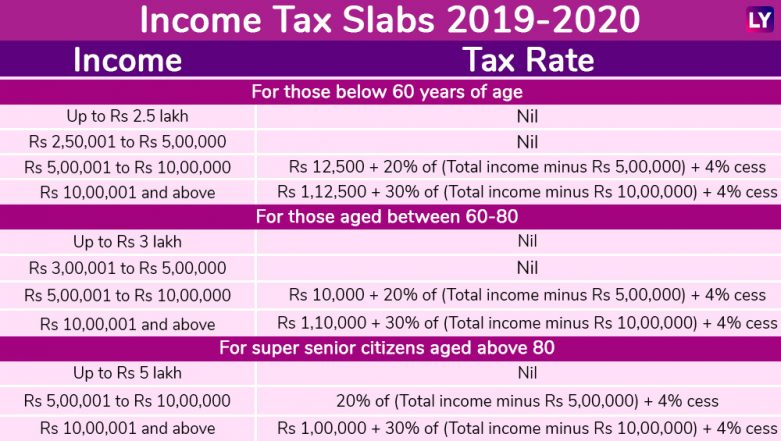

Tax Exemption Limit In India The following points clarify the limit of tax free income in India Under the old tax regime an individual below the age of 60 years is exempt up to Rs 2 5 lakhs senior citizens 60 80 years are exempt up to Rs 3 lakhs and super senior citizens above 80

HRA is exempt based on the least of actual HRA received 40 of salary 50 in major cities or rent paid minus 10 of salary Other allowances like transport and conveyance have defined exemptions For FY 2023 24 the limit of the standard deduction is Rs 50 000 for both the old and the new regime As per Budget 2023 salaried taxpayers are now eligible for a standard deduction of Rs 50 000 under the new tax regime also from the financial year 2023 24 Read more on Standard Deduction

Tax Exemption Limit In India

Tax Exemption Limit In India

http://1.bp.blogspot.com/-xESYo-Qbnrs/VPGaTy8vq2I/AAAAAAAABGU/97BvS9Qn1rI/w1200-h630-p-k-no-nu/Itax.jpg

Income Tax Basic Exemption Limit In India some Facts To Know ITR Guide

https://1.bp.blogspot.com/-HdGx2LzOXew/XKXFPMuqWuI/AAAAAAAAAD8/YrVDaA4WpG8fmaFG-Aw4ijQxSko4cZD5QCLcBGAs/s1600/Income-tax-basic-exemption-limit.jpg

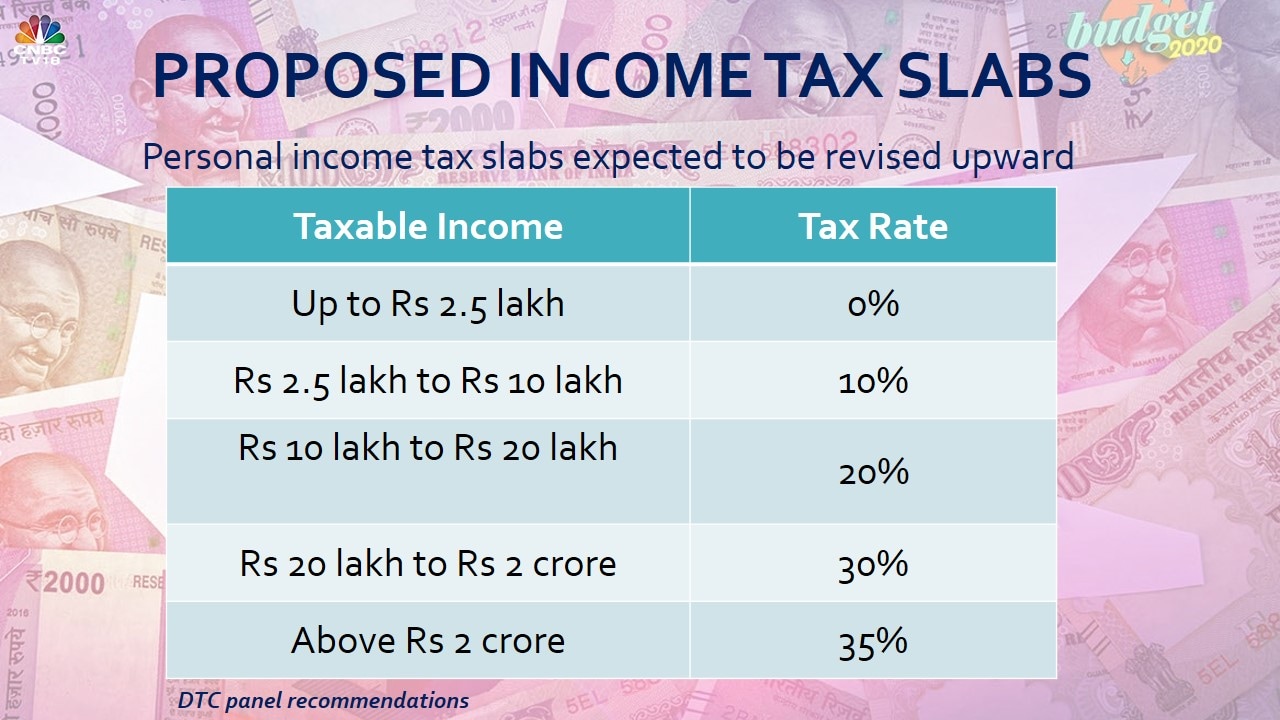

New Income Tax Slabs For 2019 2020 Will Increase In Tax Exemption

https://st1.latestly.com/wp-content/uploads/2019/02/Income-Tax-Final-Image-781x441.jpg

Some of these changes were introduction of standard deduction raising basic exemption limit hike in tax rebate under Section 87A for taxable income up to Rs 7 lakh and so on Here are the new income tax slabs under new tax regime Income tax slabs under new tax regime for FY 2024 25 Changes made in the new tax regime in Budget 2024 The Budget 2023 has hiked the basic exemption limit to Rs 3 lakh from Rs 2 5 lakh currently Thus an individual s income becomes taxable if it exceeds Rs 3 lakh in a financial year However those who have an income of up to Rs 7 5 lakh does not have to pay any income tax under the new tax regime as they will be able to claim rebate and

The basic exemption limit for resident individuals who are 60 years of age or more but less than 80 years of age at any time during the tax year is INR 300 000 For resident individuals who are 80 years of age or more it is INR 500 000 Surcharge For individuals below the age of 60 years the basic exemption limit is Rs 2 5 lakh in a financial year For senior citizens between 60 and 80 years the basic exemption limit is Rs 3 lakh For super senior citizens 80 years or more the basic exemption limit is Rs 5 lakh in the old tax regime

Download Tax Exemption Limit In India

More picture related to Tax Exemption Limit In India

Income Tax Clarification Opting For The New Income Tax Regime U s

https://blog.quicko.com/wp-content/uploads/2020/04/tax-slabs-scaled-1-1024x512.jpg

Income Tax Slab For The A Y 2024 25

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhFzJwJHyVBIaFv0G0rI9CycAztACJH2ffDNgtSG3IRxDkB8E8neD3ScVZdjeaFsEGlRNFOqKLdxATPyE6sMa7P2WhsdLZv3UJrW1PuAJqOiUXvDtJ4GGzrXO4yvVbUK8NRVEwbATdQ9KZblStNks1dIgMF8yCHF-iAGrgmOApYakwfpsgcIG_WKP3T/s633/Tax Slab for A.Y.2024-25.jpg

How Non Residents In India Can Claim Tax Relief Under Double Taxation

https://img.etimg.com/thumb/msid-17507966,width-1070,height-580,imgsize-25232,overlay-etwealth/photo.jpg

According to the Finance Act of 2014 taxable income eligible for complete tax exemption has been increased in its limits from the earlier Rs 200000 to Rs 250000 People with an annual income less than or equal to Rs 250000 will not be considered for paying income tax Allowed in Old tax regime The new regime offers lower rates of taxes but permits limited deductions and exemptions 2 Which is better between the old tax regime and the new tax regime two regimes may vary from person to person It is advisable to do a comparative evaluation and analysis under both

[desc-10] [desc-11]

Understanding Long Term Capital Gain Tax Rate LTCG Exemption Limit In

https://www.wishfin.com/blog/wp-content/uploads/2023/05/Understanding-Long-Term-Capital-Gain-Tax-Rate-LTCG-exemption-limit-in-India.jpg

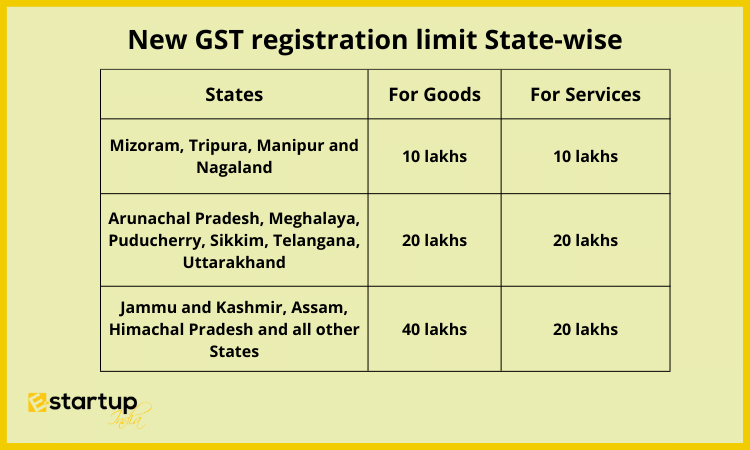

Gst Registration On Limit For Services In FY 2022 23

https://www.e-startupindia.com/learn/wp-content/uploads/2022/08/New-GST-registration-limit-State-wise.png

https://cleartax.in › tax-free-income-in-india

The following points clarify the limit of tax free income in India Under the old tax regime an individual below the age of 60 years is exempt up to Rs 2 5 lakhs senior citizens 60 80 years are exempt up to Rs 3 lakhs and super senior citizens above 80

https://taxguru.in › income-tax › list-income-tax...

HRA is exempt based on the least of actual HRA received 40 of salary 50 in major cities or rent paid minus 10 of salary Other allowances like transport and conveyance have defined exemptions

Filing Exempt On Taxes For 6 Months How To Do This

Understanding Long Term Capital Gain Tax Rate LTCG Exemption Limit In

Income Tax Exemption Limit May Get Doubled To Rs 2 Lacs

State Tax Exemption Map National Utility Solutions

What Tax Exemptions Can Startups Avail In India All That You Need To Know

GST Exemption Limit In India Times Of India

GST Exemption Limit In India Times Of India

Budget 2020 Key Expectations On Corporate Personal Taxes Cnbctv18

Budget 2023 All You Need To Know About Current Income Tax Exemption

Maximum Income Tax Exemption Limit In India For FY 2016 17

Tax Exemption Limit In India - The basic exemption limit for resident individuals who are 60 years of age or more but less than 80 years of age at any time during the tax year is INR 300 000 For resident individuals who are 80 years of age or more it is INR 500 000 Surcharge