Tax Filing Income Limit Find out if you have to file a federal income tax return and why it may pay you to file even if you don t have to

Depending on your age filing status and dependents for the 2023 tax year the gross income threshold for filing taxes is between 12 950 and 28 700 If you have self employment income you re required to report See current federal tax brackets and rates based on your income and filing status You pay tax as a percentage of your income in layers called tax brackets As your income

Tax Filing Income Limit

Tax Filing Income Limit

https://detroitmi.gov/sites/detroitmi.localhost/files/2019-01/ETIC-Chart.jpg

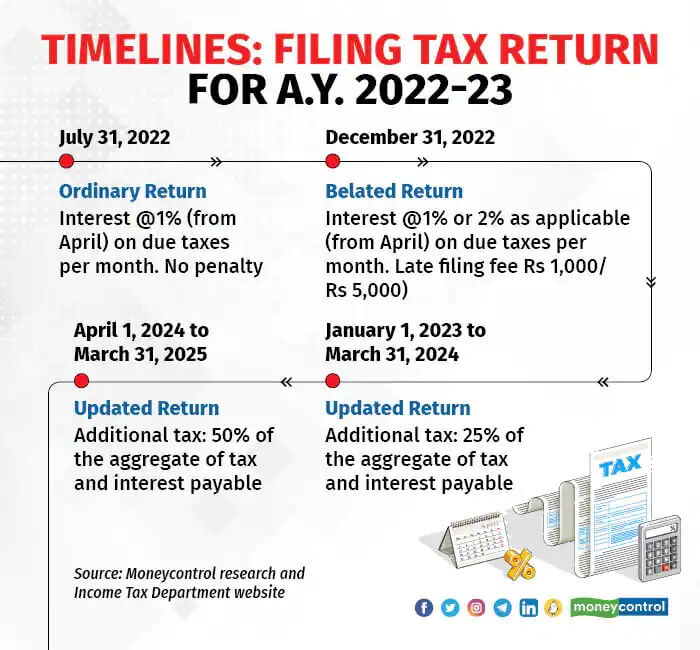

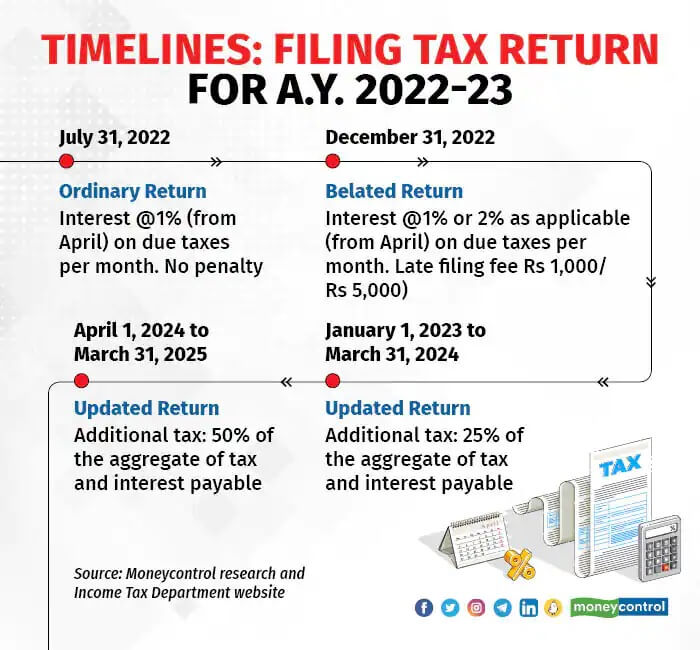

Filing Income Tax Returns After Deadline

http://bemoneyaware.com/wp-content/uploads/2022/07/timelines-filing-tax-return.jpg

.jpg?width=1667&name=tax graphic_2020 (1).jpg)

What To Expect When Filing Your Taxes This Year

https://www.churchillmortgage.com/hs-fs/hubfs/tax graphic_2020 (1).jpg?width=1667&name=tax graphic_2020 (1).jpg

You can maximize your refunds by understanding the income limit to file taxes and exploring available credits The income limit to file taxes varies but being aware of this threshold is crucial If your Taxpayers whose net investment income exceeds the IRS limit 200 000 for an individual taxpayer 250 000 married filing jointly or 125 000 married filing separately are subject to a 3 8 net

The seven federal income tax brackets for 2024 are 10 12 22 24 32 35 and 37 Your bracket depends on your taxable income and filing status Income thresholds for filing taxes When determining if you need to file a tax return your income and filing status are crucial Here s a breakdown of the income thresholds for

Download Tax Filing Income Limit

More picture related to Tax Filing Income Limit

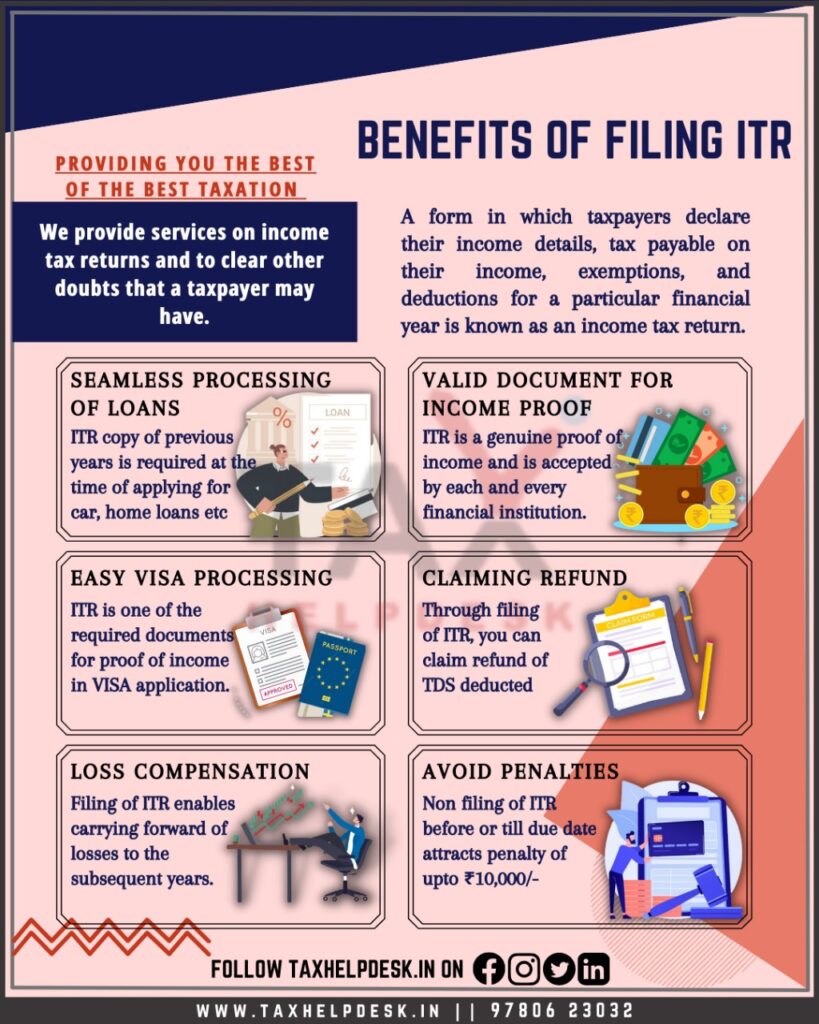

7 Reasons Why You File Your Income Tax Return In India TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/12/benefits-of-filing-income-tax-return-2-819x1024.jpeg

2023 IRS Limits The Numbers You Have Been Waiting For

https://districtcapitalmanagement.com/wp-content/uploads/2022/01/DCM-Tax-Bracket-2023.jpg

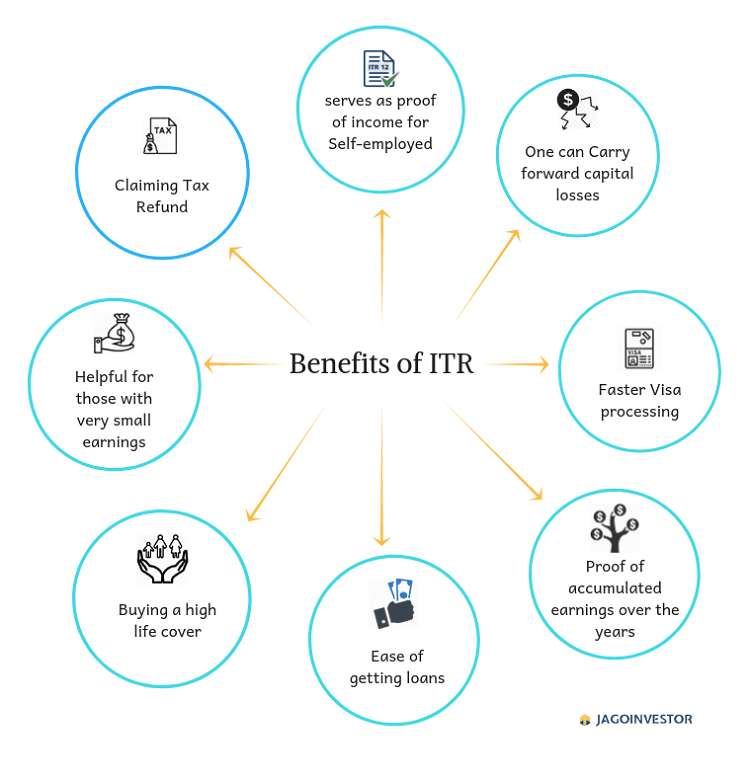

8 Benefits Of Filing ITR Even When Income Is Below Exemption Limit

https://www.jagoinvestor.com/wp-content/uploads/files/Benefits-of-ITR.png

In 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Tables 1 2021 Earned Income Tax Credit Parameters Filing Status No Children One Child Two Children Check if you re eligible to use Direct File the new free tax tool to file your federal taxes directly with the IRS

The income limit for the 2024 tax filing season is 79 000 Free File providers may add additional restrictions to services offered such as whether state AARP Tax Aide No income limits or age or membership restrictions Of course no post would be complete without including the free file options with income restrictions IRS

Income Tax Return Filing Online ITR Filing Eligibility Enterslice

https://enterslice.com/learning/wp-content/uploads/2020/12/Benefits-of-Filing-Income-Tax-Returns.png

Oct 19 IRS Here Are The New Income Tax Brackets For 2023

https://image.cnbcfm.com/api/v1/image/107136825-1666125851699-6clBX-marginal-tax-brackets-for-tax-year-2023-single-individuals_1.png?v=1666125859

https://www.irs.gov/individuals/check-if-you-need-to-file-a-tax-return

Find out if you have to file a federal income tax return and why it may pay you to file even if you don t have to

https://www.freshbooks.com/hub/taxes/…

Depending on your age filing status and dependents for the 2023 tax year the gross income threshold for filing taxes is between 12 950 and 28 700 If you have self employment income you re required to report

Income Tax Return Assessment Year 22 23 Taxzona

Income Tax Return Filing Online ITR Filing Eligibility Enterslice

IRS Announces Inflation Adjustments To 2022 Tax Brackets Foundation

Maximum Income Limit For Roth Ira INCOMUNTA

Income Tax Deductions Latest Updates File Income Tax Return Online

.png)

Income Tax Return Who Is Required Which Form Due Dates Fy 2022 23 Ay

.png)

Income Tax Return Who Is Required Which Form Due Dates Fy 2022 23 Ay

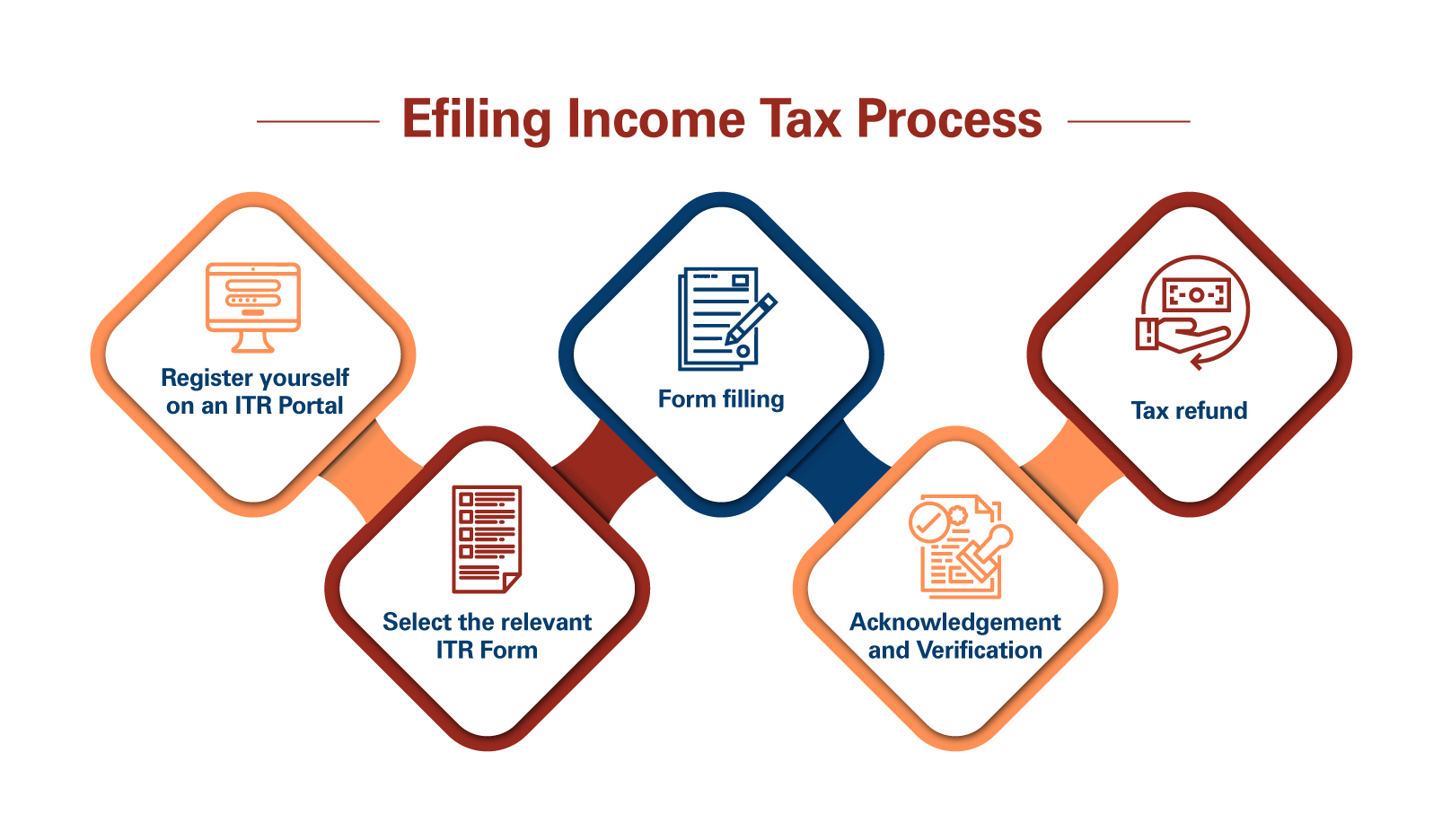

All About The Online E filing Income Tax Returns CA Rajput

Income Tax Return ITR Filing Aapka Consultant

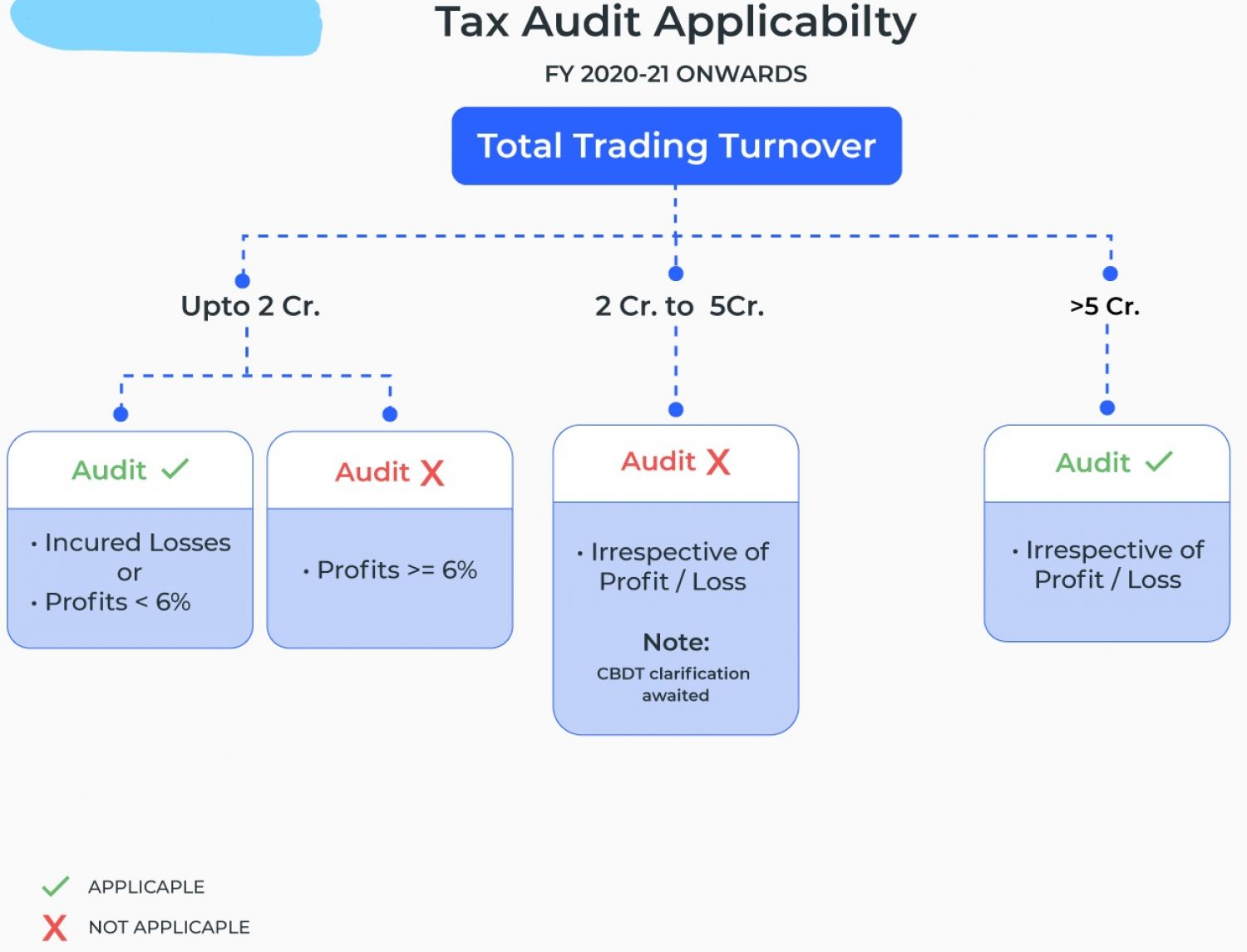

Income Tax Auditor Income Tax Audit Limit Income Tax Audit Applicability

Tax Filing Income Limit - You can maximize your refunds by understanding the income limit to file taxes and exploring available credits The income limit to file taxes varies but being aware of this threshold is crucial If your