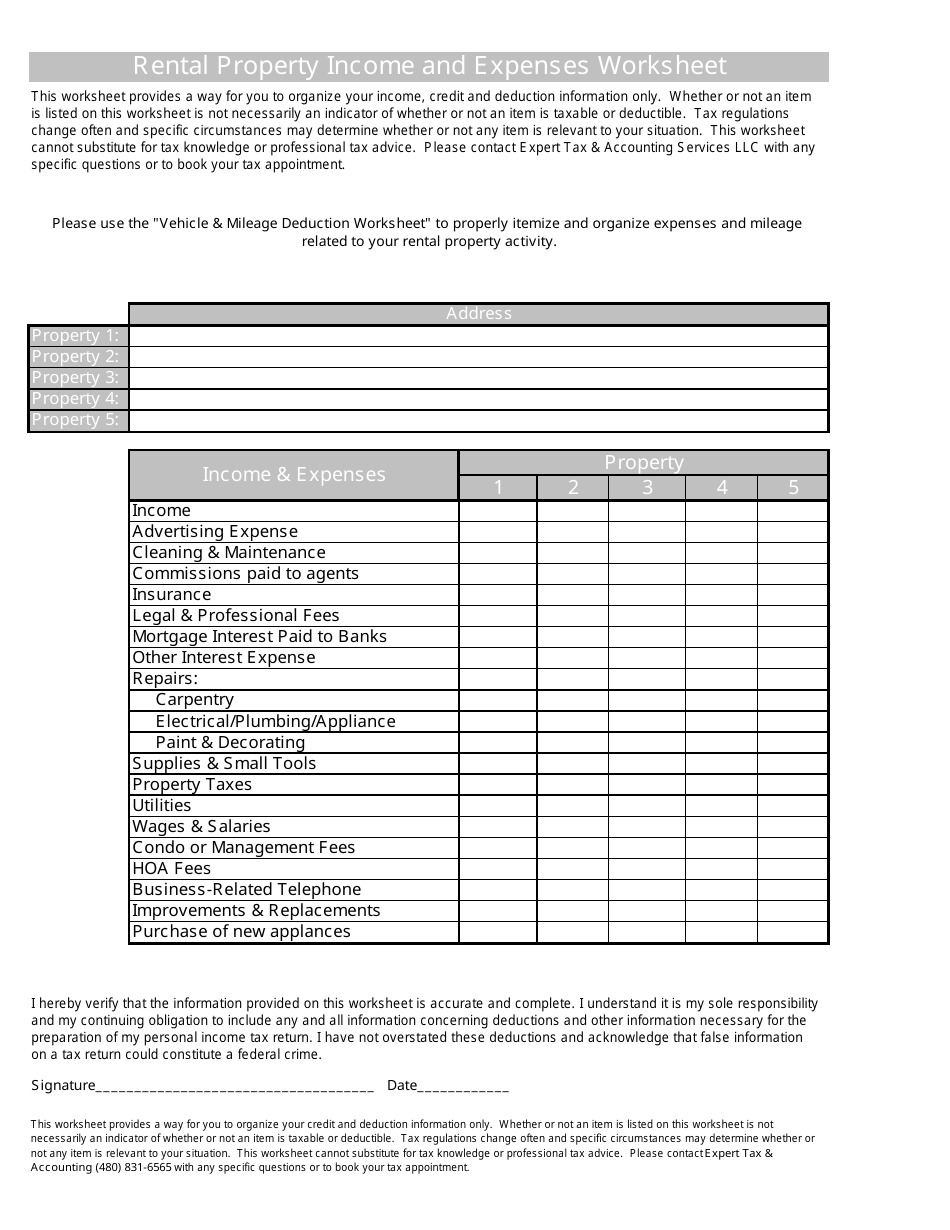

Tax Deduction Rental Property Repairs If you receive rental income from the rental of a dwelling unit there are certain rental expenses you may deduct on your tax return These expenses may include mortgage interest property tax operating expenses depreciation and repairs

Landlords can deduct most ordinary and necessary expenses related to the renting of residential property This includes rental property tax deductions for use of a car cleaning costs mortgage interest payments repairs property taxes utilities and more Your tenant pays for the necessary repairs and deducts the repair bill from the rent payment Include the repair bill paid by the tenant and any amount received as a rent payment in your rental income You can deduct the repair payment made by your tenant as a rental expense

Tax Deduction Rental Property Repairs

Tax Deduction Rental Property Repairs

https://i.pinimg.com/originals/8e/f4/2c/8ef42c9ab3dffc9b087a7a496909a1de.png

5 Most Overlooked Rental Property Tax Deductions AccidentalRental

http://accidentalrental.com/wp-content/uploads/2017/11/Rental-Tax-Deductions.png

Rental Property Income And Expenses Worksheet Expert Tax Accounting

https://data.templateroller.com/pdf_docs_html/93/934/93411/rental-property-income-and-expenses-worksheet-expert-tax-accounting-services-llc_print_big.png

The nine most common rental property tax deductions are 1 Mortgage Interest Most homeowners use a mortgage to purchase their own home and the same goes for rental properties Landlords with a mortgage will find that loan interest is A repair keeps your rental property in good condition and is a deductible expense in the year when you pay for it Repairs include painting fixing a broken toilet and replacing a faulty light

Tax deductions for rental property can be numerous This can include furnace repairs a new paint job in the home s interior lawn mowing services and more Any maintenance cost can be For information about repairs and improvements and depreciation of most rental property refer to Publication 527 Residential Rental Property Including Rental of Vacation Homes For additional information on depreciation refer to

Download Tax Deduction Rental Property Repairs

More picture related to Tax Deduction Rental Property Repairs

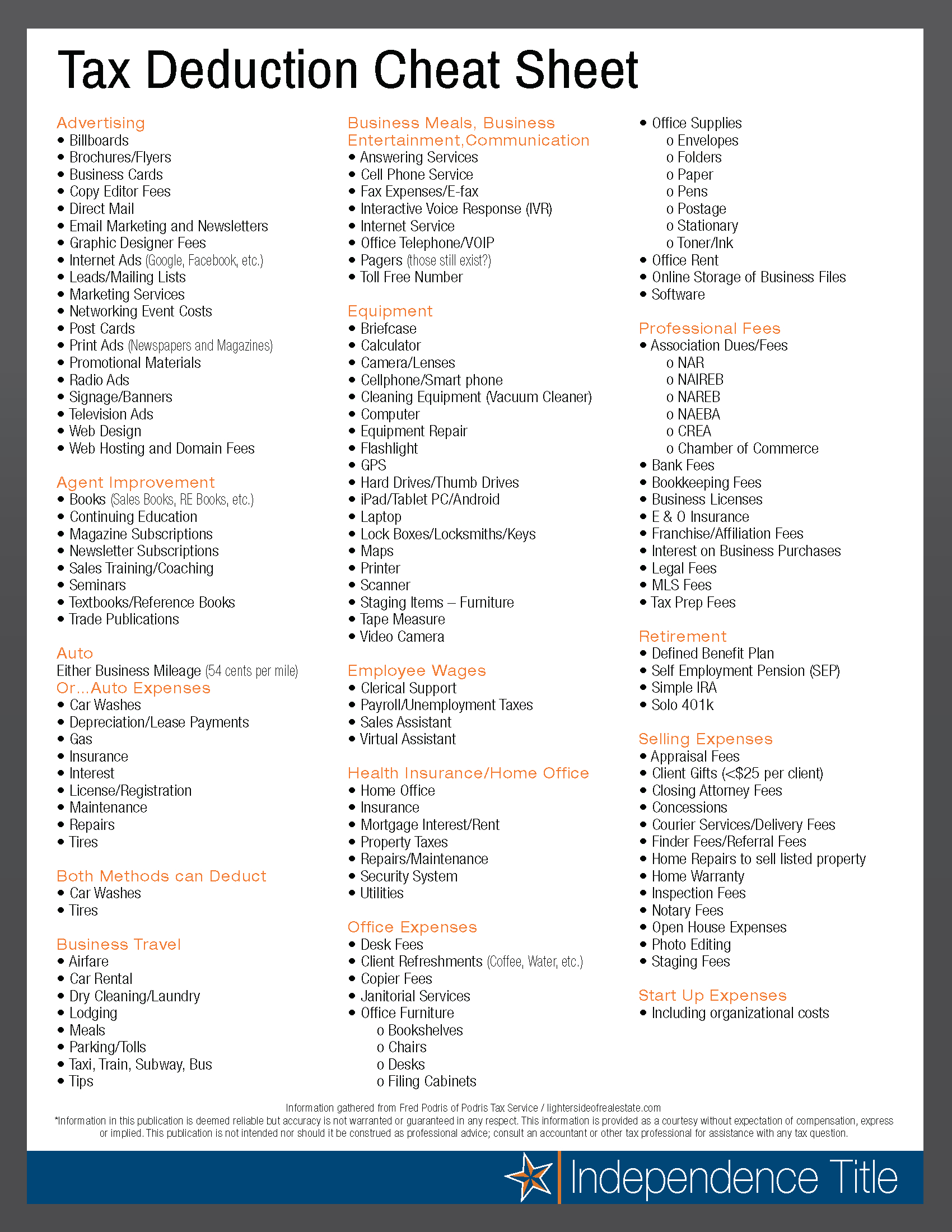

Tax Deduction Cheat Sheet For Real Estate Agents Db excel

https://db-excel.com/wp-content/uploads/2019/09/tax-deduction-cheat-sheet-for-real-estate-agents-1.png

Tax Return Tax Deduction For Rental Property

https://topaccountants.com.au/images/adv/blogs/Blog-15.png

Home Office Tax Deduction What To Know Fast Capital 360

https://www.fastcapital360.com/wp-content/uploads/2021/02/homeDeduction.jpg

Landlord Tax Deduction 3 Repairs A significant tax break for landlords can arise when they make repairs to their properties The cost of repairs to rental property provided the repairs are ordinary necessary and reasonable in amount are fully deductible in the year in which they are incurred The short answer is yes If you are the landlord you re able to deduct the full cost of a repair performed on a rental property on your taxes Deductions reduce your taxable income so in essence you can multiply the cost of the repair by your tax rate to determine how much you may save in taxes

The first and perhaps most obvious deduction category for rental property is the cost of standard repairs Adding all of these expenses maximizes how much you can deduct You will naturally incur these costs throughout the year so make sure you use them accurately to offset your income Owning a rental property can generate some extra income but it can also generate some great tax deductions Here are five big ones that tax pros say should be on your radar if own rental

Printable The Landlord s Itemized List Of Common Tenant Deposit

https://dremelmicro.com/wp-content/uploads/2020/01/printable-the-landlords-itemized-list-of-common-tenant-deposit-itemized-security-deposit-deduction-letter-example-768x1053.png

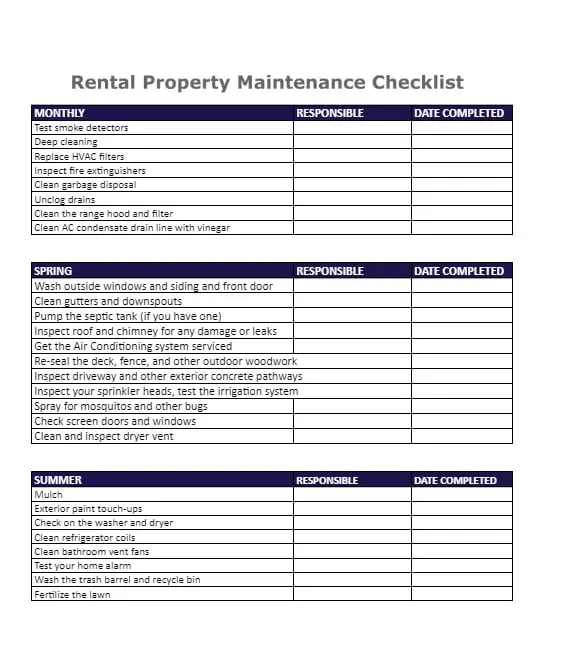

Rental Maintenance Checklist Template

https://www.rentce.com/wp-content/uploads/2021/03/RentalPropertyMaintenanceChecklist.jpg

https://www.irs.gov/businesses/small-businesses...

If you receive rental income from the rental of a dwelling unit there are certain rental expenses you may deduct on your tax return These expenses may include mortgage interest property tax operating expenses depreciation and repairs

https://turbotax.intuit.com/tax-tips/rental...

Landlords can deduct most ordinary and necessary expenses related to the renting of residential property This includes rental property tax deductions for use of a car cleaning costs mortgage interest payments repairs property taxes utilities and more

Special Tax Deduction Rental Reduction Apr 26 2022 Johor Bahru JB

Printable The Landlord s Itemized List Of Common Tenant Deposit

Deductions Worksheet Fill Out Sign Online DocHub

Rental Property Tax Deductions Tax Deductions Deduction Rental Property

Free Mortgage Calculator MN The Ultimate Selection

Get Our Sample Of Itemized Security Deposit Deduction Form For Free

Get Our Sample Of Itemized Security Deposit Deduction Form For Free

Tax deduction checklist Etsy

How To Repair Your Rental Property And Pay Less Taxes PTIreturns

Home Maintenance Schedule Spreadsheet Spreadsheet Collections In Home

Tax Deduction Rental Property Repairs - Repair and Maintenance Costs Expenses for repairing and maintaining your rental property are fully deductible in the year they occur These could include costs for replacing a water heater refrigerator or kitchen faucet Property Taxes Local and state property taxes paid on rental properties are deductible against rental income