Tax Depreciation On Rental Property Australia Property depreciation is a tax break that allows investors to offset their investment property s decline in value from their taxable

Rental property assets and items definitions and the treatment of items as depreciating assets or capital works A guide on how to treat rental income and What is rental property depreciation As a property gets older the building s structure and the assets within it wear out they depreciate The Australian Taxation Office ATO allows owners of

Tax Depreciation On Rental Property Australia

Tax Depreciation On Rental Property Australia

https://www.propertybuyer.com.au/hubfs/claiming depreciation on rental property.jpg#keepProtocol

Rental Property Depreciation All You Need To Know Baselane

https://www.baselane.com/wp-content/uploads/2022/01/Rental-Property-Depreciation-How-It-Works-and-Why-Its-Great-for-Investors.jpg

Claiming Depreciation For Common Property H R Block Australia

https://pubweb-kentico.s3.ap-southeast-2.amazonaws.com/hrb/files/20/2005fcc6-4d94-4dfa-9037-c3a372e84456.jpg

February 8 2024 Key takeaways Property tax depreciation in Australia allows property investors to claim a deduction against rental income due to the decrease in value of The Australian Taxation Office ATO allows owners of income producing properties to claim this depreciation as a tax deduction What can you claim Depreciation deductions are

Duo Tax offers a guide on how to calculate depreciation with our specially designed tax depreciation calculator Discover potential savings before purchasing a tax Depreciation refers to the decline in an asset s value over time due to wear and tear There are two main types of depreciation for rental properties capital

Download Tax Depreciation On Rental Property Australia

More picture related to Tax Depreciation On Rental Property Australia

Depreciation Recapture Calculator Rental Property HowardXinyang

https://thedarwiniandoctor.com/wp-content/uploads/2022/01/2022-Jan-3-Ways-to-Avoid-Depreciation-Recapture-Tax-on-Rental-Property.jpeg

How To Calculate 1250 Depreciation Recapture Amy Fleishman s Math

http://www.baymgmtgroup.com/wp-content/uploads/2020/10/IMG_3499-658x400.jpg

Free Investment Property Depreciation Calculator

https://investmentpropertycalculator.com.au/assets/images/free-investment-property-depreciation-calculator.jpg

Rental property depreciation rates are based upon two parts of the income tax assessment act The first is capital works deductions Division 43 which help you save The Australian Taxation Office ATO allows you to depreciate rental property assets under two broad categories 1 capital works and 2 capital allowances

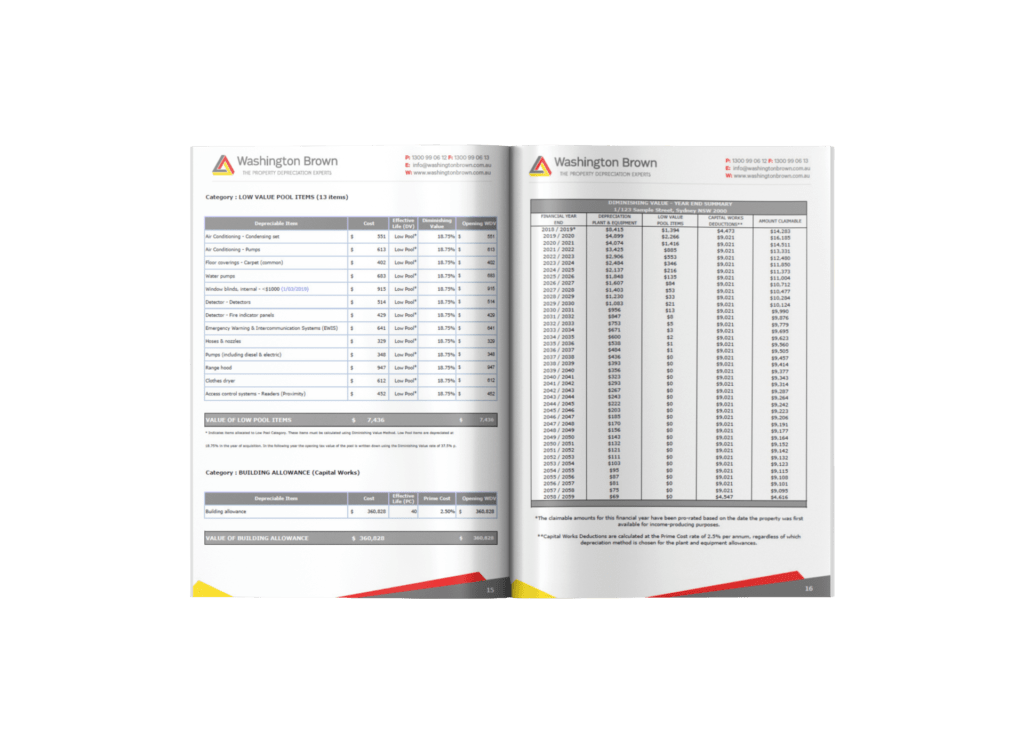

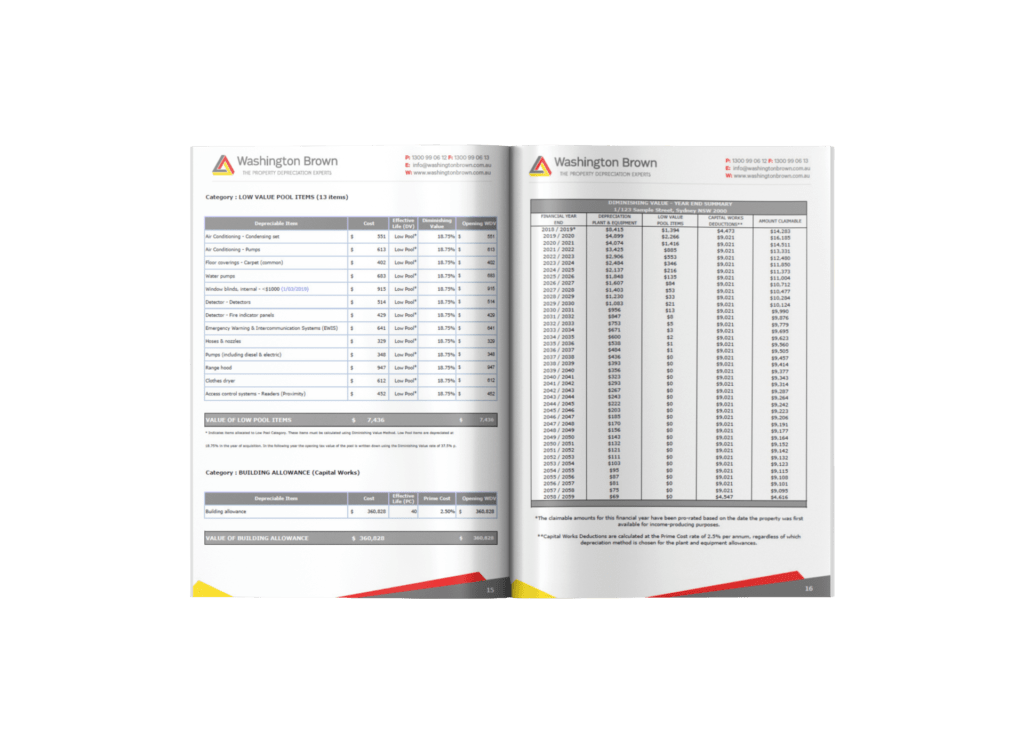

Depreciation is how much the Australian Tax Office ATO says assets decrease in value as they age For example on a 2 000 desktop computer they allow four years This The tax depreciation schedule is an important tool for the owner of a rental property as it both verifies and certifies the entitled tax depreciation claims that they can include in

Negative Gearing And Depreciation

https://www.capitalclaims.com.au/wp-content/uploads/2022/06/Table-1-for-handbook-tax-depreciation.jpg

What Is Property Depreciation Property Calculator

http://www.thepropertycalculator.com.au/images/depreciation/Dep2.png

https://www.realestate.com.au/advice/prope…

Property depreciation is a tax break that allows investors to offset their investment property s decline in value from their taxable

https://www.ato.gov.au/forms-and-instructions/rental-properties-2023

Rental property assets and items definitions and the treatment of items as depreciating assets or capital works A guide on how to treat rental income and

Calculation Of Depreciation On Rental Property InnesLockie

Negative Gearing And Depreciation

Negative Gearing For Property In Australia Capital Claims Tax

Depreciation Recapture Calculator Rental Property QuintinPraise

Tax Depreciation Schedules Australia For Depreciation Specialists By

Tax Depreciation Schedules For Property Investors Washington Brown

Tax Depreciation Schedules For Property Investors Washington Brown

Australian Taxation Office Issues Warning To Rental Property Investors

A Free Rental Property Depreciation Spreadsheet Template

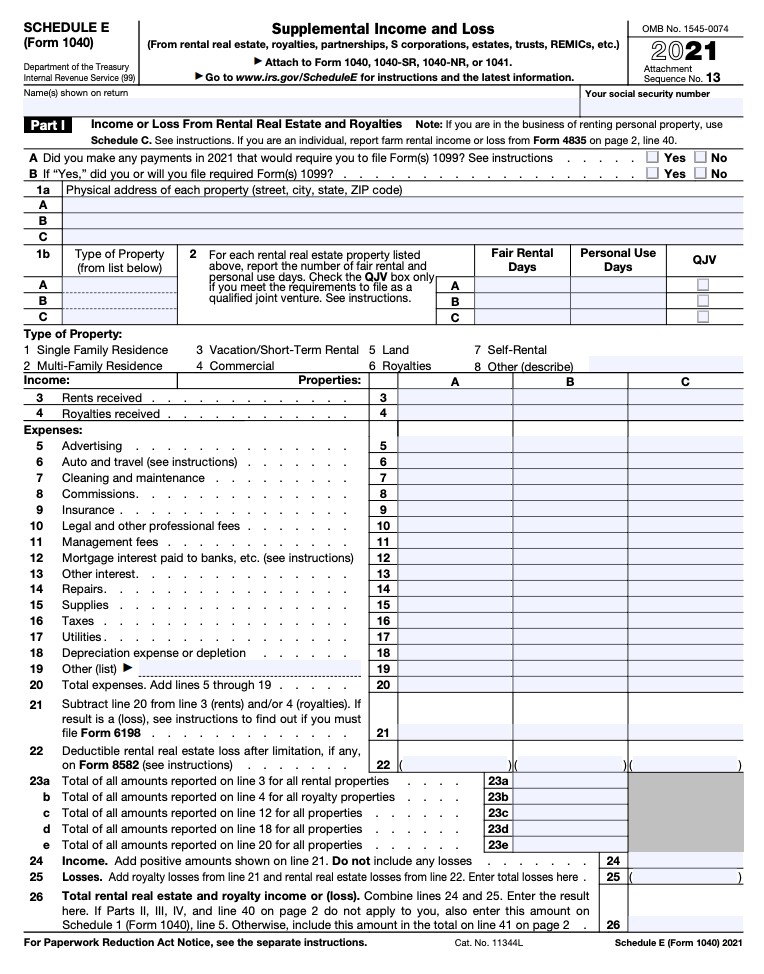

Schedule E Tax Form Survival Guide For Rental Properties 2021 Tax Year

Tax Depreciation On Rental Property Australia - Duo Tax offers a guide on how to calculate depreciation with our specially designed tax depreciation calculator Discover potential savings before purchasing a tax