Tax Exemption Limit For Home Loan Yes you claim deductions on two home loans within the specific limit under Section 24 Rs 2 lakhs per annum if the properties are self occupied Only for your first

The Union Budget 2019 has introduced a new Section 80EEA to extend the tax benefits of the interest deduction up to Rs 1 50 000 for housing loans taken for Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C

Tax Exemption Limit For Home Loan

.jpg)

Tax Exemption Limit For Home Loan

https://assets.website-files.com/6135c6db8bcea3eb76fbf0b6/63e4f075ce8bdf6bdf8d4357_tax-ex (1).jpg

Commissioners Approve New Homestead Exemptions For Tarrant County

https://fortworthreport.org/wp-content/uploads/2023/06/taxexemption-scaled.jpg

Home Loan Tax Exemption Check Tax Benefits On Home Loan

https://www.urbanmoney.com/blog/wp-content/uploads/2022/10/HOME-LOAN-TAX-EXEMPTION-Always-good-to-save-more-100-1-1.jpg

Understand tax savings on a home loan under sections 24 80EE and 80C Home loan customers should be aware of the EMI or interest rate tax benefits as they could reduce Taxpayers who took out a home loan in FY 2016 17 were eligible to claim an extra tax deduction under Section 80EE of up to Rs 50 000 Presently under Section

Each joint owner of the home loan can claim a maximum deduction of Rs 2 00 000 for interest on the home loan in case of self occupied property However there You can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home If you

Download Tax Exemption Limit For Home Loan

More picture related to Tax Exemption Limit For Home Loan

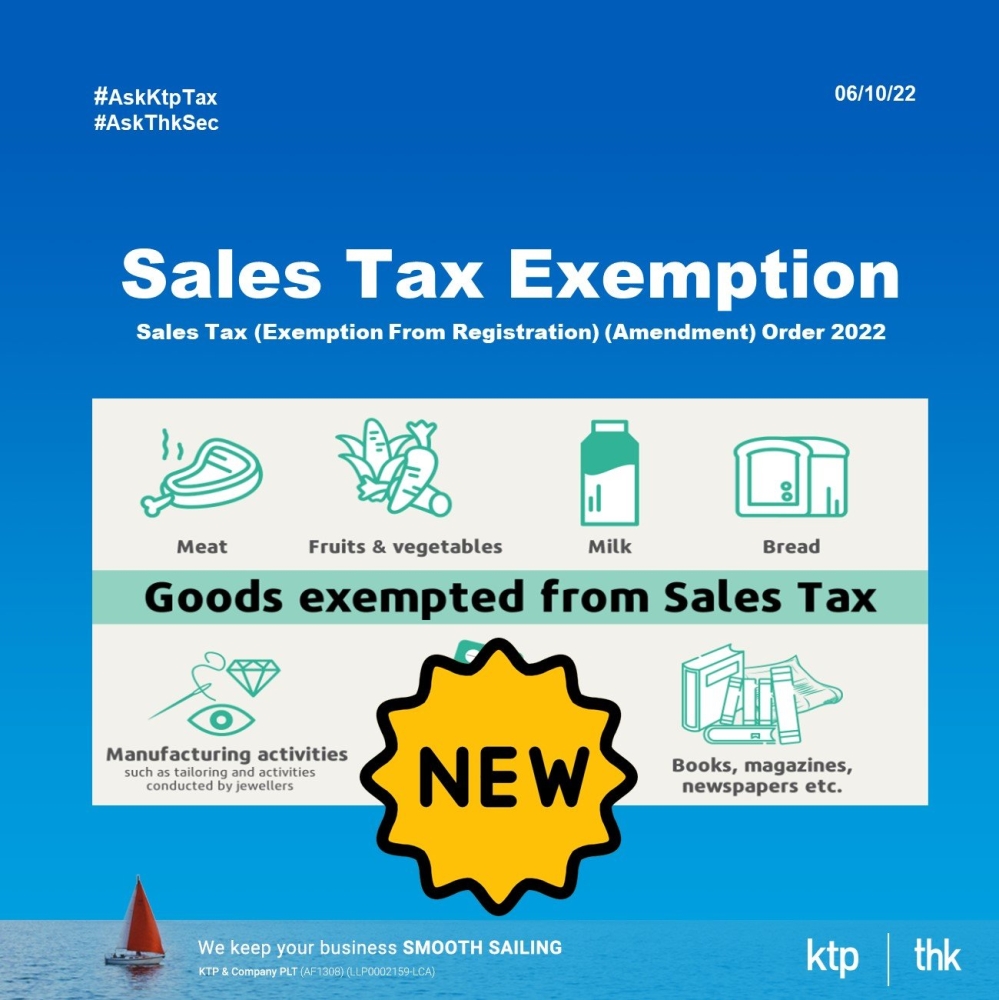

Sales Tax Exemption From Registration Amendment Order 2022 Oct 06

https://cdn1.npcdn.net/image/16650449149b8bb9581e774ba60d690e93c2dc40de.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1190&new_height=1000&w=-62170009200

New Exemption Granted For Tax Transfers Of Excess Tax

https://strategi.co.nz/storage/News/Tax-exempt_840x620.jpg

Tax Exemption Limit For Non government

https://i.ytimg.com/vi/Y5a1pPnLpaE/maxresdefault.jpg

Realtors body NAREDCO on Tuesday suggested that the tax exemption on interest on self occupied property loans should be increased to 5 lakh in the upcoming The budget 2024 may introduce new deduction and exemption benefits including higher limits for home loan interest and medical expenses These measures

Home Loan Income Tax Benefits For interest paid on home loans for affordable housing an additional Rs 1 5 lakh tax deduction under Section 80EE can be availed till 31 March Here s the math Budget 2024 has given more tax relief in the new tax regime by changing the income tax slabs under it to make it more attractive vis a vis the old tax

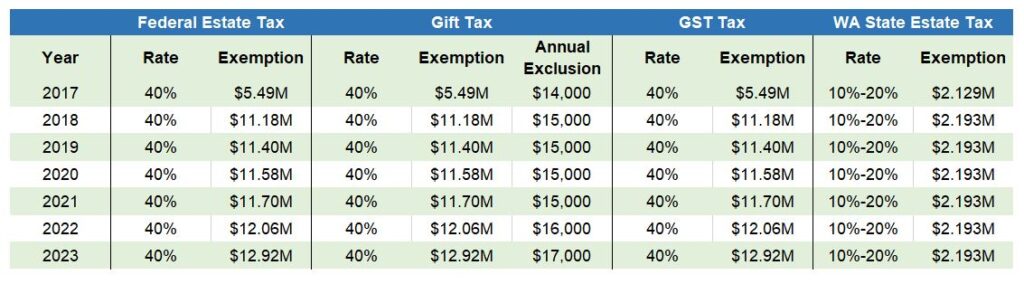

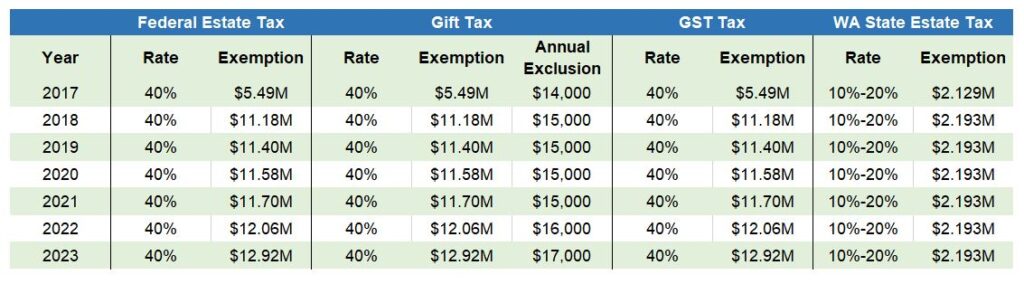

Annual Individual Gift Tax Exclusion Chart My XXX Hot Girl

https://www.helsell.com/wp-content/uploads/23-EP-Table-1024x284.jpg

Loan Against Property Documents Eligibilities And How To Apply

https://homefirstindia.com/app/uploads/2022/12/Untitled-design-23.png

.jpg?w=186)

https://housing.com/news/home-loans-guide-claiming-tax-benefits

Yes you claim deductions on two home loans within the specific limit under Section 24 Rs 2 lakhs per annum if the properties are self occupied Only for your first

https://cleartax.in/s/section-80ee-income-tax...

The Union Budget 2019 has introduced a new Section 80EEA to extend the tax benefits of the interest deduction up to Rs 1 50 000 for housing loans taken for

Budget 2023 All You Need To Know About Current Income Tax Exemption

Annual Individual Gift Tax Exclusion Chart My XXX Hot Girl

TAX EXEMPTION LIMIT ENHANCED LEAVE ENCASHMENT

Find Out What Is The Tax Exemption Limit For Senior Citizens

Non Resident Tax Exemption Form ExemptForm

Income Tax Exemptions For Investment In Target Companies MPG

Income Tax Exemptions For Investment In Target Companies MPG

Sales Tax Exemption Licking Valley Rural Electric Cooperative

The Revenue Department Issues A New Notice On Income Tax Exemption MPG

Latest Leave Encashment Tax Exemption Rules Rs 25 Lakh Limit

Tax Exemption Limit For Home Loan - Each joint owner of the home loan can claim a maximum deduction of Rs 2 00 000 for interest on the home loan in case of self occupied property However there