Tax Exemption On Joint Housing Loan If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

If you have borrowed money to buy residential property in order to rent it out you can deduct all the related interest expenses This is considered a loan for the Income Tax benefits on Housing Loan for Joint Owner of Rs 2 Lakh each Section 24 b of Income Tax Act 1961 amended Conditions for claiming Interest on

Tax Exemption On Joint Housing Loan

Tax Exemption On Joint Housing Loan

https://www.signnow.com/preview/497/332/497332566/large.png

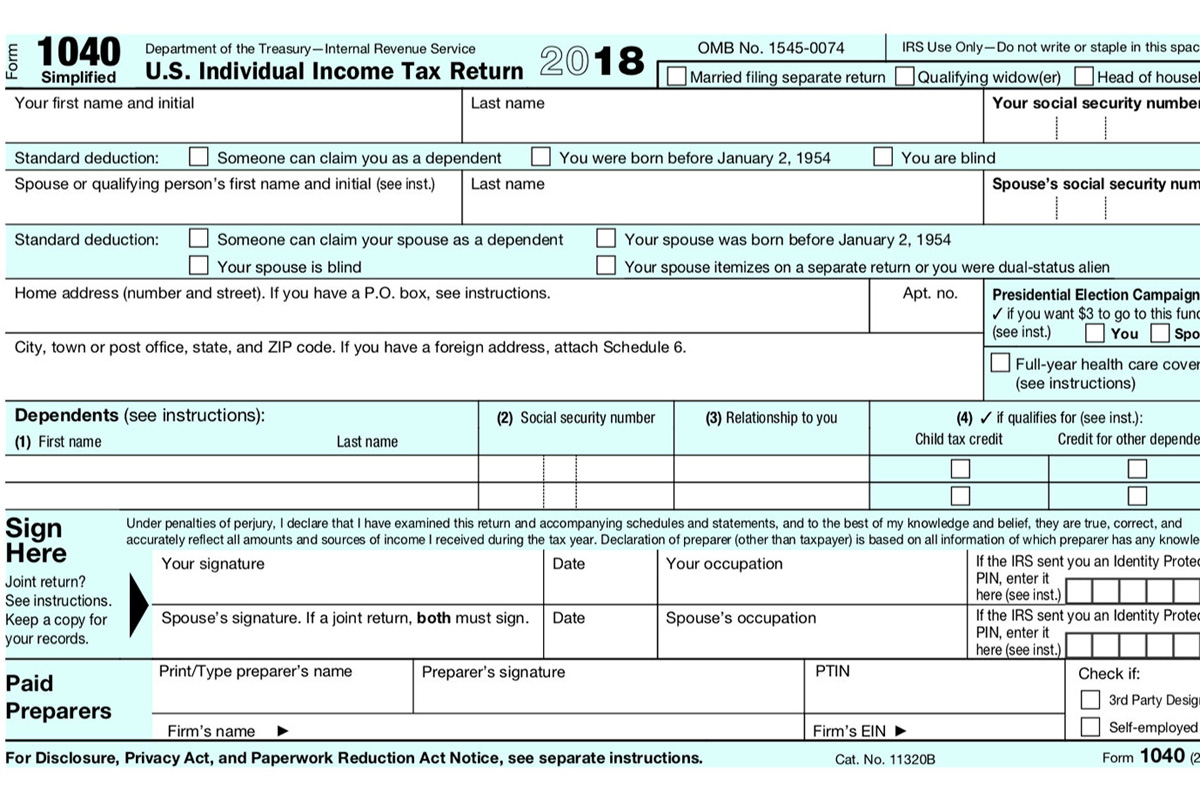

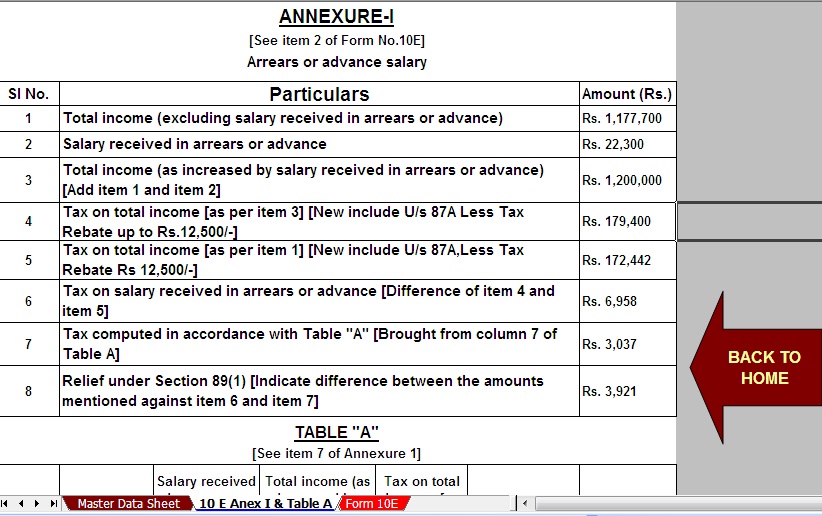

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

https://1.bp.blogspot.com/-1hmzbVNZKYo/XSHkKoX1yfI/AAAAAAAAJ48/rH6dqw_ChNcMLHBhRqZVUOtTkyFQPjeOQCLcBGAs/s1600/Picture-4%2Bof%2BArrears%2BRelief%2BCalculator%2B19-20.jpg

Loan Certificate PDF

https://imgv2-2-f.scribdassets.com/img/document/135548537/original/4d8afdd60a/1631372599?v=1

Individuals can enjoy tax benefits in obtaining a home loan under the Income Tax Act Section 24 b Section 80 EE Section 80EEA and Section 80C If a home loan is taken jointly each borrower can claim deduction on home loan interest up to Rs 2 lakh under Section 24 b and tax deduction on the principal repayment up to Rs 1 5 lakh under Section 80C

As you are staying at the house you have availed on a home loan and you work in the same city you cannot claim HRA tax benefit However you can claim the Co owners and co applicants of a joint home loan can jointly claim up to INR 2 lakh annually on the interest paid Section 24b as part of their income tax returns This

Download Tax Exemption On Joint Housing Loan

More picture related to Tax Exemption On Joint Housing Loan

Nixon Questions Tax Cut Bill s Unintended Prescription Sales Tax Hike

https://themissouritimes.com/wp-content/uploads/2013/05/GovOutdoorHR.jpg

Appeals Court Upholds Federal Tax Exemption For Clergy Housing Expenses

https://www.episcopalnewsservice.org/wp-content/uploads/2019/03/ens_031819_TaxForm.jpg

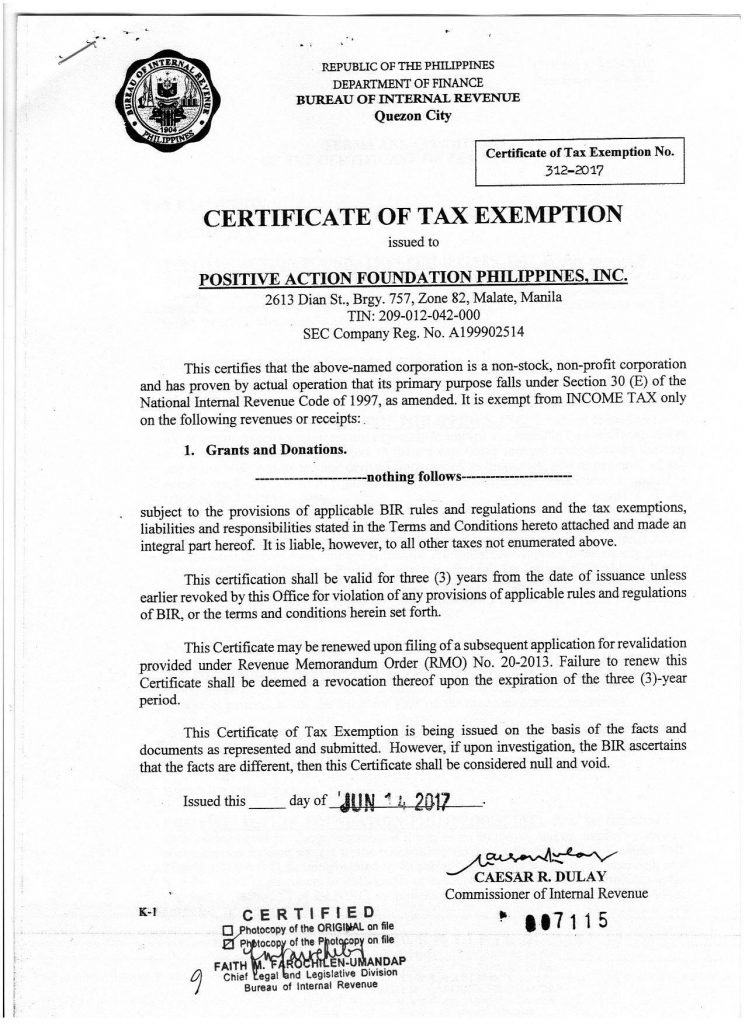

Certificate Of TAX Exemption PAFPI

https://pafpi.org/wp-content/uploads/2017/07/2017-PAFPI-Certificate-of-TAX-Exemption-745x1024.jpg

Women homebuyers who have availed Home Loans or joint Home Loan are eligible for tax benefits As per the old tax regime in a joint Home Loan between a man and a woman Home Loan Tax Benefits Know How to Get Income Tax Benefits on Your Home Loan FY 2023 24 Check Tax benefits under sections how to Claim

Joint Home loan Eligibility rules loan application Income tax benefits on Joint home loan wife husband spouse father Tax exemptions deductions Benefits of taking joint home loan Co owner and co The most significant need for tax exemption and joint house loans is that the loan must be carried out in the names of two people Naturally each individual s share of the joint

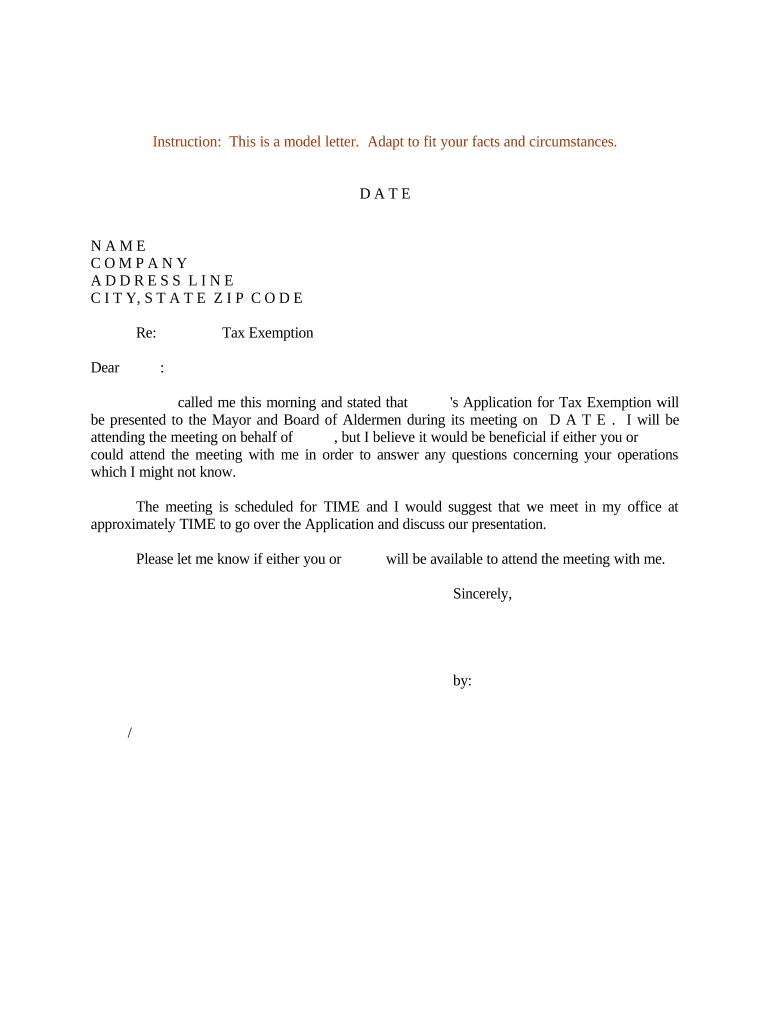

Affidavit Of Tax Exemption

https://imgv2-1-f.scribdassets.com/img/document/239250719/original/68e111ba5b/1627336409?v=1

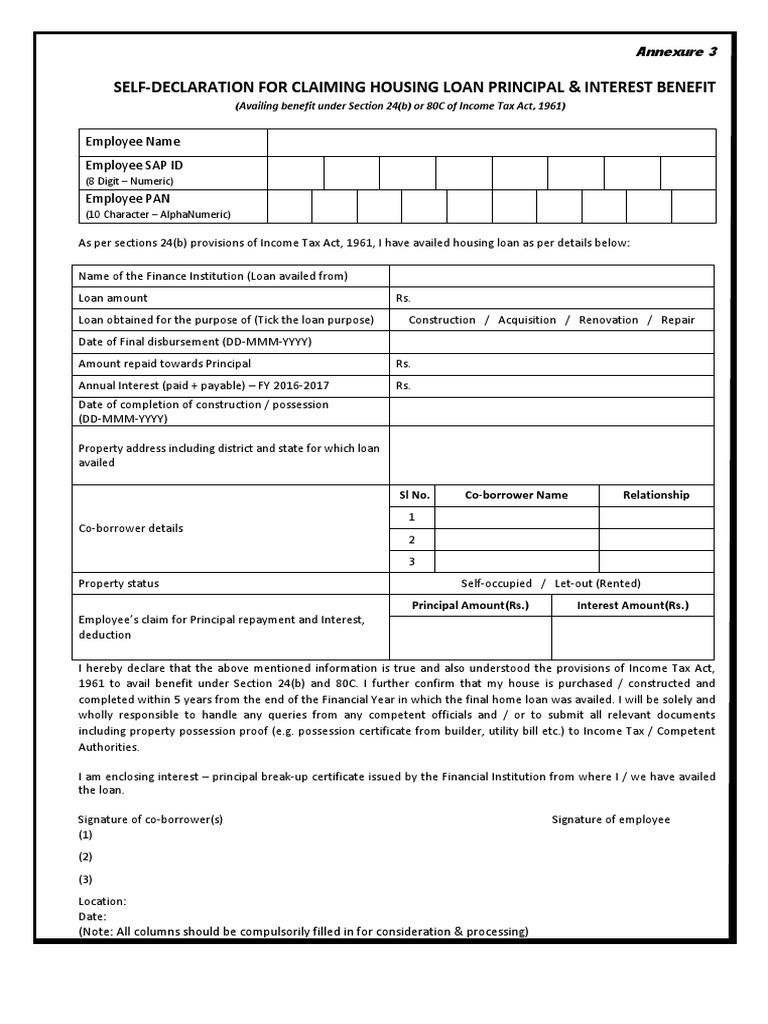

Self Declaration For Claiming Housing Loan Principal Interest Benefit

https://imgv2-2-f.scribdassets.com/img/document/558860084/original/8382a4f494/1672898190?v=1

https://cleartax.in/s/home-loan-tax-benefit

If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

https://www.vero.fi/en/individuals/tax-cards-and...

If you have borrowed money to buy residential property in order to rent it out you can deduct all the related interest expenses This is considered a loan for the

Understanding Income Tax Reliefs Rebates Deductions And Exemptions

Affidavit Of Tax Exemption

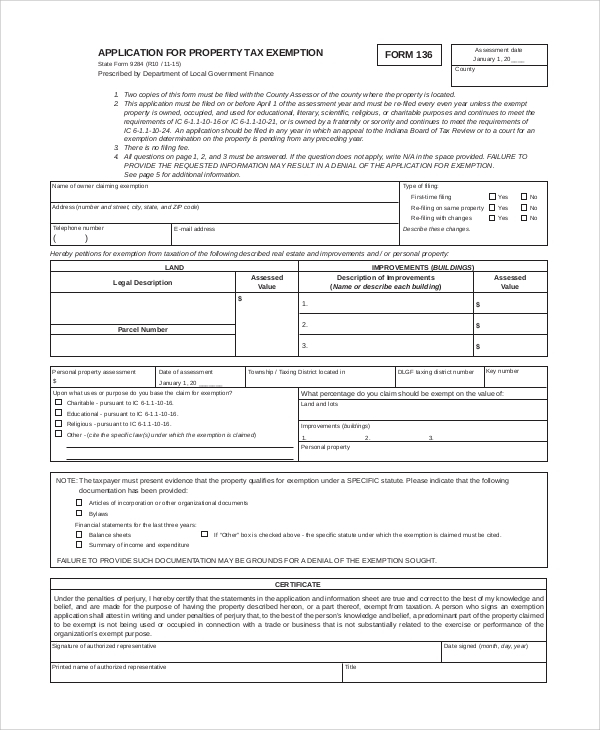

What Is A Tax Exemption Form ExemptForm

Housing Loans Joint Declaration Form For Housing Loan

Sample Home Loan Declaration Indemnity Bond PDF

Ncua Letter Exemption Form Fill Out And Sign Printable PDF Template

Ncua Letter Exemption Form Fill Out And Sign Printable PDF Template

Home Loan Tax Exemption Check Tax Benefits On Home Loan

Housing Loan Tax Exemption Revision In Fiscal 2022 PLAZA HOMES

Tax Exempt Donation Letter Sample Form Fill Out And Sign Printable

Tax Exemption On Joint Housing Loan - If a home loan is taken jointly each borrower can claim deduction on home loan interest up to Rs 2 lakh under Section 24 b and tax deduction on the principal repayment up to Rs 1 5 lakh under Section 80C