Tax Deductions Explained A tax deduction is an expense that can be subtracted from an individual s or corporation s income to reduce the amount of taxable income This decrease in taxable income means that taxpayers pay less in taxes to the government

The purpose of tax deductions is to decrease your taxable income thus decreasing the amount of tax you owe to the federal government There are hundreds of ways to use deductions to reduce your taxable income but many people don t know about them or know how to A deduction is an expense that can be subtracted from taxable income to reduce the amount owed Most taxpayers who take the standard deduction only need to file Form

Tax Deductions Explained

Tax Deductions Explained

https://i0.wp.com/biznessprofessionals.com/wp-content/uploads/2020/04/Capture351.png?fit=693%2C345&ssl=1

Vehicle Sales Tax Deductions Explained Picnic

https://www.picnictax.com/wp-content/uploads/2022/02/shutterstock_1214543995-768x512.jpg

Vehicle Tax Deduction Section 179 Explained How To Write Off A

https://i.pinimg.com/originals/dd/c3/8e/ddc38eaf0a682fb4382a7dac2ab60d6c.jpg

Tax deductions are financial provisions that allow taxpayers to reduce their taxable income These deductions represent specific expenses or allowances that the government permits individuals and businesses to subtract from their gross income before calculating their tax liability How Tax Deductions Work A tax deduction is an item you can subtract from your taxable income to lower the amount of taxes you owe Browse Investopedia s expert written library to learn more Form 8917 Tuition and

Lesson 1 Personal taxes Basics of US income tax rate schedule Tax deductions introduction AMT overview Alternative minimum tax Estate tax introduction Tax brackets and progressive taxation Calculating state taxes and take home pay A tax deduction is a provision that reduces taxable income as an itemized deduction or a standard deduction that is a single deduction at a fixed amount

Download Tax Deductions Explained

More picture related to Tax Deductions Explained

What Can FIFO Workers Claim On Tax 2022 Tax Deductions Explained

https://wealthvisory.com.au/wp-content/uploads/2021/05/273538268_677871850232189_7678163990722998246_n.png

Home Buying Tax Deductions Estate Tax Tax Deductions Tax Reduction

https://i.pinimg.com/originals/c3/7a/70/c37a709d7ea9a260e46be9a93ad066ce.jpg

Tax Deductions Explained and Common Ones You Could Claim Your Easy

https://cdn.thepennyhoarder.com/wp-content/uploads/2019/04/22130630/GettyImages-854190902.jpg

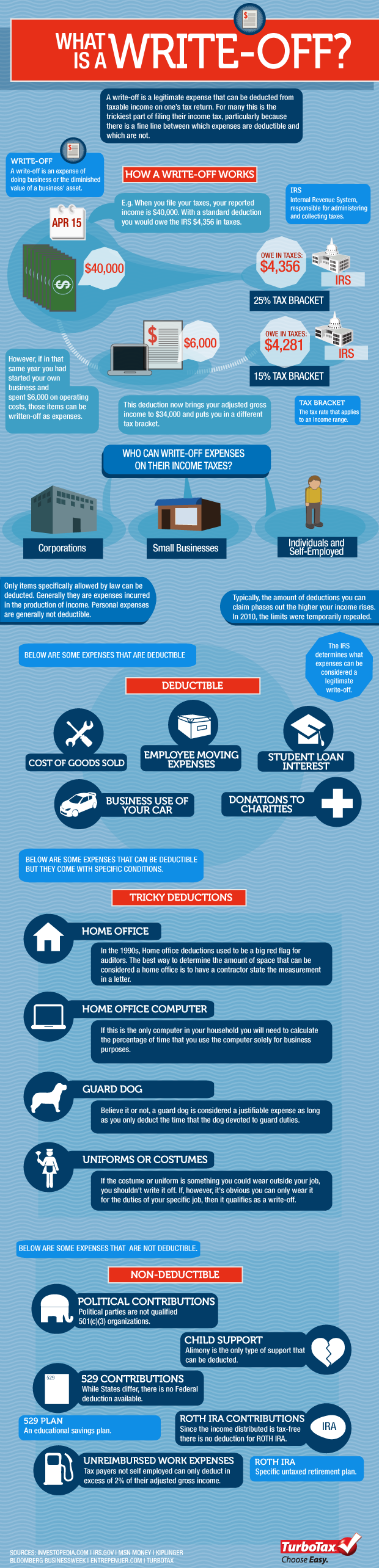

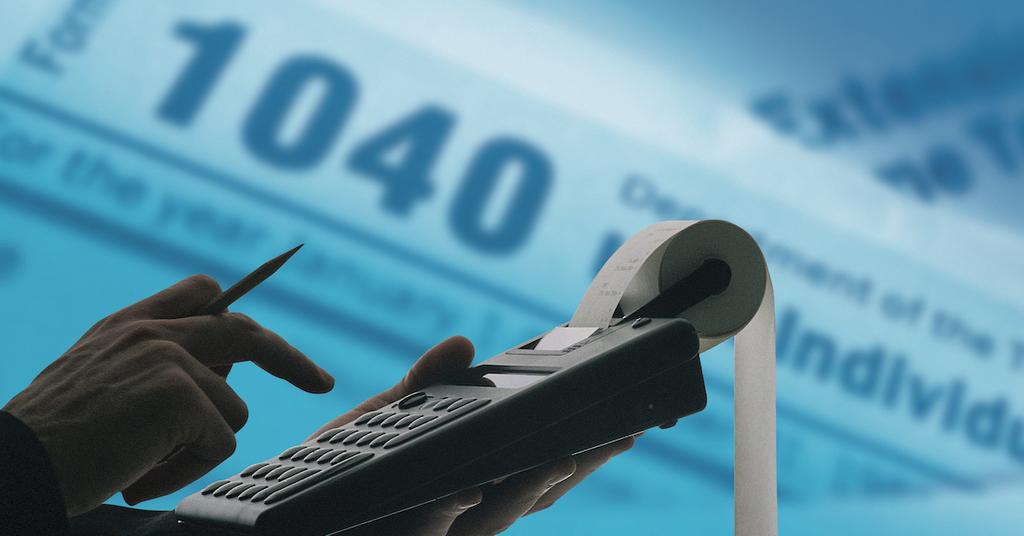

A tax deduction is a business expense that can lower the amount of tax you have to pay It s deducted from your gross income to arrive at your taxable income It is sometimes called a tax write off Tax deductions can include business expenses like office rent equipment business insurance and business travel In a nutshell a tax write off is a legitimate expense that lowers your taxable income on your tax return A tax write off is commonly referred to as a tax deduction Ultimately the IRS determines what expenses can be considered a legitimate write off

[desc-10] [desc-11]

Taxes For Endowments How It Works Tabitomo

http://blog.turbotax.intuit.com/wp-content/uploads/2010/12/writeoff.png

Small Business Tax Deductions And Write Offs Explained Startup Starter

https://i.ytimg.com/vi/kHJAX0jfIMo/maxresdefault.jpg

https://quickonomics.com/terms/tax-deduction

A tax deduction is an expense that can be subtracted from an individual s or corporation s income to reduce the amount of taxable income This decrease in taxable income means that taxpayers pay less in taxes to the government

https://money.howstuffworks.com/.../tax-deductions.htm

The purpose of tax deductions is to decrease your taxable income thus decreasing the amount of tax you owe to the federal government There are hundreds of ways to use deductions to reduce your taxable income but many people don t know about them or know how to

Budgeting 101 Understand Your Income Benefits Deductions And Taxes

Taxes For Endowments How It Works Tabitomo

What Are Tax Write Offs Tax Deductions Explained By A CPA YouTube

Tax Credits For Homeowners Homeowner Tax Deductions Explained

What Is A Tax Write Off Canadian Tax Deductions Explained YouTube

What Is A Tax Write Off Tax Deductions Explained The TurboTax Blog

What Is A Tax Write Off Tax Deductions Explained The TurboTax Blog

Are Political Contributions Tax Deductible Tax Breaks Explained

Your Tax Deductions Explained By Sekou Seasay M Fin CFP CTA GradDip

:max_bytes(150000):strip_icc()/xcar-57f681757c764d15a89bf0a5dc50c5da.jpg)

Vehicle Tax Deductions And Write Offs Explained

Tax Deductions Explained - Tax deductions are financial provisions that allow taxpayers to reduce their taxable income These deductions represent specific expenses or allowances that the government permits individuals and businesses to subtract from their gross income before calculating their tax liability How Tax Deductions Work