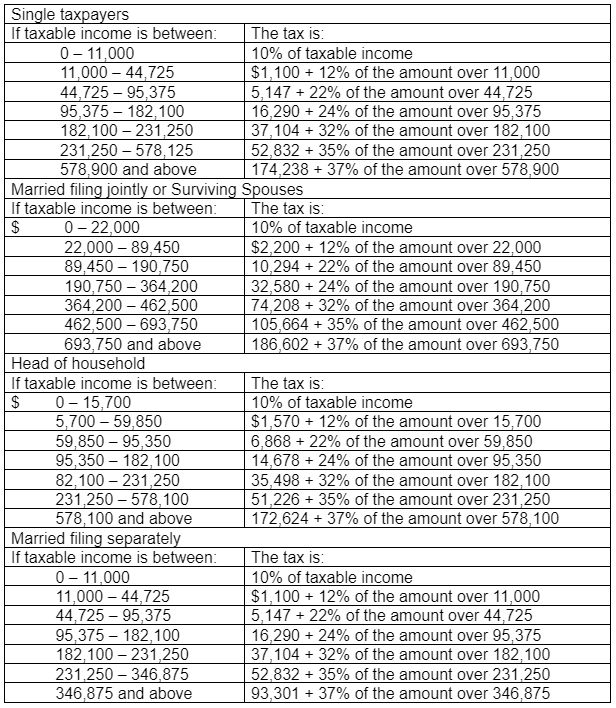

Tax Deduction Website Development Costs Software and website development costs Addressing problems around the accounting and tax treatment for software costs incurred by companies Accounting treatment under FRS 102

If you decide to develop your website in house you have the choice of two different methods of deduction You can choose to deduct the total cost of the website in the year it was paid or Start up expenses can include website development costs Up to 5 000 of otherwise deductible expenses that are incurred before your business commences can generally be deducted in the

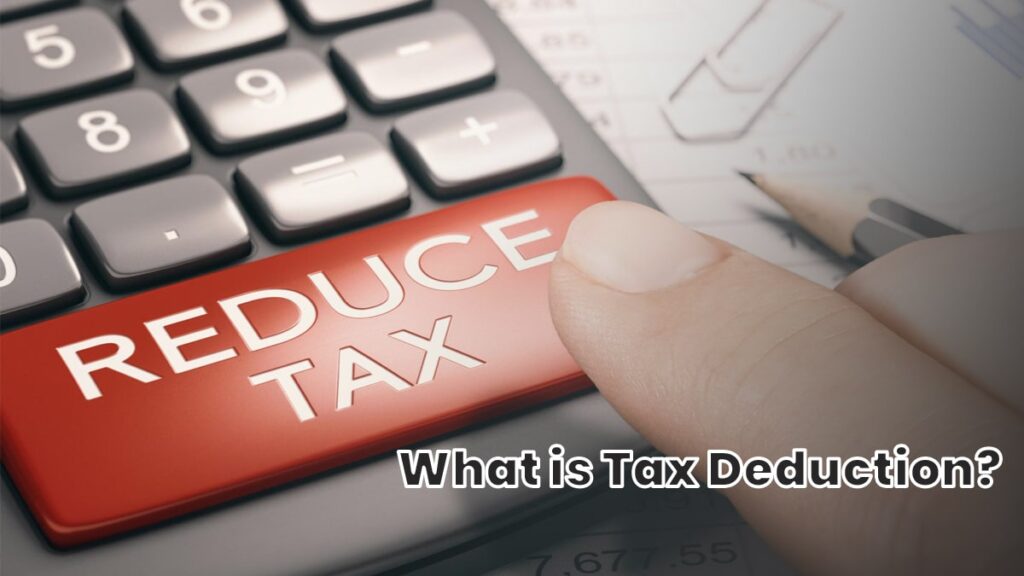

Tax Deduction Website Development Costs

Tax Deduction Website Development Costs

https://websitelearners.com/content/uploads/2021/10/Website-development-cost-in-India-Blog-03.jpg

Donate Under Section 80G Of Income Tax Receive Deduction

https://www.lyceetrust.org/storage/uploads/2023/01/blog-lyecc.jpg

Free Tax Deduction Business 3d Illustration Rendering 11629341 PNG With

https://static.vecteezy.com/system/resources/previews/011/629/341/original/tax-deduction-business-3d-illustration-rendering-png.png

Despite their widespread use the IRS hasn t issued formal guidance on when website costs can be deducted But there are established rules that generally apply to the Important Start up expenses can include website development costs But they don t include costs that you treat as deductible research and development costs under Sec 174 You can deduct those costs when they

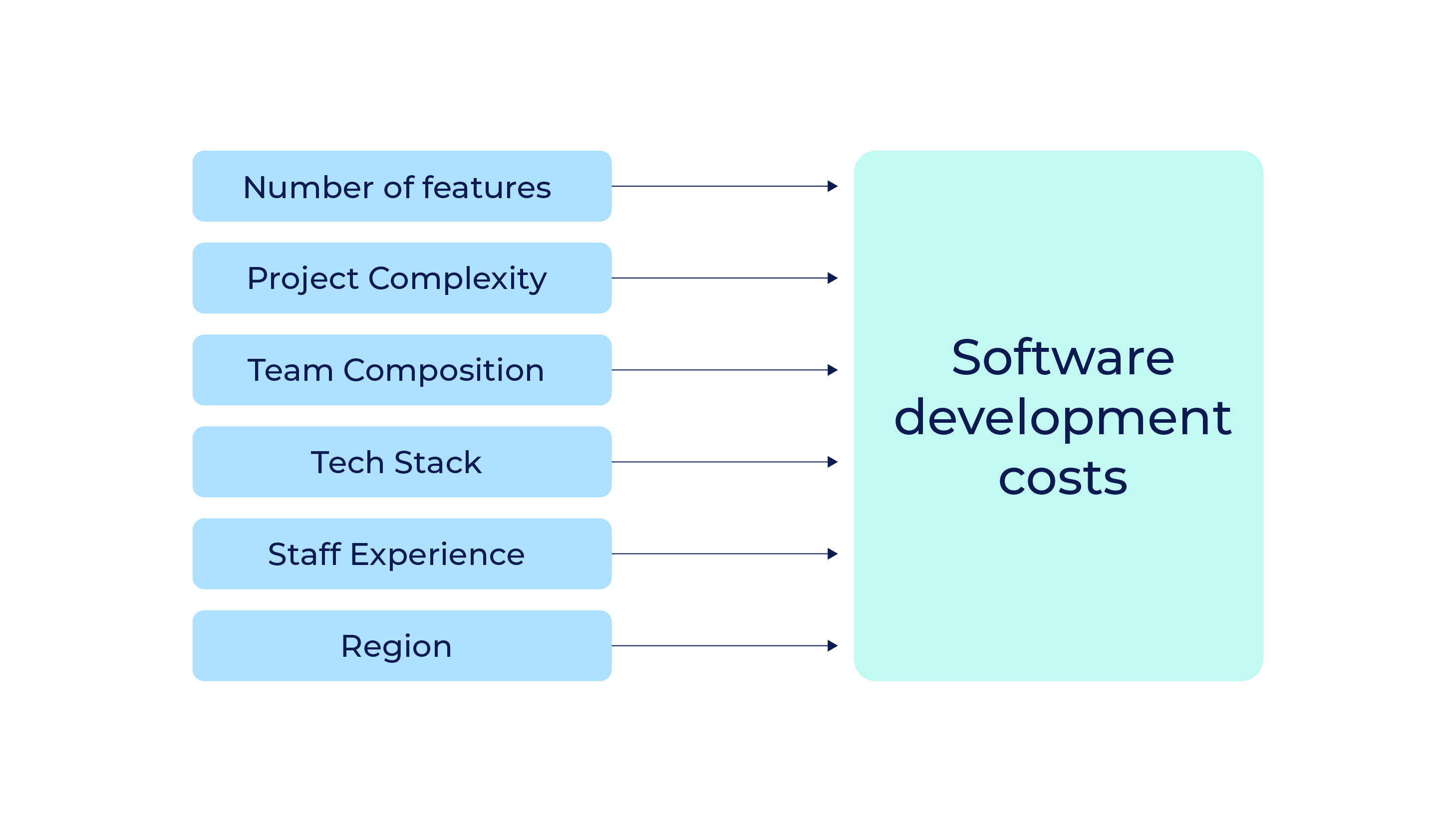

Unsure about tax treatment for your website development costs This blog should answer your questions and might even help you save a lot of money Understanding the tax implications of capitalizing website development costs requires a nuanced approach considering both immediate and long term financial impacts

Download Tax Deduction Website Development Costs

More picture related to Tax Deduction Website Development Costs

Tax Deduction Concept Of Tax Return optimization Duty Financial

https://static.vecteezy.com/system/resources/previews/013/259/623/large_2x/tax-deduction-concept-of-tax-return-optimization-duty-financial-accounting-vector.jpg

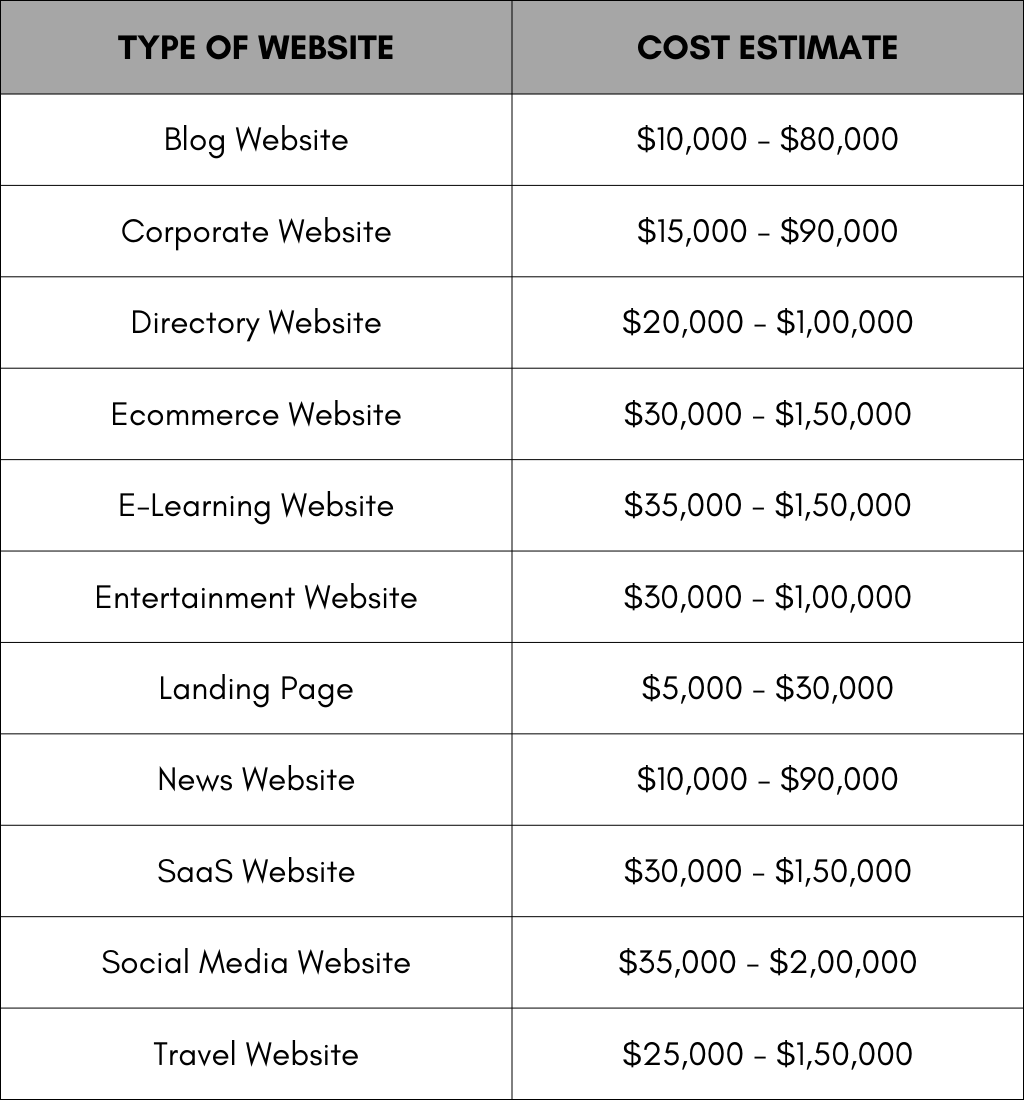

Website Development Cost

https://ares.decipherzone.com/blog-manager/uploads/ckeditor_Website Development Cost.png

Tax Deductions List Artofit

https://i.pinimg.com/originals/29/53/83/2953833b8c3d76c1445153d3773f4a10.jpg

As a business owner you can claim a tax deduction for the cost of digital products used in running your business Last updated 16 July 2024 Print or Download On Payments for leased or licensed software used for your website are currently deductible as ordinary and necessary business expenses An alternative position is that your software development costs represent

Start up expenses can include website development costs Up to 5 000 of otherwise deductible expenses that are incurred before your business commences can generally be deducted in the year business commences Website costs can be broadly classified as either capital expenses or ongoing running costs Running costs maintenance will normally be deductible as a business

What Is The Different Between Tax Credits And Deductions Wester Law

https://www.nerdwallet.com/assets/blog/wp-content/uploads/2017/11/GettyImages-1222021860.jpg

Salary Deduction Certificate Us 149 Format PDF Taxes Tax Deduction

https://imgv2-2-f.scribdassets.com/img/document/601480911/original/c351f85e51/1668978142?v=1

https://www.accaglobal.com/uk/en/techn…

Software and website development costs Addressing problems around the accounting and tax treatment for software costs incurred by companies Accounting treatment under FRS 102

https://www.bench.co/blog/tax-tips/web-development

If you decide to develop your website in house you have the choice of two different methods of deduction You can choose to deduct the total cost of the website in the year it was paid or

How To Claim 179D Tax Deduction On Energy Efficient Commercial

What Is The Different Between Tax Credits And Deductions Wester Law

Calculate Software Development Costs In 2024 LITSLINK Blog

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

United States Sales Taxes VAT GST 2023 Tax Rates And Deduction

What Is Tax Deduction Definition Types And Benefits

What Is Tax Deduction Definition Types And Benefits

Budgeting Wisely Navigating Web Development Costs Shakuro

How To Use Your Website As A Tax Deduction Landmark CPAs

Here s How Much A Professional Business Website Development Costs

Tax Deduction Website Development Costs - HMRC provides clear guidelines on how businesses can deduct website development costs for tax purposes Limited companies as well as unincorporated businesses must adhere to these