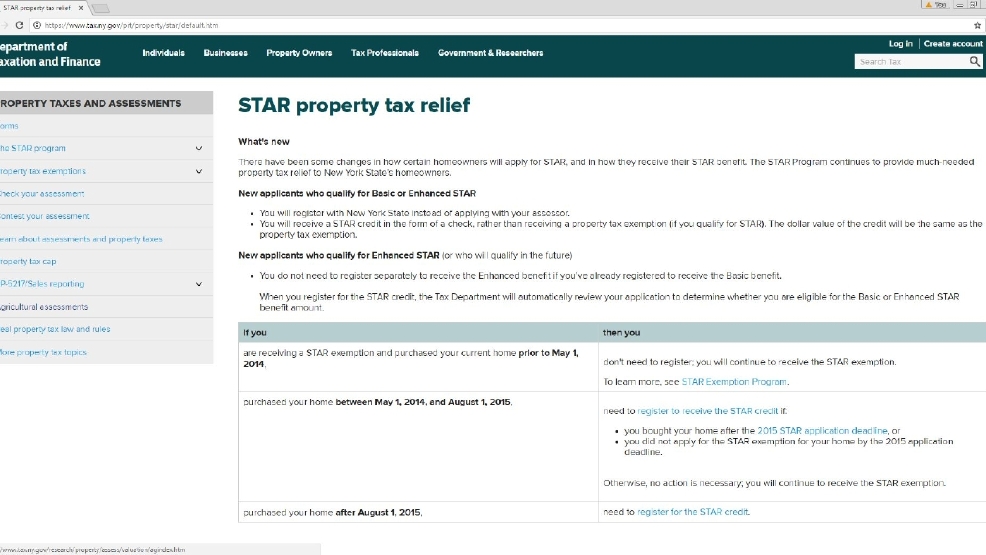

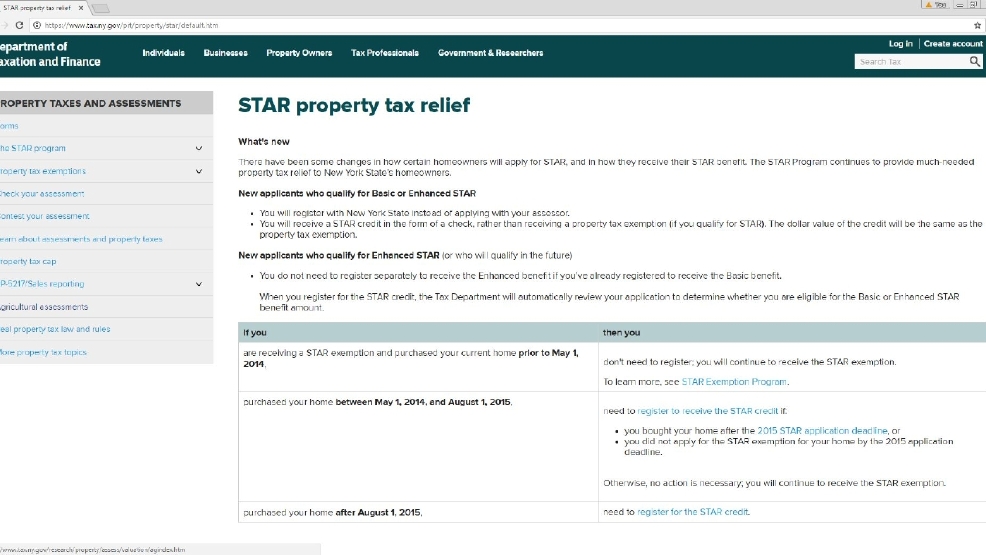

Tax Deduction Star Tax Rebate Web 5 sept 2023 nbsp 0183 32 You can receive the STAR credit if you own your home and it s your primary residence and the combined income of the owners and the owners spouses is 500 000

Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for Web 9 sept 2023 nbsp 0183 32 The proposed budget would temporarily increase the Virginia standard deduction for the 2024 and 2025 tax years For joint filers the standard deduction in

Tax Deduction Star Tax Rebate

Tax Deduction Star Tax Rebate

http://static-19.sinclairstoryline.com/resources/media/a58f3662-c124-411b-8f84-6c1a87572751-large16x9_100316STARwebsite1.JPG?1488401086657

Does This Have Anything To Do With STAR Tax Rebate Sorry If This Is A

https://i0.wp.com/www.starrebate.net/wp-content/uploads/2022/10/does-this-have-anything-to-do-with-star-tax-rebate-sorry-if-this-is-a.jpg

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

https://www.relakhs.com/wp-content/uploads/2019/03/Difference-between-Income-Tax-Exemption-Vs-Tax-Deduction-Income-Tax-Rebate-TDS-Tax-Relief-Tax-Benefit-pic.jpg

Web 30 d 233 c 2022 nbsp 0183 32 Federal Income Tax Credits and Incentives for Energy Efficiency Information updated 12 30 2022 The Inflation Reduction Act of 2022 provides federal tax credits Web Ce convertisseur permet de calculer un prix toutes taxes comprises TTC 224 partir d un prix hors taxes HT et vice versa selon le taux de TVA applicable

Web The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 The used EV tax credit can only be claimed

Download Tax Deduction Star Tax Rebate

More picture related to Tax Deduction Star Tax Rebate

Foster Appliance Promotions

https://foster-appliance.markupfactory.com/assets/foster-appliance/UtilityCoRebate copy.jpeg

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

Nys Star Tax Rebate Checks 2022 StarRebate

https://i0.wp.com/www.starrebate.net/wp-content/uploads/2022/10/senator-o-brien-reminds-homeowners-to-reapply-for-star-property-tax-2.jpg?w=1120&ssl=1

Web 9 sept 2023 nbsp 0183 32 The proposed budget would temporarily increase the Virginia standard deduction for the 2024 and 2025 tax years For joint filers the standard deduction in Web To be eligible for Basic STAR your income must be 250 000 or less You currently receive Basic STAR and would like to apply for Enhanced STAR You may be eligible for

Web 9 juin 2022 nbsp 0183 32 School Tax Relief STAR credit homeowner tax rebate credit HTRC If you itemize your deductions reduce your itemized deduction for real estate taxes paid by Web 30 d 233 c 2022 nbsp 0183 32 Information updated 12 30 2022 Under the Inflation Reduction Act of 2022 federal income tax credits for energy efficiency home improvements will be available

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

Major Exemptions Deductions Availed By Taxpayers In India

https://www.taxhelpdesk.in/wp-content/uploads/2020/12/Weekly-Updates-1.png

https://www.tax.ny.gov/star

Web 5 sept 2023 nbsp 0183 32 You can receive the STAR credit if you own your home and it s your primary residence and the combined income of the owners and the owners spouses is 500 000

https://www.irs.gov/credits-deductions/energy-efficient-home...

Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

How To Calculate Tax Rebate On Home Loan Grizzbye

2007 Tax Rebate Tax Deduction Rebates

80C TO 80U DEDUCTIONS LIST PDF

Travelling Expenses Tax Deductible Malaysia Paul Springer

Pin On Tax Credits Vs Tax Deductions

Standard Deduction For 2021 22 Standard Deduction 2021

Standard Deduction For 2021 22 Standard Deduction 2021

Solved Janice Morgan Age 24 Is Single And Has No Chegg

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

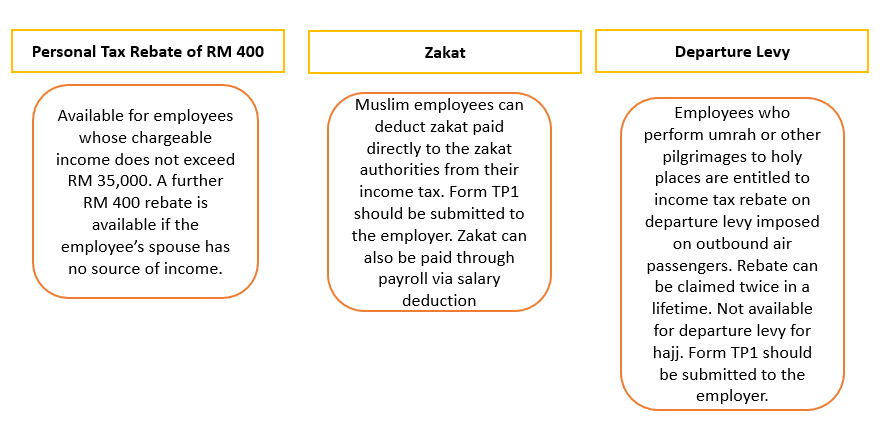

Everything You Need To Know About Running Payroll In Malaysia

Tax Deduction Star Tax Rebate - Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 The used EV tax credit can only be claimed