Tax Exemption For House Loan Which Is Under Construction Can I claim tax benefits if the purchase a property with a home loan but the house is under construction You cannot claim tax deductions till the construction of the house is completed Once it is completed you can claim an aggregate of interest paid for the period prior to the year of taking possession in five equal instalments from the year

Tax exemption on home loan interest for under construction property You can claim a tax exemption of up to Rs 2 00 000 on the interest payments made in a year and deductions of up to Rs 1 50 000 on the principal amount paid under Section 80C of the Income Tax Act ITA The tax benefit under section 24 is reduced from Rs 2 lakhs to Rs 30 000 if the property is not acquired or construction is not completed within 3 years from the end of Financial Year in which the loan was taken However the limit of 3 years has been increased to 5 years from Financial Year 2016 17 and onwards

Tax Exemption For House Loan Which Is Under Construction

Tax Exemption For House Loan Which Is Under Construction

https://www.thebluediamondgallery.com/wooden-tile/images/home-loan.jpg

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2022/10/Is-plot-loan-eligible-for-tax-exemption-V1-724x1024.png

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

In case of a Home Loan availed of to buy a ready to move in property one can claim tax exemption up to a maximum of Rs 2 Lakh per year under this section of the Income Tax Act In the case of under construction properties one can claim tax exemption on the payments made towards interest repayment while the construction was on after Tax Benefit for a Property Under Construction Loan Individuals cannot claim tax benefits on home loan repayment till their property is fully constructed However that does not mean one cannot claim any tax benefit

Section 24 of the Income Tax Act for Under Construction Property Under section 24B of the Income Tax Act 1961 homeowners can claim a tax deduction of up to Rs 2 lakh per financial year on the interest paid for IT Act 1961 Section 24B Section 24B offers an under construction property tax benefit of up to Rs 2 Lakh in each financial year This amount can be deducted from the interest rate on a home loan IT Act 1961 Section 80C Section 80C offers an under construction property tax benefit of up to Rs 1 5 Lakh in each financial

Download Tax Exemption For House Loan Which Is Under Construction

More picture related to Tax Exemption For House Loan Which Is Under Construction

Home Loan Tax Exemption Check Tax Benefits On Home Loan

https://www.urbanmoney.com/blog/wp-content/uploads/2022/10/HOME-LOAN-TAX-EXEMPTION-Always-good-to-save-more-100-1-1.jpg

SOLON PUSHES FOR TAX EXEMPTION ON ALL DONATIONS FOR YOUTH AND SPORTS

https://the-post-assets.sgp1.digitaloceanspaces.com/2022/01/Untitled-design-2022-01-09T144940.071-1896x800.jpg

Tax Exemption On Behance

https://mir-s3-cdn-cf.behance.net/project_modules/1400/35e4cf111674031.600692193312f.jpg

Although you have begun repaying the housing loan through EMIs you are not eligible to claim these tax benefits during the pre construction phase i e a house under construction cannot be Home Real Estate Under Construction House How to claim tax deduction on Home Loan Interest payments A home loan borrower can claim Income Tax exemption on interest payments of up

Yes tax deduction under various sections of the income tax law is allowed for pre construction stage in home loan However there is a catch to this A borrower can only claim this benefit after the construction work is complete If you buy an under construction property and pay the EMIs you can claim interest on your housing loan as deduction after the construction gets completed Income Tax Act allows to claim a deduction of both the pre construction period interest and post construction period interest

Sample Letter Tax Exemption Complete With Ease AirSlate SignNow

https://www.signnow.com/preview/497/332/497332566/large.png

Why Is The US Considering Temporary Tax Exemption For Solar Panels

https://danviet.mediacdn.vn/296231569849192448/2022/6/9/pin-nang-luong-mat-troi-16547835774941772326054-0-0-838-1600-crop-16547838532401761773730.jpg

https://cleartax.in/s/home-loan-tax-benefit

Can I claim tax benefits if the purchase a property with a home loan but the house is under construction You cannot claim tax deductions till the construction of the house is completed Once it is completed you can claim an aggregate of interest paid for the period prior to the year of taking possession in five equal instalments from the year

https://www.tatacapital.com/blog/loan-for-home/can...

Tax exemption on home loan interest for under construction property You can claim a tax exemption of up to Rs 2 00 000 on the interest payments made in a year and deductions of up to Rs 1 50 000 on the principal amount paid under Section 80C of the Income Tax Act ITA

Housing Loan Tax Exemption Revision In Fiscal 2022 PLAZA HOMES

Sample Letter Tax Exemption Complete With Ease AirSlate SignNow

Tax Exemption Form For Veterans ExemptForm

Howtocivil Is Under Construction

Government Extends Rice Sector Income Tax Exemption For Another 5 Years

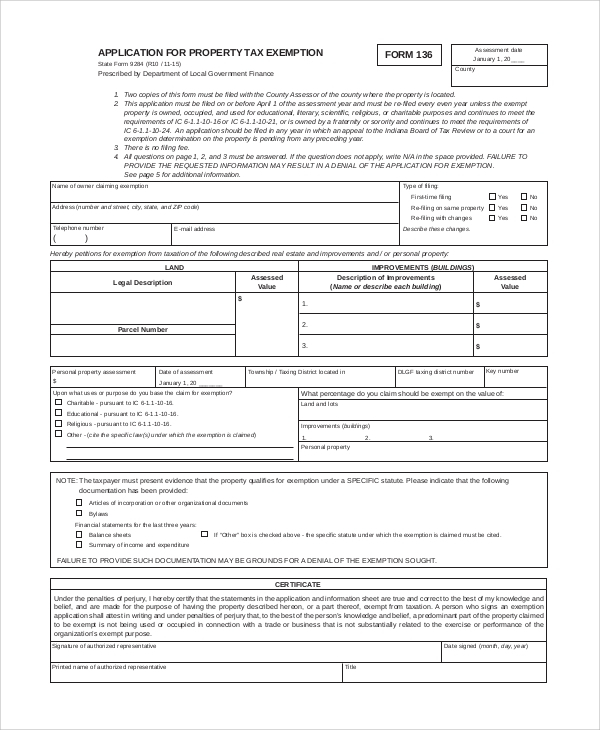

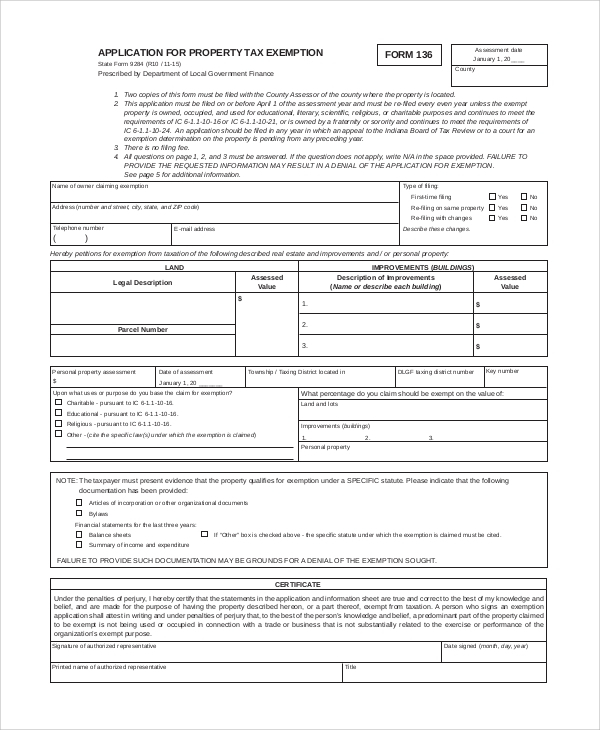

FREE 10 Sample Tax Exemption Forms In PDF ExemptForm

FREE 10 Sample Tax Exemption Forms In PDF ExemptForm

Joint Home Loan Declaration Form For Income Tax Savings And Non

Section 80EEA Additional Deduction Of Interest Payment On Housing Loan

Section 24 Of Income Tax Act Deduction For Home Loan Interest

Tax Exemption For House Loan Which Is Under Construction - IT Act 1961 Section 24B Section 24B offers an under construction property tax benefit of up to Rs 2 Lakh in each financial year This amount can be deducted from the interest rate on a home loan IT Act 1961 Section 80C Section 80C offers an under construction property tax benefit of up to Rs 1 5 Lakh in each financial