Tax Deduction Under Section 16 Section 16 provides a deduction from the income chargeable to tax under the head salaries It offers deductions for the standard deduction entertainment allowance and

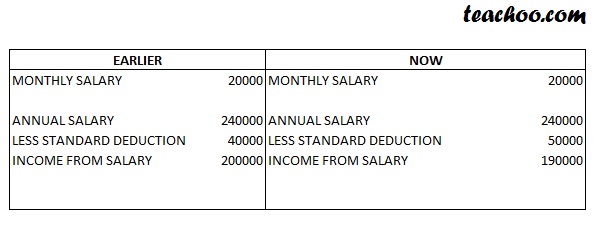

Standard deduction under Section 16 ia is a flat deduction that is allowed from the salary income The concept of standard deduction was introduced in the Union Standard deduction comes under which section Standard deduction comes under Section 16 ia of the Income Tax Act As per this section you can use a standard deduction of Rs 50 000 or the amount

Tax Deduction Under Section 16

Tax Deduction Under Section 16

https://www.taxhelpdesk.in/wp-content/uploads/2021/08/Deductions-under-Section-80C-its-allied-sections.png

What Are Deductions From Salary Under Section 16 Deductions From Sal

https://d1avenlh0i1xmr.cloudfront.net/d3065173-b8e7-42dc-b7a8-f6bf474bc611/earlier-now---teachoo.jpg

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction.jpg

The standard deduction under Section 16 i a allows salaried individuals and pensioners to claim a flat deduction from their salary or pension income up to a limit specified by law This provides The standard deduction under section 16ia of the Income Tax Act permits salaried employees to reduce their taxable income The Indian Finance Minister established the standard deduction under 16 ia

Explore the benefits and eligibility criteria for the Section 16 deduction under the Income Tax Act Understand how salaried employees can claim relief and reduce taxable income Section 16 of Income Tax Act of 1961 allows deductions for salaried individuals in India to calculate their taxable income It lowers the amount of your salary that can be taxed by

Download Tax Deduction Under Section 16

More picture related to Tax Deduction Under Section 16

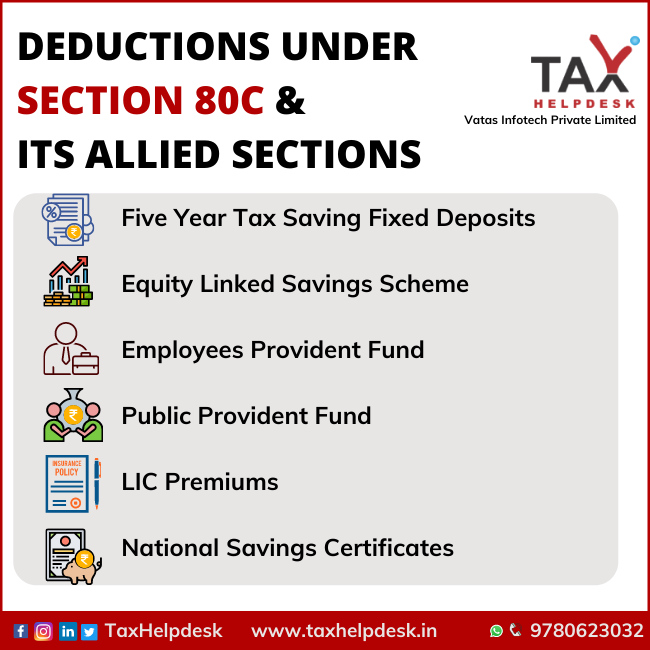

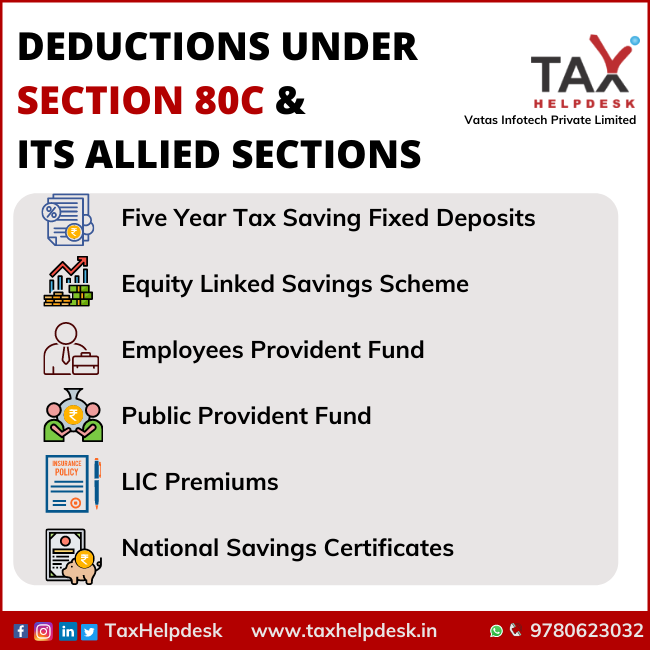

Section 80C Deductions Save Up To 1 5 Lakhs On Taxes

https://life.futuregenerali.in/media/2zjhyg5j/section-80c-deductions.jpg

Deductions Under Salaries Section 16 YouTube

https://i.ytimg.com/vi/gADEgGn3iOk/maxresdefault.jpg

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-11.jpg

Salaried Indians get a tax break Section 16 offers deductions including a standard 50 000 for everyone Find out how to lower your tax bill Standard deduction under Section 16 ia Under Section 16 ia the standard deduction is a flat deduction allowed on your salary income It replaced the transport

Standard Deductions under Section 16 ia The Standard Deduction under Section 16 ia is this section s most prominent and universally applicable deduction It is Under the Income tax Act whatever professional tax is paid during the previous year is deductible Example Suppose X posted in Hyderabad is required to pay Rs 2 000

Section 80GG Of Income Tax Act Tax Claim Deduction For Rent Paid

https://blog.tax2win.in/wp-content/uploads/2019/06/Deduction-where-House-rent-is-paid-and-HRA-not-received.jpg

Section 16 Standard Deduction Professional Tax LegalRaasta

https://www.legalraasta.com/blog/wp-content/uploads/2021/10/Section-16.png

https://groww.in/p/tax/section-16-of-income-tax-act

Section 16 provides a deduction from the income chargeable to tax under the head salaries It offers deductions for the standard deduction entertainment allowance and

https://www.turtlemint.com/tax/section-16-of-income-tax-act

Standard deduction under Section 16 ia is a flat deduction that is allowed from the salary income The concept of standard deduction was introduced in the Union

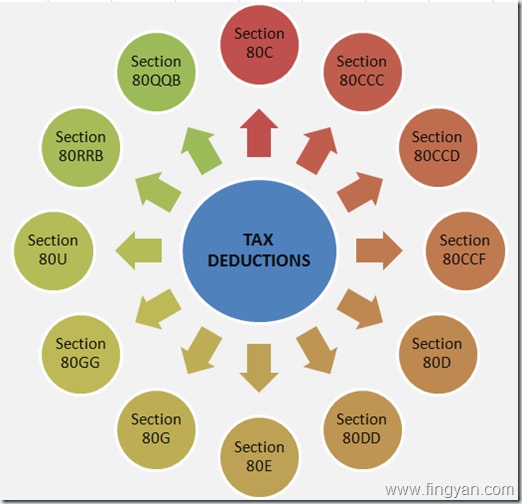

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Section 80GG Of Income Tax Act Tax Claim Deduction For Rent Paid

Section 80C Of Income Tax Act Tax Deduction AY 2023 24

7 Tax Provisions That Are Relevant To You Beyond Just Section 80C

Information On Section 80G Of Income Tax Act Ebizfiling

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Section 80U Tax Deductions For Disabled Individuals Tax2win

Section 10 Of Income Tax Act Exemptions Deductions How To Claim

Section 80C Deduction Under Section 80C In India Paisabazaar

Tax Deduction Under Section 16 - Section 16 of Income Tax Act 1961 provides deduction from income chargeable to tax under the head salaries It provides deductions for the standard