Tax Exemption On Interest Income Section 80TTA of the Income Tax Act 1961 provides a deduction of up to Rs 10 000 on the income earned from interest on savings made in a bank co operative society or post office There is no deduction for interest

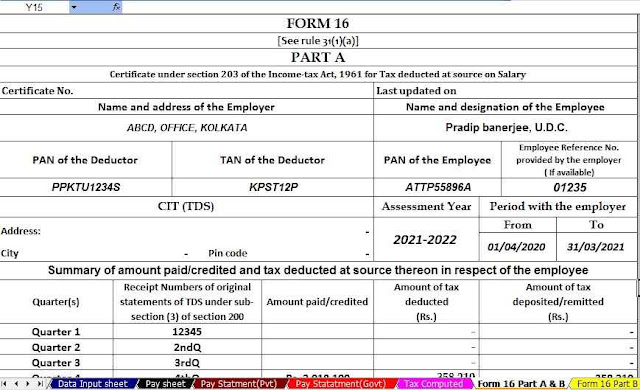

Tax exempt interest involves earnings from interest payments that are not subject to certain taxes such as federal or state income taxes Many types of interest are taxable tax exempt interest generally applies to more nuanced or niche situations Taxation of interest Interest income from Treasury bills notes and bonds is subject to federal income tax but is exempt from all state and local income taxes You should receive Form 1099 INT showing the interest in box 3 paid to you for the year

Tax Exemption On Interest Income

Tax Exemption On Interest Income

https://wealthtechspeaks.in/wp-content/uploads/2022/02/Income-Tax-Deductions.png

2017 PAFPI Certificate of TAX Exemption

https://www.certificateof.com/wp-content/uploads/2018/06/2017-PAFPI-Certificate-of-TAX-Exemption.jpg

Solved Please Note That This Is Based On Philippine Tax System Please

https://www.coursehero.com/qa/attachment/19096880/

Box 8 Tax Exempt Interest Any interest exempt from all levels of tax for any reason including tax free dividends from mutual funds or other regulated investment companies Most interest you receive that s available for a withdrawal is taxable income This can include interest on Bank accounts Money market accounts Deposited insurance dividends If you receive taxable interest on a regular basis you might have to

Tax on FD Interest All interest income from fixed deposits is taxable Know how to calculate income tax on FD interest when to pay it and how TDS and FD taxation works for senior citizens Tax exempt interest and how it can affect your tax bill Written by Ben Luthi April 17 2019 4 min read In a Nutshell Certain types of interest income can be exempt from federal income tax Here s what you need to know about tax exempt interest and what to watch out for

Download Tax Exemption On Interest Income

More picture related to Tax Exemption On Interest Income

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/497/332/497332566/large.png

Solved Recall That In Class We Discussed How Personal Tax Chegg

https://d2vlcm61l7u1fs.cloudfront.net/media/81d/81d94927-6b1c-489a-8a14-b54618e199e2/phpASKjQX.png

Income Tax On Interest On Savings Bank FD Account In India Fintrakk

https://fintrakk.com/wp-content/uploads/2019/07/Tax-on-interest.jpg

You should report tax exempt and taxable interest on your income tax return lines 2a and 2b of the 1040 You may also be required to file Schedule B if your taxable income is more than 1 500 or under certain other conditions see the form instructions According to the IRS you must report all taxable and tax exempt interest you earned on your federal income tax return even if the bank didn t send you a form

[desc-10] [desc-11]

Certificate Of Exemption To 2024 STEEI Fla Sales Tax EARTHSAVE FLORIDA

https://earthsavemiami.org/wp-content/uploads/2019/08/Certificate-of-Exemption-to-2024-STEEI-Fla-Sales-Tax-768x889.jpg

Sample Letter Exemptions Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/497/331/497331433/large.png

https://cleartax.in/s/claiming-deduction-on-interest-under-section-80tta

Section 80TTA of the Income Tax Act 1961 provides a deduction of up to Rs 10 000 on the income earned from interest on savings made in a bank co operative society or post office There is no deduction for interest

https://www.thebalancemoney.com/what-is-tax-exempt-interest-5223748

Tax exempt interest involves earnings from interest payments that are not subject to certain taxes such as federal or state income taxes Many types of interest are taxable tax exempt interest generally applies to more nuanced or niche situations

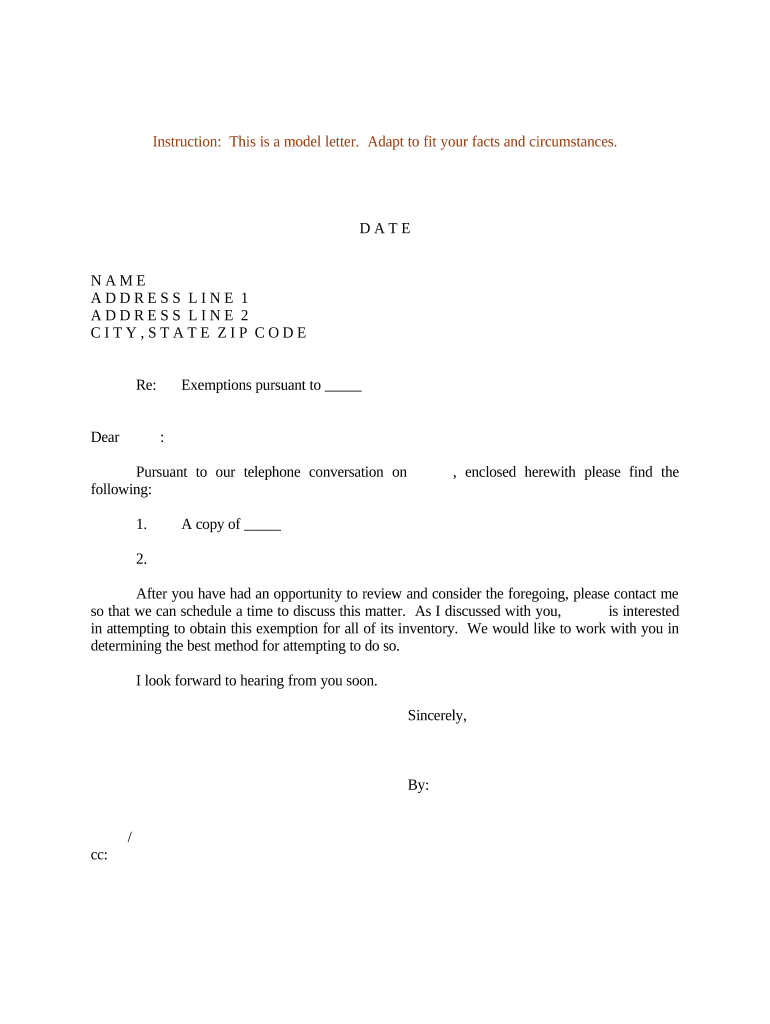

Exemption U s 80C As Per Income Tax Act With Automated Income Tax

Certificate Of Exemption To 2024 STEEI Fla Sales Tax EARTHSAVE FLORIDA

2023 Federal Tax Exemption Form ExemptForm

How To Deduct Property Taxes On IRS Tax Forms Irs Tax Forms Mortgage

Texas Homestead Tax Exemption Cedar Park Texas Living

Income Tax Exemption On Interest Of Education Loan YouTube

Income Tax Exemption On Interest Of Education Loan YouTube

How Is Interest Income From Your Investments Taxed Personal Finance Plan

Nixon Questions Tax Cut Bill s Unintended Prescription Sales Tax Hike

Estate Tax Exemption Level Tax Policy Center

Tax Exemption On Interest Income - Most interest you receive that s available for a withdrawal is taxable income This can include interest on Bank accounts Money market accounts Deposited insurance dividends If you receive taxable interest on a regular basis you might have to