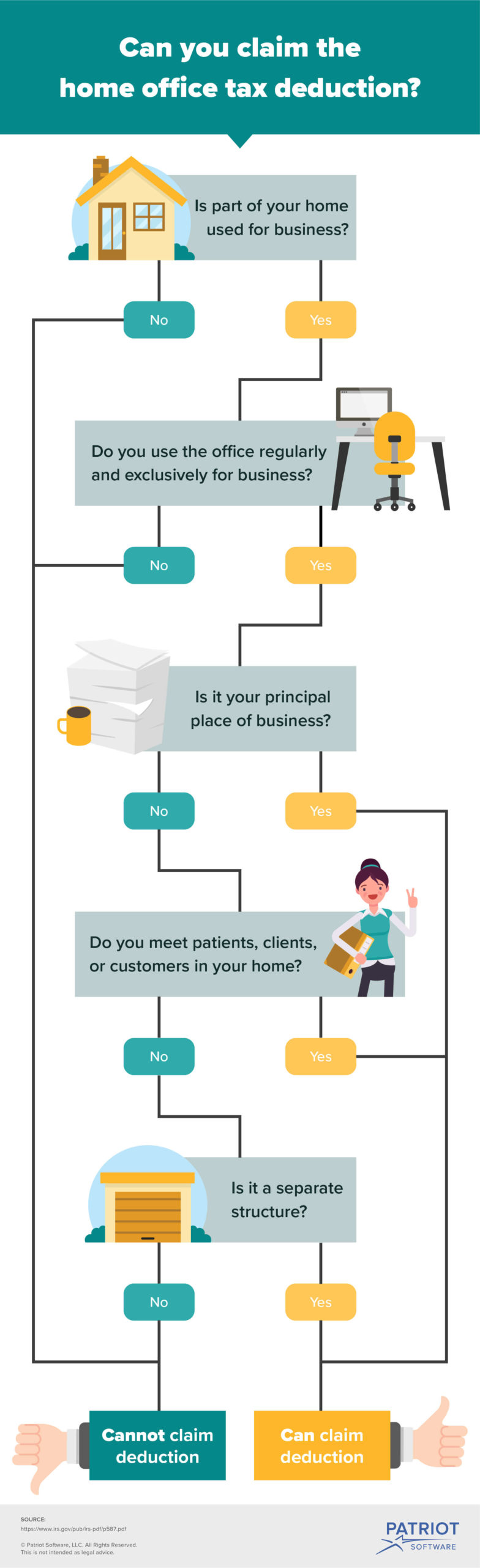

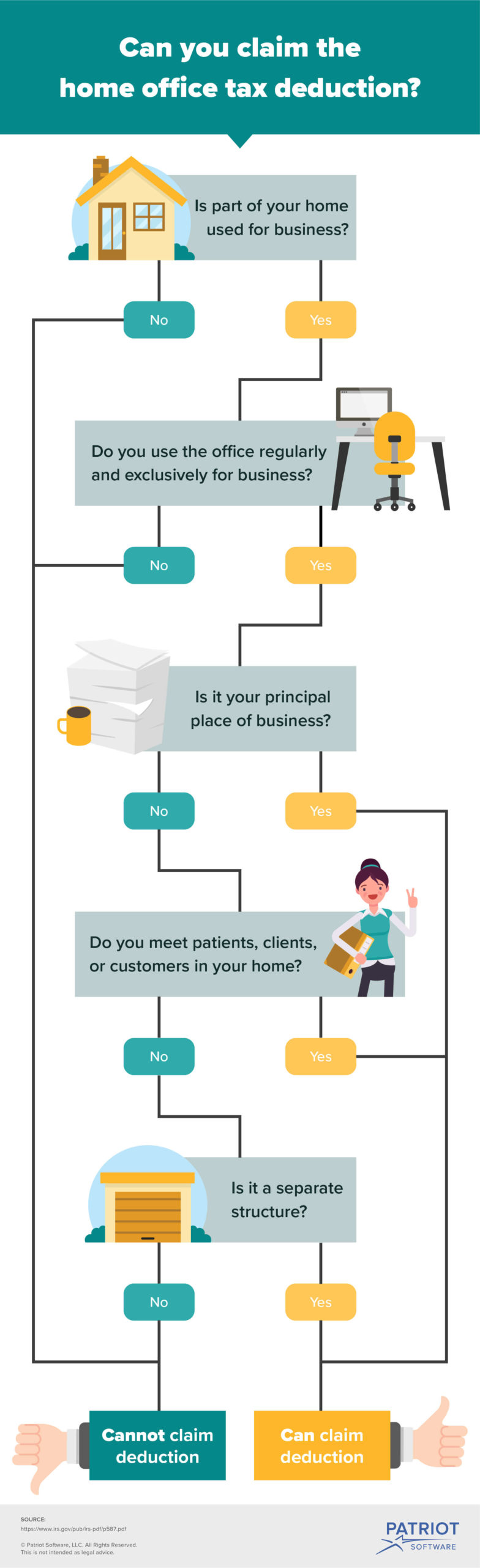

Tax Deductions For Home Office 2022 What is the home office deduction Small business owners and freelancers who regularly and exclusively use part of their home for work and business related activities may be able to write off rent

OVERVIEW An unprecedented number of workers and businesses have transitioned to a work from home model If you work from home you should know these important tax implications of setting up a home office TABLE OF CONTENTS Do I qualify for the home office tax deduction Here s what you should know about the home office tax deduction before you file your 2023 tax return Home office tax deduction Who qualifies

Tax Deductions For Home Office 2022

Tax Deductions For Home Office 2022

https://petermcfarland.us/wp-content/uploads/2018/12/itemized-deductions-worksheet-for-small-business-awesome-tax-document-5c07da7c4121e.jpg

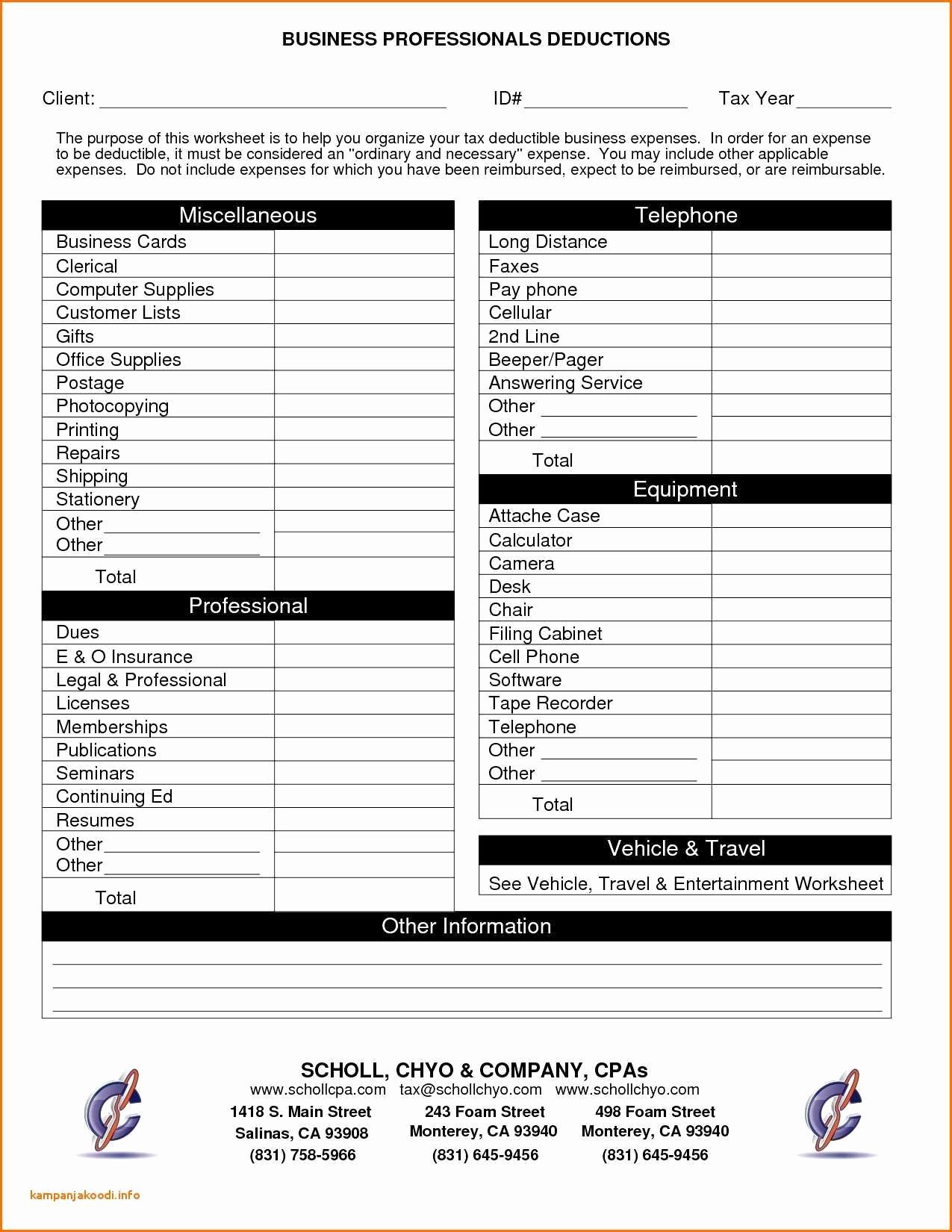

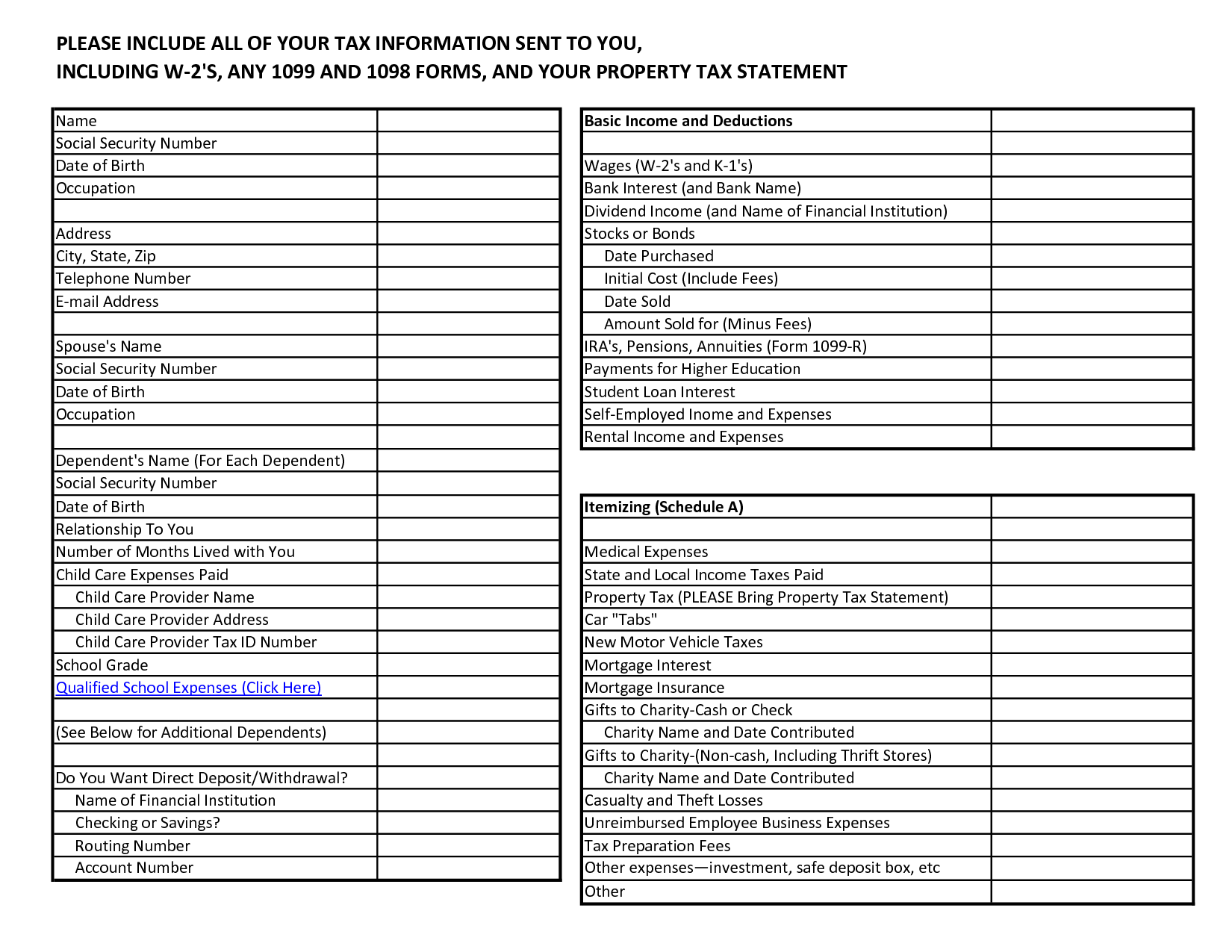

List Of Tax Deductions Examples And Forms

https://www.qtoffice.com/ckfinder/userfiles/images/1312/Tax Deductions.png

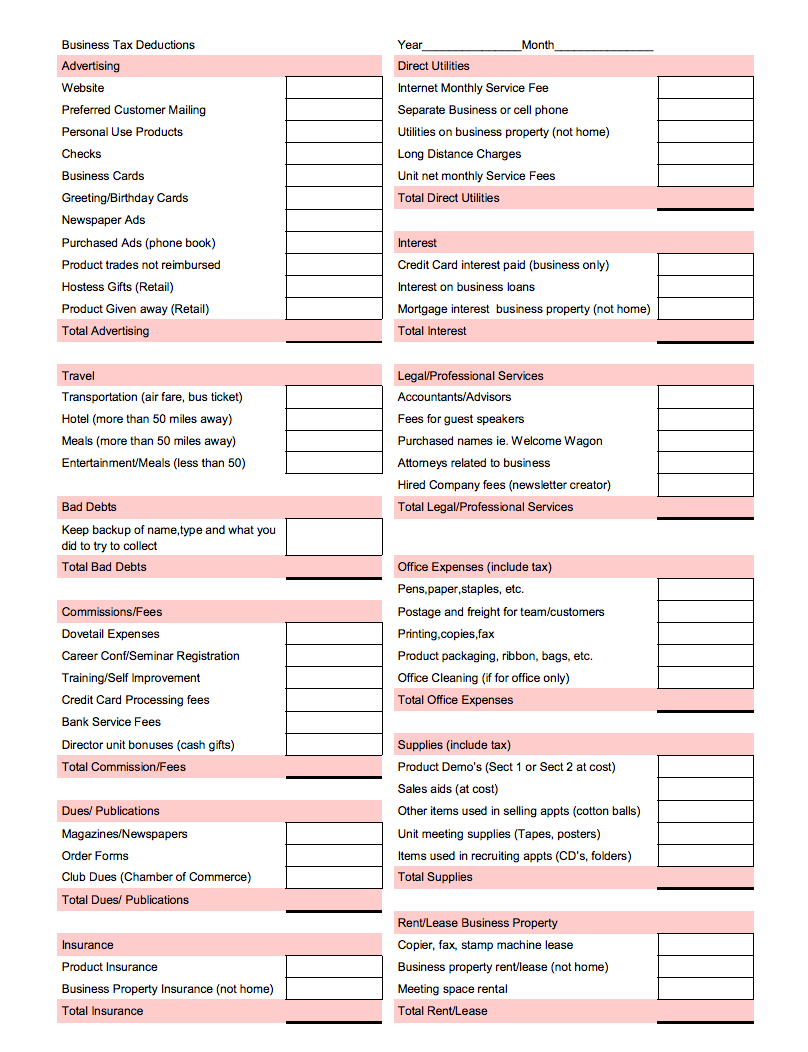

Real Estate Agent Tax Deductions Worksheet 2022

http://www.geocities.ws/mcalarneybrien/Files/100p.JPG

What is the Home Office Deduction and Who Qualifies The home office deduction is a tax deduction available to you if you are a business owner and use part of your home for your business Updated on June 30 2022 Reviewed by Khadija Khartit In This Article What Is the Home Office Deduction How To Calculate the Home Office Deduction Tips for Taking the Home Office Deduction Frequently Asked Questions FAQs Photo Alistair Berg Getty Images Sources

Step 1 Calculate the square footage of your home office If your home office is a 15 foot by 15 foot room then its total square footage is 225 square feet 15 feet 15 feet 225 square feet Individuals Tax card and tax return Deductions Remote working and deductions Working remotely may cause you expenses that are deductible in taxation These include your expenses caused by using a remote workspace expenses paid for

Download Tax Deductions For Home Office 2022

More picture related to Tax Deductions For Home Office 2022

Anchor Tax Service Medical Deductions

http://www.anchor-tax-service.com/s/cc_images/cache_2322142.jpg?t=1395580404

![]()

Real Estate Agent Commission Spreadsheet With Realtor Expense Tracking

https://db-excel.com/wp-content/uploads/2019/01/real-estate-agent-commission-spreadsheet-with-realtor-expense-tracking-spreadsheet-fresh-tax-deduction-cheat-sheet-768x994.png

Tax Prep Checklist Tracker Printable Tax Prep 2022 Tax Checklist Tax

https://i.etsystatic.com/31990504/r/il/22f689/3639280950/il_fullxfull.3639280950_fitj.jpg

If your business is a company and does not pay anything towards the home office expenses it cannot claim an expense If you run your business from home you can claim a deduction of 50 of the rental of a telephone landline if this is also your private line Business related toll calls are 100 deductible 2021 2022 47 85 per square Click to expand Key Takeaways Employees who work from home can no longer claim tax deductions for their unreimbursed employee expenses or home office costs on their federal tax return Prior to the 2018 tax reform employees could claim these expenses as an itemized deduction

For the 2022 23 income year there are 2 methods to calculate working from home expenses depending on your circumstances Revised fixed rate method Actual cost method You can use the method that will give you the best outcome But make sure you meet the criteria and record keeping requirements for the method you use What else Forty one percent split their time between home and office up from 35 in January 2022 it said Despite all that work at home most of them likely aren t eligible for any home office

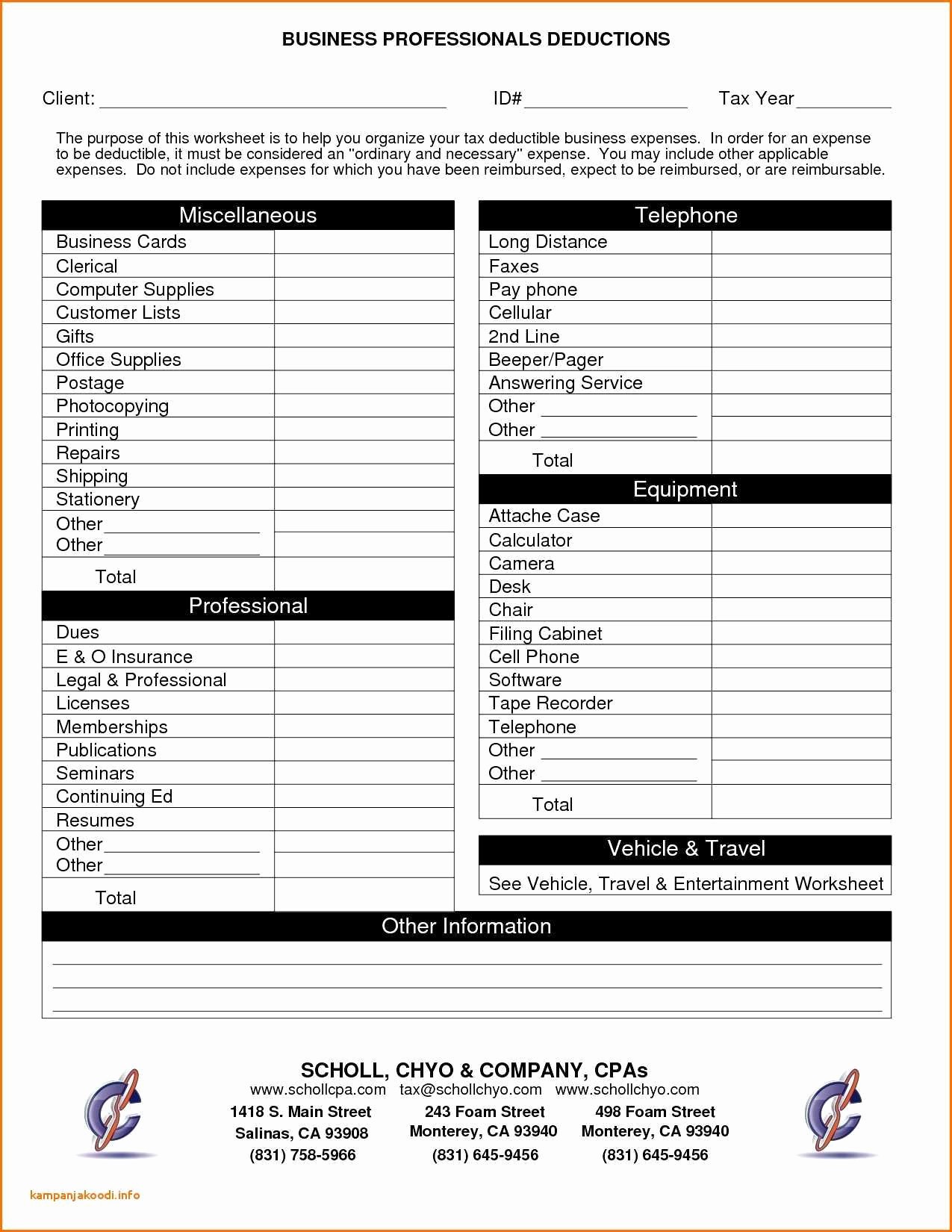

Printable Itemized Deductions Worksheet

https://www.worksheeto.com/postpic/2010/07/schedule-c-tax-deduction-worksheet_449335.png

Charitable Contributions And How To Handle The Tax Deductions

https://growthmastery.net/wp-content/uploads/2017/11/form-1040.jpg

https://www. nerdwallet.com /article/tax…

What is the home office deduction Small business owners and freelancers who regularly and exclusively use part of their home for work and business related activities may be able to write off rent

https:// turbotax.intuit.com /tax-tips/small...

OVERVIEW An unprecedented number of workers and businesses have transitioned to a work from home model If you work from home you should know these important tax implications of setting up a home office TABLE OF CONTENTS Do I qualify for the home office tax deduction

Tax Deduction Cheat Sheet For Real Estate Agents Db excel

Printable Itemized Deductions Worksheet

Itemized Tax Deduction Worksheet Oaklandeffect Deductions Db excel

Tax Prep Worksheet

10 Home Based Business Tax Worksheet Worksheeto

Home Office Tax Deduction What Is It And How Can It Help You

Home Office Tax Deduction What Is It And How Can It Help You

Tax Worksheet For Expenses

Printable Tax Deduction Cheat Sheet

Self Employed Tax Deductions Worksheet Db excel

Tax Deductions For Home Office 2022 - Deductions for expenses you incur to work from home such as stationery energy and office equipment Last updated 25 April 2023 Print or Download On this page Eligibility to claim Additional running expenses Choosing a method to calculate your claim Prior year work from home methods Expenses you can t claim Eligibility to claim