Tax Deduction Retirement Tax and Retirement Congratulations on your retirement We believe that your retirement should be enjoyed and that you should not stress about tax Therefore

Get information about IRA contributions and claiming a deduction on your individual federal income tax return for the amount you contributed to your IRA The primary benefits of contributing to an individual retirement account IRA are the tax deductions the tax deferred or tax free growth on earnings and if you are

Tax Deduction Retirement

Tax Deduction Retirement

https://www.provise.com/wp-content/uploads/2020/08/shutterstock_573113545.jpg

Special Tax Deduction On Renovation Extension Jan 20 2022 Johor

https://cdn1.npcdn.net/image/164268488608eb2865a0692287fabecd75401ae768.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1000&new_height=1000&w=-62170009200

2021 Taxes For Retirees Explained Cardinal Guide

https://cardinalguide.com/app/uploads/2021/02/Standard_deductions_2021-751x550.jpg

You have to pay income tax on your pension and on withdrawals from any tax deferred investments such as traditional IRAs 401 k s 403 b s and similar retirement plans The Saver s Credit is a tax credit for eligible contributions to your IRA employer sponsored retirement plan or Achieving a Better Life Experience ABLE

Key Takeaways Contributions to a traditional IRA are deductible in the year they are made Your ability to deduct an IRA contribution depends on how much you Here s a breakdown of some common retirement income sources and a brief description of their federal tax implications More below on state taxes on retirement

Download Tax Deduction Retirement

More picture related to Tax Deduction Retirement

The Standard Deduction And Itemized Deductions After Tax Reform

https://www.coastalwealthmanagement24.com/wp-content/uploads/2018/03/The-Standard-Deduction-and-Itemized-Deductions-After-Tax-Reform-Coastal-Wealth-Management.gif

For Most Taxpayers The Amount Of The Standard Deduction And The

https://i.pinimg.com/originals/2d/5a/bd/2d5abd52bdb8d039ecf499b8a449547a.png

2023 Contribution Limits And Standard Deduction Announced Day Hagan

https://images.squarespace-cdn.com/content/v1/5e68f47ca0d8573682071426/db14bc39-72bb-4656-9ad5-416374313bf0/2023-retirement-account-contribution-limits-announced-10.25.2022.JPG

Do you have to pay taxes in retirement Use this guide to determine how different types of retirement income are taxed so you can plan accordingly When you turn 65 the IRS offers you a tax benefit in the form of an extra standard deduction for people age 65 and older For example a single 64 year old

You may be eligible for a 401 k tax deduction if you have a retirement account Read about contribution limits employer contributions and tax deferred options Tax tips for retirement Key Takeaways Limit income from pretax retirement plans to reduce your potential tax burden Understand your traditional IRA tax treatment

Abolition Of State Tax Deduction Keeps NJ Tax In Check

https://d.newsweek.com/en/full/718411/gettyimages-109917953.jpg

What Will My Tax Deduction Savings Look Like The Motley Fool

https://g.foolcdn.com/editorial/images/436120/tax-deduction_gettyimages-515708887.jpg

https://www.sars.gov.za/.../tax-and-retirement

Tax and Retirement Congratulations on your retirement We believe that your retirement should be enjoyed and that you should not stress about tax Therefore

https://www.irs.gov/retirement-plans/ira-deduction-limits

Get information about IRA contributions and claiming a deduction on your individual federal income tax return for the amount you contributed to your IRA

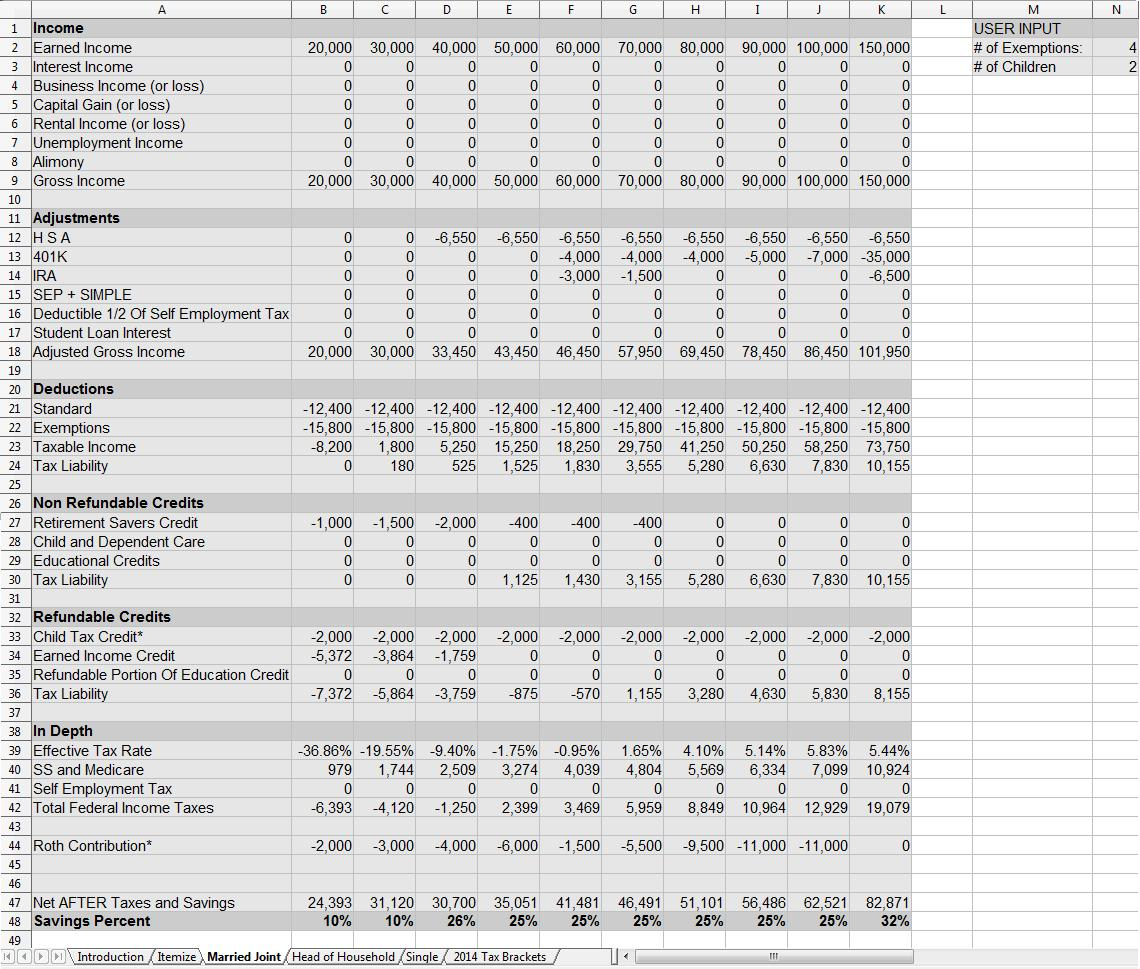

Financial Savings Spreadsheet Regarding Tax Planning Spreadsheet Valid

Abolition Of State Tax Deduction Keeps NJ Tax In Check

/https:%2F%2Fspecials-images.forbesimg.com%2Fdam%2Fimageserve%2F1128262916%2F0x0.jpg%3Ffit%3Dscale)

2 Ways The 199A Deduction Has Changed Retirement Planning

Tax Deduction 2022 Sonosite

Tax Deduction Tax Deduction 1040 IRS Tax Return Form And C Flickr

How To Fully Maximize Your 1099 Tax Deductions Steady

How To Fully Maximize Your 1099 Tax Deductions Steady

Maximising Tax Benefits Your Guide To Claiming A Rental Property

New Tax Laws Business Deduction Changes You Need To Know About

Tax Deduction Tracker Printable Tax Sheet Business Decduction Log

Tax Deduction Retirement - You have to pay income tax on your pension and on withdrawals from any tax deferred investments such as traditional IRAs 401 k s 403 b s and similar retirement plans