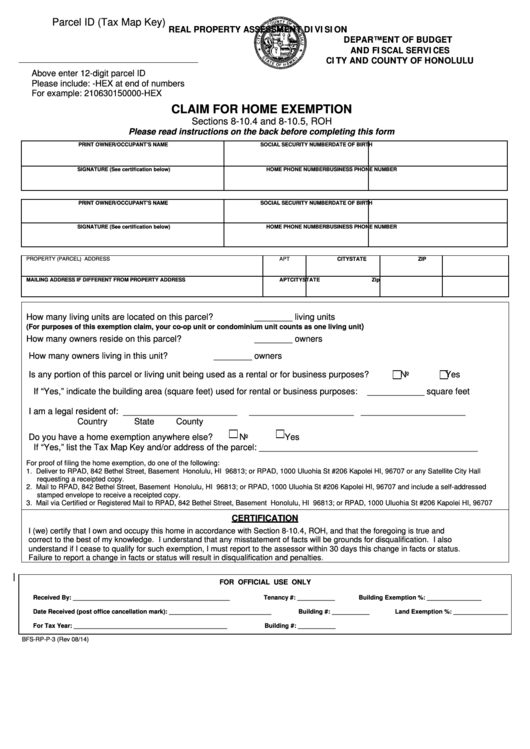

Tax Exemption For Home Loan Under Construction Can I claim tax benefits if the purchase a property with a home loan but the house is under construction You cannot claim tax deductions for interest portion till

You can get the under construction property tax benefit of Rs 1 5 Lakh per financial year on your paid home loan principal amount However you can claim this benefit only after getting possession of the For under construction property tax deductions on home loan interest can be claimed only after the construction is complete Interest payments made towards the loan during pre construction are eligible for a claim

Tax Exemption For Home Loan Under Construction

Tax Exemption For Home Loan Under Construction

https://img1.wsimg.com/isteam/ip/3c3bf6dc-20de-47e0-ae92-9e904b35b9d8/land tax exemption.png

How To Claim Tax Exemptions Here s Your 101 Guide

https://okcredit-blog-images-prod.storage.googleapis.com/2021/02/taxexemption1.jpg

Home Loan Tax Exemption Check Tax Benefits On Home Loan

https://www.urbanmoney.com/blog/wp-content/uploads/2022/10/HOME-LOAN-TAX-EXEMPTION-Always-good-to-save-more-100-1-1.jpg

The interest portion of the EMI paid for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 in Under Construction House How to claim tax deduction on Home Loan Interest payments A home loan borrower can claim Income Tax exemption on interest payments of up to Rs 2 lakh and another Rs

Home under construction You can treat a home under construction as a qualified home for a period of up to 24 months but only if it becomes your qualified home at the time it is ready for occupancy The 24 month You can claim tax benefits on a Home Loan availed of to purchase an under construction property Familiarising yourself with the tax exemptions available

Download Tax Exemption For Home Loan Under Construction

More picture related to Tax Exemption For Home Loan Under Construction

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

Harris County Homestead Exemption Form ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/harris-county-homestead-exemption-form-printable-pdf-download-3.png

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2022/10/Is-plot-loan-eligible-for-tax-exemption-V1-724x1024.png

As per the current income tax rules you cannot claim any tax benefits for the home loan till you get possession of the house i e during the pre construction If you buy an under construction property and pay the EMIs you can claim interest on your housing loan as deduction after the construction gets completed Income Tax Act allows to claim a deduction of both the pre

Tax benefits on home loan interest payment include deductions under Section 24 for self occupied and let out properties and an additional benefit of up to Rs If you re operating under the old tax system you re eligible for a deduction on the principal component of your Home Loan s EMI under section 80C of the Income Tax Act

Will Apply For Tax Exemption For Dangal Aamir

https://assets-cdn.kathmandupost.com/uploads/source/news/2016/entertainment/29112016024813a888cad0f66c41f56de3025e1d84a627.JPG

Tax Exemption On Behance

https://mir-s3-cdn-cf.behance.net/project_modules/1400/35e4cf111674031.600692193312f.jpg

https://cleartax.in/s/home-loan-tax-benefit

Can I claim tax benefits if the purchase a property with a home loan but the house is under construction You cannot claim tax deductions for interest portion till

https://www.magicbricks.com/blog/avail-t…

You can get the under construction property tax benefit of Rs 1 5 Lakh per financial year on your paid home loan principal amount However you can claim this benefit only after getting possession of the

Homeowners Exemption Form Riverside County ExemptForm

Will Apply For Tax Exemption For Dangal Aamir

Loan Against Property Documents Eligibilities And How To Apply

Sample Letter Tax Exemption Complete With Ease AirSlate SignNow

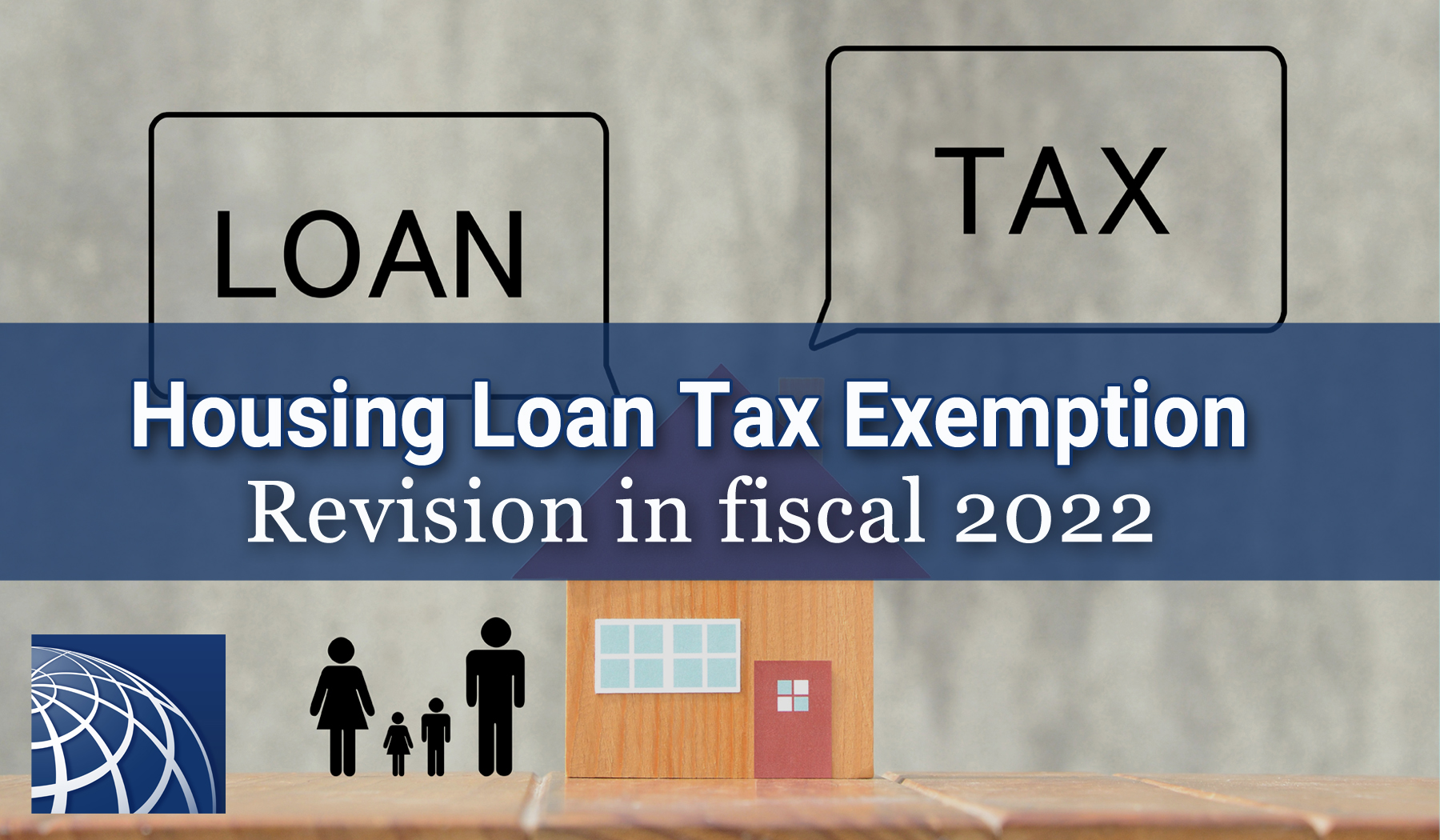

Housing Loan Tax Exemption Revision In Fiscal 2022 PLAZA HOMES

Singapore Startup Tax Exemption Scheme For New Startups

Singapore Startup Tax Exemption Scheme For New Startups

Duty Exemption And Remission Scheme DEARS

Section 24 Of Income Tax Act Deduction For Home Loan Interest

Estate Tax Exemption Amount Goes Up In 2023

Tax Exemption For Home Loan Under Construction - You can claim tax benefits on a Home Loan availed of to purchase an under construction property Familiarising yourself with the tax exemptions available