Tax Exemption For Higher Education For more information about the tax relief granted to teaching and research staff see Taxation of people working for higher education institutions international situations The

Taxpayers who pay for higher education in 2021 can see these tax savings when they file their tax return next year If taxpayers their spouses or their dependents take post An individual can get tax deductions on the interest paid for educational laon taken for higher studies This tax benefits on education loan can be claimed under Section 80E of the Income

Tax Exemption For Higher Education

Tax Exemption For Higher Education

https://www.signnow.com/preview/497/331/497331433/large.png

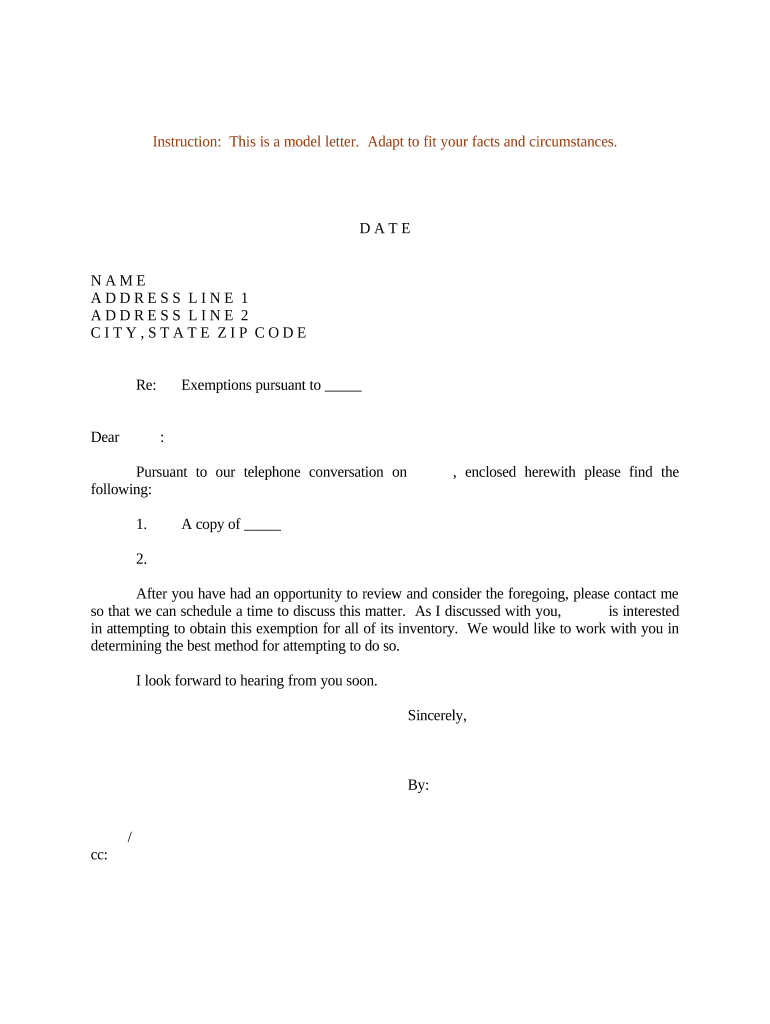

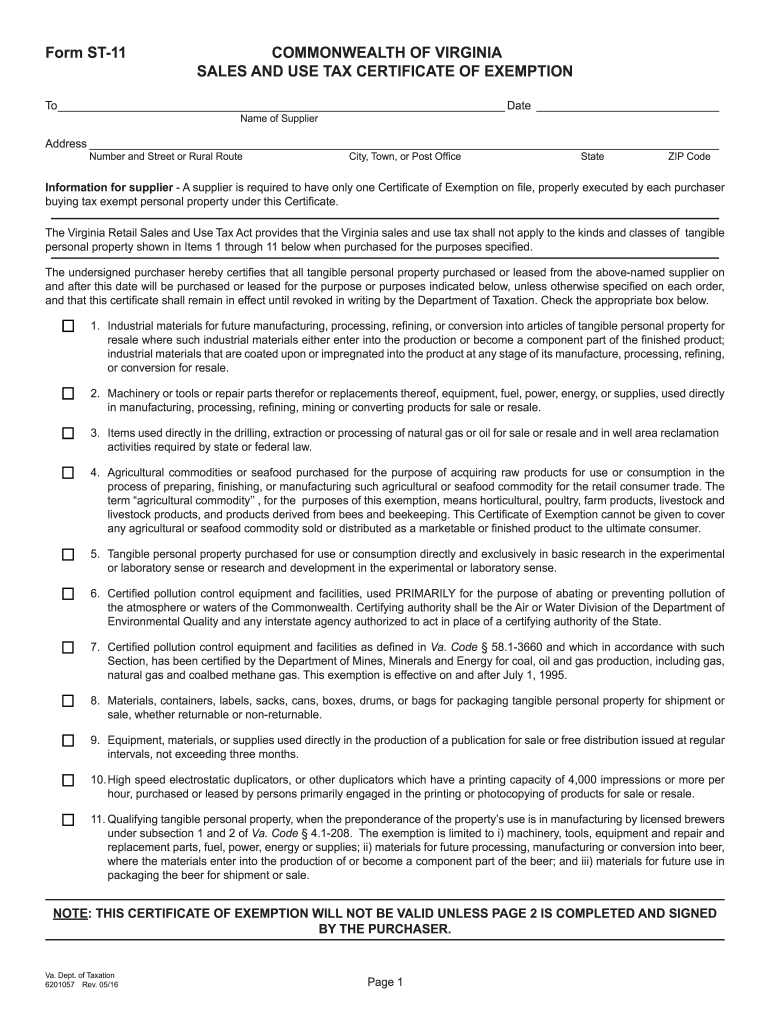

St4 Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/443/65/443065685/large.png

Tax Exemptions For Startups In India Bizzopedia

https://m.media-amazon.com/images/G/31/bizzopedia/Blog20/Blog_20_Image_2.png

Interest on loans taken for pursuing higher education including vocational studies is eligible for deduction u s 80E Understand Section 80E of the Income Tax Act which allows tax deductions for interest paid on education Section 80E of the Income tax act allows you to claim a deduction for the education loan taken from any financial institution or approved charitable institution Under this section you can only take a tax deduction for the

Education loan interest is tax deductible under section 80E for individuals taking loans for higher studies limited to interest payments only Loan must be from recognized institutions No cap on deduction amount available Higher education for this purpose means any educational course undertaken after completion of Senior Secondary Examination You can claim this benefit for yourself spouse and any number of

Download Tax Exemption For Higher Education

More picture related to Tax Exemption For Higher Education

How To Get A Certificate Of Tax Exemption In The Philippines FilipiKnow

https://filipiknow.net/wp-content/uploads/2021/09/bir-tax-exemption-certificate-sample-743x1024.png

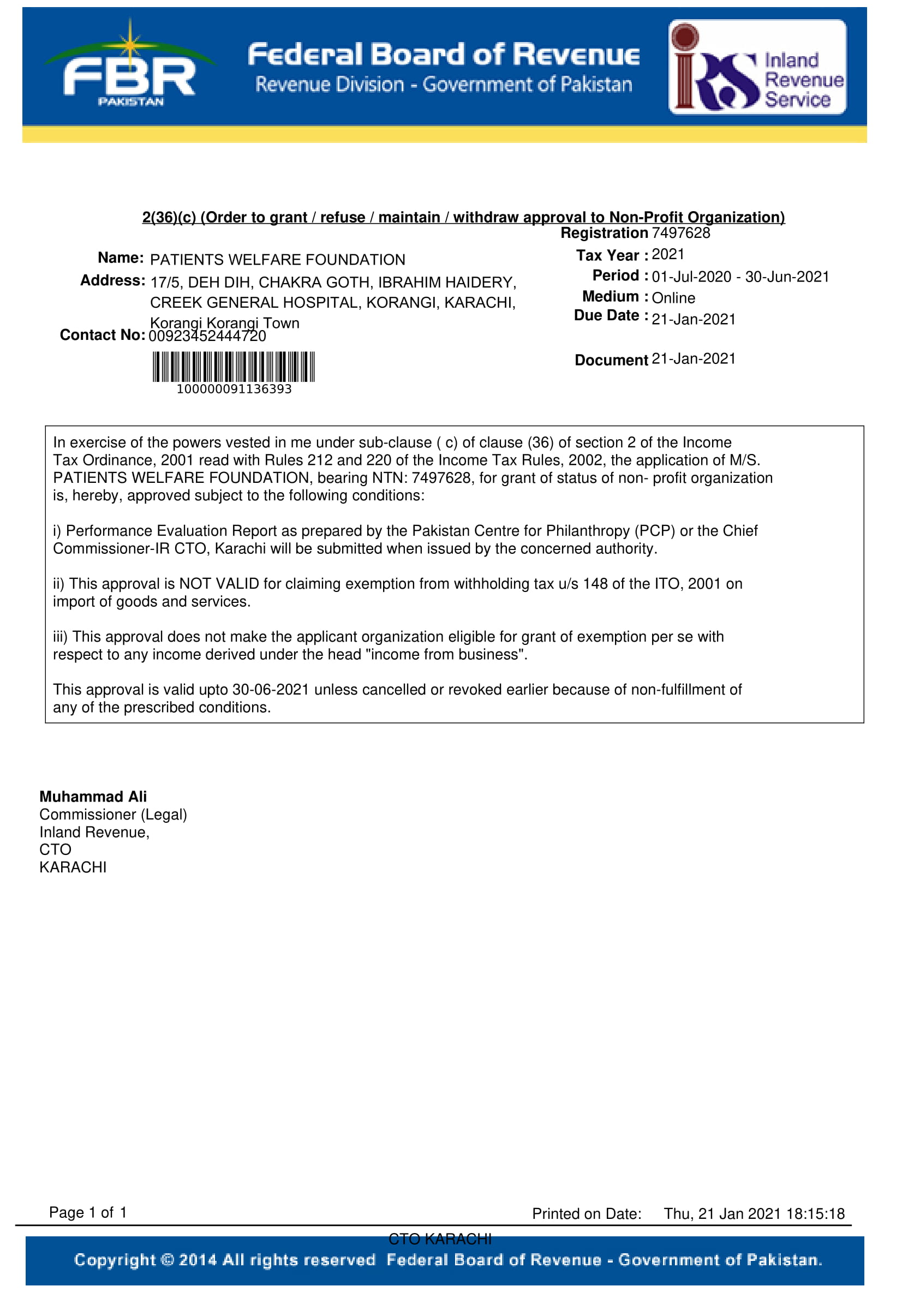

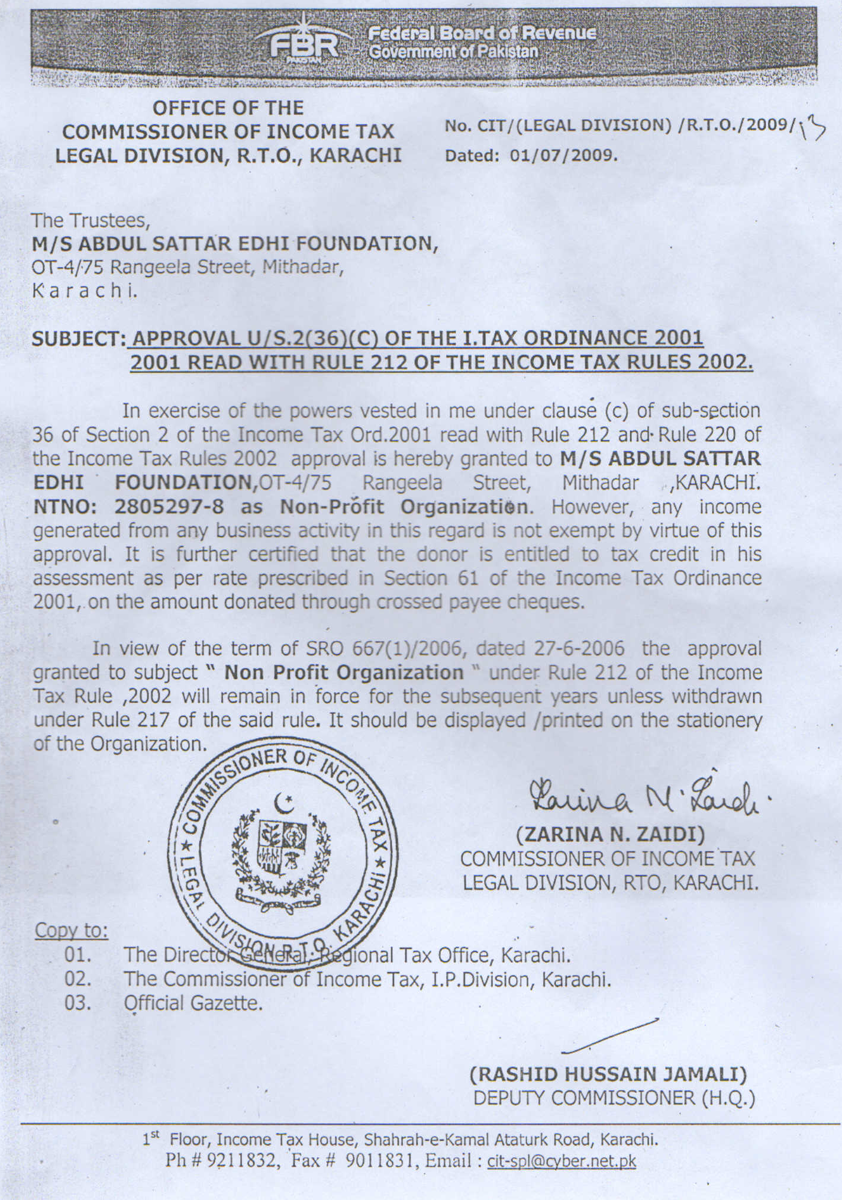

Tax Exemption Certificate PWF Pakistan

https://pwfpakistan.org/wp-content/uploads/2021/01/EXEMPTION-2021-30-06-2021.jpg

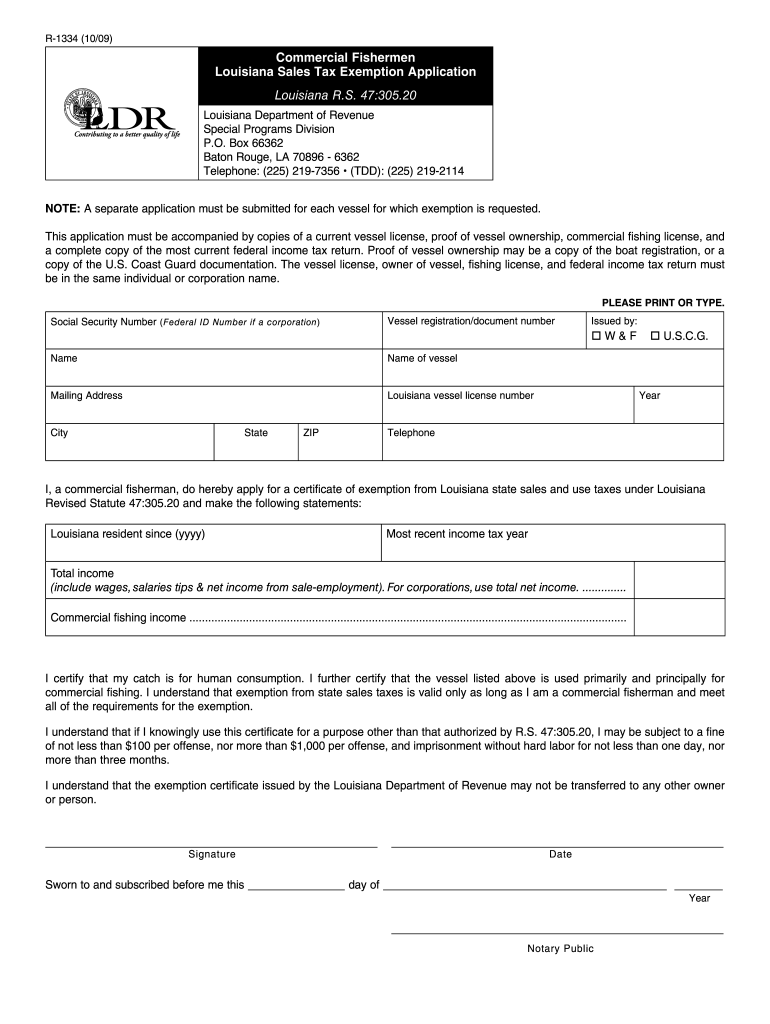

Louisiana Resale Certificate PDF Complete With Ease AirSlate SignNow

https://www.signnow.com/preview/11/44/11044386/large.png

Higher education institutions are in turn exempted from income tax so they can make the most of their revenues This tax exemption enables universities and colleges to You can take the tax exclusion if you meet all of these conditions You were 24 years old or older before the bonds were issued Your modified adjusted gross income is less than the cut

For the purposes of the 10 additional penalty exception higher education means costs of tuition fees books supplies and equipment to a post secondary school college This guidance concerns the taxation of people working for universities of applied sciences and universities in international situations International tax situations include expert

Russia Approves Potential Tax Exemption For Issuers Of Digital Assets

https://news.coincu.com/wp-content/uploads/2022/06/Russia-Approves-Potential-Tax-Exemption-for-Issuers-of-Digital-Assets.png

FREE 10 Sample Tax Exemption Forms In PDF ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/free-10-sample-tax-exemption-forms-in-pdf-22.jpg

https://www.vero.fi › en › detailed-guidance › guidance › ...

For more information about the tax relief granted to teaching and research staff see Taxation of people working for higher education institutions international situations The

https://www.irs.gov › newsroom › heres-what-taxpayers...

Taxpayers who pay for higher education in 2021 can see these tax savings when they file their tax return next year If taxpayers their spouses or their dependents take post

NHS Medical Exemption Certificate

Russia Approves Potential Tax Exemption For Issuers Of Digital Assets

IRS Tax Exemption Letter Peninsulas EMS Council

Council Tax Exemption For Students How To Guide Glide

Tax Exempt Forms San Patricio Electric Cooperative

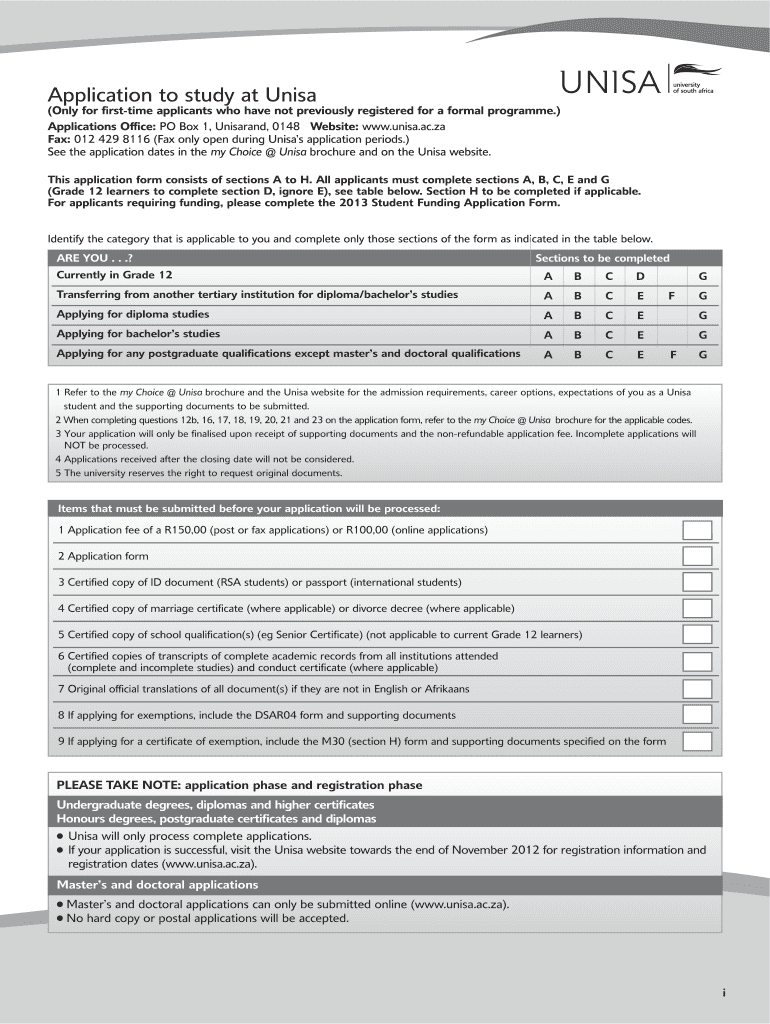

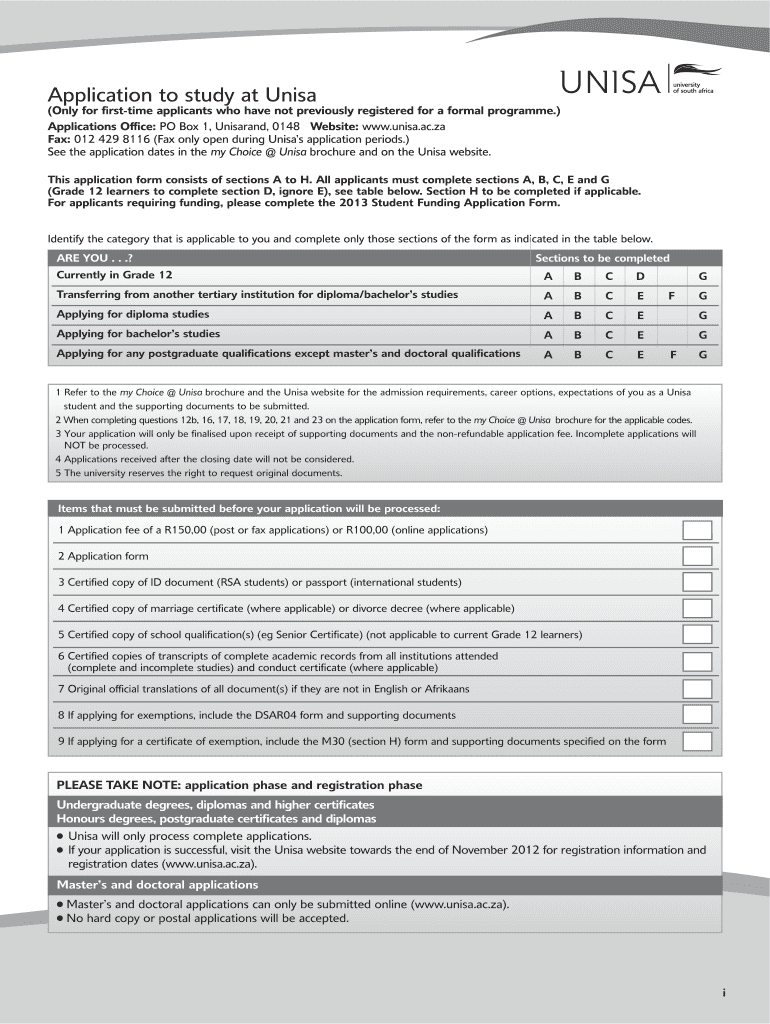

Mature Age Exemption Fill Online Printable Fillable Blank PdfFiller

Mature Age Exemption Fill Online Printable Fillable Blank PdfFiller

How To Claim Tax Exemptions Here s Your 101 Guide

2017 PAFPI Certificate of TAX Exemption Certificate Of

How To Get Certificate Of Tax Exemption For Scholarship PurpleConsults

Tax Exemption For Higher Education - Interest on loans taken for pursuing higher education including vocational studies is eligible for deduction u s 80E Understand Section 80E of the Income Tax Act which allows tax deductions for interest paid on education