Tax Deductions For Army Personnel Learn more about the various tax deductions and write offs available to military members in 2024 and discover our tips for filing your taxes as a service member Types of Military Tax Deductions There are four primary

For 2023 the standard deduction amount has been increased for all filers The amounts are Single or Married filing separately 13 850 Married filing jointly or Qualifying surviving spouse 27 700 and Head of household 20 800 For more information see the Instructions for Form 1040 Credits for qualified sick and family leave wages These states join others exempting all or part of military pay for eligible members Know your state s rules and make sure your tax withholding is correct ALERT Arkansas instituted new tax guidelines in 2014 exempting certain military pay

Tax Deductions For Army Personnel

Tax Deductions For Army Personnel

https://www.armstrongeconomics.com/wp-content/uploads/2020/09/Tax-Deductions-scaled.jpg

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

https://i.etsystatic.com/34842725/r/il/d7a013/4058712943/il_fullxfull.4058712943_8i57.jpg

Schedule C Tax Form Eebinger

https://thekalculators.com.au/wp-content/uploads/2022/06/tax-deductions-for-hospitality-workers-1536x1024.jpg

This article will focus on the deductions available to military families All information in this piece is based on information supplied by the IRS in the Armed Forces Tax Guide For Check if you are eligible for military tax benefits Current and former military MilTax a Department of Defense program that generally offers free return preparation and e filing software for all military members and some veterans with no income limit Get free tax help from volunteers Armed Forces Tax Guide Publication 3 for active and

Tax Information A substantial but often unseen and overlooked aspect of military pay is certain built in tax advantages Most allowances are tax exempt Additionally certain hardship In honor of our nation s military personnel all enlisted active duty and reserve military can file free federal and state taxes with TurboTax Online using the TurboTax Military Discount The 1 best selling tax software

Download Tax Deductions For Army Personnel

More picture related to Tax Deductions For Army Personnel

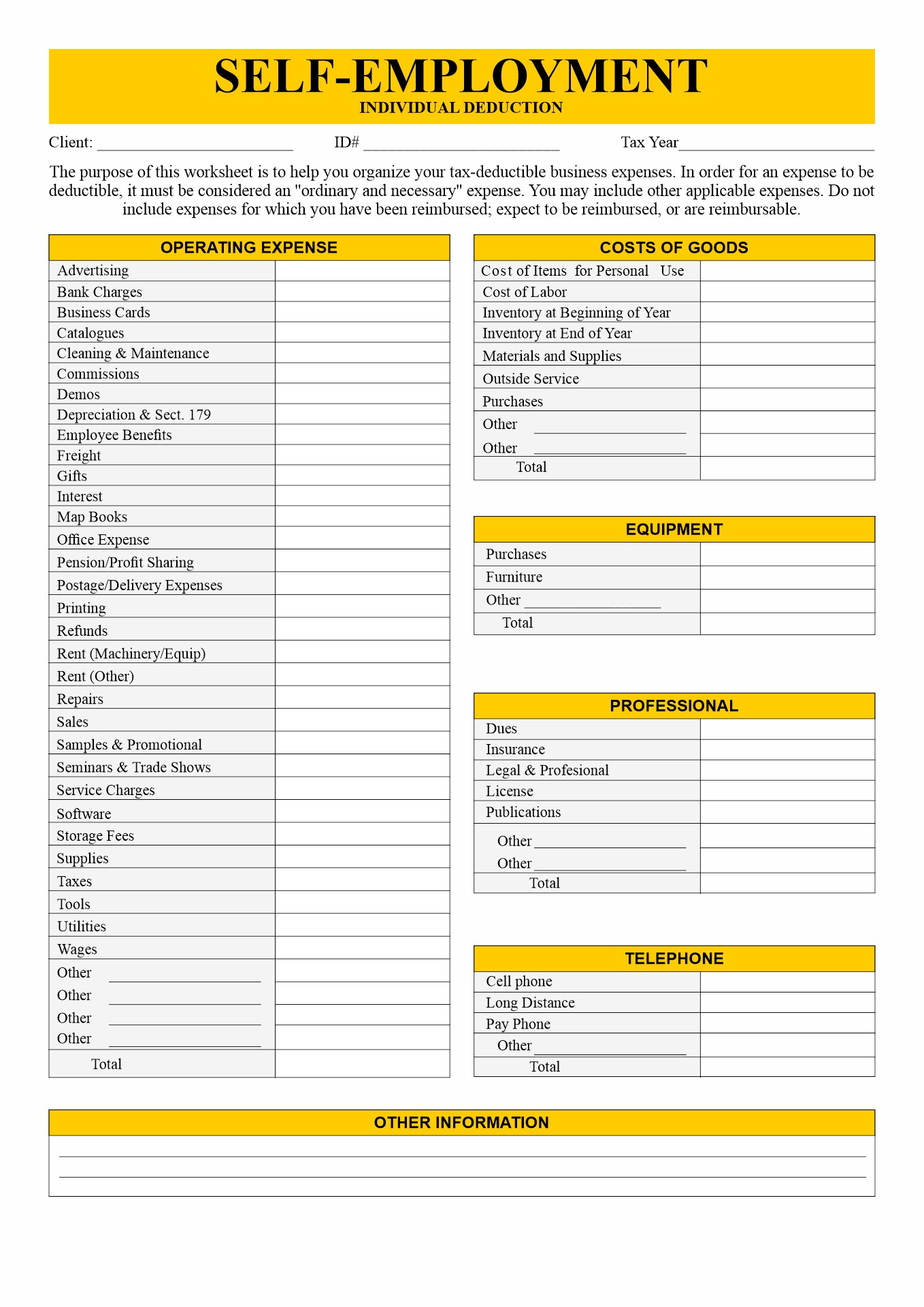

20 Self Motivation Worksheet Worksheeto

https://www.worksheeto.com/postpic/2014/10/self-employed-tax-deductions-worksheet_526560.png

/Tax-form-56a0d5af3df78cafdaa57849.jpg)

Business Travel Tax Deductions

https://www.tripsavvy.com/thmb/IteNxEW8QfH_iYKm5GSnBrx6j18=/4230x2914/filters:fill(auto,1)/Tax-form-56a0d5af3df78cafdaa57849.jpg

Tax Deductions For Charitable Donations

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA17y0HM.img?w=3000&h=2000&m=4&q=100

Be prepared for tax time with these tax definitions Tax return vs tax refund Dependent Taxable vs nontaxable income Combat Pay Exclusion Pretax and post tax retirement contributions Interest income vs investment income Military extension on capital gains taxes Moving deductions Military pay deductions Taxes SGLI TSP and more Everyone has deductions for taxes including Social Security and Medicare You probably have a federal tax deduction and you may have a state tax deduction depending on your state of legal residence

Publication 3 covers the special tax situations of active members of the U S Armed Forces It does not cover military pensions or veterans benefits or give the basic tax rules that apply to all taxpayers Tax credits reduce the amount of federal income tax you owe tax deductions reduce the amount of your income subject to tax and savings plan benefits like a 529 plan allow accumulated earnings to grow tax free until money is taken out

7 Things To Know About Tax Deductions When Moving Tamara Like Camera

https://i0.wp.com/tamaracamerablog.com/wp-content/uploads/2022/01/Screen-Shot-2022-01-12-at-12.09.10-PM.png?ssl=1

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction.jpg

https://themilitarywallet.com/military-t…

Learn more about the various tax deductions and write offs available to military members in 2024 and discover our tips for filing your taxes as a service member Types of Military Tax Deductions There are four primary

https://www.irs.gov/publications/p3

For 2023 the standard deduction amount has been increased for all filers The amounts are Single or Married filing separately 13 850 Married filing jointly or Qualifying surviving spouse 27 700 and Head of household 20 800 For more information see the Instructions for Form 1040 Credits for qualified sick and family leave wages

Understanding Tax Deductions For Seniors Sugar Grove Senior Living

7 Things To Know About Tax Deductions When Moving Tamara Like Camera

10 Tax Deductions For Property Owners In Canada

Tax Deduction For Employees Sonia Dawar

Top 5 Business Tax Deductions For Employers Accountabilities

Get Over 100K In Tax Deductions Pachira Financials

Get Over 100K In Tax Deductions Pachira Financials

Section 179 Tax Deduction Infographic Business Tax Deductions

What Are The Top 10 Pre Tax Deduction List For Maximizing Savings In

Army Stop Meal Deductions Army Military

Tax Deductions For Army Personnel - Tax Information A substantial but often unseen and overlooked aspect of military pay is certain built in tax advantages Most allowances are tax exempt Additionally certain hardship