Tax Exemption For Disabled Person Most income is taxable but some is exempt like SSI payments workers comp settlements and some short term disability benefits If you made 50 000 of

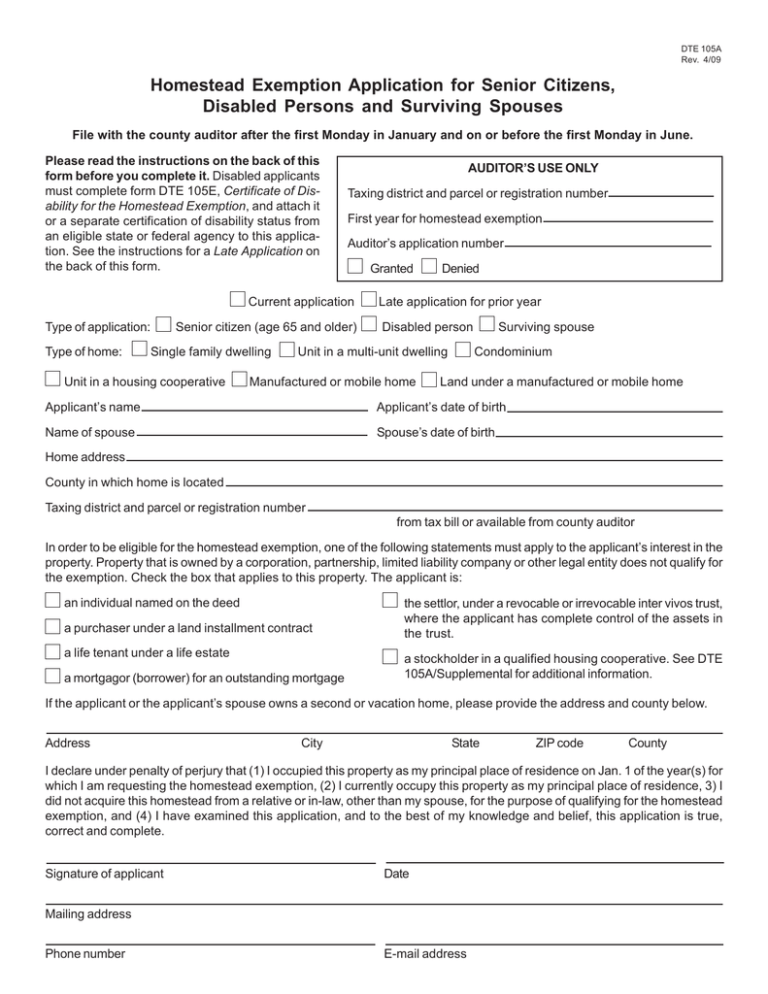

Special Deductions for People With Disabilities First we ll look at deductions A tax deduction reduces your taxable income so the more deductions you You do not have to pay tax on some types of vehicle for example disabled passenger vehicles mobility vehicles and powered wheelchairs Check which types of vehicles are

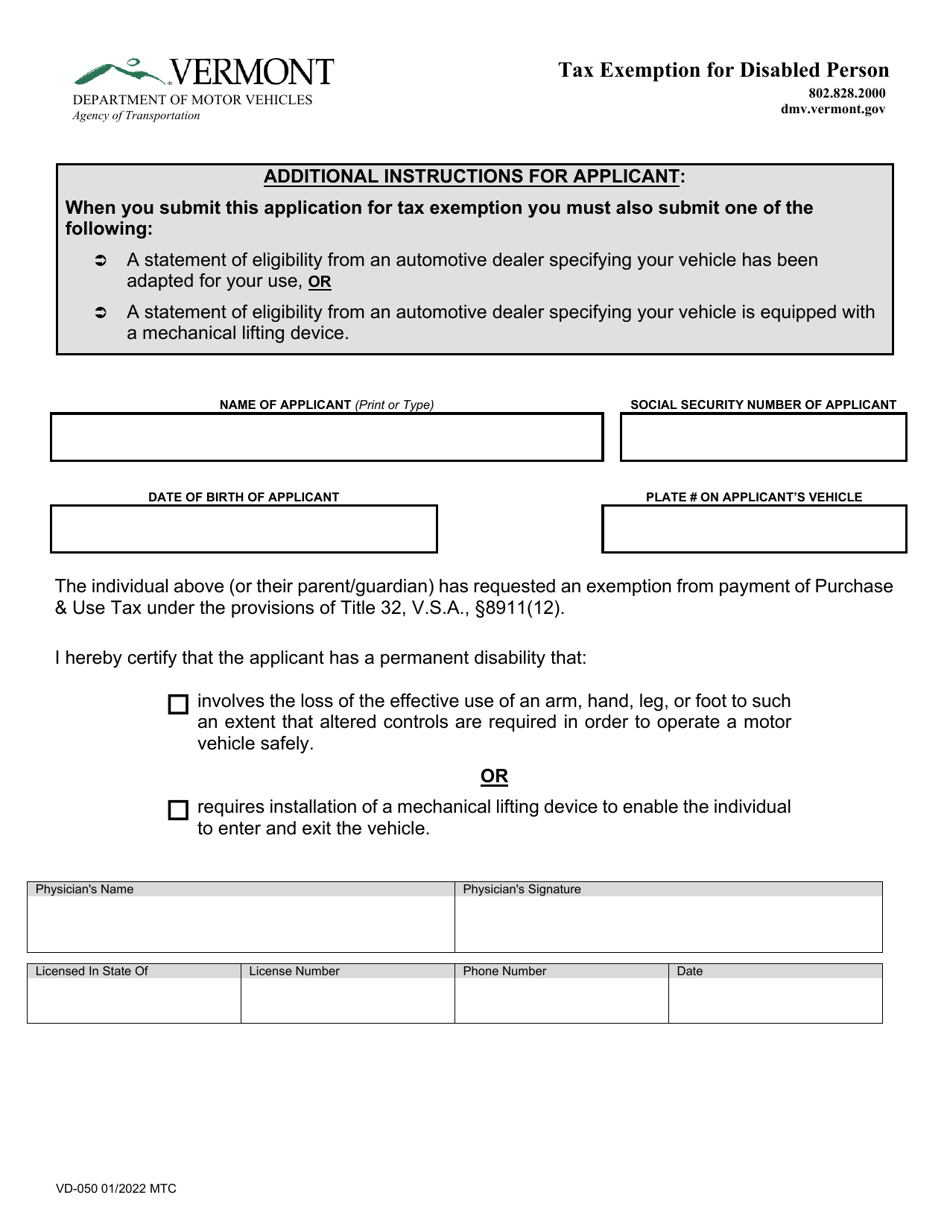

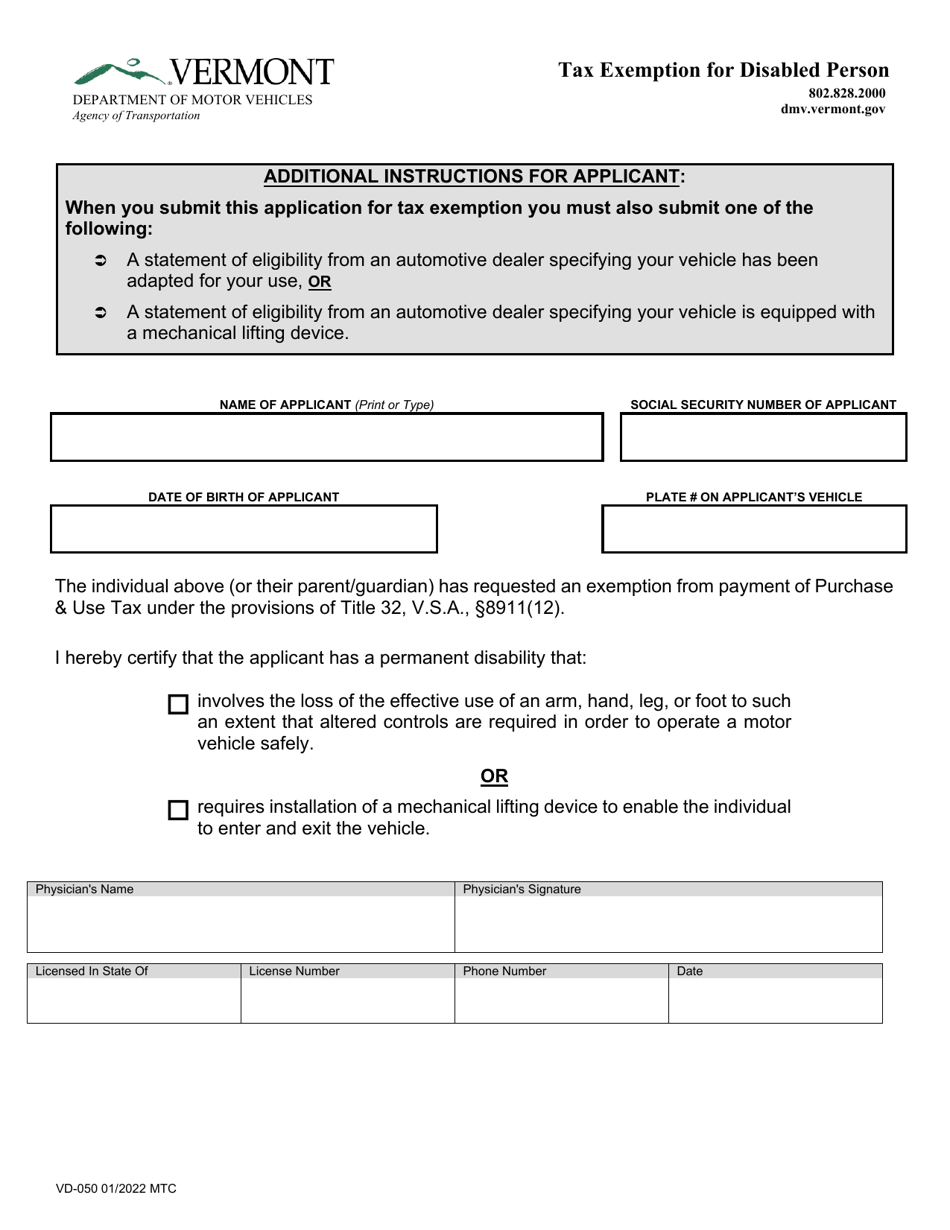

Tax Exemption For Disabled Person

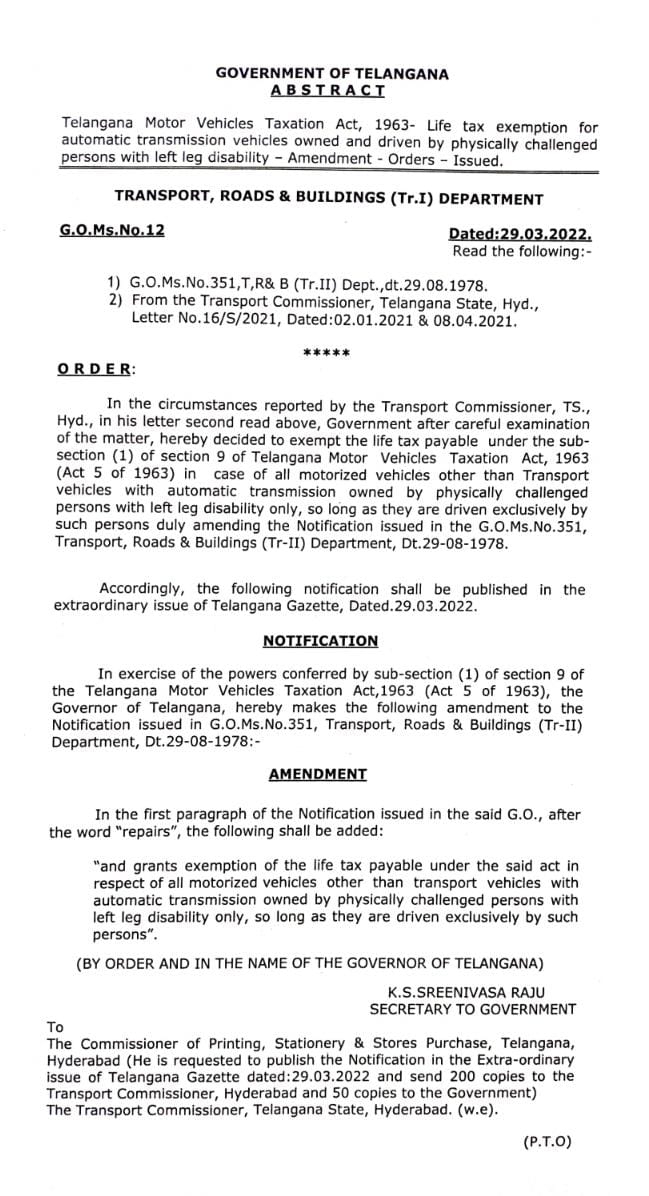

Tax Exemption For Disabled Person

https://data.templateroller.com/pdf_docs_html/2382/23821/2382137/page_1_thumb_950.png

Disabled Veteran Property Tax Exemption In Every State

https://blog.veteransloans.com/wp-content/uploads/2022/08/Blog-Cover-Disabled-Veteran-Property-Tax-Exemption.jpg

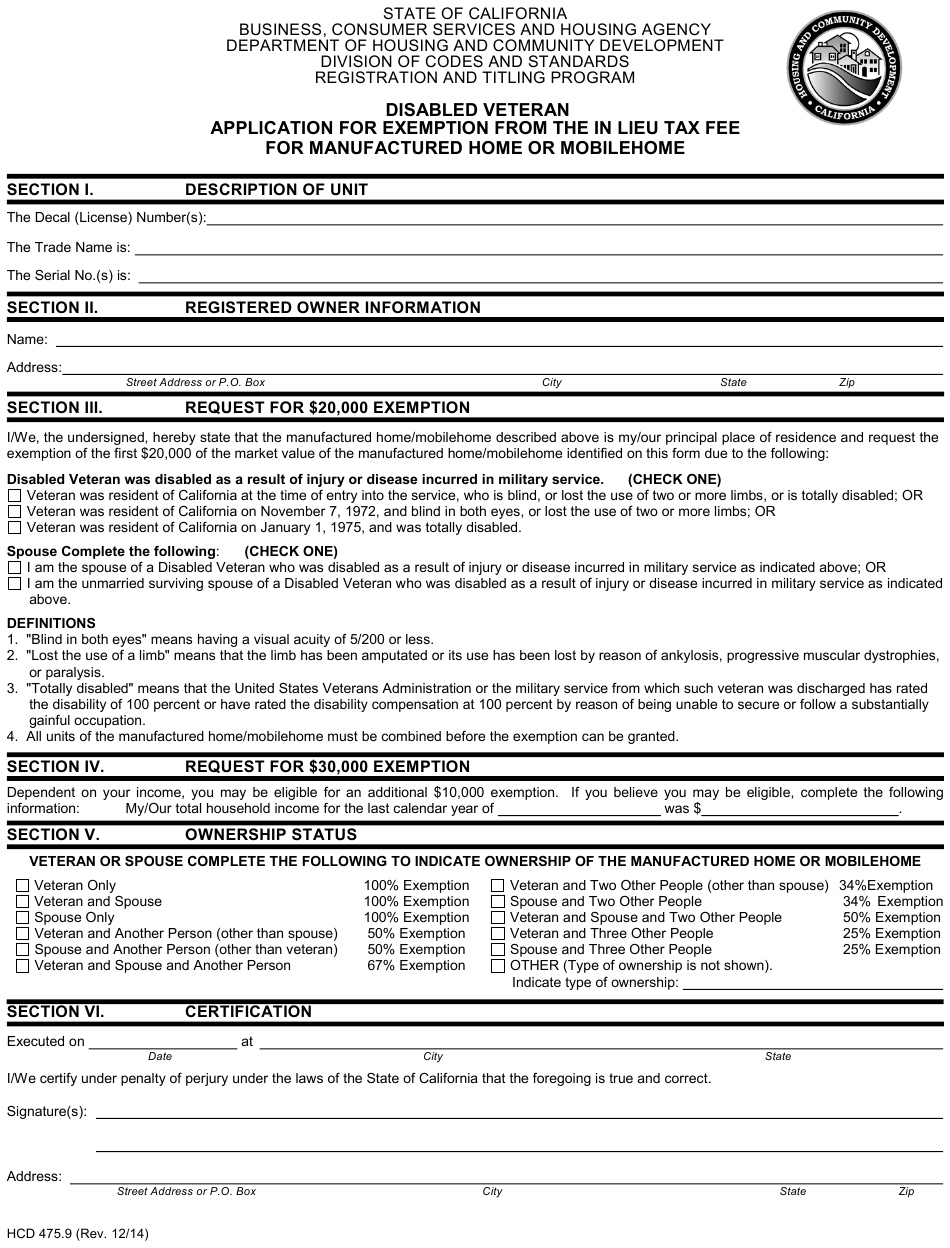

Disability Car Tax Exemption Form ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/form-hcd475-9-download-printable-pdf-or-fill-online-disabled-veteran.png

Disabled access credit This is a nonrefundable tax credit for an eligible small business that pays or incurs expenses to provide access to persons with disabilities The If you are permanently and totally disabled and have taxable disability income you may qualify for the federal Tax Credit for the

AS A PERSON WITH A DISABILITY you may qualify for some of the following tax deductions income exclusions and credits More detailed information may be found in A Person with Disabilities Exemption is for persons with disabilities and provides an annual 2 000 reduction in the equalized assessed value EAV of the property

Download Tax Exemption For Disabled Person

More picture related to Tax Exemption For Disabled Person

Property Tax Exemption For Disabled Person CommonFloor Groups

https://groups.commonfloor.com/blog/wp-content/uploads/2019/07/Property-Tax-1-649x424.png

Property Tax Exemption For Disabled Veterans Esper Aiello Law Group

https://www.esperaiellolawgroup.com/wp-content/uploads/property-tax-exemption-for-disabled-veterans.jpg

Hecht Group Oklahoma Property Tax Exemption For Disabled Veterans

https://img.hechtgroup.com/1664933010645.jpg

You can claim disability exemption when you apply for vehicle tax Find out if you re eligible and how to claim You can remove an exemption from a vehicle if it s no longer Home VAT Guidance Reliefs from VAT for disabled and older people VAT Notice 701 7 Find out about which goods and services for disabled people and people

The Persons with Disabilities Act 2003 and The Persons with Disabilities Income Tax Deductions and Exemptions Order 2010 forms the legal basis for granting of Income A deduction of Rs 75 000 is allowed for people with disabilities and Rs 1 25 000 deduction for people with severe disability Requirements to Claim Deductions

Hecht Group The Maryland Property Tax Exemption For Social Security

https://img.hechtgroup.com/1664073659838.png

Texas Veteran Property Tax Exemption Disabled Veteran Benefits

https://assets.site-static.com/userFiles/3705/image/dis-vet-tax-header.png

https://www.atticus.com/advice/general/disability...

Most income is taxable but some is exempt like SSI payments workers comp settlements and some short term disability benefits If you made 50 000 of

https://www.disabilitysecrets.com/resources/tax...

Special Deductions for People With Disabilities First we ll look at deductions A tax deduction reduces your taxable income so the more deductions you

Toll Tax Exemption For Disabled Persons

Hecht Group The Maryland Property Tax Exemption For Social Security

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

Property Tax Exemption For Illinois Disabled Veterans

York County Sc Residential Tax Forms Homestead Exemption CountyForms

York County Sc Residential Tax Forms Homestead Exemption CountyForms

Homestead Exemption Application For Senior Citizens Disabled Persons

2023 Disabled Veteran Property Tax Exemption Lake County Veterans And

18 States With Full Property Tax Exemption For 100 Disabled Veterans

Tax Exemption For Disabled Person - AS A PERSON WITH A DISABILITY you may qualify for some of the following tax deductions income exclusions and credits More detailed information may be found in