Tax Filing Fixed Deposits A tax saving fixed deposit FD account is a type of fixed deposit account that offers a tax deduction under Section 80C of the Income Tax Act 1961 Any investor

This article provides an overview of how to pay income tax on FD interest income earned from fixed deposits It outlines the process of calculating the taxable amount filing the income tax return and paying due taxes Accrual basis Paying tax every year In this method you pay tax on your interest income as it accrues to you i e every year You can find the interest earned

Tax Filing Fixed Deposits

Tax Filing Fixed Deposits

https://www.paisabazaar.com/wp-content/uploads/2017/10/Step-up-card-11.jpg

6 Important Things To Consider Before Investing In Fixed Deposits In India

https://staging.hdfcsales.com/blog/wp-content/uploads/2019/04/Things-to-Consider-Before-Investing-in-Fixed-Deposits-OPTION-4.jpg

SBI Tax Saving Fixed Deposit Scheme IndiaFilings

https://www.indiafilings.com/learn/wp-content/uploads/2019/03/SBI-Tax-Saving-Fixed-Deposit-Scheme.jpg

The principal component of Tax Saver FDs of up to Rs 1 5 lakhs each financial year would qualify for tax deduction under Section 80C However the interest Increase deduction amount u s 80TTB from Rs 50 000 for interest from savings bank account and fixed deposits Enhance deduction limit u s 80D of the I T Act

Consider investing in a tax saving fixed deposit In this article we provide an overview of the top options for tax saving fixed deposits including the benefits and What is a tax saving FD account As the name suggests a tax saving FD account is a type of FD account that provides a tax deduction under Section 80C of the Income Tax Act of 1961 By investing in a tax

Download Tax Filing Fixed Deposits

More picture related to Tax Filing Fixed Deposits

Fixed Deposit Interest Rate In Nigeria InvestSmall

https://www.investsmall.co/wp-content/uploads/2020/07/fixed-depot-scaled.jpg

Checkable Deposits InfoComm

https://www.infocomm.ky/wp-content/uploads/2020/09/1600284357.jpeg

Deposits

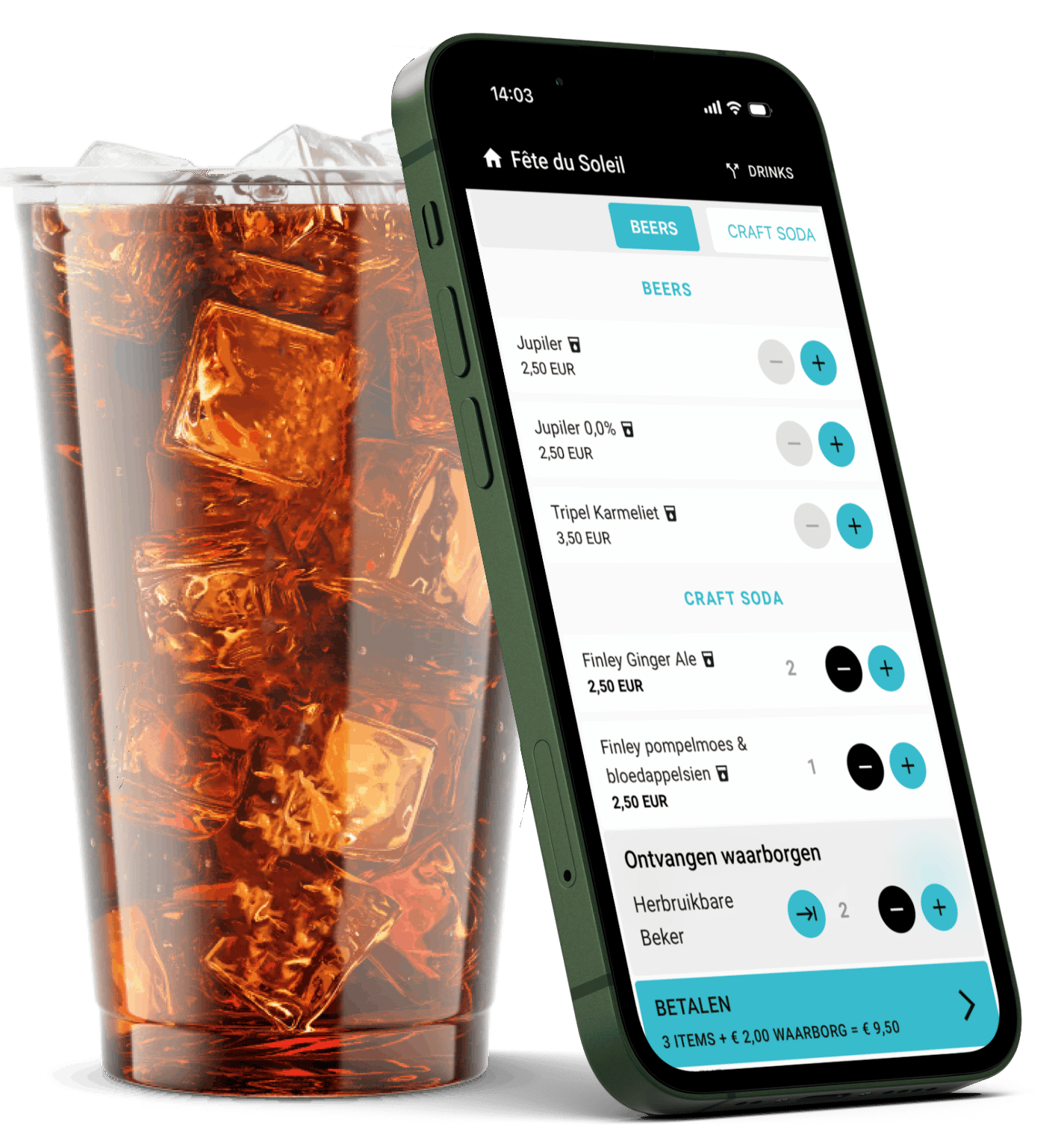

https://beyondordering.com/wp-content/uploads/2023/01/Deposits-e1673875762467.png

Investing in Fixed Deposits FDs is a popular choice among taxpayers due to its lower risk and guaranteed returns Banks offer FDs with fixed interest rates and there are even tax This includes tax saving Bank Fixed Deposits Government Small Savings Schemes etc Many of these entail lock ins of five or more years Many of these entail

Interest earned on fixed deposits is taxable as per the Income Tax Act 1961 If you have FD in one or more bank accounts you should aggregate FD interest Under income tax laws fixed deposit returns are taxed under the head Income from other sources Also Read What are the changes in the New Income Tax

Filing Taxes Deadline Is Approaching Skip The Paper Return This Year

https://www.gannett-cdn.com/-mm-/b10a309f3918ef8193b468174eae4528e462b2d9/c=0-109-2123-1303/local/-/media/2020/06/15/USATODAY/usatsports/tax-form-1040_gettyimages-624709906.jpg?width=2123&height=1194&fit=crop&format=pjpg&auto=webp

Free Of Charge Creative Commons Deposits Image Laptop 1

https://pix4free.org/assets/library/2021-08-01/originals/deposits.jpg

https://cleartax.in/s/tax-saving-fd-fixed-deposits

A tax saving fixed deposit FD account is a type of fixed deposit account that offers a tax deduction under Section 80C of the Income Tax Act 1961 Any investor

https://www.wishfin.com/fixed-deposits/inco…

This article provides an overview of how to pay income tax on FD interest income earned from fixed deposits It outlines the process of calculating the taxable amount filing the income tax return and paying due taxes

/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif)

Draht Verantwortlicher F r Das Sportspiel Vermuten States Of Jersey

Filing Taxes Deadline Is Approaching Skip The Paper Return This Year

Tax Saving Fixed Deposits What Are They How They Work StepUpMoney

Income Tax Return ITR Filing How To Calculate Your TDS On Fixed

How Do I Set Up Different Online Deposits For Individual Services

Fixed Deposits Term Deposit Accounts Business Sampath Bank PLC

Fixed Deposits Term Deposit Accounts Business Sampath Bank PLC

Avoid These Common Mistakes In Filing Income Tax Returns

Complete Rules Guide For Tax Calculation On Fixed Deposits GibaultOnline

Fixed Deposits 3 FD 7

Tax Filing Fixed Deposits - The principal component of Tax Saver FDs of up to Rs 1 5 lakhs each financial year would qualify for tax deduction under Section 80C However the interest