Tax Deduction Washing Clothes Flat rate expenses sometimes known as a flat rate deduction allow you to claim tax relief for an agreed fixed amount each tax year to cover what you spend on the clothing and

Key Takeaways Certain job related expenses such as theatrical costumes hard hats and other safety gear may be deductible Items that can be worn outside of work including IRS Publication 529 gives us the basic rules that taxpayers must meet ALL three 3 of the following conditions The clothing is required or essential for your job The clothing is

Tax Deduction Washing Clothes

Tax Deduction Washing Clothes

https://i.pinimg.com/originals/c1/fe/77/c1fe77bfd3a19358901fe3dcd052a853.jpg

Special Tax Deduction On Renovation Extension Jan 20 2022 Johor

https://cdn1.npcdn.net/image/164268488608eb2865a0692287fabecd75401ae768.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1000&new_height=1000&w=-62170009200

How To Get Your Biggest Tax Deduction The Motley Fool

https://g.foolcdn.com/editorial/images/437194/tax-deduction_gettyimages-515708887.jpg

If your laundry expenses pass the wholly exclusively and necessarily test you can claim self employed expenses You do this when you do your Self Assessment tax return In Deducting laundry expenses If your clothes do qualify as business expenses you can also write off the cost of upkeep That means dry cleaning expenses and fees for

The initial cost of buying clothing for work cleaning repairing or replacing everyday clothing you wear for work even if you must wear a certain design or colour the cost of Clothing is one of the more contested tax deductions and it tends to get rejected a lot But this doesn t mean you should avoid deducting work related clothing expenses on your

Download Tax Deduction Washing Clothes

More picture related to Tax Deduction Washing Clothes

5 Easy Tax Deductions For A Higher Tax Return AUSTRALIA Part 1

https://financefornoobs.com/wp-content/uploads/2022/10/Tax-deductible-uniform.jpeg

13 Car Expenses Worksheet Worksheeto

https://www.worksheeto.com/postpic/2010/10/tax-deduction-worksheet_449321.png

8 Tax Preparation Organizer Worksheet Worksheeto

https://www.worksheeto.com/postpic/2015/05/2015-itemized-tax-deduction-worksheet-printable_449272.png

Clothing Tax Deduction Guide In order to deduct the cost of purchasing work clothing and the expense of cleaning them your employer must expressly require that you wear the 1 min read Share Determining if work tools and uniforms as well as works clothes are tax deductible depends on a couple of factors In regard to uniforms you can deduct the

General Business Claiming for Clothes Understanding Deductible Expenses for Work Attire and Uniforms Maximize tax deductions for work attire Learn how to claim Did it count as business related clothing for tax purposes The answer in my case was no However your situation may be different here s how to know if your business

Example Tax Deduction System For A Single Gluten free GF Item And

https://www.researchgate.net/profile/Julio-Bai/publication/274087526/figure/tbl1/AS:391861509345282@1470438472540/Example-tax-deduction-system-for-a-single-gluten-free-GF-item-and-calculations-for-tax.png

ITR Filing Income Tax Exemption Deduction That Home Loan Borrowers

https://img.etimg.com/thumb/msid-103082793,width-1070,height-580,imgsize-1585531/photo.jpg

https://www.gov.uk/guidance/job-expenses-for...

Flat rate expenses sometimes known as a flat rate deduction allow you to claim tax relief for an agreed fixed amount each tax year to cover what you spend on the clothing and

https://turbotax.intuit.com/tax-tips/jobs-and...

Key Takeaways Certain job related expenses such as theatrical costumes hard hats and other safety gear may be deductible Items that can be worn outside of work including

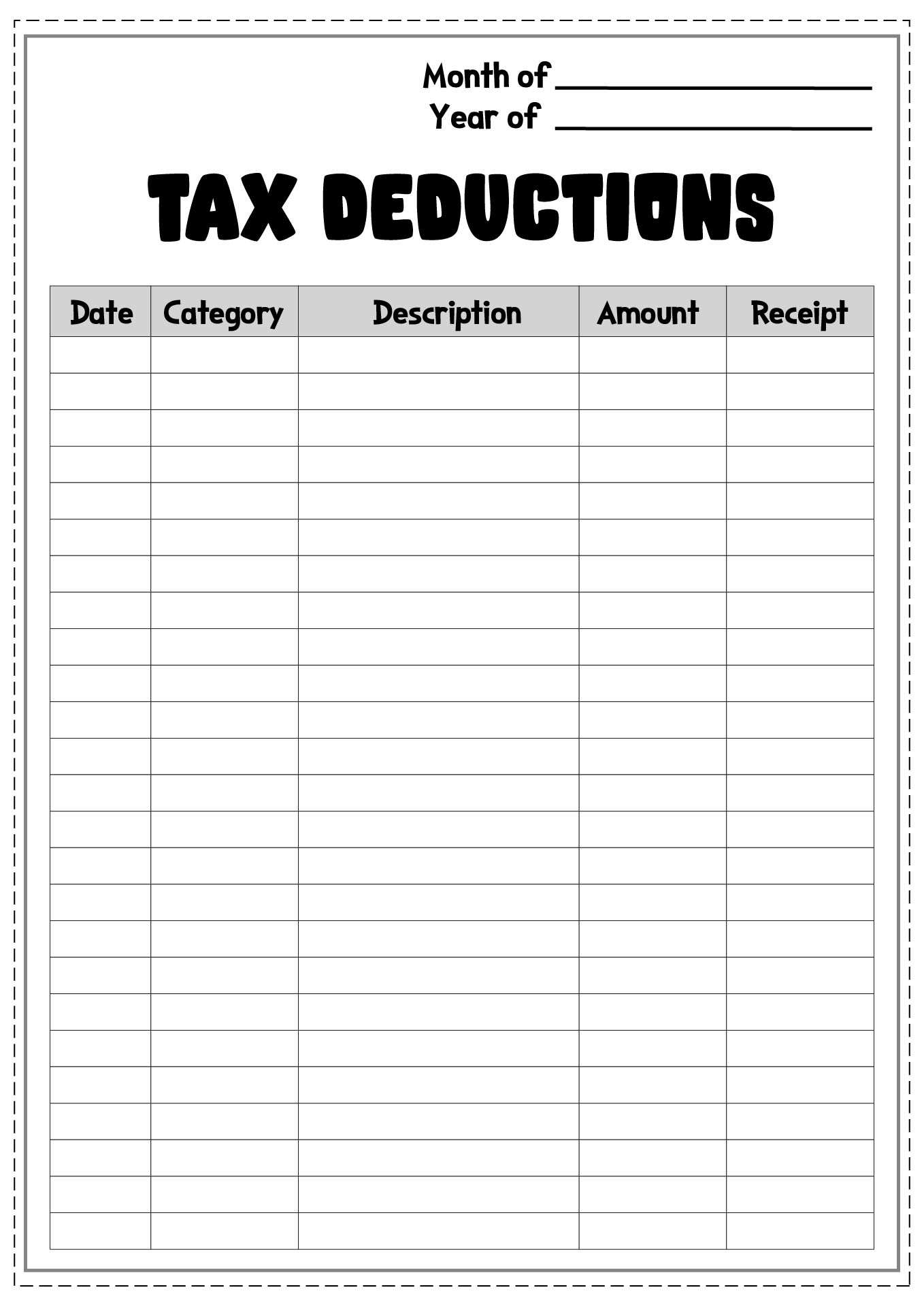

Tax Deductions

Example Tax Deduction System For A Single Gluten free GF Item And

How To Fully Maximize Your 1099 Tax Deductions Steady

Maximising Tax Benefits Your Guide To Claiming A Rental Property

Printable Itemized Deductions Worksheet

Tax Deduction Tax Deduction 1040 IRS Tax Return Form And C Flickr

Tax Deduction Tax Deduction 1040 IRS Tax Return Form And C Flickr

New Tax Laws Business Deduction Changes You Need To Know About

Rebating Meaning In Insurance What Is Insurance Rebating The

Maryland Enacts Classroom Supplies Deduction Tax Accounting Blog

Tax Deduction Washing Clothes - If your laundry expenses pass the wholly exclusively and necessarily test you can claim self employed expenses You do this when you do your Self Assessment tax return In