Tax Exemption For Mediclaim Policy Mediclaim Deduction Individuals are eligible for tax deduction under section 80D Avail tax benefit for the premium paid against health insurance policy

Section 80D allows a tax deduction of up to 25 000 per financial year on medical insurance premiums for non senior citizens and 50 000 for senior citizens This limit also includes Deduction Under Section 80D in respect of Medical Insurance Premium Mediclaim paid to keep in force insurance by individual either on his own health or on the health of spouse

Tax Exemption For Mediclaim Policy

Tax Exemption For Mediclaim Policy

https://megaphone.imgix.net/podcasts/9be8cd02-21e2-11ec-8d36-736e738f5207/image/exvangelical_3000x3000__3_.JPG?ixlib=rails-2.1.2&max-w=3000&max-h=3000&fit=crop&auto=format,compress

Mediclaim Letter Sample Declaration Sample Declaration Letter YouTube

https://i.ytimg.com/vi/u8_fH1k7uug/maxresdefault.jpg

Revocation Of Federal Tax Exemption Grant Management Nonprofit Fund

https://mygrantmanagement.com/wp-content/uploads/2019/07/tax_exemption_1563850735.png

You can claim tax deductions on mediclaim plans provided by your employer or on policies taken by you independent of your employment The tax deduction is applicable on both health insurance and mediclaim Section 80D offers tax deductions on health insurance premiums of up to a maximum limit of 25 000 in a financial year You can claim deductions for a policy bought for yourself

Tax Exemption Under section 80 D of the Income Tax Act 1961 the premium paid for medicalim policy for self dependent parents children and spouses are exempted from Section 80D Deduction on Medical insurance comes under Income Tax Know how you can claim a deduction under Section 80D Its maximum limit to save tax

Download Tax Exemption For Mediclaim Policy

More picture related to Tax Exemption For Mediclaim Policy

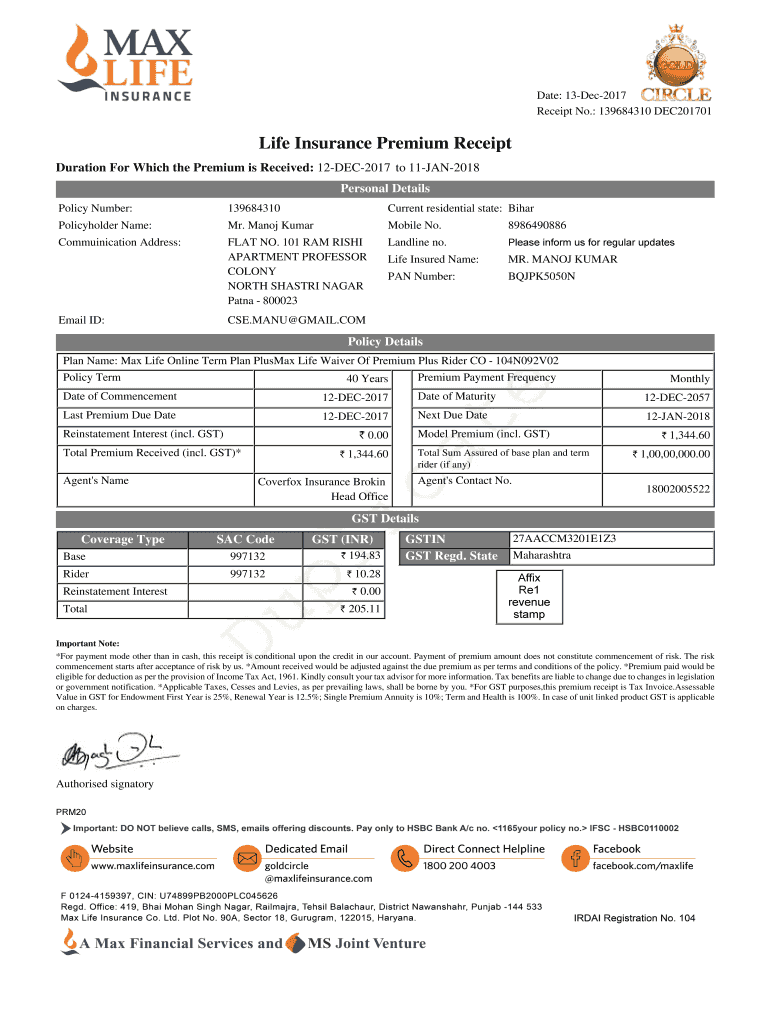

Medical Insurance Premium Receipt PDF Form Fill Out And Sign

https://www.signnow.com/preview/470/590/470590793/large.png

Who Can Avail Tax Benefits On Mediclaim Policy Who Will Not Get

http://my-finance-guide.com/wp-content/uploads/2023/09/Tax-Benefits-On-Mediclaim-Policy.jpg

Antitrust Exemption For Healthcare Insurers Ends What Does The Repeal

https://www.nortonrosefulbright.com/-/media/images/nrf/thought-leadership/us/antitrust-exemption-for-healthcare-insurers-ends-what-does-the-repeal-mean.png?revision=96db55a8-b55e-47ef-915f-824bc4ce5de9&revision=5249498491837387904

Section 80D provides for deduction towards mediclaim payment and preventive health check up payment There are lot of confusion as to whether the limit is Rs 25000 OR Rs 50 000 Further the doubt is You can claim a tax deduction for the medical insurance premium paid for your parents whether they are dependent on you or not The condition of dependency of parents is

The Income Tax Act Section 80D allows health and mediclaim policyholders to claim tax deductions on the premiums paid for their insurance policy The section applies to all the regular healthcare An individual can avail tax benefit under Section 80D of the Income Tax Act for the payment of medical insurance premium for self spouse dependent children and for parents Up

Preventive Check Up 80d Wkcn

https://emailer.tax2win.in/assets/guides/all_images/Section-80D-Summary.jpg

Mediclaim Receipt PDF Insurance Taxes

https://imgv2-1-f.scribdassets.com/img/document/621617355/original/6847dd0a3f/1687582685?v=1

https://www.careinsurance.com/blog/health...

Mediclaim Deduction Individuals are eligible for tax deduction under section 80D Avail tax benefit for the premium paid against health insurance policy

https://www.policybazaar.com/health-insurance/section80d-deductions

Section 80D allows a tax deduction of up to 25 000 per financial year on medical insurance premiums for non senior citizens and 50 000 for senior citizens This limit also includes

All You Need To Know About Section 80D Of Income Tax Act Ebizfiling

Preventive Check Up 80d Wkcn

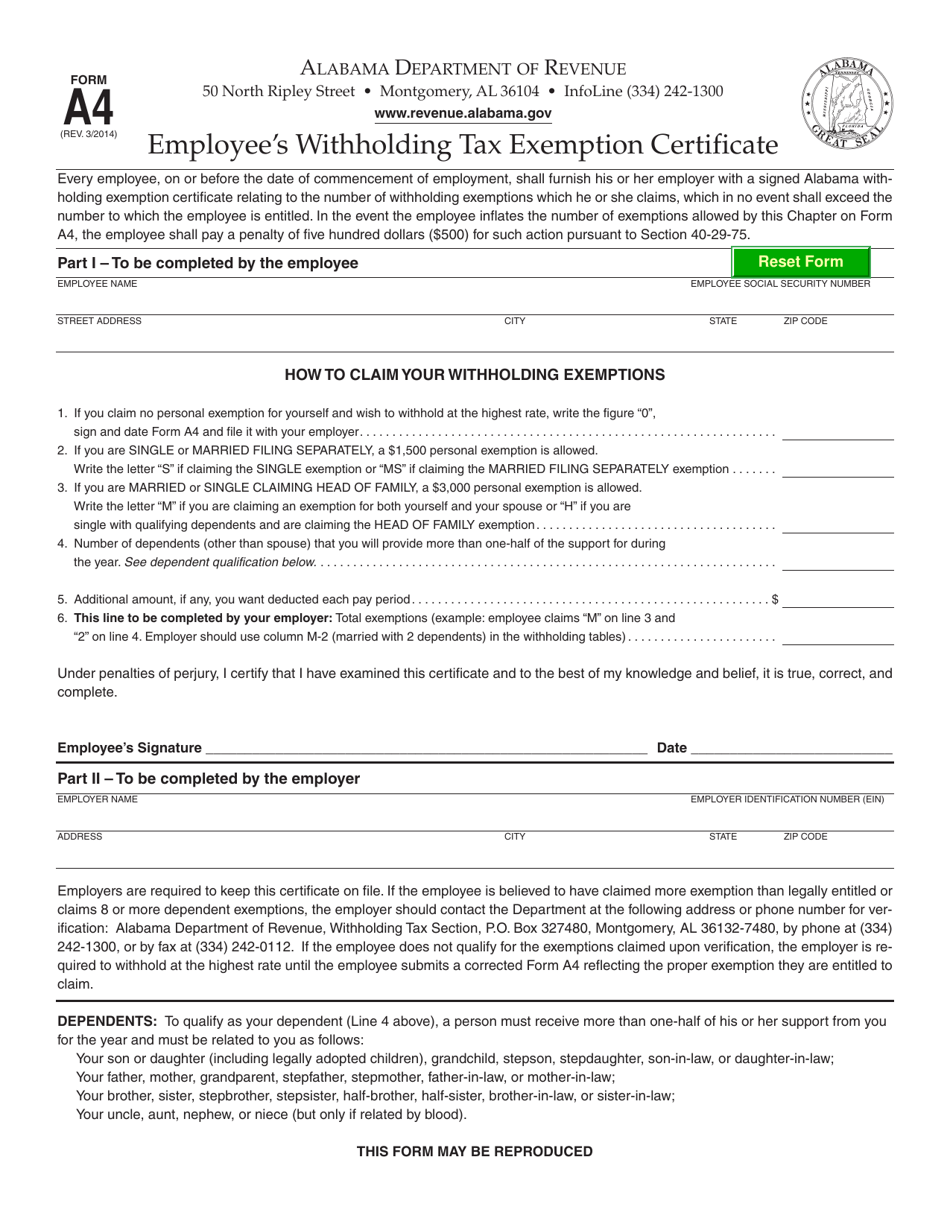

Printable Exemption Form From Garnishment Printable Forms Free Online

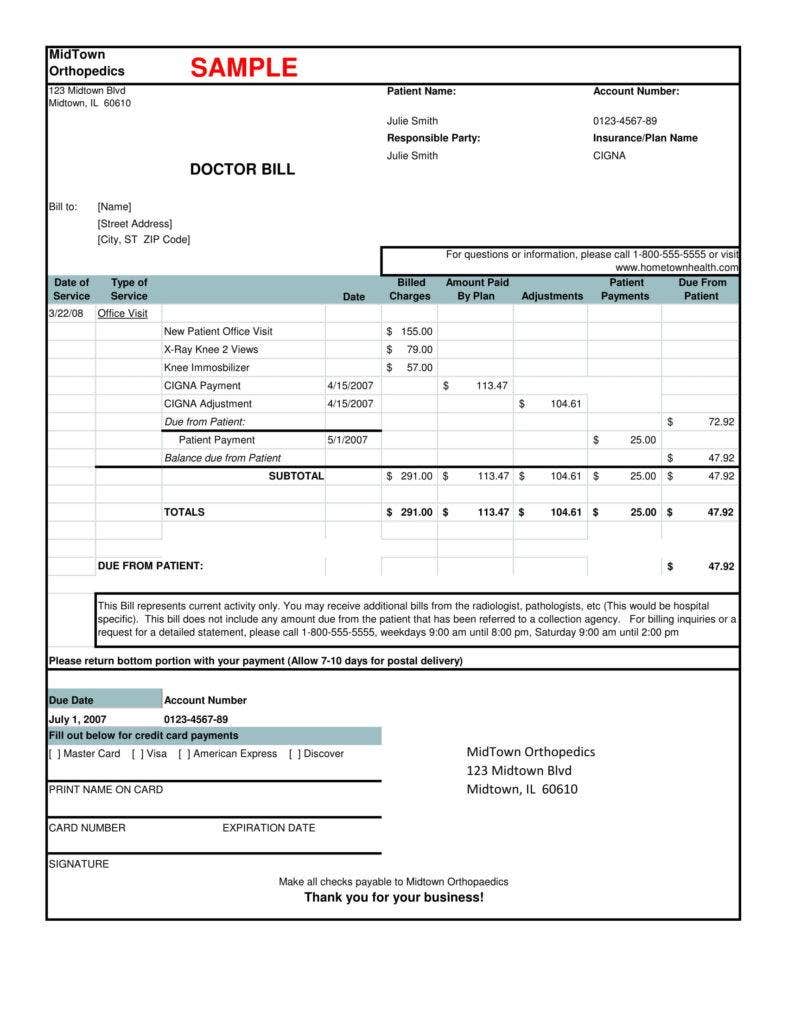

Sample Medical Bill Receipt Invoice Template

Advantages Of Group Mediclaim Policy By GreenLife Insurance Issuu

Sample Letter Exemptions Form Fill Out And Sign Printable PDF

Sample Letter Exemptions Form Fill Out And Sign Printable PDF

Taxes Tippinsights

How To Fill ICICI Lombard Mediclaim Form Health Insurance Covid 19

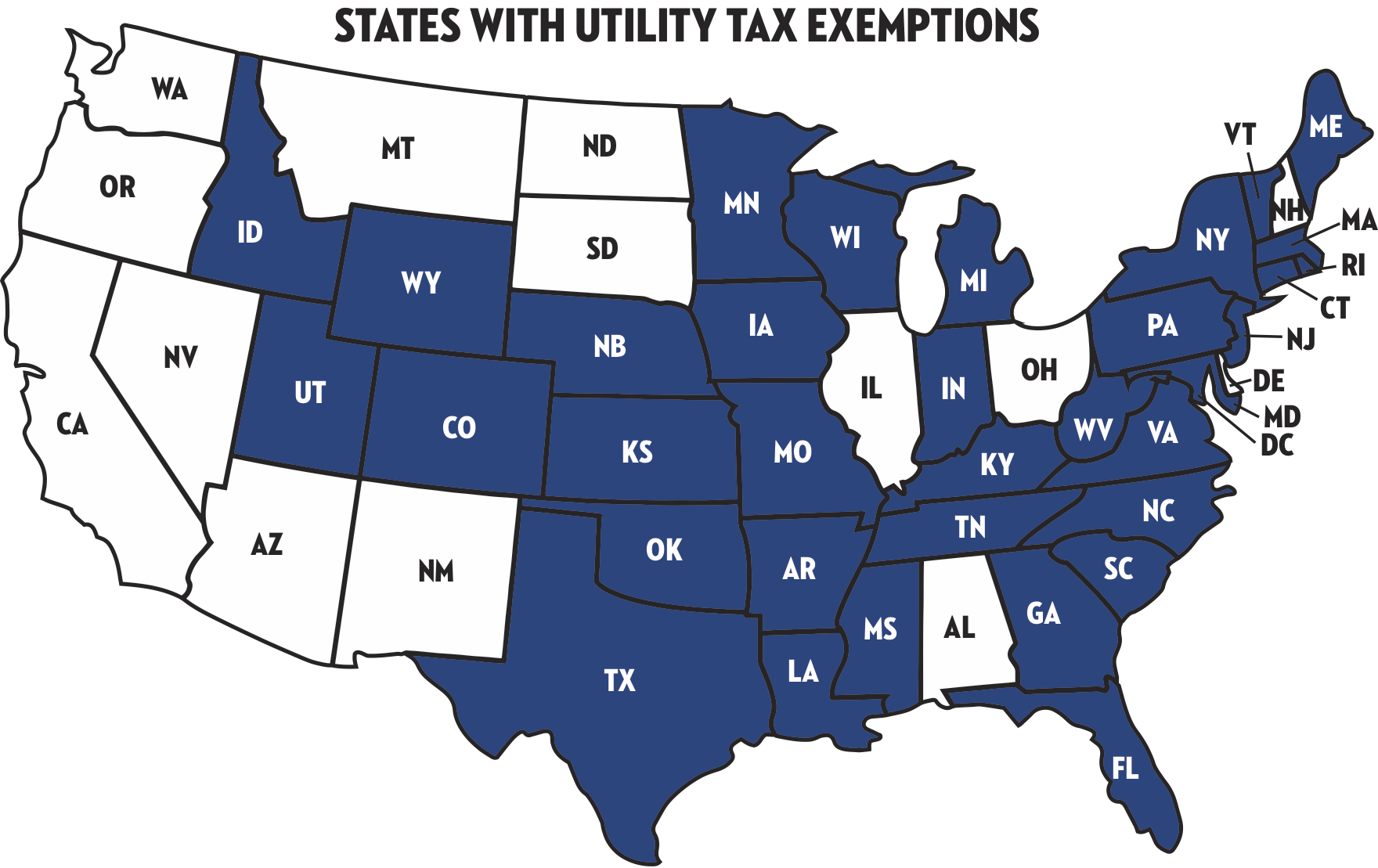

State Tax Exemption Map National Utility Solutions

Tax Exemption For Mediclaim Policy - Section 80D offers tax deductions on health insurance premiums of up to a maximum limit of 25 000 in a financial year You can claim deductions for a policy bought for yourself