Tax Exemption On Interest Earned Updated June 28 2020 Reviewed by Janet Berry Johnson What Is Tax Exempt Interest Tax exempt interest is interest income that is not subject to federal income

You must report all taxable and tax exempt interest on your federal income tax return even if you don t receive a Form 1099 INT or Form 1099 OID You must give the payer of Mark P Cussen Updated December 01 2023 Reviewed by Ebony Howard Fact checked by Suzanne Kvilhaug Income can be earned through investments with capital in the form of capital gains

Tax Exemption On Interest Earned

Tax Exemption On Interest Earned

https://www.gregspetro.com/wp-content/uploads/2019/08/Tax-Exemptions-Just-Ahead-01.jpg

How To Claim Tax Exemptions Here s Your 101 Guide

https://okcredit-blog-images-prod.storage.googleapis.com/2021/02/taxexemption1.jpg

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/497/332/497332566/large.png

By Jake Safane Updated on November 18 2022 Reviewed by Lea D Uradu Fact checked by Daniel Rathburn Photo MStudioImages Getty Images Tax The Balance Julie Bang The interest income you earn on bank accounts money market funds and certain bonds must be reported on your tax return as ordinary income Here s how it works

The short answer is yes Here are a few things you need to know about tax for savings accounts how to file and ways to save Is Savings Account Interest Taxable and Tax Exempt Interest Income 2 min read Share Most interest you receive that s available for a withdrawal is taxable income This can include interest on Bank

Download Tax Exemption On Interest Earned

More picture related to Tax Exemption On Interest Earned

How Much Is The Homestead Exemption In Houston Square Deal Blog

https://res.cloudinary.com/agiliti/image/upload/v1665312015/harris-cad-homestead-exemption-status.webp

Sample Letter Exemptions Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/497/331/497331433/large.png

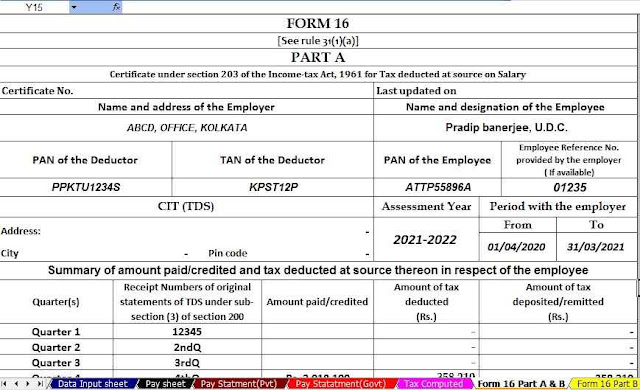

Exemption U s 80C As Per Income Tax Act With Automated Income Tax

https://1.bp.blogspot.com/-Jy3Z02QCNwo/YL5GsKSOyzI/AAAAAAAAQxE/SilH8g_onbwsXDWMBME8njjuec7yWjNDQCNcBGAsYHQ/w640-h390/Form%2B16%2BPart%2BA%2Band%2BB.jpg

While certain types of interest are tax exempt such as interest earned from some government bonds interest on money in a savings account is eligible to be taxed Most people can earn some interest from their savings without paying tax Your allowances for earning interest before you have to pay tax on it include your Personal Allowance

What s Exempt From Tax The earned interest on savings accounts is taxed but you do not have to pay taxes on the full balance in your account The original money Intro Here is the bad news Interest earned on your savings or fixed deposit account is taxable Good news You will only be taxed on interest if your interest earned in any one

![]()

Optima Tax Relief Reviews Form 1023 Tax Exemption Revision

https://www.rebelliouspixels.com/wp-content/uploads/2020/03/tax_free_residency-1536x1066.jpg

Illinois With Holding Income Tax Return Wiki Form Fill Out And Sign

https://www.signnow.com/preview/6/960/6960443/large.png

https://www.investopedia.com/terms/t/taxexemptinterest.asp

Updated June 28 2020 Reviewed by Janet Berry Johnson What Is Tax Exempt Interest Tax exempt interest is interest income that is not subject to federal income

https://www.irs.gov/taxtopics/tc403

You must report all taxable and tax exempt interest on your federal income tax return even if you don t receive a Form 1099 INT or Form 1099 OID You must give the payer of

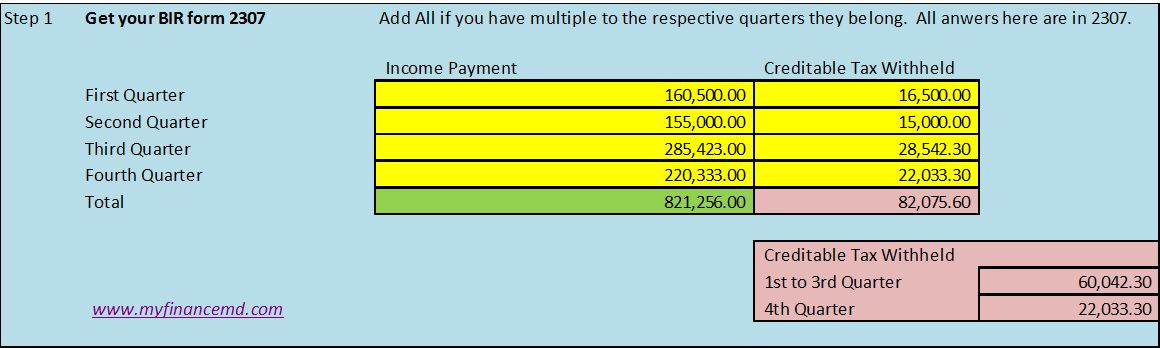

Doctor s Taxation How To Compute Your Income Tax Return Part 5 My

Optima Tax Relief Reviews Form 1023 Tax Exemption Revision

Writing Religious Exemption Letters

Income Tax Exemption On Interest Of Education Loan YouTube

Understanding Income Tax Reliefs Rebates Deductions And Exemptions

Texas Homestead Tax Exemption Cedar Park Texas Living

Texas Homestead Tax Exemption Cedar Park Texas Living

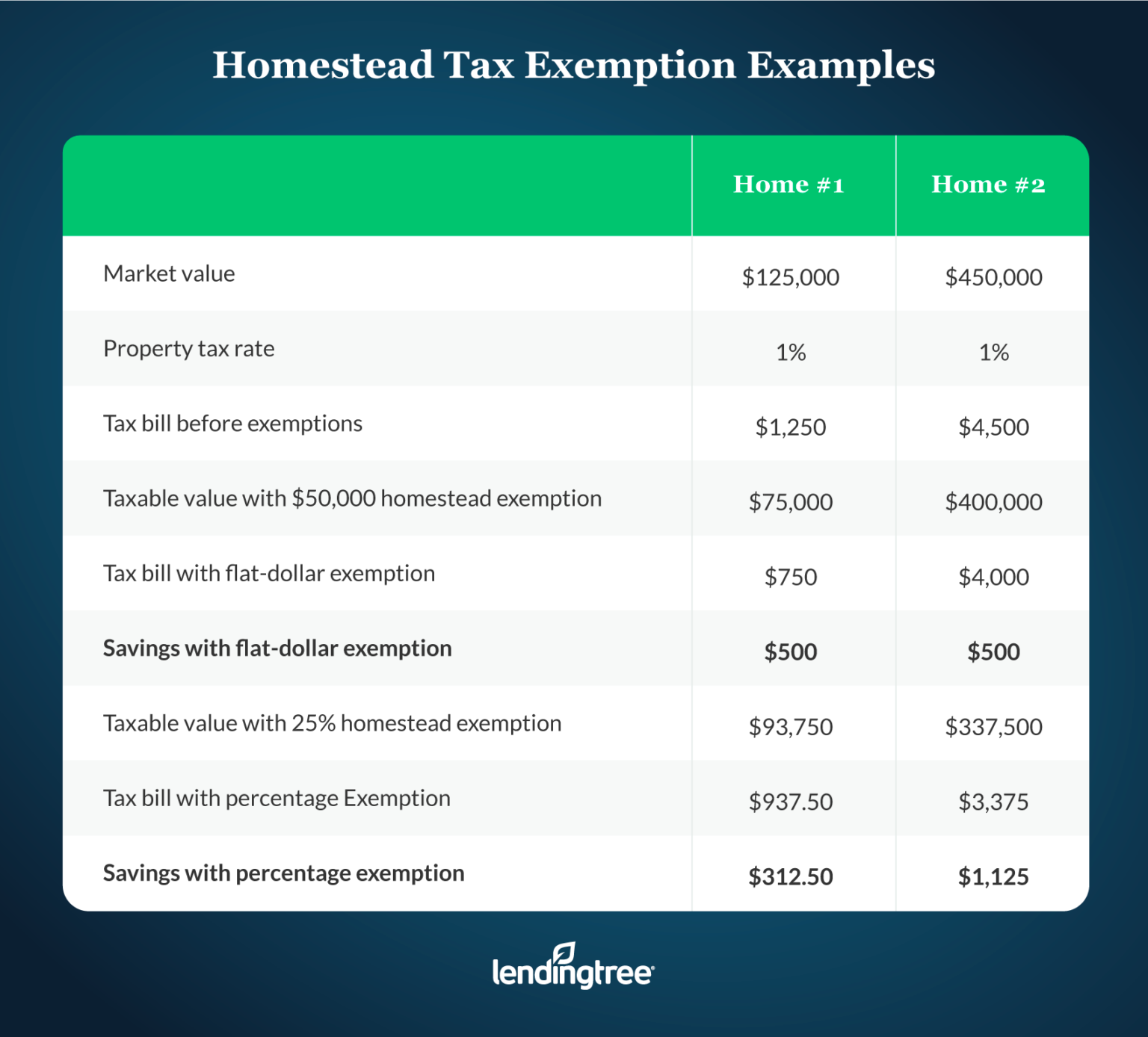

What Is A Homestead Exemption And How Does It Work LendingTree

Income Tax On Interest On Savings Bank FD Account In India Fintrakk

Texas Sales Tax Exemption Certificate From The Texas Human Rights

Tax Exemption On Interest Earned - Most all earned interest is taxable at both the federal and state levels in the year that it is earned An exception to this rule would be if you earned interest in a tax