Tax Deductions For Renters Is there a tax deduction for renters You may be eligible for a tax credit or deduction depending on your income level filing status and place of residence Check with your state s department of revenue website to confirm your eligibility

Taxpayers cannot deduct residential rent payments on your federal income taxes But depending on where you live you might be able to deduct a portion of rent from your state income taxes Laws are subject to change with each year Make sure you look up the rules in your individual state before filing your taxes Unfortunately you generally cannot deduct the cost of rent on your taxes But there s one related tax break you may be able to take advantage of

Tax Deductions For Renters

Tax Deductions For Renters

https://fosheeresidential.com/wp-content/uploads/2023/01/HERO_belair05.jpg

Tax Deductions For Renters 2022 Edition Liv talk Webinar YouTube

https://i.ytimg.com/vi/KkUrtSSlfqg/maxresdefault.jpg

Tax Deductions For Renters In Michigan Sapling

https://img.saplingcdn.com/640/cme-data/getty/4df83e0e3c7943f3b64bbaf2f1f6eea3.jpg

The tax is deducted from the rent that will be received by the individual Liability to tax When a natural person individual leases or subleases real estate to legal entity and earns income based on this lease or sublease then the legal entity is obliged pay tax and to submit tax return Topic no 414 Rental income and expenses Cash or the fair market value of property or services you receive for the use of real estate or personal property is taxable to you as rental income In general you can deduct expenses of

Topic no 415 Renting residential and vacation property If you receive rental income for the use of a dwelling unit such as a house or an apartment you may deduct certain expenses These expenses which may include mortgage interest real estate taxes casualty losses maintenance utilities insurance and depreciation will reduce the If you receive rental income from the rental of a dwelling unit there are certain rental expenses you may deduct on your tax return These expenses may include mortgage interest property tax operating expenses depreciation and repairs

Download Tax Deductions For Renters

More picture related to Tax Deductions For Renters

Three Tax Deductions For Renters Irvine Company Apartments

https://www.irvinecompanyapartments.com/rental-living/wp-content/uploads/2020/04/taxes-768x441.jpeg

6 Potential Tax Deductions For Renters HotPads Blog

http://cdn2.blog-media.zillowstatic.com/2/Computer_Taxes-4b6c98-930x400.jpg

Tax Breaks for Homeowners and Renters The Official Blog Of TaxSlayer

https://www.taxslayer.com/blog/wp-content/uploads/2023/02/Tax-Breaks-for-Homeowners-and-Renters-scaled.jpg

Understanding the various tax credits and income exclusions available is essential for expats to minimizing their tax liability and ensuring compliance with U S tax laws Below we explore some of the key tax credits and income exclusions that are particularly relevant for US expats in Serbia Dive into rental income tax property deductions and landlord write offs Understand rental revenue tax returns and home improvement deductions to optimize rental investments

[desc-10] [desc-11]

Tax Breaks for Homeowners and Renters min 5 The Official Blog Of

https://www.taxslayer.com/blog/wp-content/uploads/2023/02/Tax-Breaks-for-Homeowners-and-Renters-min-5-1200x900.jpg

Tax Breaks for Homeowners and Renters The Official Blog Of TaxSlayer

https://www.taxslayer.com/blog/wp-content/uploads/2023/02/Tax-Breaks-for-Homeowners-and-Renters-800x900.jpg

https://www.taxslayer.com/blog/do-renters-qualify...

Is there a tax deduction for renters You may be eligible for a tax credit or deduction depending on your income level filing status and place of residence Check with your state s department of revenue website to confirm your eligibility

https://smartasset.com/taxes/can-you-deduct-rent-on-your-taxes

Taxpayers cannot deduct residential rent payments on your federal income taxes But depending on where you live you might be able to deduct a portion of rent from your state income taxes Laws are subject to change with each year Make sure you look up the rules in your individual state before filing your taxes

NJ Senate Democrats On Twitter S 343 Sponsored By Troy4NJ7

Tax Breaks for Homeowners and Renters min 5 The Official Blog Of

An Insider s Guide To Tax Deductions Fee Based Wealth Management And

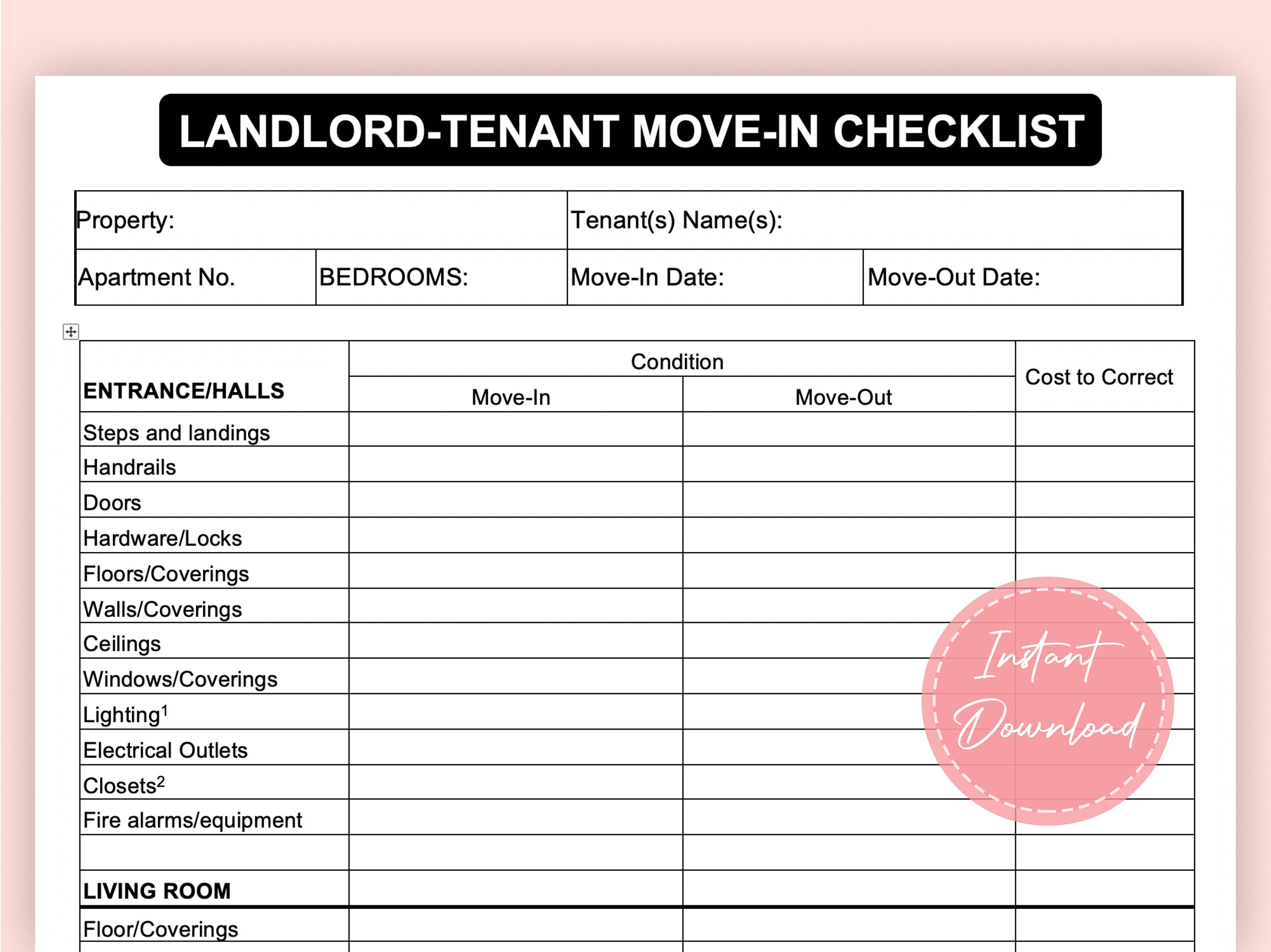

Landlord tenant Checklist Move in Move out Checklist Landlord tenant

Five Tax Deductions Renters Often Overlook

TaxSlayer Homeowner vs Renter IG V02 01 1 1 The Official Blog Of

TaxSlayer Homeowner vs Renter IG V02 01 1 1 The Official Blog Of

The Deductions You Can Claim Hra Tax Vrogue

7 Things To Know About Tax Deductions When Moving Tamara Like Camera

529 Tax Deductions The Essentials The Education Plan

Tax Deductions For Renters - [desc-12]