Tax Deductions For Homeowners Tax deductions for homeowners can add up to thousands of dollars but claiming them is worth the trouble only if all your itemized deductions exceed the IRS standard deduction

To deduct expenses of owning a home you must file Form 1040 U S Individual Income Tax Return or Form 1040 SR U S Income Tax Return for Seniors and itemize your deductions on Schedule A Form 1040 Most home buyers take out a mortgage to buy their home and then make monthly payments to the mortgage holder This payment may bundle other costs of owning a home The costs the homeowner can deduct are State and local real estate taxes subject to the 10 000 limit

Tax Deductions For Homeowners

Tax Deductions For Homeowners

https://www.rocketmortgage.com/resources-cmsassets/RocketMortgage.com/Article_Images/Large_Images/Stock-Couple-Doing-Taxes-AdobeStock-389591364-copy.jpeg

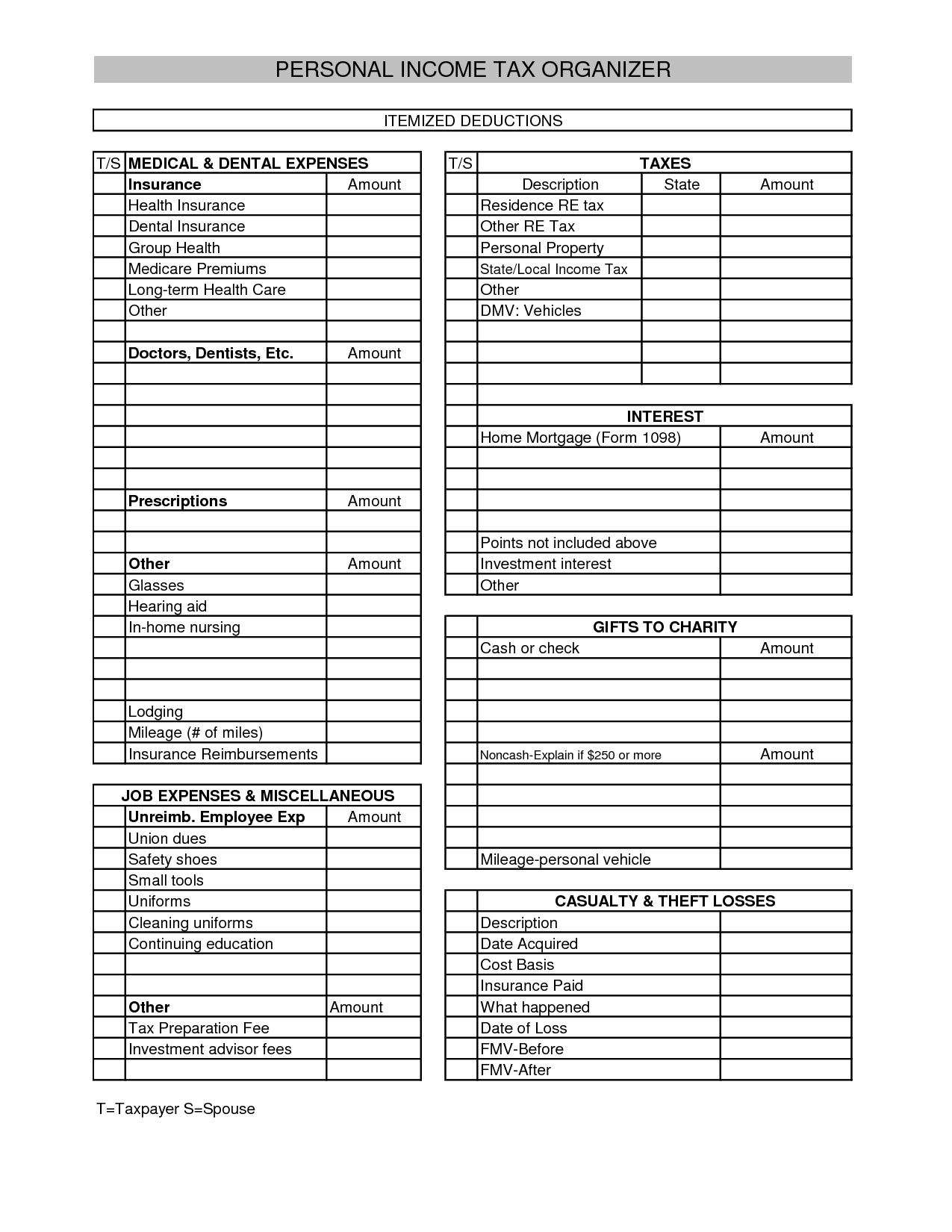

Tax Prep Checklist 2022 Printable Printable World Holiday

https://lh3.googleusercontent.com/OP_23uM8LQ7RIC0P52RW_5cNsEkdN1hWcbqBiE0vIV4lpsP-PzjIK8yAwm3o7UKbW3P2KmlM58WVG-5QIas=s1600

34 Tax Write Off Worksheet Worksheet Source 2021

https://www.pdffiller.com/preview/100/302/100302714/large.png

Good news the IRS offers several tax breaks for homeowners from deductions for the interest on your mortgage to credits if you improve your home s OVERVIEW You know that you can get an income tax deduction on the mortgage interest you pay But there are other tax deductions you can take on your principal residence or second home such as property taxes TABLE OF CONTENTS Eligible for a tax deduction How much can I save What can t I deduct Eligible for a tax deduction

Tax Deductions for Homeowners Learn about the many tax benefits of owning your own home By Stephen Fishman J D USC Gould School of Law Updated Below CNBC Select walks you through the deductions and credits available to homeowners including who is eligible and how much you can deduct

Download Tax Deductions For Homeowners

More picture related to Tax Deductions For Homeowners

Don t Miss These Home Tax Deductions Rutenbergblog

http://rutenbergblog.com/wp-content/uploads/2016/01/RE411-2014-03-Tax-Deductions-for-Homeowners-POSTCARD-front.jpg

Resources

http://tax29.com/wp-content/uploads/2016/11/Tax29-Self-Employed-Deduction-List.png

![]()

Farm Cash Flow Spreadsheet Google Spreadshee Farm Cash Flow Projection

http://db-excel.com/wp-content/uploads/2019/01/farm-cash-flow-spreadsheet-with-budgetrksheet-expense-grass-fedjp-study-site-farm-xls-tracking-sof-750x970.png

2023 Tax Year Homeowner Deductions Types of Tax Breaks for Buying a House The IRS offers many tax breaks that can help offset the substantial costs of buying and owning a home Most Owning or buying a home is expensive But there are some tax breaks for homeowners that can help you recoup some of those costs

[desc-10] [desc-11]

11 Tax Deductions For Homeowners 1040Return File 1040 1040ez And

http://1040return.com/wp-content/uploads/2015/03/1040Returntaxdeductionhomeowners1.jpg

3 Tax Deductions Homeowners Should Consider To Maximize Their Tax

https://www.actblogs.com/wp-content/uploads/2021/01/tax-deductions-for-homeowners.jpg

https://www.nerdwallet.com/article/mortgages/tax...

Tax deductions for homeowners can add up to thousands of dollars but claiming them is worth the trouble only if all your itemized deductions exceed the IRS standard deduction

https://www.irs.gov/publications/p530

To deduct expenses of owning a home you must file Form 1040 U S Individual Income Tax Return or Form 1040 SR U S Income Tax Return for Seniors and itemize your deductions on Schedule A Form 1040

Tax Deductions For Homeowners In 2018 800 Buy Kwik

11 Tax Deductions For Homeowners 1040Return File 1040 1040ez And

Tax Deductions For Homeowners

4 Form Deductions 4 Benefits Of 4 Form Deductions That May Change Your

Business Tax List Of Business Tax Deductions

Tax Deductions For New Homeowners Rocket Lawyer

Tax Deductions For New Homeowners Rocket Lawyer

Printable Tax Deduction Worksheet Db excel

Tax Deductions For Homeowners How The New Tax Law Affects Mortgage

Tax Deductions For Homeowners Real Estate Information Tax Deductions

Tax Deductions For Homeowners - Good news the IRS offers several tax breaks for homeowners from deductions for the interest on your mortgage to credits if you improve your home s