Tax Exempt State Of Illinois Sales Tax Exemptions Who qualifies for a sales tax exemption Your organization must be not for profit and organized and operated exclusively for charitable religious educational or governmental purposes to qualify for the exemption from state and local sales tax Who receives sales tax exemptions Sales tax exemptions are given to

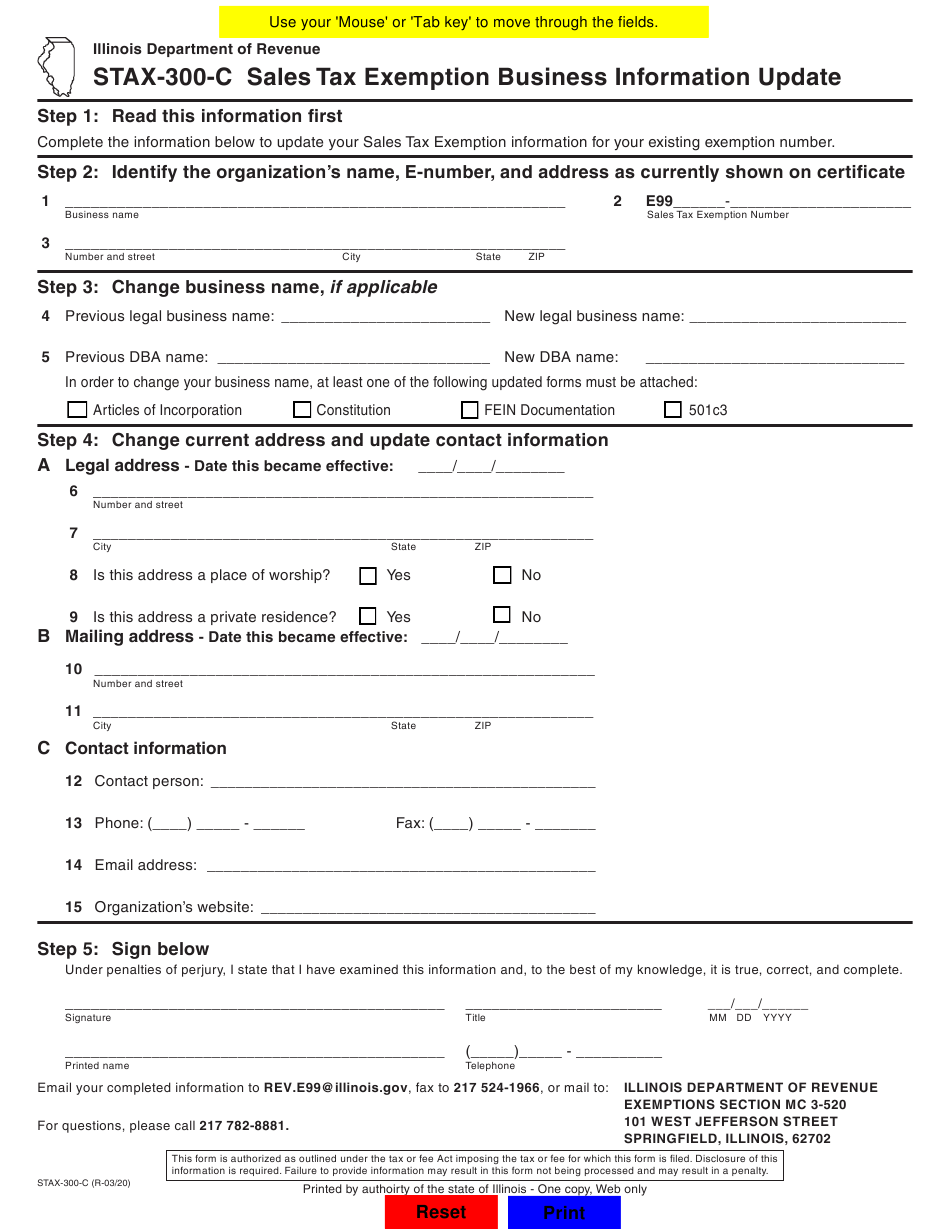

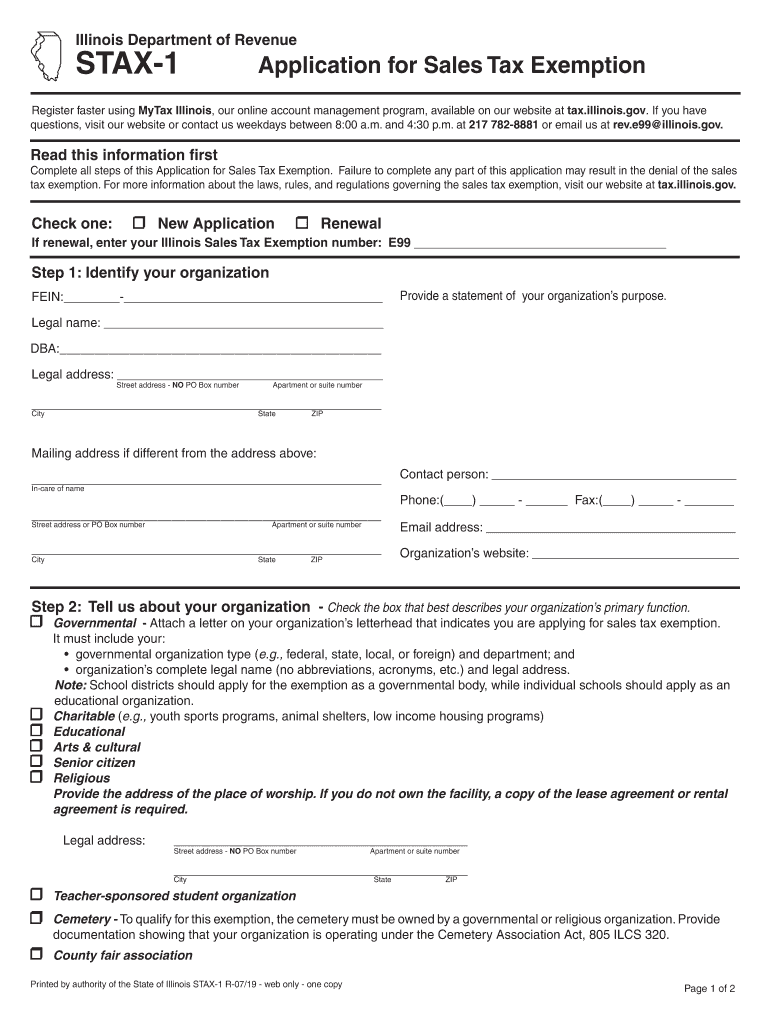

In Illinois certain items may be exempt from the sales tax to all consumers not just tax exempt purchasers Some items which are considered to be exempt from sales tax in the state include machinery and building materials for real estate development Complete all steps of this Application for Sales Tax Exemption Failure to complete any part of this application may result in the denial of the sales tax exemption For more information about the laws rules and regulations governing the sales tax exemption visit our website at tax illinois gov

Tax Exempt State Of Illinois

Tax Exempt State Of Illinois

https://www.signnow.com/preview/497/332/497332566/large.png

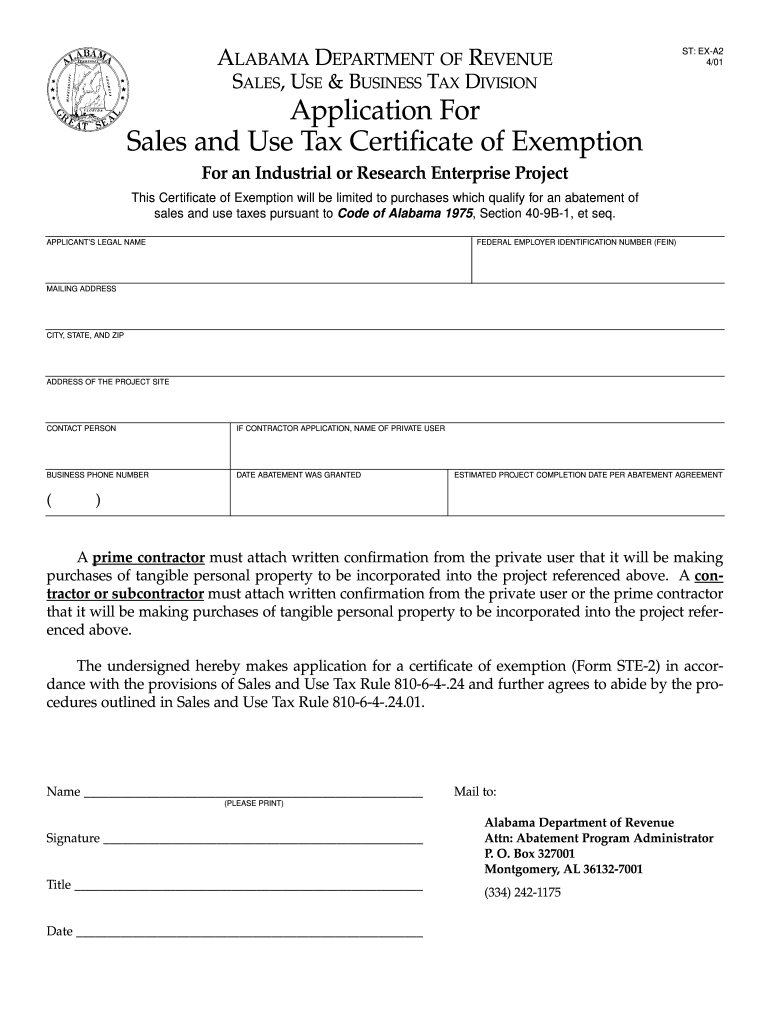

Alabama State Sales And Use Tax Certificate Of Exemption Form Ste 1

https://www.exemptform.com/wp-content/uploads/2022/08/alabama-state-sales-and-use-tax-certificate-of-exemption-form-ste-1-11.png

What Is A Sales Tax Exemption Certificate In Florida Printable Form

https://www.salestaxhandbook.com/img/MTC_Thumbnail.jpg

A 501 c 3 operating in Illinois may not have to pay Illinois sales tax and it may be exempt from real estate taxes on property it owns Both the Illinois sales tax and property tax exemptions are not automatic based on the 501 c 3 s income tax exempt status You must apply for both additional exemptions separately All the exemptions highlighted above equally apply to Illinois four sales tax types the Retailers Occupation Tax the Service Occupation Tax the Service Use Tax and the Use Tax There are also certain exemptions unique

TAX EXEMPT STATUS NOT ALL NOT FOR PROFIT CORPORATIONS ARE TAX EXEMPT Before you take any action you should decide whether you wish to apply for federal income tax exempt status e g 501 c 3 status Only certain kinds of charities schools churches research institutes clubs etc fall into that category The words Updated on January 15 2022 Reviewed by Ebony J Howard Fact checked by Leila Najafi In This Article View All Photo MoMo Productions Getty Images Here s what you need to know about the Illinois state income tax from the state s flat tax rate to available deductions credits and exemptions

Download Tax Exempt State Of Illinois

More picture related to Tax Exempt State Of Illinois

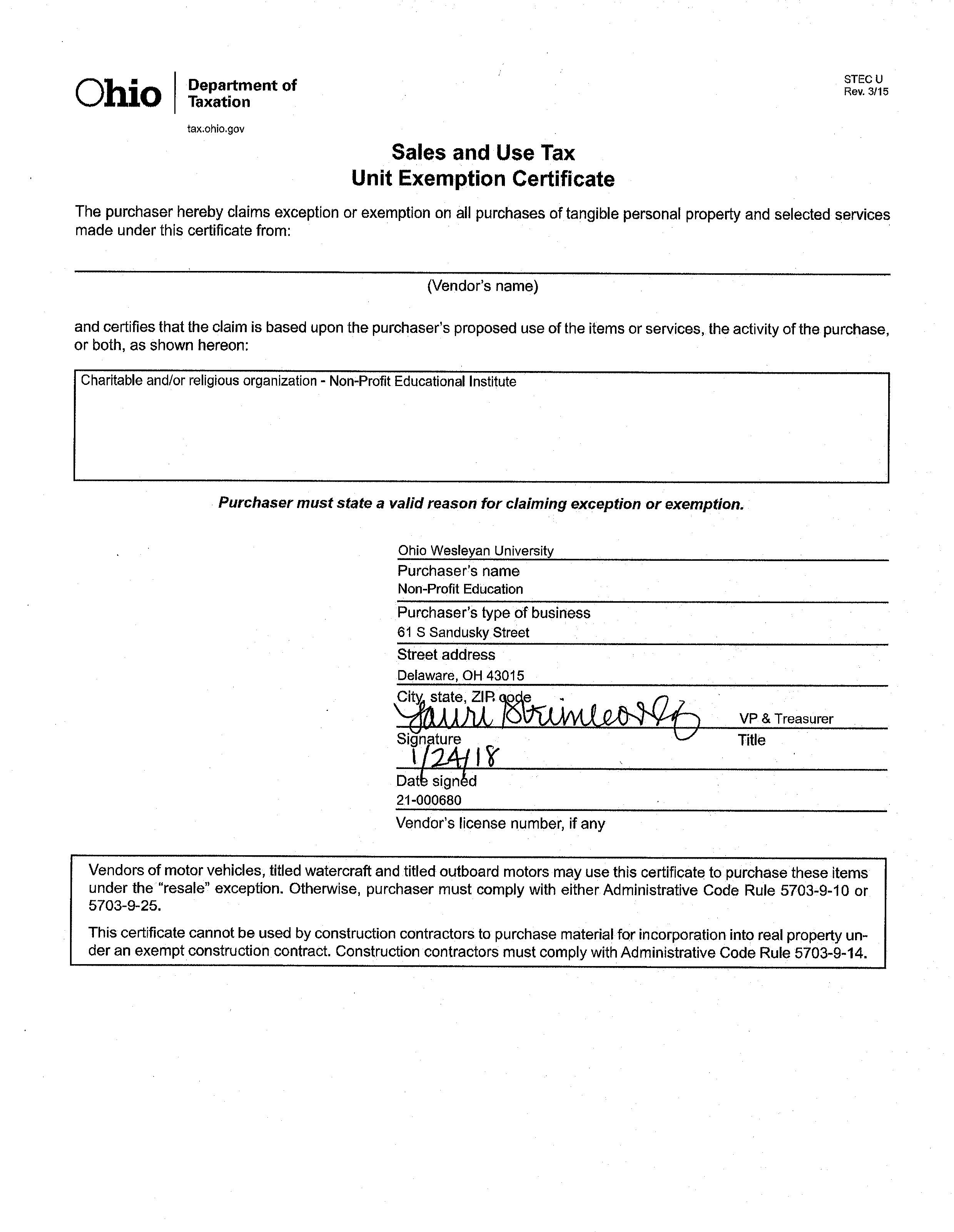

California Sales Tax Exemption Form Video Bokep Ngentot

https://www.owu.edu/files/resources/state-of-ohio-sales-tax-exemption.jpg

Gsa Missouri Tax Exempt Form Form Example Download

https://nationalutilitysolutions.com/wp-content/uploads/2019/01/State-Tax-Exemption-Map.png

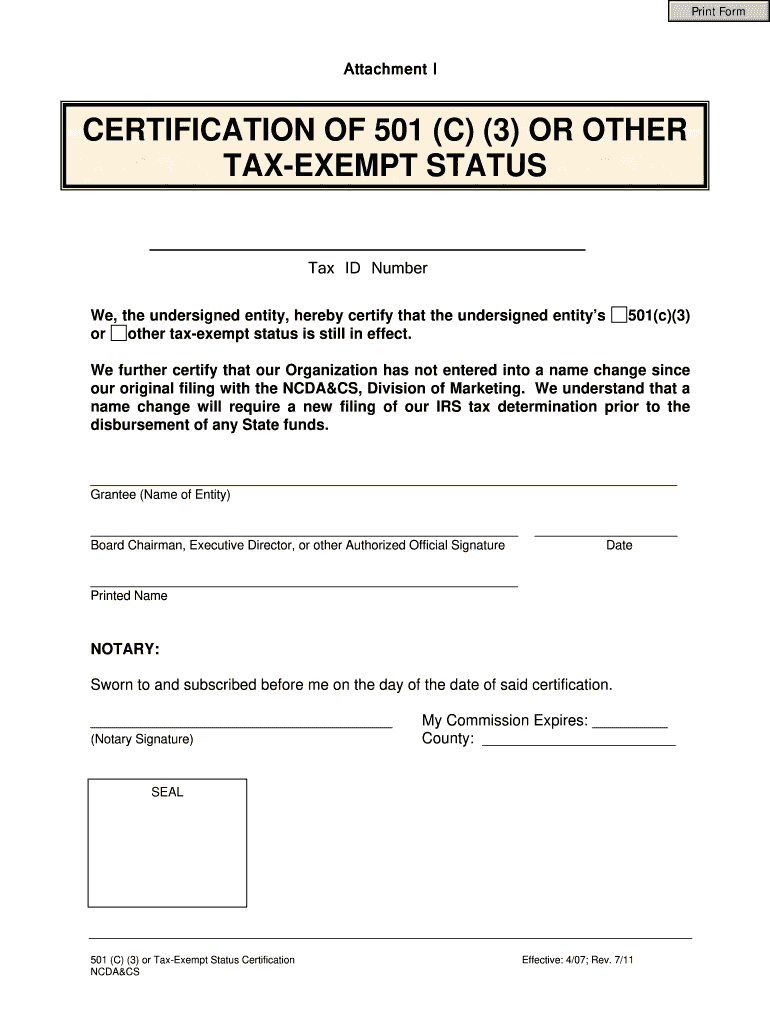

Nc Certification 501 3 Form Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/18/63/18063082/large.png

The Illinois income tax rate is a flat 4 95 Unlike the federal government and many other states Illinois does not have tax brackets that impose higher rates on people who earn more Illinois Illinois first adopted a general state sales tax in 1933 and since that time the base sales tax rate has risen to 6 25 percent On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 percent and 4 75 percent

Property Tax Exemptions Revenue Local Governments Property Tax Relief Homestead Exemptions PTELL and Senior Citizens Real Estate Tax Deferral Program 35 ILCS 200 15 175 General Homestead Exemption GHE January 4 2021 Watch Our Video Contributor Kevin O Flaherty In this article we discuss the difference between a not for profit organization and tax exempt status in Illinois and answer the following questions What Is A Nonprofit Organization What Does It Mean To Be Tax Exempt

Georgia Sales Tax Exemption Form St 5 ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/fillable-form-st-5-sales-and-use-tax-certificate-of-exemption-georgia-10.png

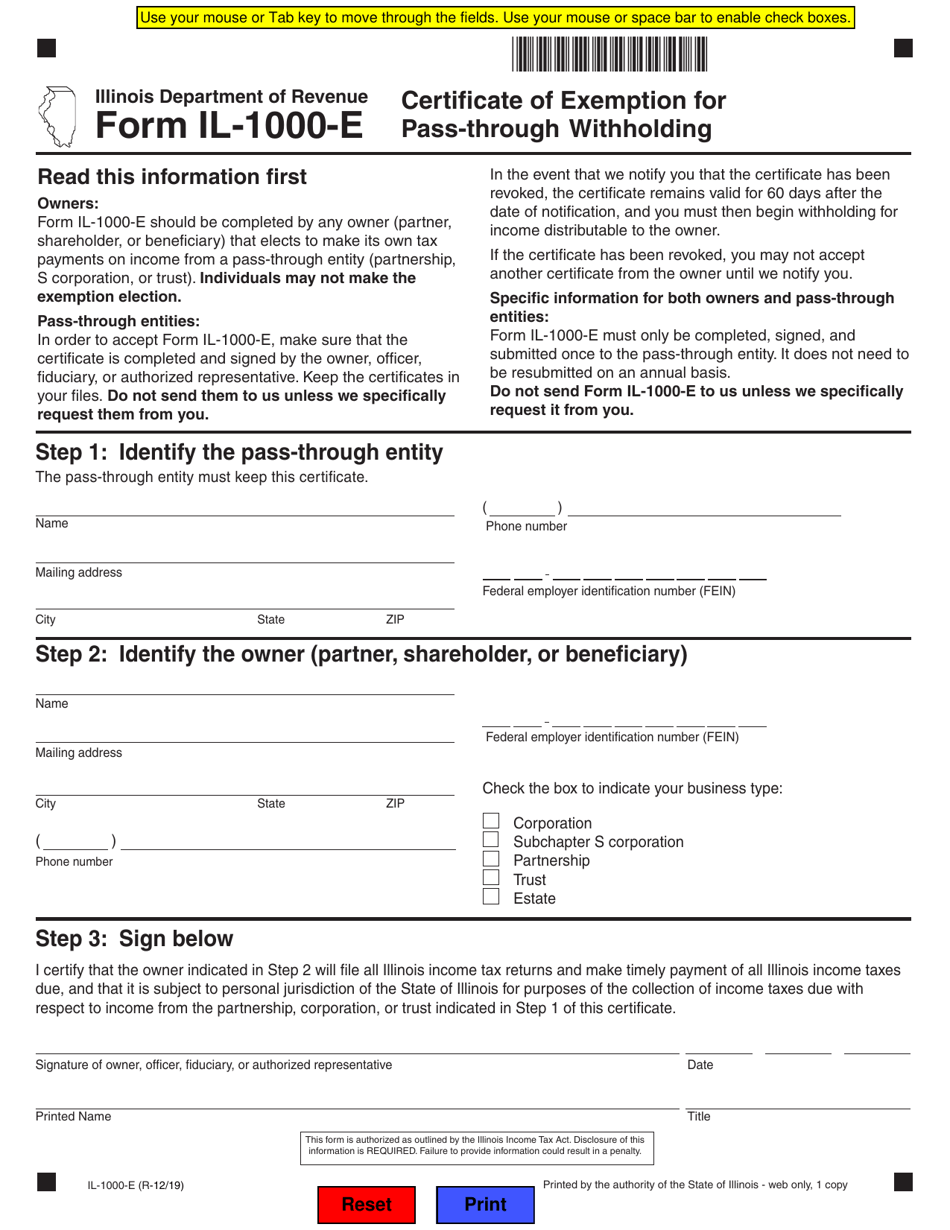

Form IL 1000 E Fill Out Sign Online And Download Fillable PDF

https://data.templateroller.com/pdf_docs_html/2024/20243/2024366/form-il-1000-e-certificate-of-exemption-for-pass-through-withholding-illinois_print_big.png

https://tax.illinois.gov/research/publications/pio-37.html

Sales Tax Exemptions Who qualifies for a sales tax exemption Your organization must be not for profit and organized and operated exclusively for charitable religious educational or governmental purposes to qualify for the exemption from state and local sales tax Who receives sales tax exemptions Sales tax exemptions are given to

https://www.salestaxhandbook.com/illinois/sales-tax-exemptions

In Illinois certain items may be exempt from the sales tax to all consumers not just tax exempt purchasers Some items which are considered to be exempt from sales tax in the state include machinery and building materials for real estate development

2018 Exempt Form W 4 News Illinois State

Georgia Sales Tax Exemption Form St 5 ExemptForm

Illinois Tax Exempt Form Pdf Fill Out Sign Online DocHub

Tax Exempt Forms San Patricio Electric Cooperative

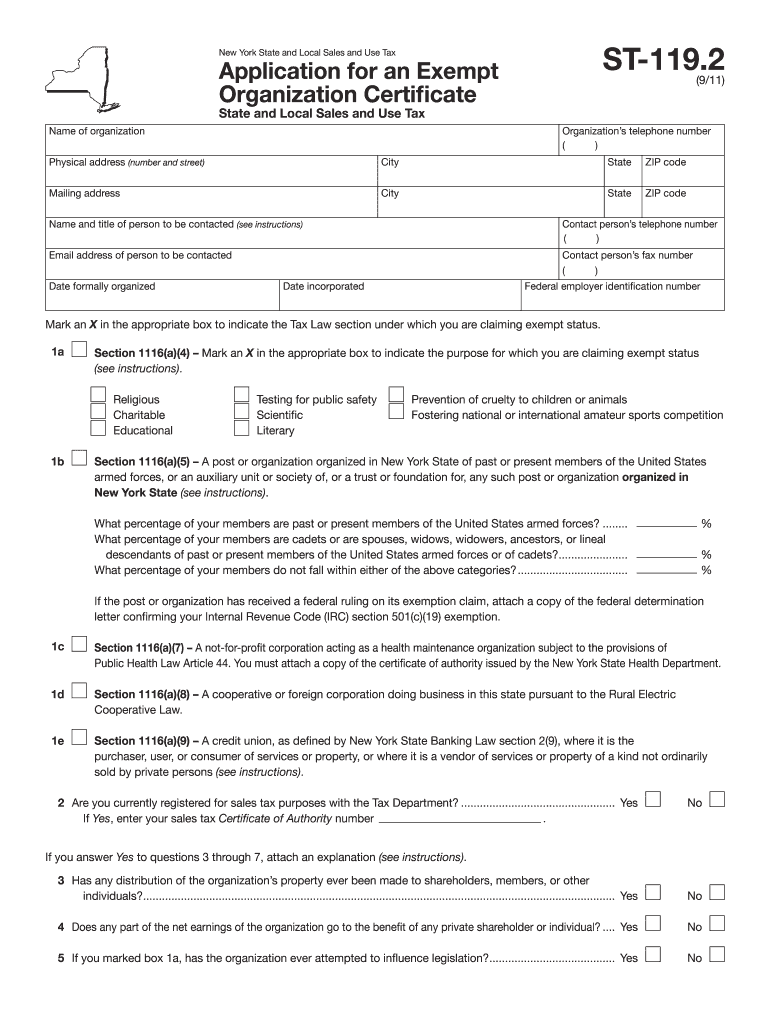

Sales Tax Exemption Certificate New York 2011 2024 Form Fill Out And

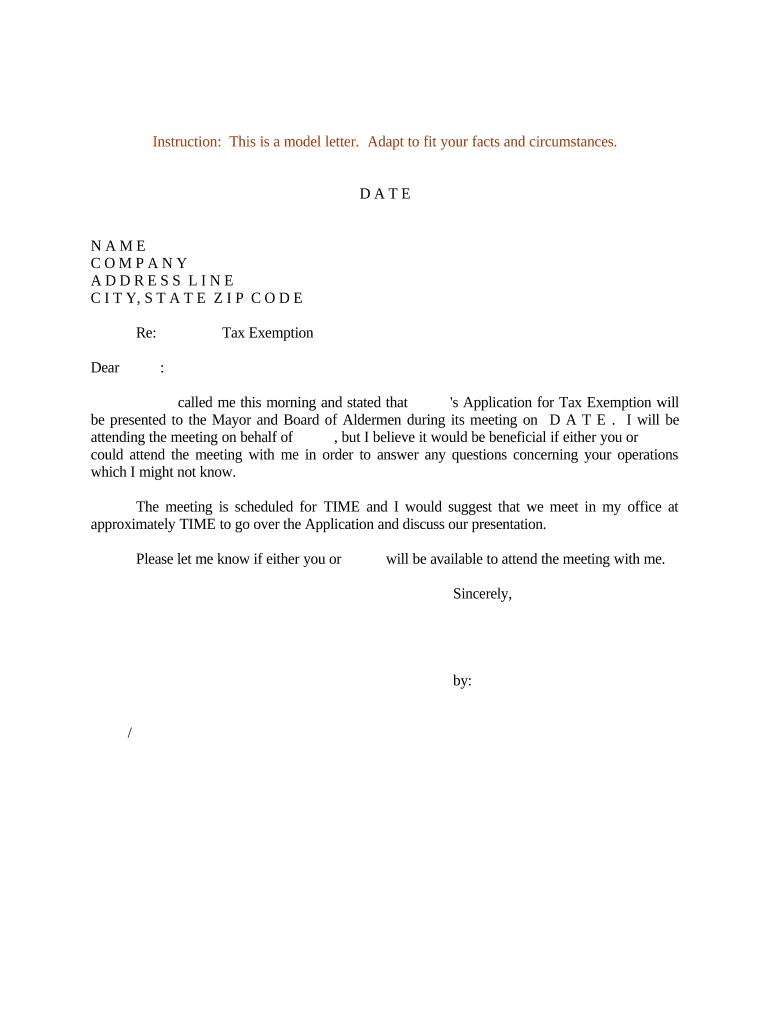

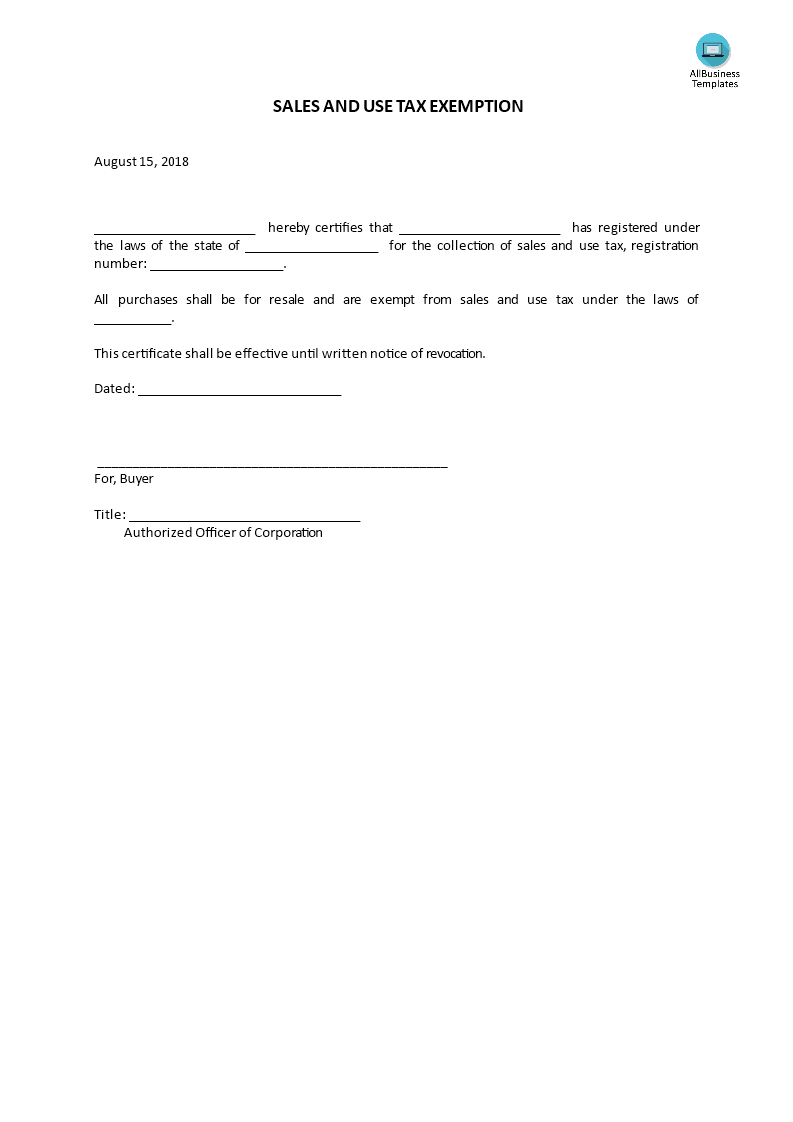

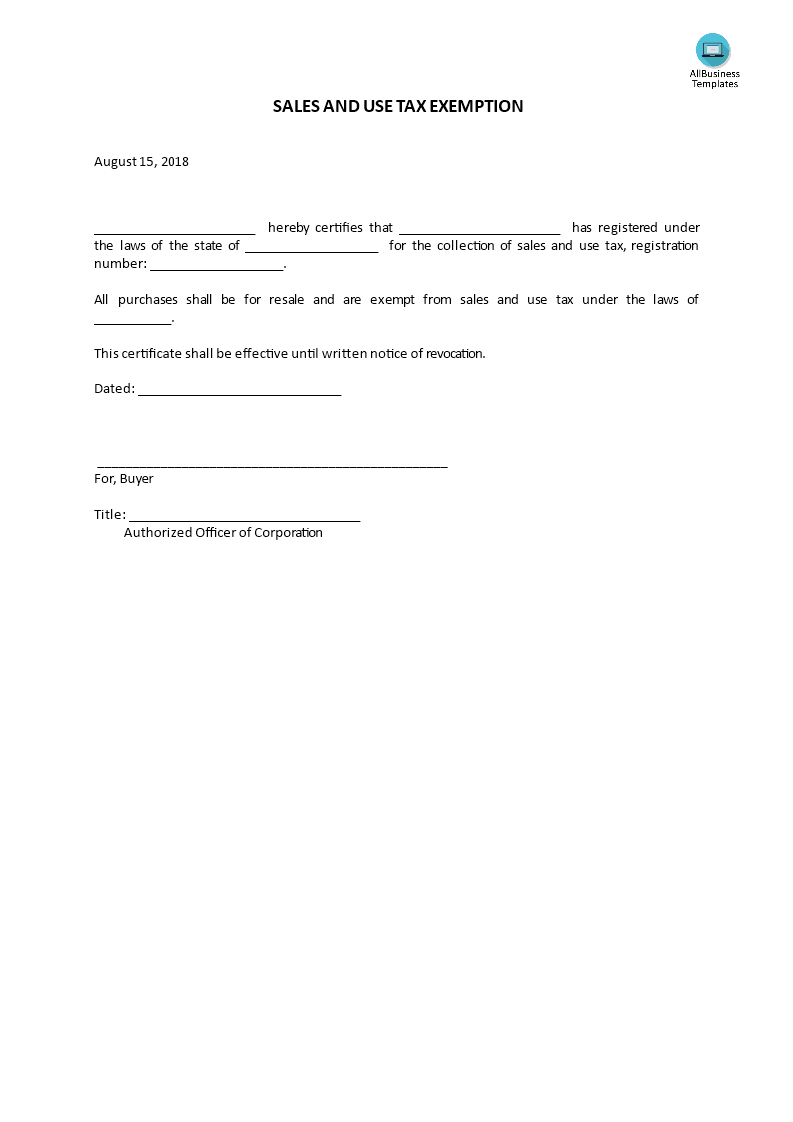

Sales And Use Tax Exemption Letter Templates At Allbusinesstemplates

Sales And Use Tax Exemption Letter Templates At Allbusinesstemplates

Il Sales Tax Exemption Form For Church ExemptForm

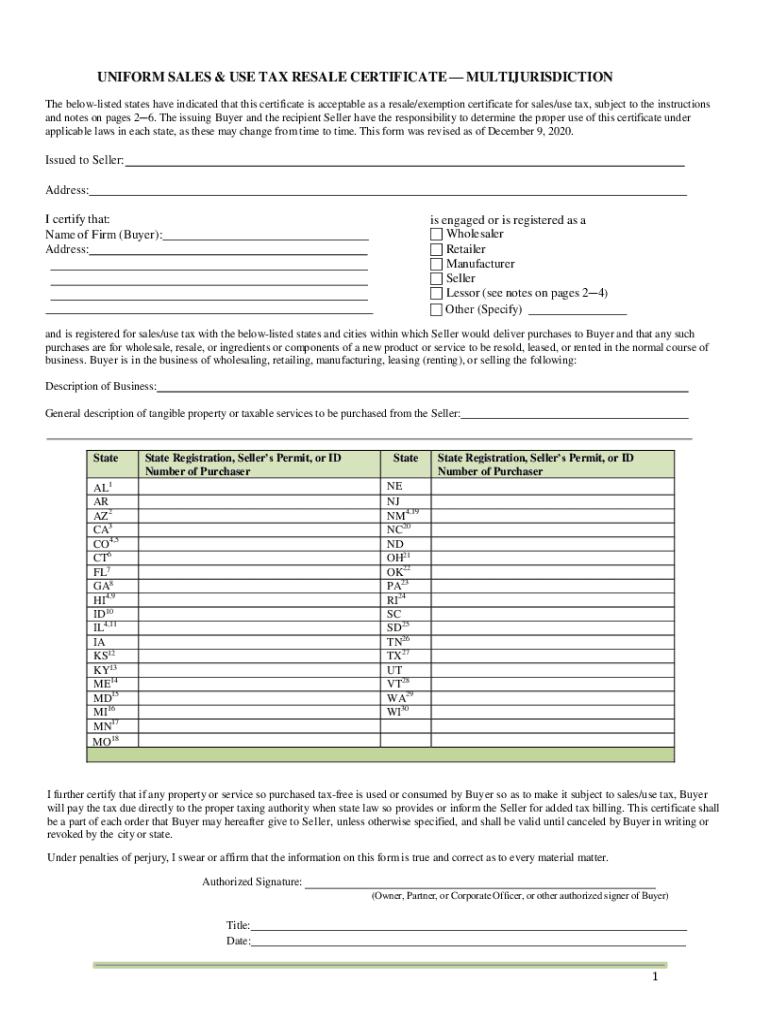

MTC Uniform Sales Use Tax Certificate Multijurisdiction 2020 2022

Senior Exemption Certificate Fill Out And Sign Printable Pdf Template

Tax Exempt State Of Illinois - STEPS TO APPLYING FOR ILLINOIS SALES TAX EXEMPTION Is a nonprofit in Illinois eligible for tax exemptions in the state If the not for profit organization is operated entirely for a charitable religious or educational purpose it may apply for