Tax Exemption For Medical Expenses Taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their adjusted gross income The 7 5 threshold used to be 10 but legislative

If you have medical expenses that exceed 7 5 of your adjusted gross income in 2024 and 2025 you may be able to deduct them on your federal income tax return Section 80DD of the Income Tax Act allows individuals to claim a tax deduction of up to 75 000 per financial year for medical expenses related to the treatment of a dependent with a disability

Tax Exemption For Medical Expenses

Tax Exemption For Medical Expenses

https://images-hub.s3.ap-south-1.amazonaws.com/Usefull/Blog/BannerImages/3470/3470.png

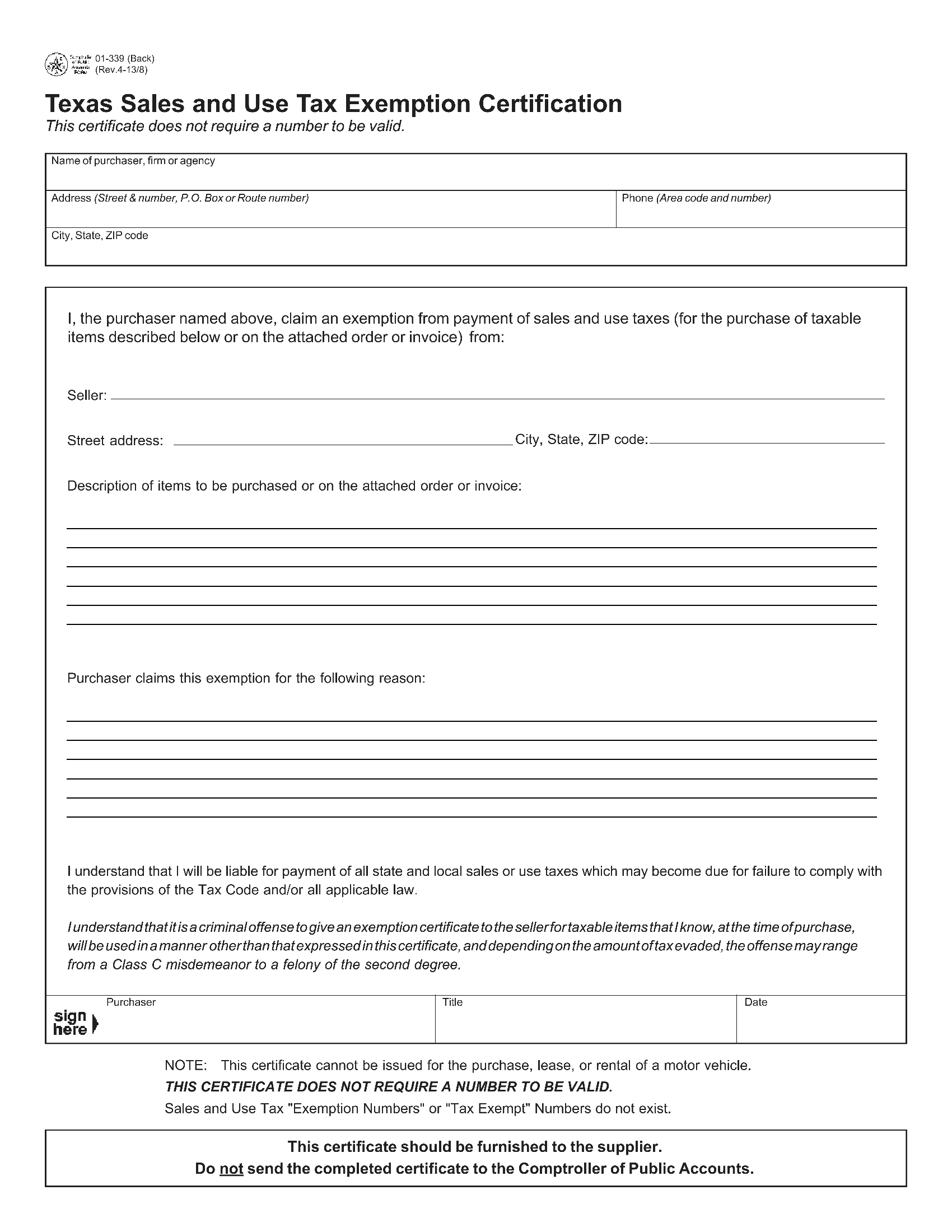

Texas Sales And Use Tax Exemption Certification Forms Docs 2023

https://blanker.org/files/images/01-339b.png

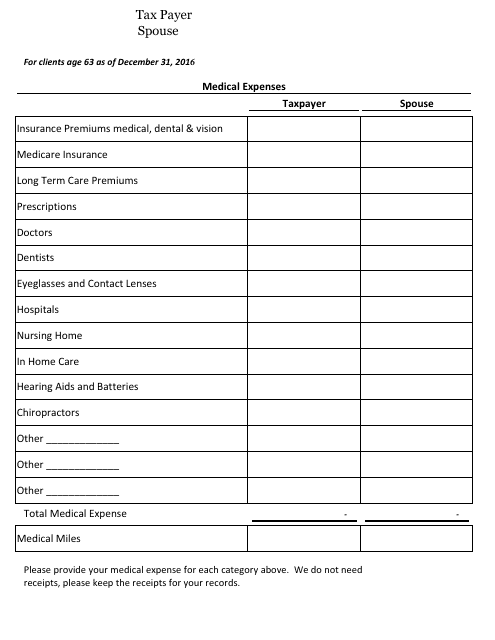

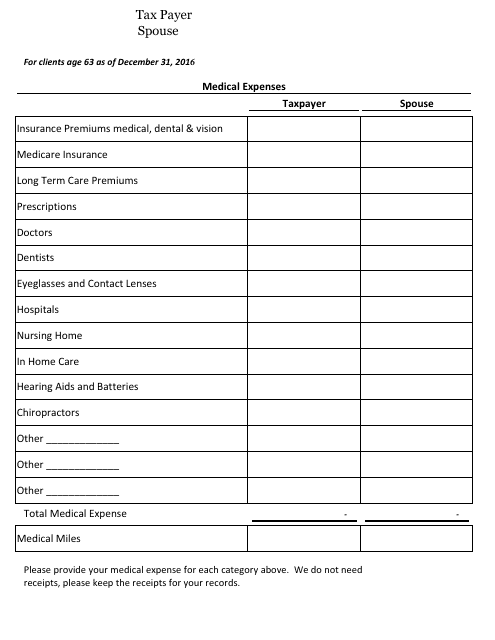

Printable Itemized Deductions Worksheet

https://www.pdffiller.com/preview/391/382/391382225/large.png

Section 80DDB permits a tax deduction for expenses related to the treatment of certain diseases for oneself one s spouse dependent children dependent parents and Section 80D of the Income Tax Act permits a reduction in taxable income when an individual pays Health Insurance premiums for themselves and or their family members Furthermore an amendment in this section

To claim qualifying medical expenses on your tax return you ll need to complete Schedule A and file it with your Form 1040 If you re using one of today s best tax software products it Deduction for medical expenses can be claimed u s 80DDB for medical expenditure incurred in case of self spouse children parents or dependent siblings This deduction can be claimed only by a resident

Download Tax Exemption For Medical Expenses

More picture related to Tax Exemption For Medical Expenses

Income Tax Compliance Dates Extended Govt Announces Exemption For

https://www.taxscan.in/wp-content/uploads/2021/06/CBDT-Income-Tax-Compliance-dates-Exemption-for-Medical-Treatment-Expenses-Ex-Gratia-Death-due-to-Covid-19-Taxscan.jpeg

Appeals Court Upholds Federal Tax Exemption For Clergy Housing Expenses

https://episcopalnewsservice.org/wp-content/uploads/2019/03/ens_031819_TaxForm.jpg

Tax Exempt Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/11/214/11214589/large.png

A prominent exemption pertains to medical expenses incurred by an individual for self and family during a given financial year Medical bills of salaried employees reimbursed by employers are not taxable Unlike allowance medical reimbursements are exempt from tax to a certain extent Currently reimbursements up to Rs 15 000 each year is exempt from taxation To claim this exemption

Individuals can claim some of the cost of medical dental and other health care related expenses on tax returns if they itemize Learn about the rules that apply Medical expenses are deductible only to the extent the total exceeds 7 5 of your adjusted gross income AGI For example if you itemize your AGI is 100 000 and your total

How To Claim Sales Tax Exemptions RunSignup

https://s3.amazonaws.com/cdn.freshdesk.com/data/helpdesk/attachments/production/17105153044/original/y7PDwO5DWbQoLw3YmcGZUn9GYjqHnh1CqA.gif?1682101063

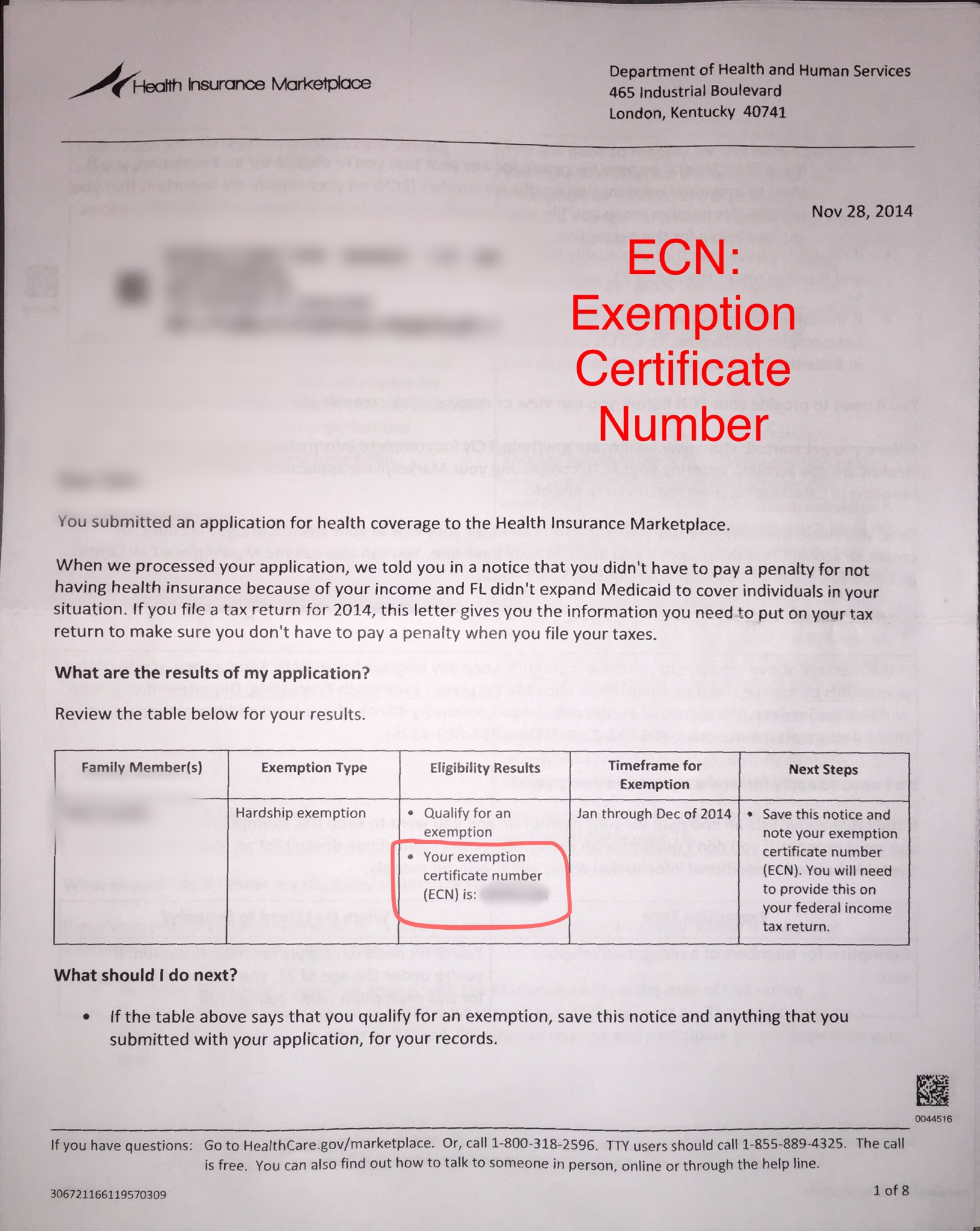

Exemption Certificate Number ECN

http://igotmyrefund.com/wp-content/uploads/2014/12/IMG_2421-0.jpg

https://www.nerdwallet.com › article › taxe…

Taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their adjusted gross income The 7 5 threshold used to be 10 but legislative

https://nationaltaxreports.com › what-are-medical...

If you have medical expenses that exceed 7 5 of your adjusted gross income in 2024 and 2025 you may be able to deduct them on your federal income tax return

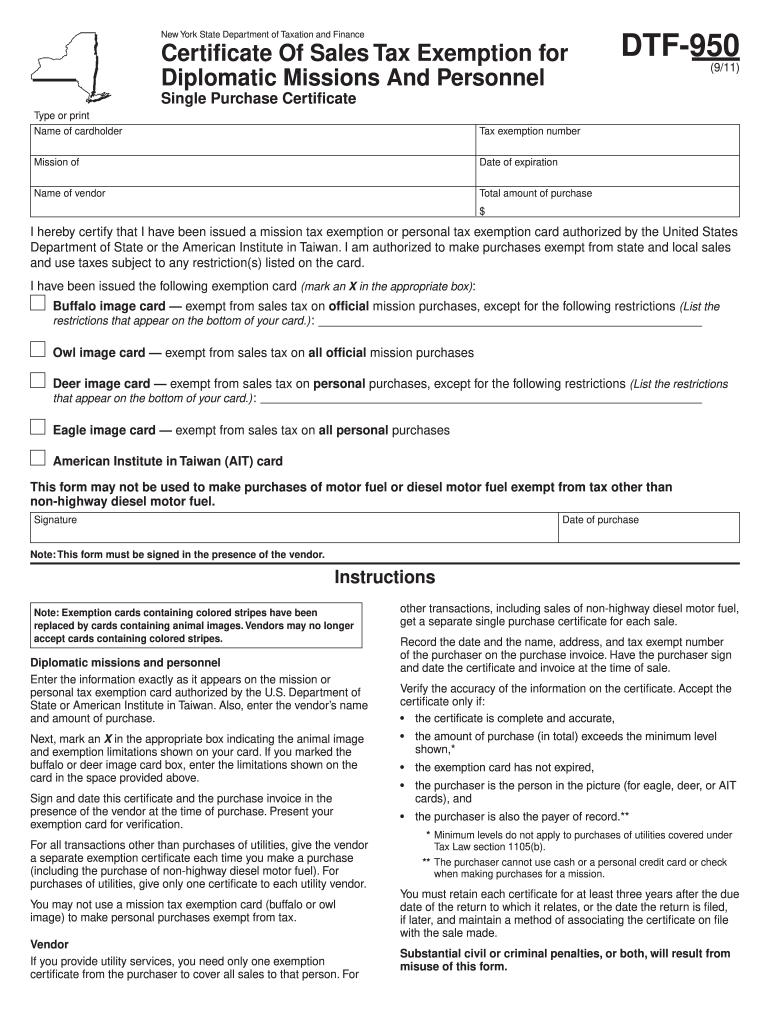

Sample Letter Tax Exemption Complete With Ease AirSlate SignNow

How To Claim Sales Tax Exemptions RunSignup

Looking For Sample Letter For Tax Amnesty For Motor Vehicle Taxes In

Tax Exempt Sales Use And Lodging Certification Standardized As Of Jan

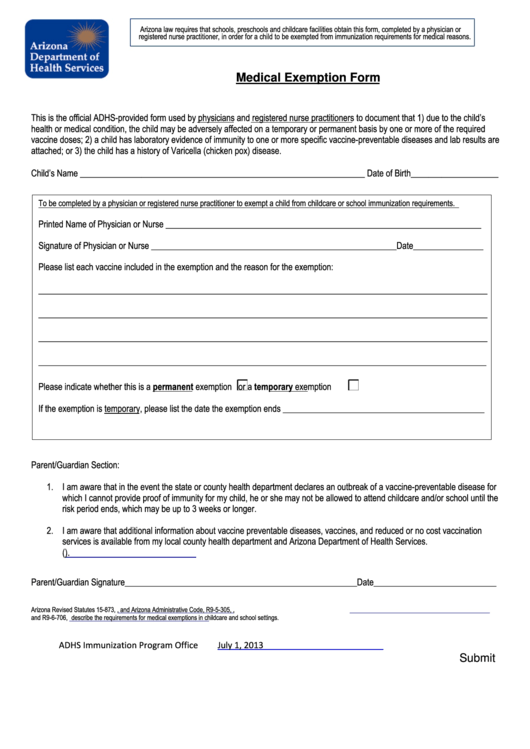

Fillable Medical Exemption Form Printable Pdf Download

Medical Expenses Worksheet Download Fillable PDF Templateroller

Medical Expenses Worksheet Download Fillable PDF Templateroller

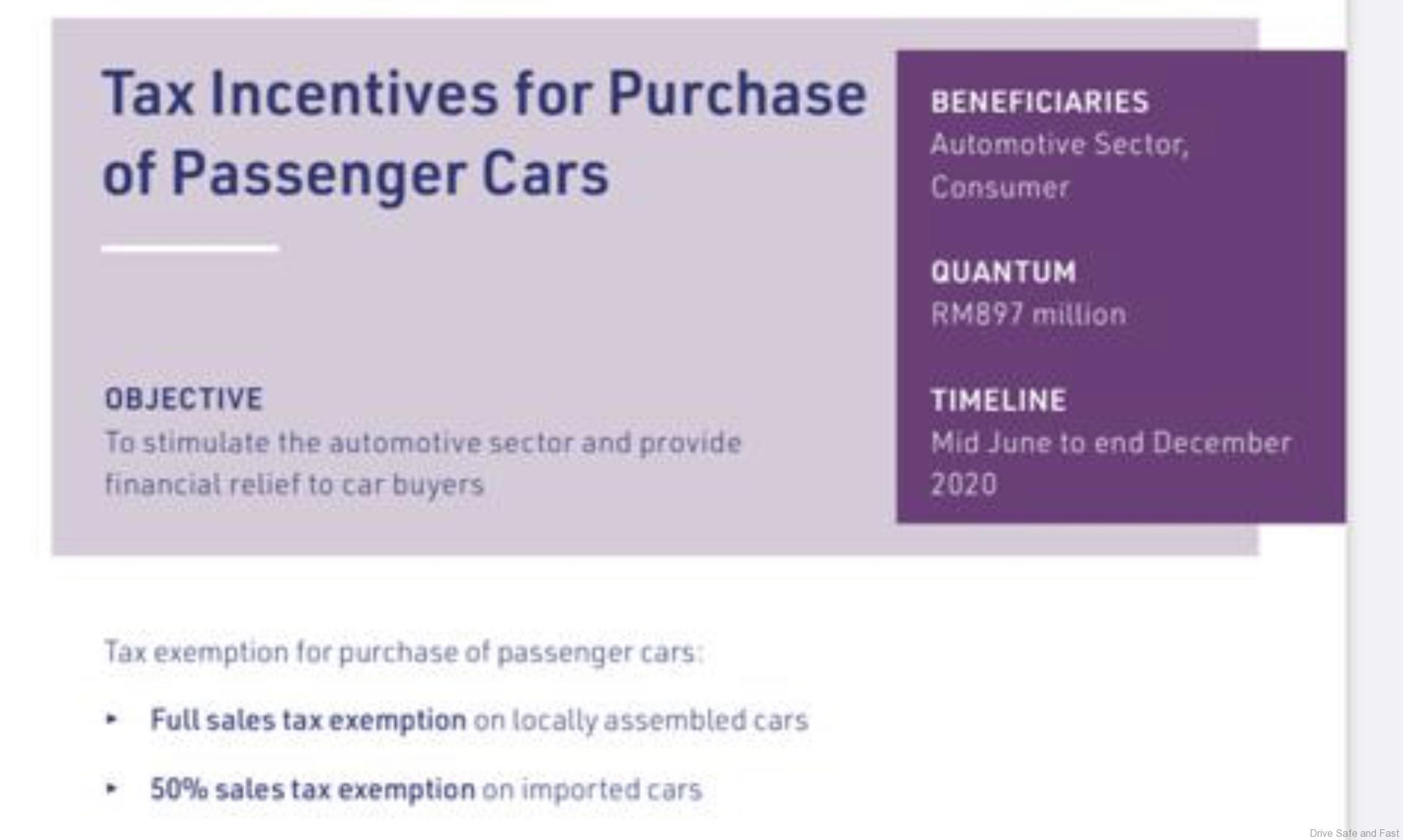

Sales Tax Exemption For CKD 100 And CBU Cars 50

Tax Exemption On Behance

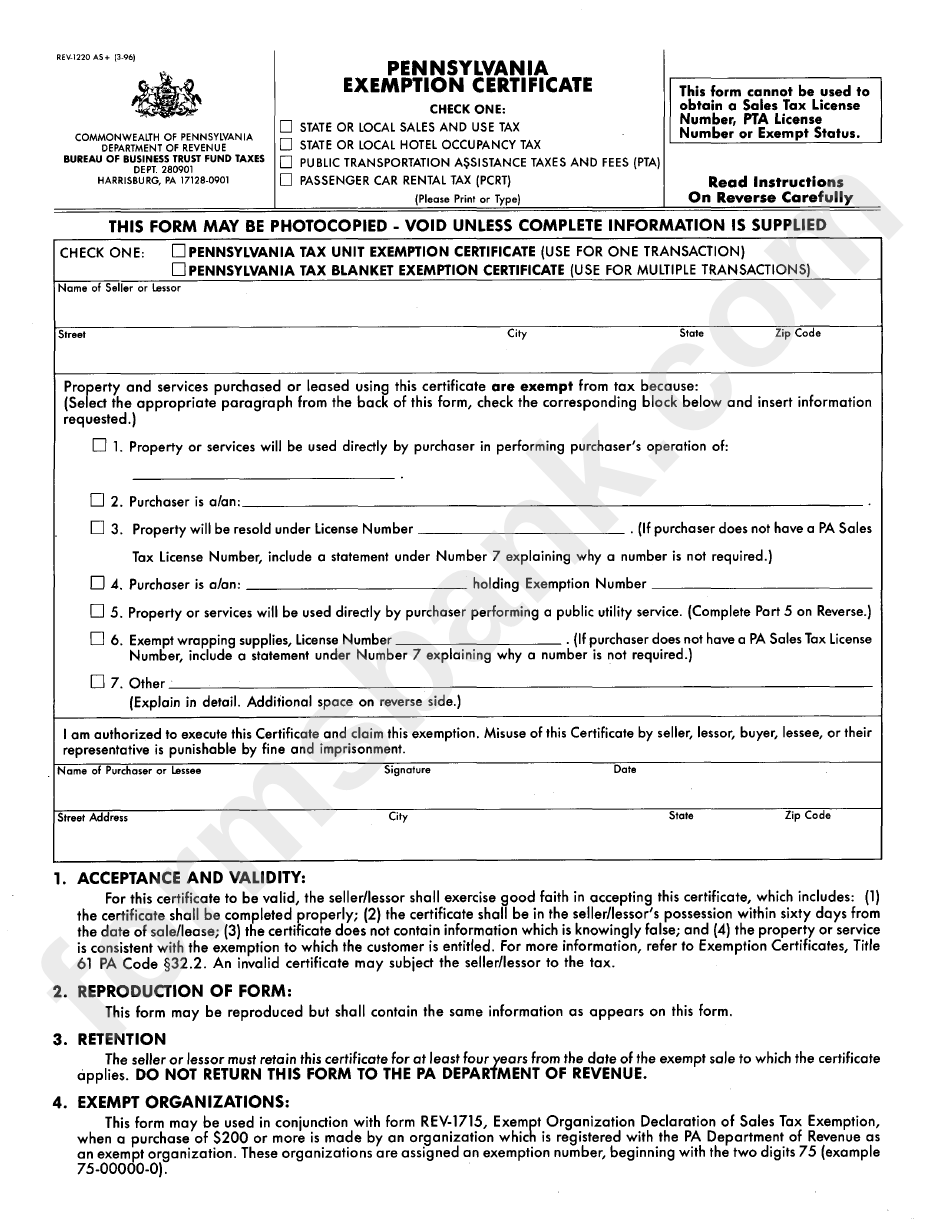

Pa Tax Exempt Form Printable Printable Forms Free Online

Tax Exemption For Medical Expenses - To claim qualifying medical expenses on your tax return you ll need to complete Schedule A and file it with your Form 1040 If you re using one of today s best tax software products it