Tax Exemption On Electric Car Loan EV buyers can claim up to 1 5 lakh income tax deduction on the interest paid for vehicle loans under section 80EEB of the IT Act As the current financial year is

Presently the interest on loans sanctioned to purchase electric vehicles up to March 31 2023 is eligible for maximum deduction of up to Rs 1 5 lakh per year This The electric vehicle loan must be taken from a financial institution or an NBFC The loan must be sanctioned between April 1 2019 and March 31 2023 The

Tax Exemption On Electric Car Loan

Tax Exemption On Electric Car Loan

https://www.pdffiller.com/preview/50/825/50825271/large.png

Income Tax Exemption On Electric Vehicle Deduction On Electric Vehicle

https://carajput.com/art_imgs/income-tax-exemption-on-electric-vehicle-u-s-80eeb.jpg

HOME LOAN INTEREST CERTIFICATE For FY 2021 22 PDF Loans Interest

https://imgv2-2-f.scribdassets.com/img/document/553973286/original/542bfb7a7c/1661356692?v=1

Under Section 80EEB you can get tax benefit of up to Rs 1 5 lacs for the interest paid towards the loan taken to purchase an electric vehicle The benefit is available for purchase of both electric Do you know that you can avail tax deduction on loan taken for purchase of electric vehicle under section 80EEB on Income Tax Act Learn here the eligibilty criteria conditions to avail deduction

Explore the benefits of Section 80EEB providing a deduction for interest paid on loans for Electric Vehicles EVs Understand the eligibility criteria quantum of From April 1 2019 March 31 2022 a total of Rs 10 000 crore would be spent on FAME India Phase II Section 80EEB allows a deduction for the interest paid on the loan taken

Download Tax Exemption On Electric Car Loan

More picture related to Tax Exemption On Electric Car Loan

Sales Tax Exemption Licking Valley Rural Electric Cooperative

https://i0.wp.com/lvrecc.com/wp-content/uploads/2022/11/2022-Sales-Tax-Exemption-Facebook.jpg?w=2500&ssl=1

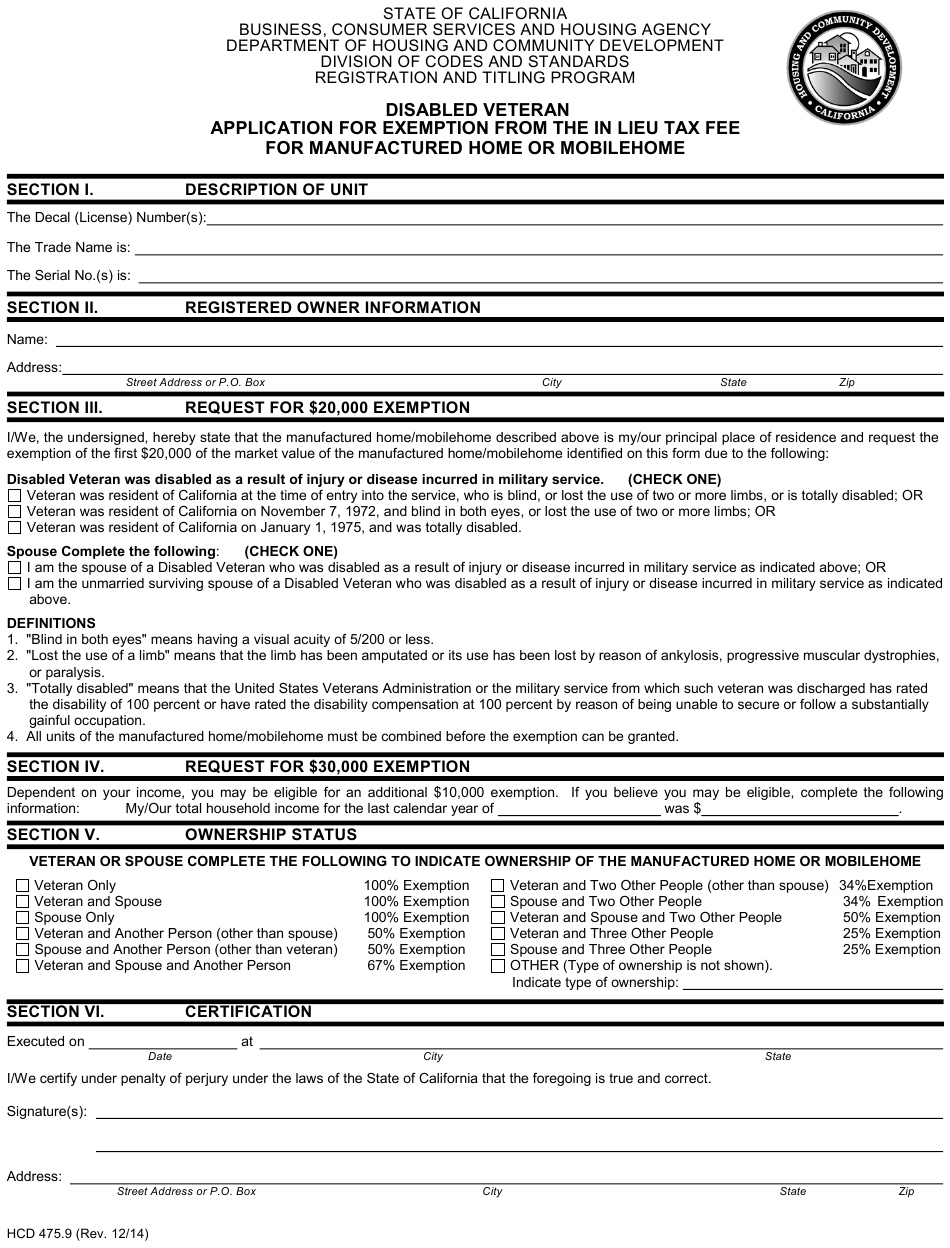

Disability Car Tax Exemption Form ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/form-hcd475-9-download-printable-pdf-or-fill-online-disabled-veteran.png

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/497/332/497332566/large.png

People who buy new electric vehicles may be eligible for a tax credit of up to 7 500 and used electric car buyers may qualify for up to 4 000 New in 2024 If you buy a new all electric plug in hybrid or fuel cell electric vehicle in 2023 or after you can claim a clean vehicle tax credit of up to 7 500 The tax credit is

The short answer is that very few models currently qualify for the full 7 500 electric vehicle tax credit Others qualify for half that amount and some don t qualify at all For the first time in years some Teslas will qualify for a 7 500 federal tax credit for new electric vehicles But only some vehicles and only some buyers are eligible

Understanding Income Tax Reliefs Rebates Deductions And Exemptions

https://i2.wp.com/ringgitplus.wpcomstaging.com/wp-content/uploads/2020/02/Tax-Exemptions-1.jpg?resize=874%2C548&ssl=1

Hyundai I10 NIOS Aura CNG Kona EV 100 Finance Zero Fees Offer

https://www.rushlane.com/wp-content/uploads/2022/05/hyundai-cng-i10-nios-aura-offer-kona-electric-sbi-1057x1125.jpg

https://auto.hindustantimes.com/auto/electric...

EV buyers can claim up to 1 5 lakh income tax deduction on the interest paid for vehicle loans under section 80EEB of the IT Act As the current financial year is

https://economictimes.indiatimes.com/wealth/...

Presently the interest on loans sanctioned to purchase electric vehicles up to March 31 2023 is eligible for maximum deduction of up to Rs 1 5 lakh per year This

Optima Tax Relief Reviews Form 1023 Tax Exemption Revision

Understanding Income Tax Reliefs Rebates Deductions And Exemptions

EV Loans 2022 Check Electric Car Bike Loan Special Interest Rates In

How To Qualify For Tax Exemption On Your Vehicle Purchase Door To

80EEB New Tax Exemption On Loan For Purchase Of Electric Vehicles

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

Loan Certificate PDF

Writing Religious Exemption Letters

How Electric Vehicle Tax Credit Works Web2Carz

Tax Exemption On Electric Car Loan - Under Section 80EEB you can get tax benefit of up to Rs 1 5 lacs for the interest paid towards the loan taken to purchase an electric vehicle The benefit is available for purchase of both electric