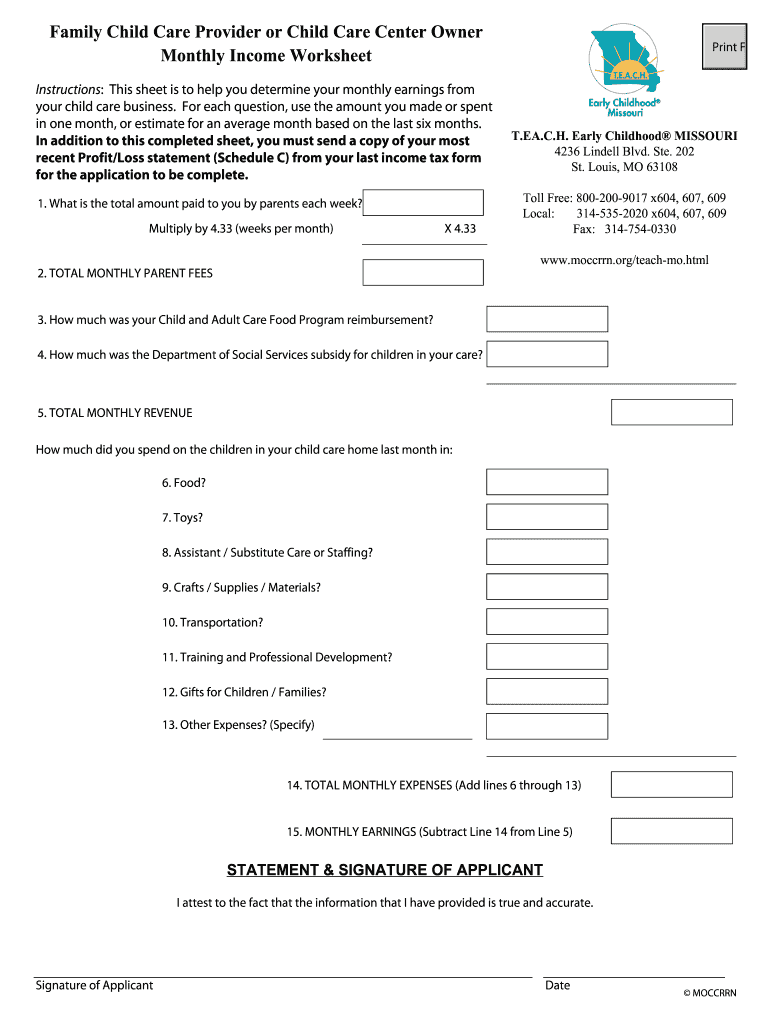

Tax Deductions For Daycare Providers Here are our top 10 deductions for a daycare business 1 Employee Wages 2 Bank Fees and Interest 3 Advertising Charges 4 Continuing Education Fees 5 Membership Dues 6 Charges for Supplies 7 Furniture and Equipment Costs 8 Meal Expenses 9 Insurance Charges 10 Charges for Utilities Tax Deductions for Daycares

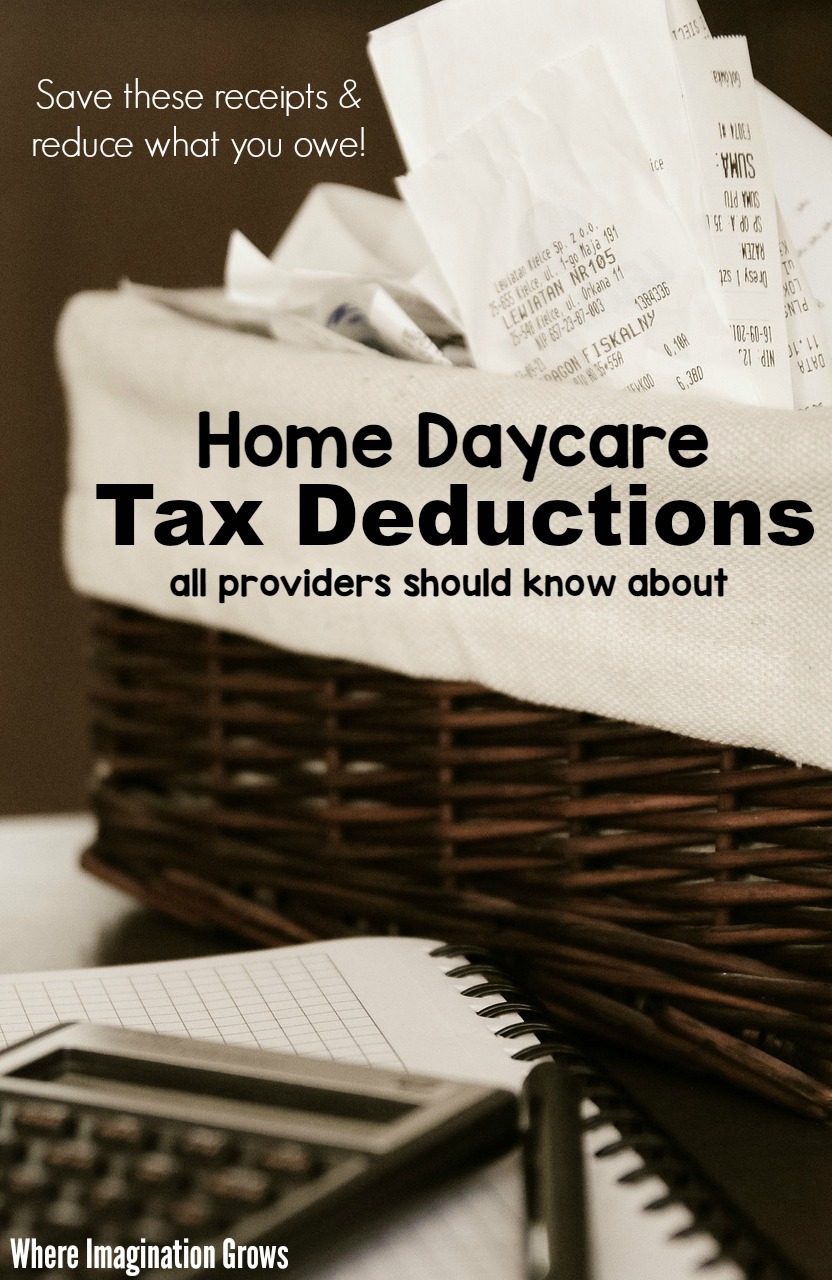

1 Car travel Deductions are allowed based on the number of qualified business miles driven Mileage can include trips to and from classes taken to improve daycare skills field trips with attendees and errands related to the daycare business such as trips to the bank The big list of home daycare tax deductions for family child care businesses A checklist of tax write offs that all child care providers should know about Where Imagination Grows

Tax Deductions For Daycare Providers

Tax Deductions For Daycare Providers

https://i.pinimg.com/736x/e9/48/ef/e948ef82f7ef147edc42ad3ec5575d81.jpg

The BIG List Of Common Tax Deductions For Home Daycare Home Daycare

https://i.pinimg.com/originals/b6/d7/02/b6d702bf4eecf4b5cf332c646707fe5c.png

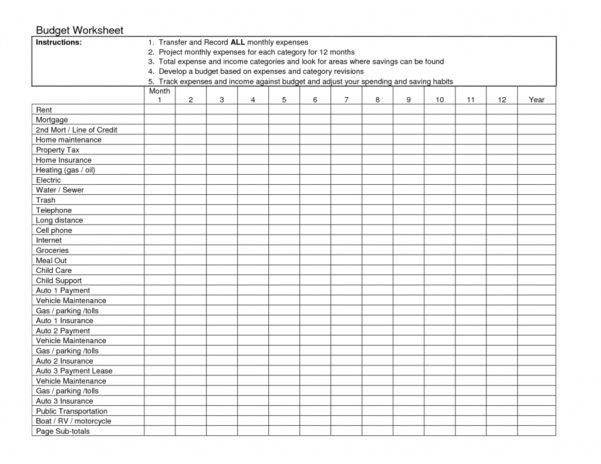

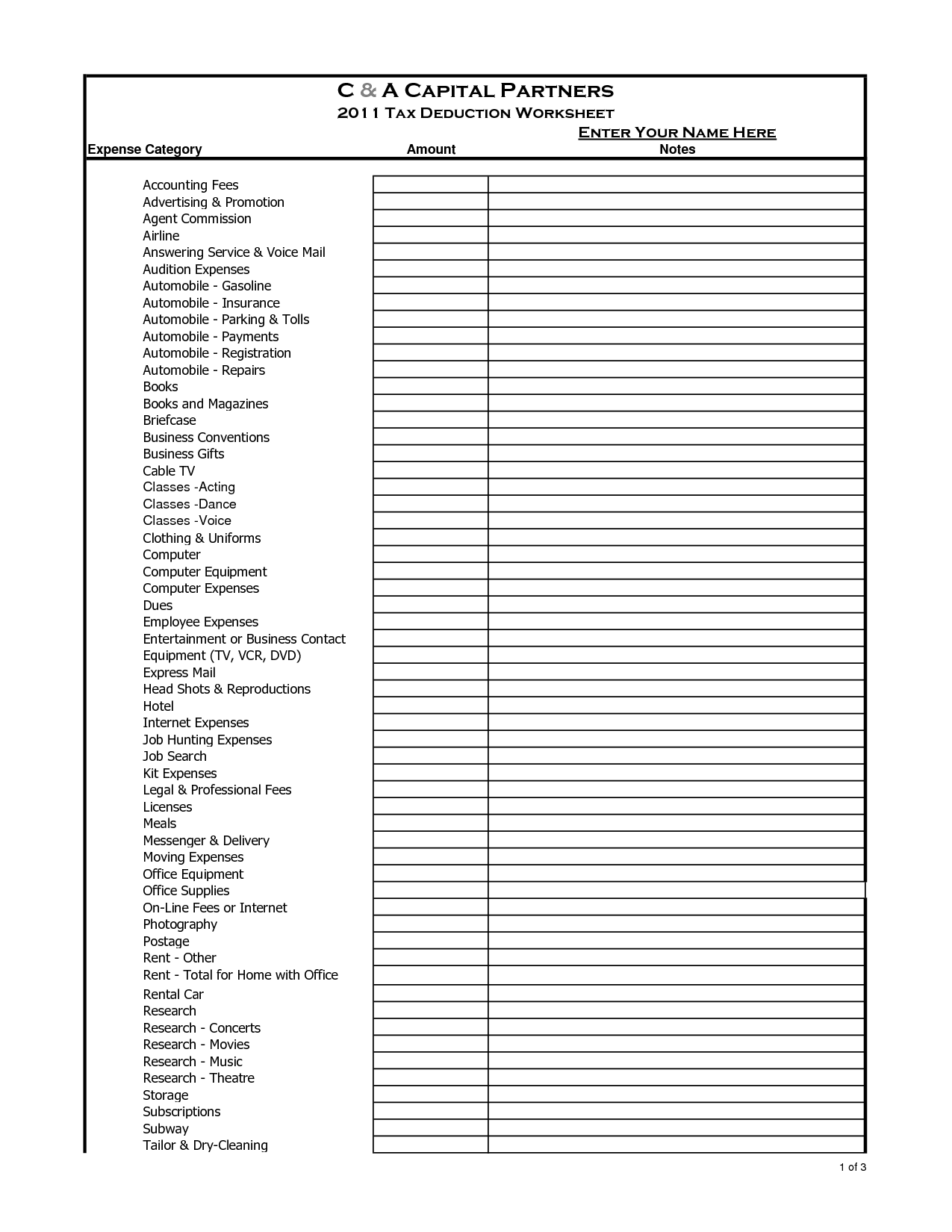

Home Daycare Income And Expense Worksheet Nacedero riourederra

https://i.pinimg.com/originals/95/ae/9f/95ae9f36e3ed71d56300eeaab21d4dce.jpg

According to the IRS in home daycare tax write offs are available Real estate taxes rent mortgage interest utilities insurance and repairs are all deductible costs The portion of the tax deduction depends on how much of the home is used as a daycare home business That s why here at Keeper we ve gathered the best tax write offs for independent childcare providers so you can lower your tax bills and your stress levels at the same time With these write offs you ll be able to watch your savings grow up before your eyes

The business use of home deduction is arguably one of the most valuable deductions for home day care providers This deduction lets you deduct certain home expenses such as utility bills mortgage or renter s insurance and property taxes as business expenses IRS points out that daycare business providers are entitled to deduct a business use portion Some deductions like depreciation of a vehicle you use in the daycare business may be subject to depreciation See IRC Section 280F to learn more Deductions for Your Center Some of the possible deductions for your daycare center

Download Tax Deductions For Daycare Providers

More picture related to Tax Deductions For Daycare Providers

Daycare Business Income And Expense Sheet To File Your Daycare Business

https://i.pinimg.com/originals/5b/3b/21/5b3b21e30091d2391c9664101cf13515.jpg

Daycare Profit And Loss Statement Fill Online Printable Fillable

https://www.pdffiller.com/preview/100/112/100112118/large.png

Family Day Care Tax Spreadsheet Printable Spreadshee Family Day Care

http://db-excel.com/wp-content/uploads/2019/01/family-day-care-tax-spreadsheet-pertaining-to-child-care-receipt-template-excel-daycare-uis-payment-spreadsheet-601x464.jpg

Home Forms and Instructions About Publication 587 Business Use of Your Home Including Use by Daycare Providers This publication explains how to figure and claim the deduction for business use of your home It includes special rules for daycare providers Current Revision Publication 587 PDF HTML eBook EPUB Recent If you are a child care provider without a W 2 how do you file your taxes Learn more from the tax experts at H R Block

The IRS has a standard rate that family daycare providers can use to calculate the deduction or you can use the actual cost The standard rates are listed in IRS Publication 587 Using the standard rate you can deduct breakfast lunch dinner and snacks for each person in your care Tax deductions for childcare providers allow you to reduce your amount of taxable income That means that based on some of the expenses you make their amount can be deducted from the income you use to calculate your owed taxes

DAYCARE TAX DEDUCTIONS FOR DAYCARE PROVIDERS

https://static.wixstatic.com/media/fb2033_d264fe40de724ff4a9ede6723868fa8b~mv2.png/v1/fill/w_1000,h_701,al_c,q_90,usm_0.66_1.00_0.01/fb2033_d264fe40de724ff4a9ede6723868fa8b~mv2.png

Home Office Deduction Worksheet 2021

https://i.pinimg.com/originals/ca/43/e0/ca43e0d9e04562c9fe549f7e609ef8b9.jpg

https://www.freshbooks.com/hub/expenses/tax...

Here are our top 10 deductions for a daycare business 1 Employee Wages 2 Bank Fees and Interest 3 Advertising Charges 4 Continuing Education Fees 5 Membership Dues 6 Charges for Supplies 7 Furniture and Equipment Costs 8 Meal Expenses 9 Insurance Charges 10 Charges for Utilities Tax Deductions for Daycares

https://info.ezchildtrack.com/blog/10-tax-deductions-for-daycare-providers

1 Car travel Deductions are allowed based on the number of qualified business miles driven Mileage can include trips to and from classes taken to improve daycare skills field trips with attendees and errands related to the daycare business such as trips to the bank

Tax Deductions For Daycare Business Top 10 Deductions

DAYCARE TAX DEDUCTIONS FOR DAYCARE PROVIDERS

Home Daycare Tax Deductions For Child Care Providers Where

Home Daycare Business Forms Set 2 Where Imagination Grows

PBS Tax And Accounting

Home Daycare Tax Deductions For Child Care Providers Where

Home Daycare Tax Deductions For Child Care Providers Where

10 Tax Deductions For Daycare Providers

The Big List Of Home Daycare Tax Deductions For Family Child Care

10 2014 Itemized Deductions Worksheet Worksheeto

Tax Deductions For Daycare Providers - Daycare providers can save a lot of money by taking advantage of tax deductions This is why keeping track of Daycare Receipts is crucial for budgeting Here are the top eight expenses that are eligible for tax write offs