Tax Exemption Income Verkko 28 huhtik 2023 nbsp 0183 32 Provisions concerning an exemption with progression method are found in 167 6 of the Act on the elimination of international double taxation when income is exempted from Finnish tax it only has an impact on the progressive accumulation of income of a Finnish resident taxpayer s income on the condition that it represents

Verkko 2 tammik 2023 nbsp 0183 32 You can make the following deductions in your tax assessment Amount of deductions in 2022 More information on the deduction Own liability in 2022 Maximum amount in 2022 tax credit for household expenses Home repair or improvement and renovations 100 2 250 Verkko 16 tammik 2023 nbsp 0183 32 1 Introduction If an individual resident in Finland works in another country their income is as a rule taxable in Finland However in some cases the provisions of Finland s national legislation treat such income as tax exempt Often income is not only taxable in Finland but also in the country of work

Tax Exemption Income

Tax Exemption Income

http://blog.getdistributors.com/wp-content/uploads/2014/07/Tax-cut.jpg

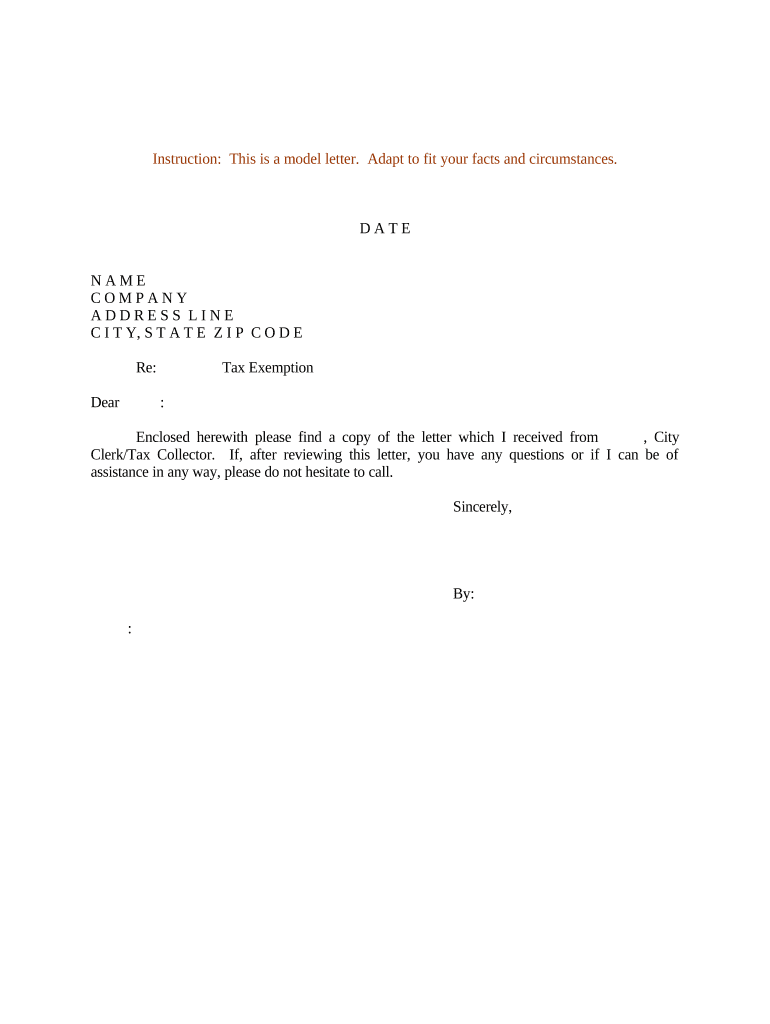

Tax Exempt Donation Letter Sample Form Fill Out And Sign Printable

https://www.signnow.com/preview/497/332/497332572/large.png

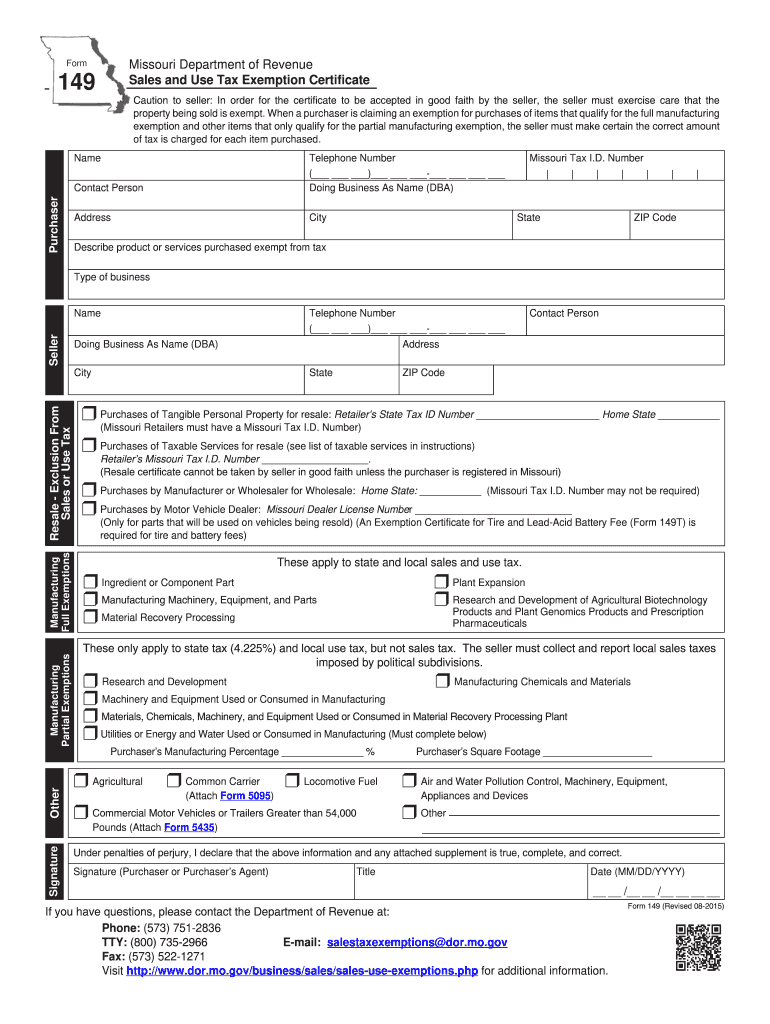

Mo Tax Exemption Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/6/964/6964282/large.png

Verkko 22 maalisk 2023 nbsp 0183 32 Tax exempt or taxable grant A grant or scholarship received for studies academic research or artistic activity may be tax exempt income If the grant is paid by a public authority such as the State of Finland a municipality the Central Arts Council a local arts council the Academy of Finland or the Nordic Council it is entirely Verkko Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a ruling power upon persons property income or transactions Tax exempt status may provide complete relief from taxes reduced rates or tax on only a portion of items Examples include exemption of charitable

Verkko 10 marrask 2023 nbsp 0183 32 Exempt income refers to certain types of income not subject to income tax Some types of income are exempt from federal or state income tax or both The IRS determines which types Verkko 1 helmik 2023 nbsp 0183 32 1 2 5 Tax exempt income from an international organisation and taxation of other earned income According to decision KHO 2021 54 of the Supreme Administrative Court salaries wages received from an international organisation do not in some cases affect the taxation of the employee s other possible earned income the

Download Tax Exemption Income

More picture related to Tax Exemption Income

Tax Exemption Certificate SACHET Pakistan

https://sachet.org.pk/wp-content/uploads/2016/01/Exemption-236-698x1024.jpg

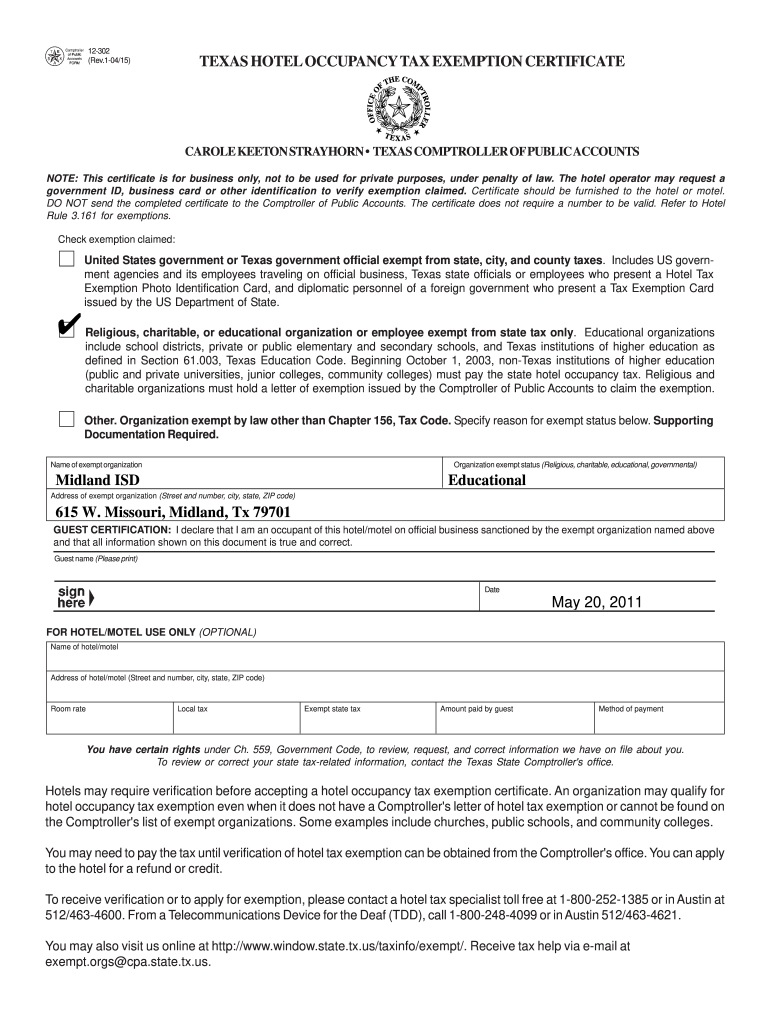

Government Tax Exempt Form Pdf Fill Online Printable Fillable

https://www.pdffiller.com/preview/15/184/15184121/large.png

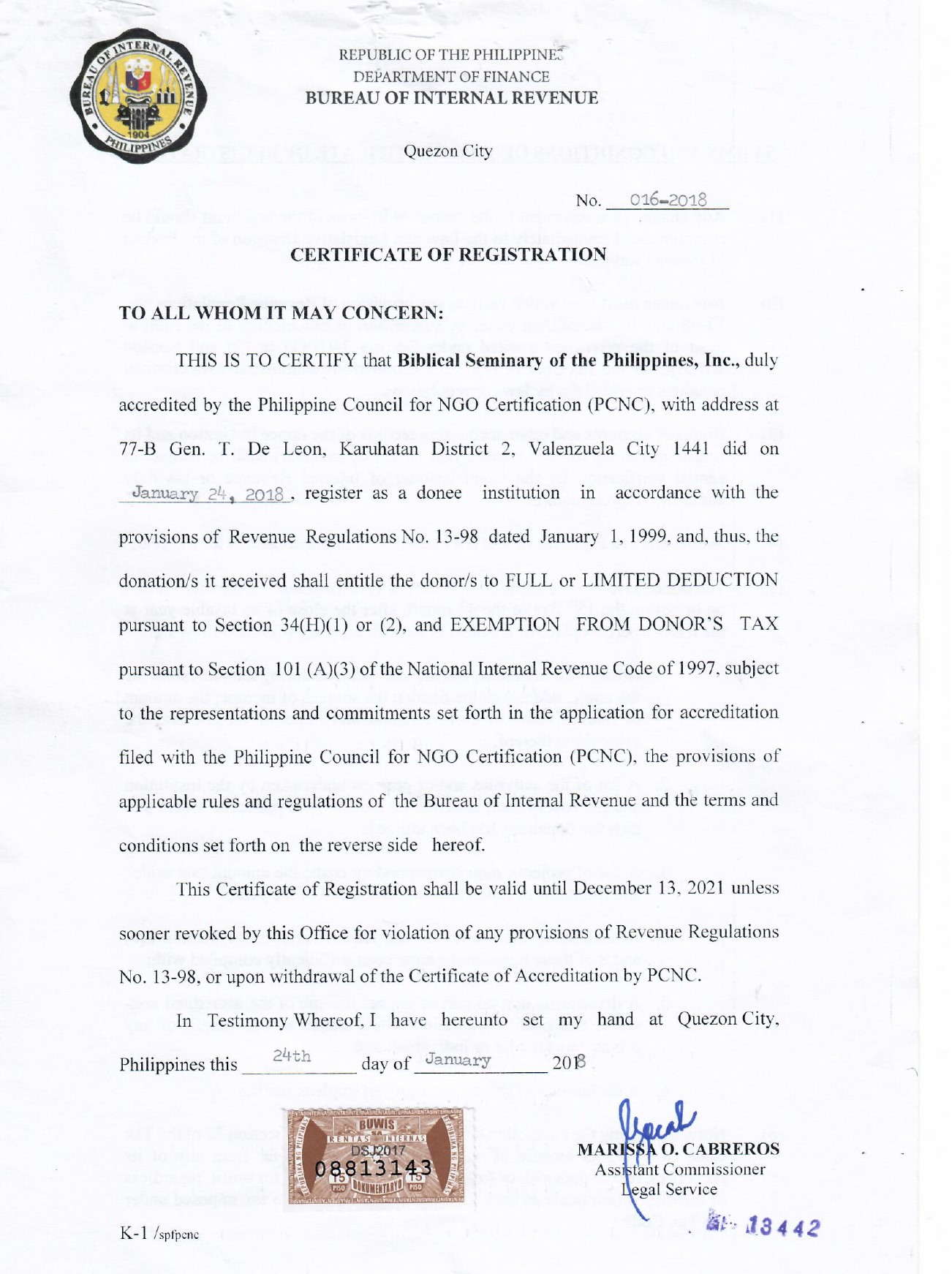

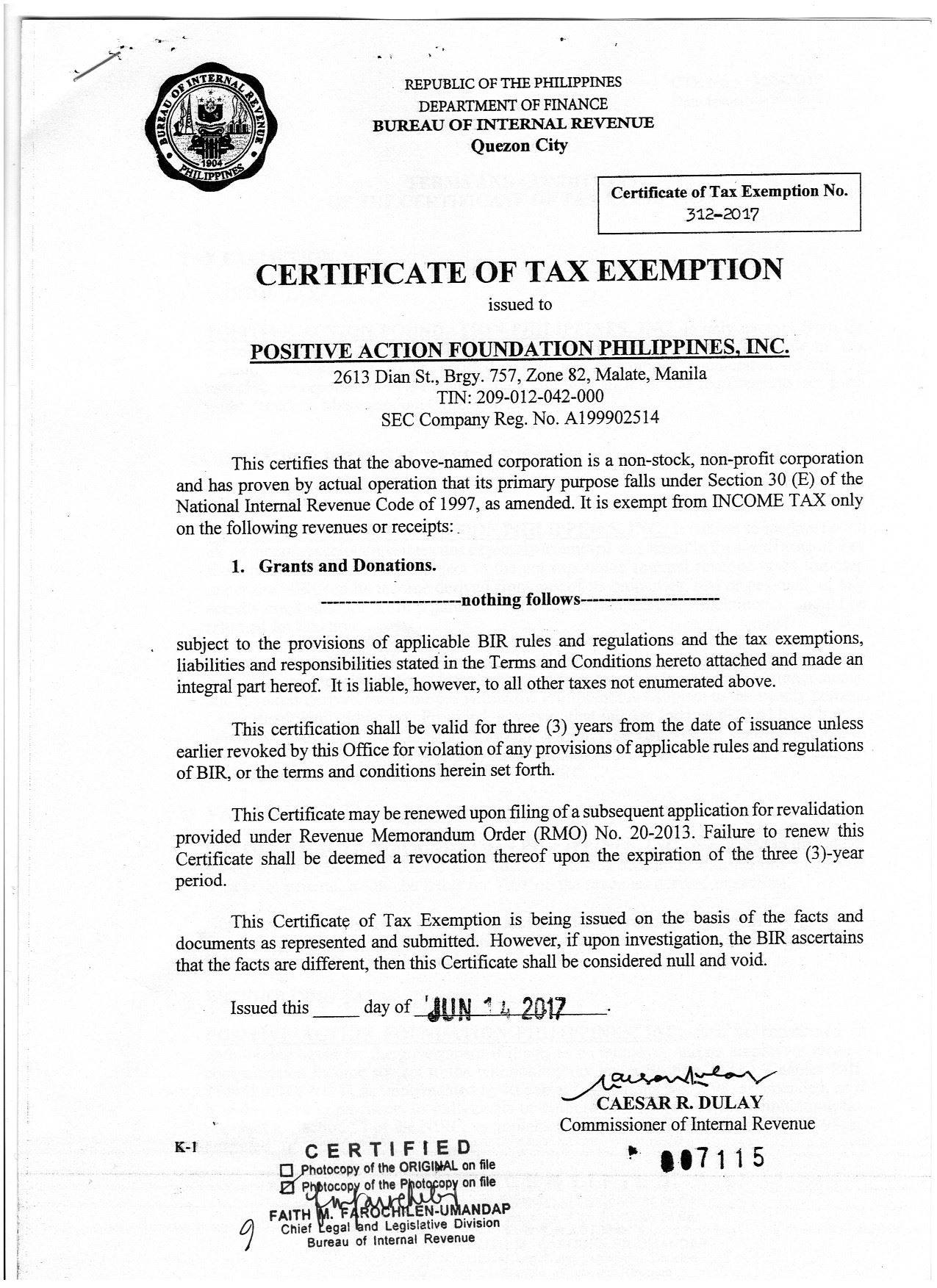

Donors BSOP

http://bsop.edu.ph/wp-content/uploads/2018/03/BIR-Donee.jpg

Verkko 22 kes 228 k 2022 nbsp 0183 32 4 Derogation to the requirement on the number of unitholders The number of unitholders in an investment fund or special investment fund may be fewer than 30 which is given as the minimum for qualifying for tax exemption in section 20a 1 2 of the Income Tax Act immediately after the fund is newly established or at other times Verkko 27 huhtik 2022 nbsp 0183 32 A tax exemption can reduce or eliminate the amount owed in certain types of taxes such as income tax property tax or sales tax Many different types of tax exemptions exist some of which apply to individuals and some to organizations To receive the benefits of a tax exemption you re often required to apply for it

Verkko 13 helmik 2023 nbsp 0183 32 A tax exemption is the right to exclude certain amounts of income or activities from taxation A few years ago taxpayers were able to exclude up to 4 050 for each eligible individual off Verkko Most taxpayers are entitled to an exemption on their tax return that reduces your tax bill in the same way a deduction does Federal and state governments frequently exempt organizations from income tax entirely when it serves the public such as with charities and religious organizations

Understanding Income Tax Reliefs Rebates Deductions And Exemptions

https://i2.wp.com/ringgitplus.wpcomstaging.com/wp-content/uploads/2020/02/Tax-Exemptions-1.jpg?resize=874%2C548&ssl=1

Tax Exemptions What Part Of Your Income Is Taxable

https://ringgitplus.com/img/wysiwyg/ringgitplus-tax-exemption-1.226183236.jpg

https://www.vero.fi/en/detailed-guidance/guidance/71691/deduction-of...

Verkko 28 huhtik 2023 nbsp 0183 32 Provisions concerning an exemption with progression method are found in 167 6 of the Act on the elimination of international double taxation when income is exempted from Finnish tax it only has an impact on the progressive accumulation of income of a Finnish resident taxpayer s income on the condition that it represents

https://www.vero.fi/en/individuals/tax-cards-and-tax-returns/...

Verkko 2 tammik 2023 nbsp 0183 32 You can make the following deductions in your tax assessment Amount of deductions in 2022 More information on the deduction Own liability in 2022 Maximum amount in 2022 tax credit for household expenses Home repair or improvement and renovations 100 2 250

Tax Exemption For Rental Income 2018 Donovan Ho

Understanding Income Tax Reliefs Rebates Deductions And Exemptions

Depositphotos 190434054 stock illustration tax exempt grunge rubber

Income Tax Exemption Limit What Are The Tax Exemption Limits For

California Sales Tax Exemption Certificate Video Bokep Ngentot

Certificate Of Exemption To 2024 STEEI Fla Sales Tax EARTHSAVE FLORIDA

Certificate Of Exemption To 2024 STEEI Fla Sales Tax EARTHSAVE FLORIDA

Income Tax Exemption Form 5 Here s What No One Tells You About Income

County Legislature Increases Senior Citizen Tax Exemption Rodney J

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

Tax Exemption Income - Verkko The income tax law also provides for an LTA exemption to salaried employees restricted to travel expenses incurred during leaves by them Please note that the exemption doesn t include costs incurred for the entire trip such as shopping food expenses entertainment and leisure among others