Tax Exemption Income Limit Verkko 14 jouluk 2023 nbsp 0183 32 Income tax law has prescribed a basic exemption limit for individuals upto which the taxpayers are not required to pay taxes Such a limit is different for different categories of taxpayers Individual below 60 years of age are not required to pay tax upto the income limit of Rs 2 5 Lakh

Verkko 1 helmik 2023 nbsp 0183 32 The salary of an MEP is taxed as wage income and if the conditions are met the six month rule on tax exemption for income from foreign employment under section 77 of the Income Tax Act may be applied Verkko 28 huhtik 2023 nbsp 0183 32 Example 1 Starting 1 February 2022 and ending 31 May 2022 a Finnish resident taxpayer works in Germany for a German employer After 31 May the taxpayer returns to Finland The tax treaty between the Federal Republic of Germany and Finland on the Avoidance of double taxation of income and capital does not prevent

Tax Exemption Income Limit

Tax Exemption Income Limit

https://1.bp.blogspot.com/-prJpam_lFnI/XMdpYfbdIII/AAAAAAAABM4/sCP3PZywJyUQi6p7PqKutMirNe426OKGACLcBGAs/s1600/tax-exemption.jpg

Budget 2023 Income Tax Exemption Limit May Raise To Rs 5 Lakh By Govt

https://studycafe.in/wp-content/uploads/2023/01/Income-Tax-Exemption.jpg

Income Tax Income Tax Credit Www gotcredit With An Act Flickr

https://live.staticflickr.com/8276/30023384350_3fa5295abc_b.jpg

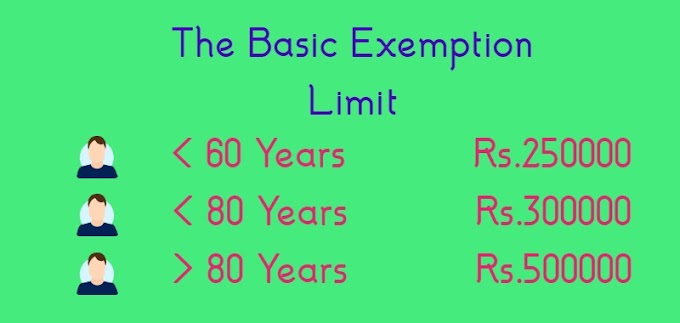

Verkko 1 tammik 2023 nbsp 0183 32 The exemption limits are as follows If you have dependent children your exemption limits are increased by 575 per child for your first two children 830 per child for each additional child A dependent child is one who was born during the year is under 18 years of age at the start of the year became incapacitated before they Verkko 21 helmik 2023 nbsp 0183 32 For FY 2022 23 the limit of the standard deduction is Rs 50 000 in the old regime As per Budget 2023 salaried taxpayers are now eligible for a standard deduction of Rs 50 000 under the new tax regime also from the financial year 2023 24 Read more on Standard Deduction Leave Travel Allowance LTA

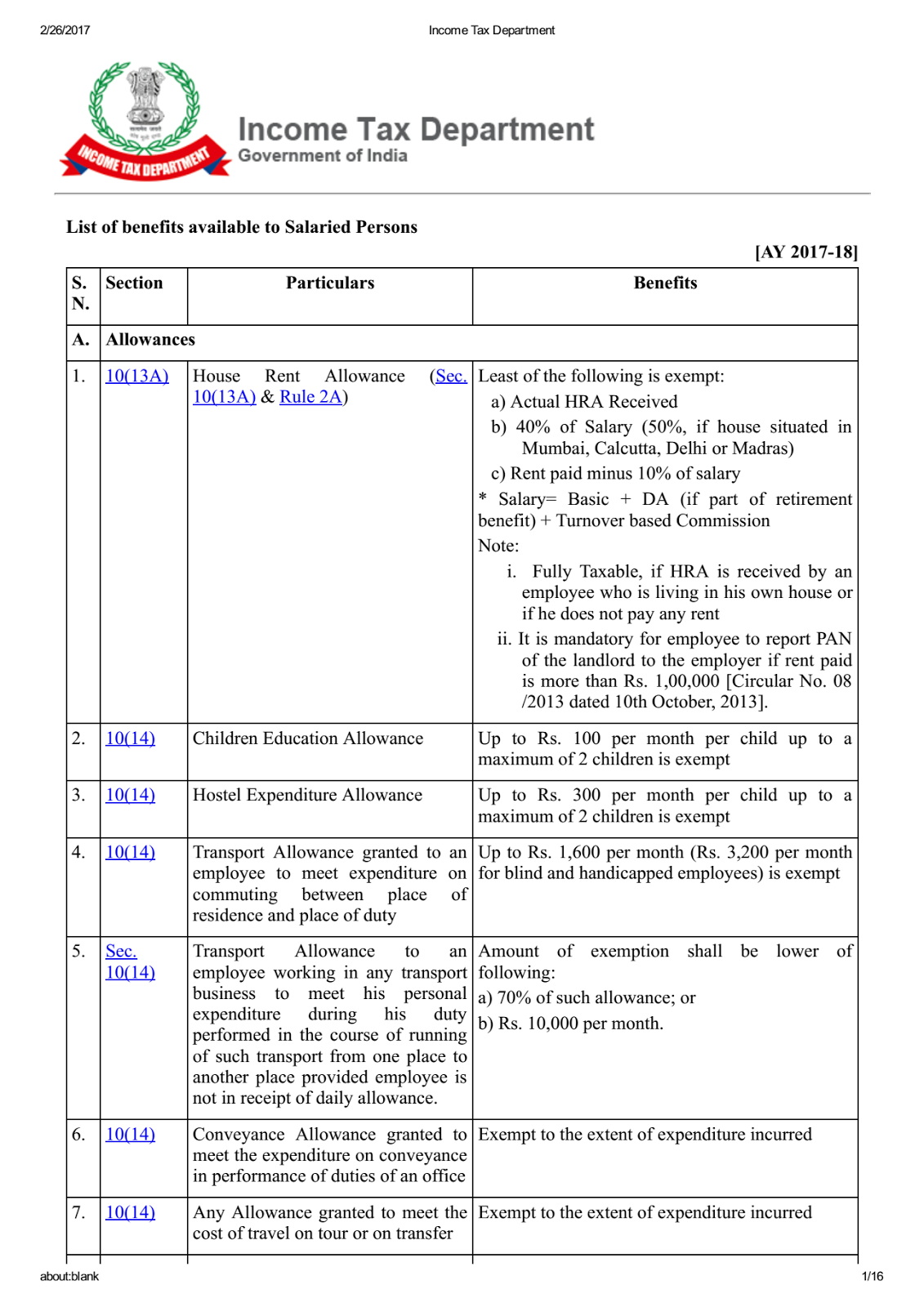

Verkko 11 tammik 2023 nbsp 0183 32 Section 10 of the Income Tax Act maximum limit is of Rs 2 50 lakhs for people below 60 years of age and Rs 3 lakhs for individuals above 60 below 80 years and Rs 5 lakhs for people aged 80 years or more The higher limit of Rs 3 amp 5 lakhs is available only for those citizens who are Resident in India Verkko 21 syysk 2023 nbsp 0183 32 Foreign Earned Income Exclusion If you meet certain requirements you may qualify for the foreign earned income exclusion the foreign housing exclusion and or the foreign housing deduction To claim these benefits you must have foreign earned income your tax home must be in a foreign country and you must be one of

Download Tax Exemption Income Limit

More picture related to Tax Exemption Income Limit

Best Instant Personal Loan App In India SmartCoin

https://blog.smartcoin.co.in/wp-content/uploads/2023/03/Tax-Exemption-scaled.jpg

Income Tax Clarification Opting For The New Income Tax Regime U s

https://blog.quicko.com/wp-content/uploads/2020/04/tax-slabs-scaled-1-1024x512.jpg

Elite Universities Must Purpose Endowments To Subsidize Students

https://dailytrojan.com/wp-content/uploads/2021/08/Dt_tax_Exemption.jpg

Verkko 13 helmik 2023 nbsp 0183 32 Who Is Exempt From Paying Income Taxes Certain groups of people who meet specific criteria don t have to pay income taxes For example for the 2022 tax year 2023 if you re single under the age of 65 and your yearly income is less than 12 950 you re exempt from paying taxes Verkko 15 jouluk 2023 nbsp 0183 32 Please note that the quantum of deduction under Section 80C of the Income Tax Act 1961 was last revised in FY 2014 15 and as such the upward revision is long overdue

Verkko 10 marrask 2023 nbsp 0183 32 Exempt income refers to certain types or amounts of income not subject to federal income tax Some types of income may also be exempt from state income tax The IRS determines which types of Verkko Income Tax Exemption Limit The basic exemption limit for individuals below the age of 60 years is Rs 2 50 lakhs For senior citizens the exemption limit is Rs 3 lakhs and for very senior citizen who are above 80 years it is Rs 3 50 lakhs The income tax slab is

Exemption U s 11 Of The Act Is Allowable When Income TaxReturn Filed

https://www.taxscan.in/wp-content/uploads/2022/11/Exemption-Income-Tax-Return-ITAT-TAXSCAN.jpg

Income Tax

https://www.marathigold.com/wp-content/uploads/2023/04/income-tax-exemption.jpg

https://cleartax.in/s/income-tax-slabs

Verkko 14 jouluk 2023 nbsp 0183 32 Income tax law has prescribed a basic exemption limit for individuals upto which the taxpayers are not required to pay taxes Such a limit is different for different categories of taxpayers Individual below 60 years of age are not required to pay tax upto the income limit of Rs 2 5 Lakh

https://www.vero.fi/en/detailed-guidance/guidance/167663/taxation-of...

Verkko 1 helmik 2023 nbsp 0183 32 The salary of an MEP is taxed as wage income and if the conditions are met the six month rule on tax exemption for income from foreign employment under section 77 of the Income Tax Act may be applied

INCOME TAX EXEMPTIONS SA POST

Exemption U s 11 Of The Act Is Allowable When Income TaxReturn Filed

Tax Exemption Certificate SACHET Pakistan

Income Tax Basic Exemption Limit In India some Facts To Know ITR Guide

Private Sector Employees Can Now Claim Tax Exemption For Leave Travel

Tax Exemptions What Part Of Your Income Is Taxable

Tax Exemptions What Part Of Your Income Is Taxable

Income Tax Practitioner Dhaka

Income Tax Exemption Cannot Be Granted Since Share Transactions Found

Debt Adjustments Such As principal Reduction Or Exemption For Small

Tax Exemption Income Limit - Verkko 1 tammik 2023 nbsp 0183 32 The exemption limits are as follows If you have dependent children your exemption limits are increased by 575 per child for your first two children 830 per child for each additional child A dependent child is one who was born during the year is under 18 years of age at the start of the year became incapacitated before they