Tax Deductions For Home Improvements 2022 What Home Improvements Are Tax Deductible in 2023 Most home improvements like putting on a new roof or performing routine maintenance don t qualify for any immediate tax breaks However

Home improvements that qualify as capital improvements are tax deductible but not until you sell your home Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement

Tax Deductions For Home Improvements 2022

Tax Deductions For Home Improvements 2022

http://www.homeandgardeningguide.com/wp-content/uploads/tax-deductions-home-business.jpg

10 Tax Deductions For Home Improvements HowStuffWorks

https://resize.hswstatic.com/w_1024/gif/home-improve-deduction-3.jpg

3 Tax Deductions For Home Improvements

http://www.homeandgardeningguide.com/wp-content/uploads/tax-deductions-home-improvement.jpg

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide Home improvements and taxes When you make a home improvement such as installing central air conditioning or replacing the roof you can t deduct the cost in the year you spend the money But if

The Short Version Tax breaks on home improvements to your principal residence are generally limited to energy efficient improvements and adaptations for medical care Home improvements Most home improvements and repairs aren t tax deductible with some exceptions Capital improvements can increase the cost basis of your home which lowers your tax bill if you make a profit when you sell

Download Tax Deductions For Home Improvements 2022

More picture related to Tax Deductions For Home Improvements 2022

3 Tax Deductions For Home Improvements

https://www.homeandgardeningguide.com/wp-content/uploads/tax-deductions-home-business-improvement.jpg

10 Tax Deductions For Home Improvements Tax Deductions Home

https://i.pinimg.com/originals/3b/51/90/3b51902ec7dd98b0220862a5ed58babb.jpg

5 Tax Deductible Home Improvements And Repairs

https://www.budgetdumpster.com/blog/wp-content/uploads/2017/03/home-improvements-tax-deductions.jpg

IRS Requirements For Tax Deductible Home Improvements Homeowners can only deduct capital improvements from their taxes when they sell their homes Capital improvements are permanent upgrades In some cases home improvements can result in tax deductions But before tearing down the walls in your house and expecting huge tax write off results there are several important factors

The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 To deduct expenses of owning a home you must file Form 1040 U S Individual Income Tax Return or Form 1040 SR U S Income Tax Return for Seniors and itemize your

Why It s Important To Keep Track Of Improvements To Your House Merriman

http://www.merriman.com/wp-content/uploads/Home-Improvements-Graphic-e1503428959816.jpg

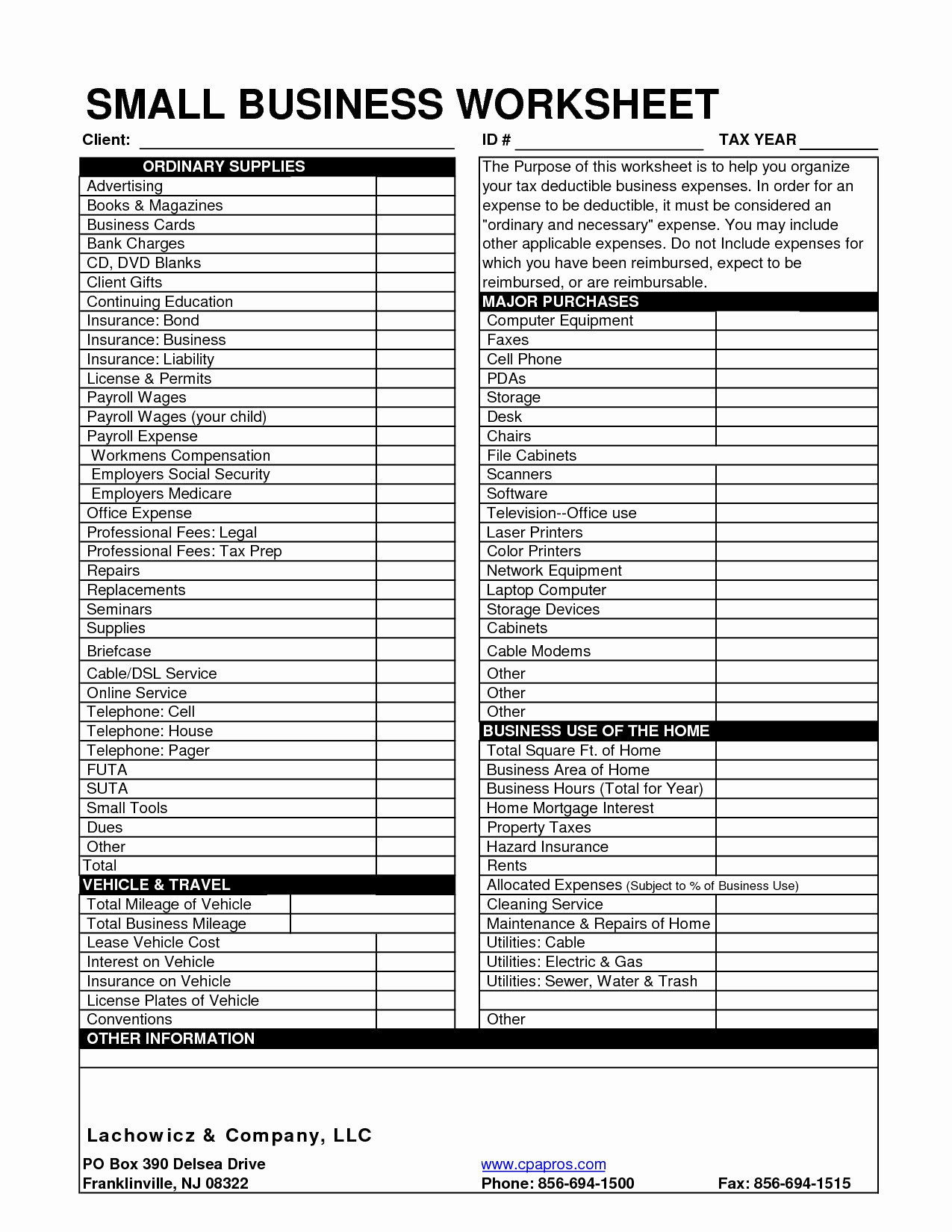

Real Estate Agent Tax Deductions Worksheet 2022 Fill Online

https://www.pdffiller.com/preview/354/967/354967762/large.png

https://www.familyhandyman.com/artic…

What Home Improvements Are Tax Deductible in 2023 Most home improvements like putting on a new roof or performing routine maintenance don t qualify for any immediate tax breaks However

https://www.consumeraffairs.com/finance/what-home...

Home improvements that qualify as capital improvements are tax deductible but not until you sell your home

Printable Yearly Itemized Tax Deduction Worksheet Fill And Sign

Why It s Important To Keep Track Of Improvements To Your House Merriman

What Are The Tax Deductions For Home Improvements Home Improvement

10 Best Tax Deductions For Small Businesses Run Viably

Tax Deduction Spreadsheet Then Small Business Tax Deductions Db excel

List Of Tax Deductions Examples And Forms

List Of Tax Deductions Examples And Forms

Missmeldesigns Home Improvement Tax Deductions Uk

Printable Self Employed Tax Deductions Worksheet

Printable Itemized Deductions Worksheet

Tax Deductions For Home Improvements 2022 - The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide