Tax Exemption For 2022 The IRS Announces New Tax Numbers for 2022 Each year the IRS updates the existing tax code numbers for items that are indexed for inflation This includes the tax rate tables many deduction limits and exemption amounts The following are the tax numbers impacting most taxpayers which will be in effect beginning January 1 2023

However you may qualify to exclude your foreign earnings from income up to an amount that is adjusted annually for inflation 107 600 for 2020 108 700 for 2021 112 000 for 2022 and 120 000 for 2023 In addition you can exclude or deduct certain foreign housing amounts There are seven tax rates in 2022 10 12 22 24 32 35 and 37 Here s how they apply by filing status Single tax rates 2022 AVE Joint tax rates 2022 AVE

Tax Exemption For 2022

Tax Exemption For 2022

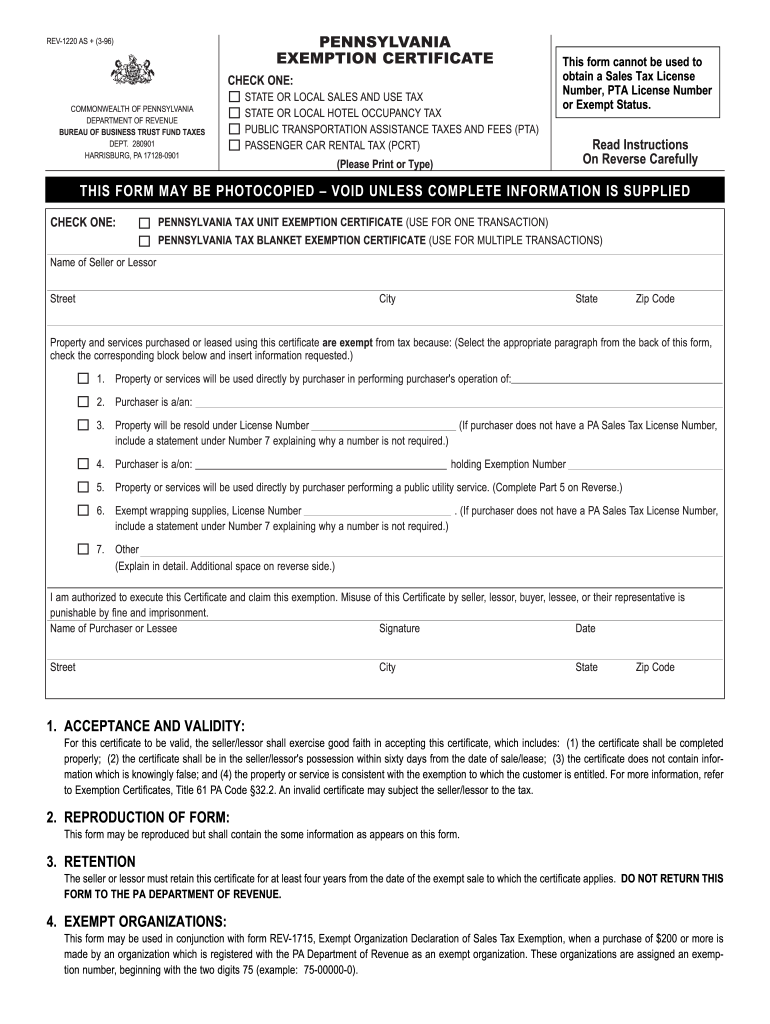

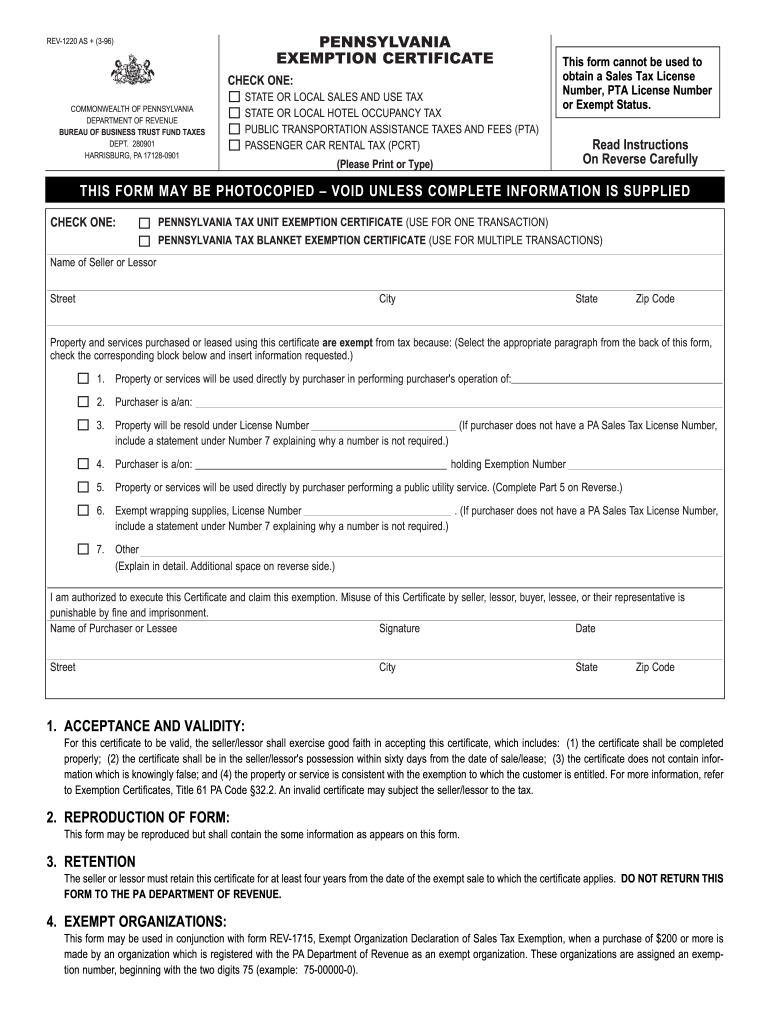

https://www.exemptform.com/wp-content/uploads/2022/08/pa-exemption-certificate-form-fill-out-and-sign-printable-pdf-3.png

Historical Estate Tax Exemption Amounts And Tax Rates

https://i2.wp.com/financialsamurai.com/wp-content/uploads/2020/05/federal-estate-tax-rates.png?fit=1456

California Tax Exempt Form 2020 2022 Fill And Sign Printable Template

https://www.pdffiller.com/preview/76/457/76457885/large.png

For single taxpayers and married individuals filing separately the standard deduction rises to 12 950 for 2022 up 400 and for heads of households the standard deduction will be 19 400 for tax year 2022 up 600 The personal exemption for tax year 2022 remains at 0 as it was for 2021 this elimination of the personal exemption was a What Are Tax Exemptions Written by a TurboTax Expert Reviewed by a TurboTax CPA Updated for Tax Year 2017 March 5 2024 8 53 PM OVERVIEW TABLE OF CONTENTS Tax exemptions Personal exemptions Dependent exemptions Click to expand Taxes done right with experts by your side Start for free Looking for more

2022 Personal Exemption The personal exemption for 2022 remains at 0 The Tax Cuts and Jobs Act of 2017 eliminated the personal exemption until tax year 2025 2022 Alternative Minimum Tax Exemption The alternative minimum tax AMT is a tax imposed on taxpayers who earn above certain thresholds estates and trusts The maximum Earned Income Tax Credit for 2022 will be 6 935 vs 6 728 for tax year 2021 for taxpayers with three or more qualifying children Basic exclusion for decedents who die in 2022

Download Tax Exemption For 2022

More picture related to Tax Exemption For 2022

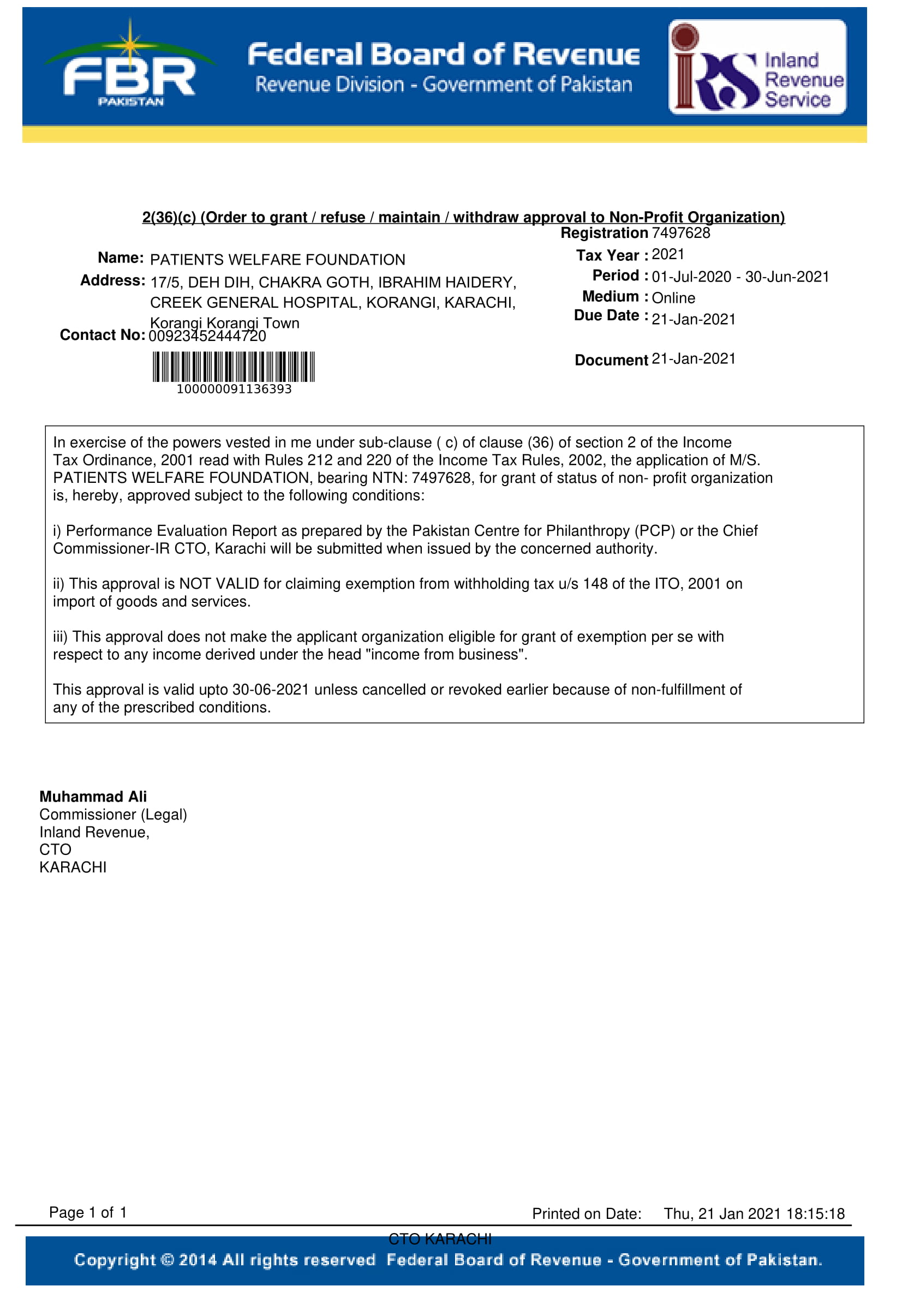

Tax Exemption Certificate PWF Pakistan

https://pwfpakistan.org/wp-content/uploads/2021/01/EXEMPTION-2021-30-06-2021.jpg

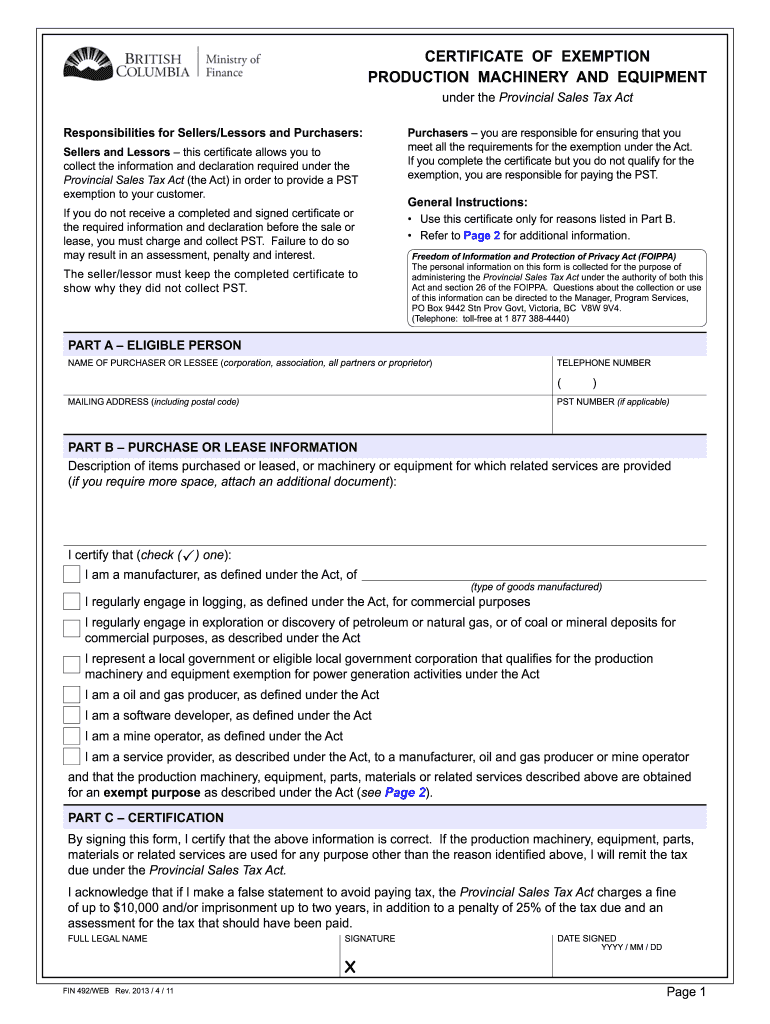

Pst Exemption Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/29/381/29381973/large.png

2022 Tax Exemption Certificate

https://i.pinimg.com/736x/78/1e/95/781e9571ea0cc7080028b9320f929b6b.jpg

The personal exemption for 2022 remains at 0 eliminating the personal exemption was part of the Tax Cuts and Jobs Act of 2017 TCJA Alternative Minimum Tax AMT The alternative minimum tax AMT was created in the 1960s to prevent high income taxpayers from avoiding the individual income tax There are seven federal tax brackets for tax year 2024 They are 10 12 22 24 32 35 and 37 The highest earners fall into the 37 range while those who earn the least are in the

Tax Exemption Schemes The tax exemption scheme for new start up companies and partial tax exemption scheme for companies are tax reliefs available to reduce companies tax bills Learn more through our e Learning video on the Common Tax Reliefs That Help Reduce Tax Bills Expand all Tax Exemption Scheme for New Start Up Companies Additional exemption of RM8 000 disable child age 18 years old and above not married and pursuing diplomas or above qualification in Malaysia bachelor degree or above outside Malaysia in program and in Higher Education Institute that is accredited by related Government authorities effective from YA 2021 until YA 2022 Restricted to

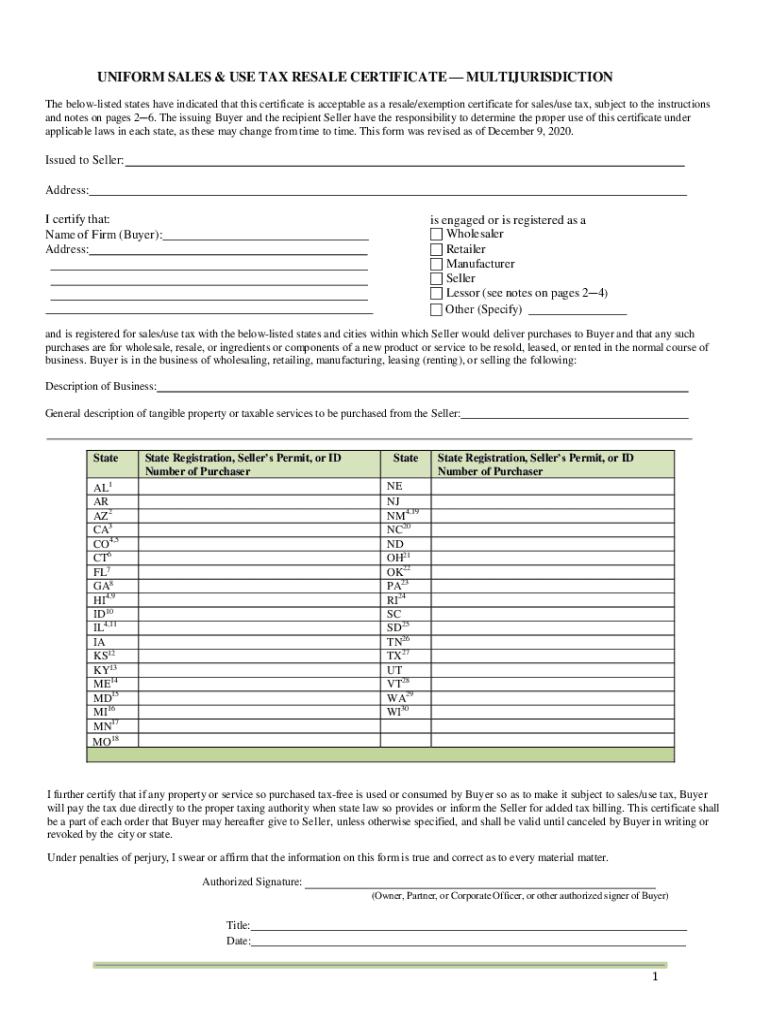

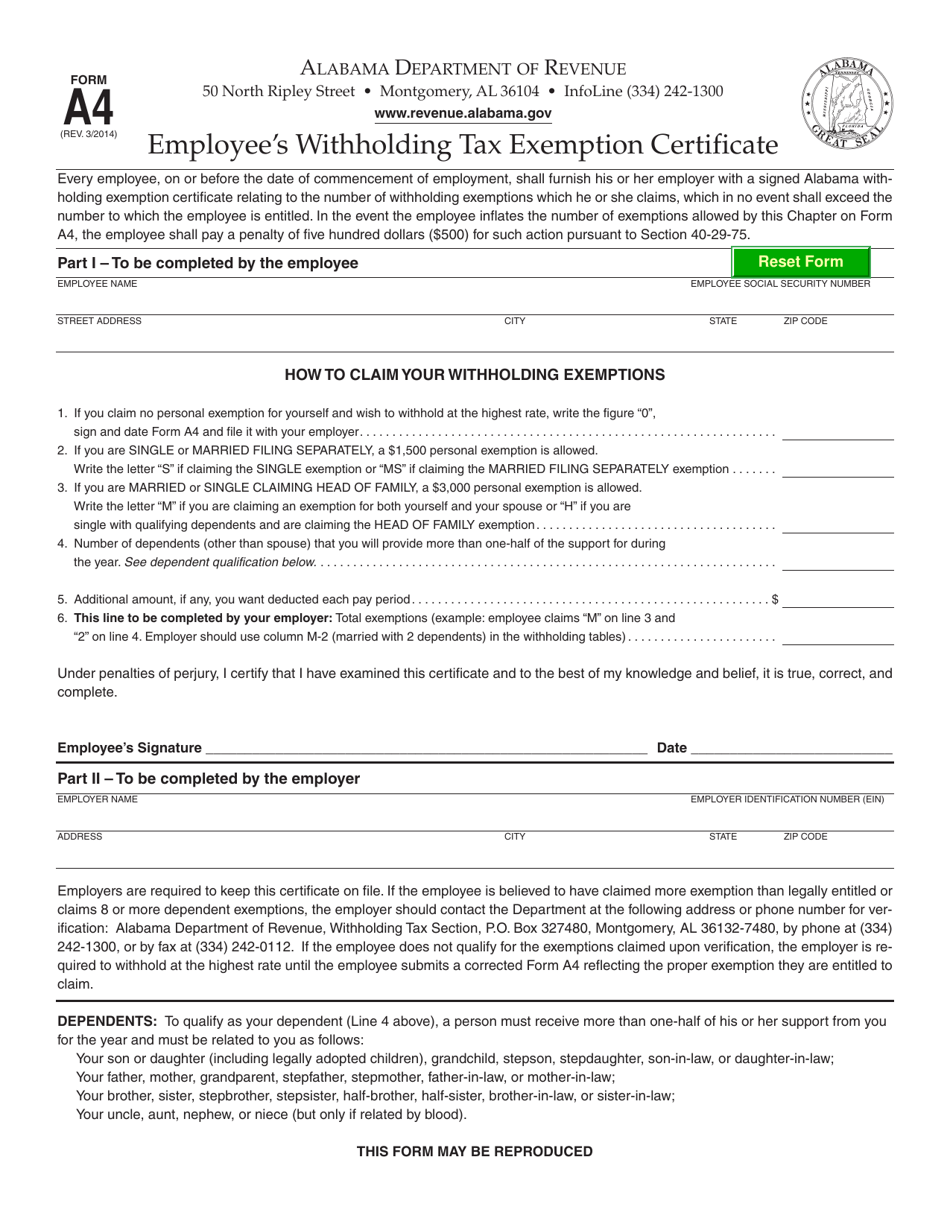

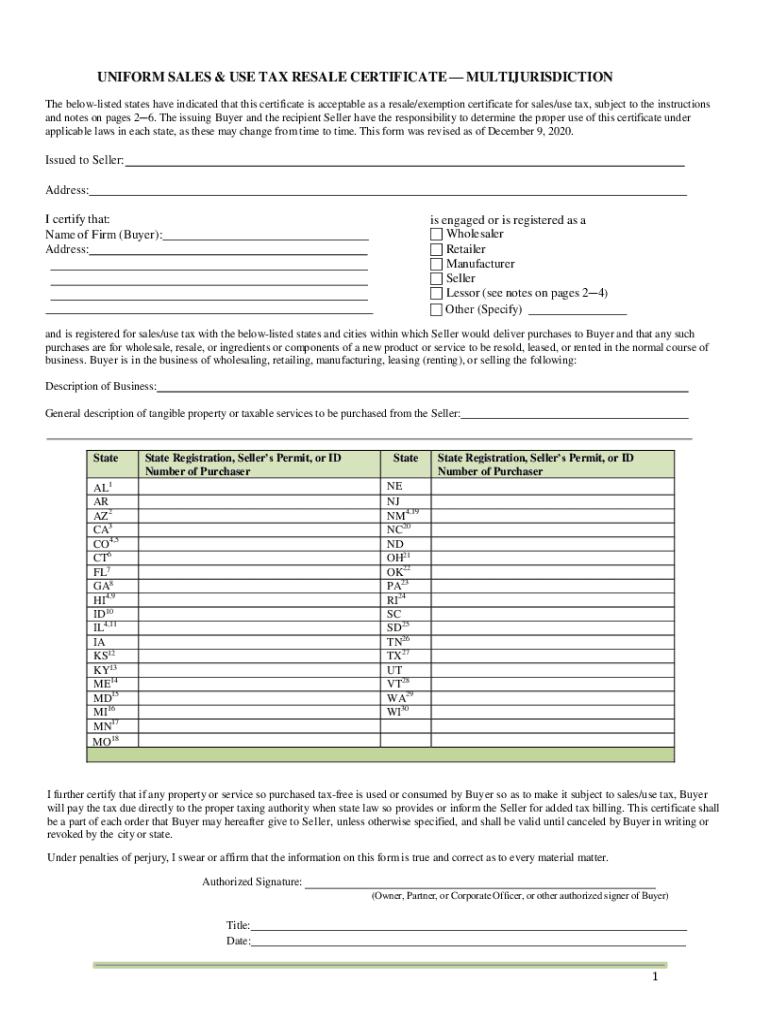

MTC Uniform Sales Use Tax Certificate Multijurisdiction 2020 2022

https://www.pdffiller.com/preview/541/304/541304812/large.png

Tax Exemption For Online Businesses

https://manilashaker.com/wp-content/uploads/2022/08/Tax-Exemption-for-Online-Businesses.jpg

https://www.purposefulfinance.org/home/articles/...

The IRS Announces New Tax Numbers for 2022 Each year the IRS updates the existing tax code numbers for items that are indexed for inflation This includes the tax rate tables many deduction limits and exemption amounts The following are the tax numbers impacting most taxpayers which will be in effect beginning January 1 2023

https://www.irs.gov/individuals/international...

However you may qualify to exclude your foreign earnings from income up to an amount that is adjusted annually for inflation 107 600 for 2020 108 700 for 2021 112 000 for 2022 and 120 000 for 2023 In addition you can exclude or deduct certain foreign housing amounts

Printable Exemption Form From Garnishment Printable Forms Free Online

MTC Uniform Sales Use Tax Certificate Multijurisdiction 2020 2022

Ohio Tax Exempt Form 2020 2022 Fill And Sign Printable Template

Tax Exempt Forms San Patricio Electric Cooperative

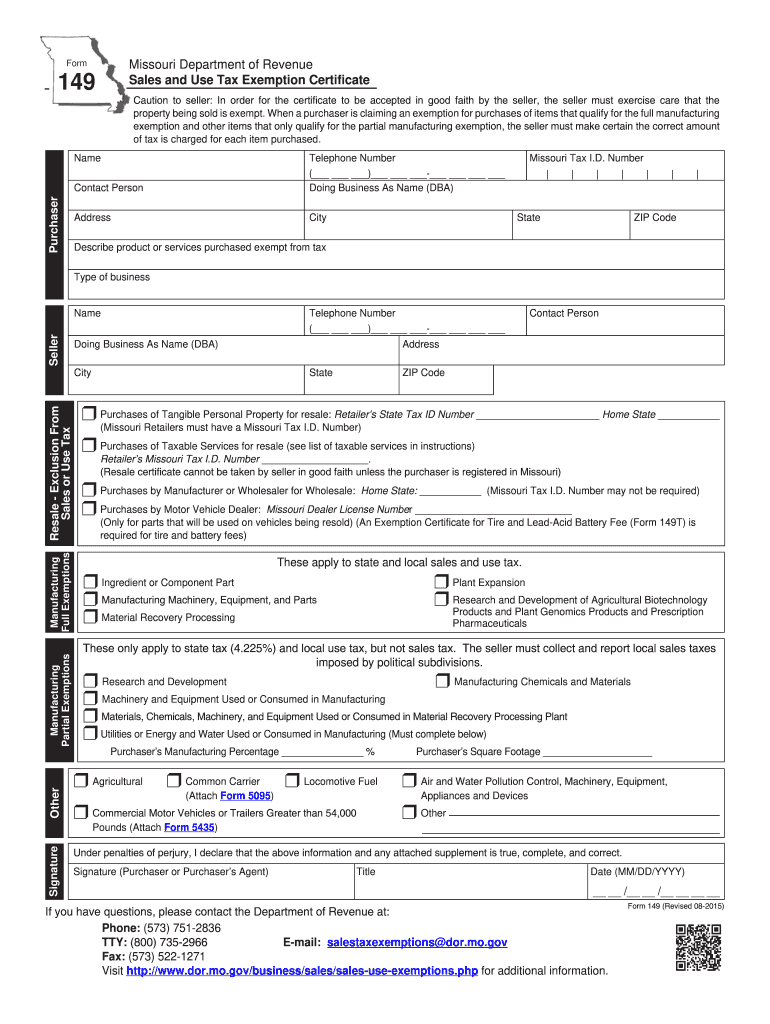

Mo Tax Exemption Form Fill Out And Sign Printable PDF Template SignNow

2022 Deductions List Name List 2022

2022 Deductions List Name List 2022

Certificate Of Exemption To 2024 STEEI Fla Sales Tax EARTHSAVE FLORIDA

HRDF Exemption 2021 Aug 17 2021 Johor Bahru JB Malaysia Taman

Montgomery County Homestead Exemption Online 2019 2024 Form Fill Out

Tax Exemption For 2022 - What Are Tax Exemptions Written by a TurboTax Expert Reviewed by a TurboTax CPA Updated for Tax Year 2017 March 5 2024 8 53 PM OVERVIEW TABLE OF CONTENTS Tax exemptions Personal exemptions Dependent exemptions Click to expand Taxes done right with experts by your side Start for free Looking for more