Tax Filing Income Threshold 2023 Generally you need to file if Your income is over the filing requirement You have over 400 in net earnings from self employment side jobs or other independent work You

You probably have to file a tax return in 2024 if your gross income in 2023 was at least 13 850 as a single filer 27 700 if married The IRS launched the 2023 tax filing season and began accepting 2022 tax returns on January 23 The final day for on time filing is April 18 2023 unless you file a valid tax extension

Tax Filing Income Threshold 2023

Tax Filing Income Threshold 2023

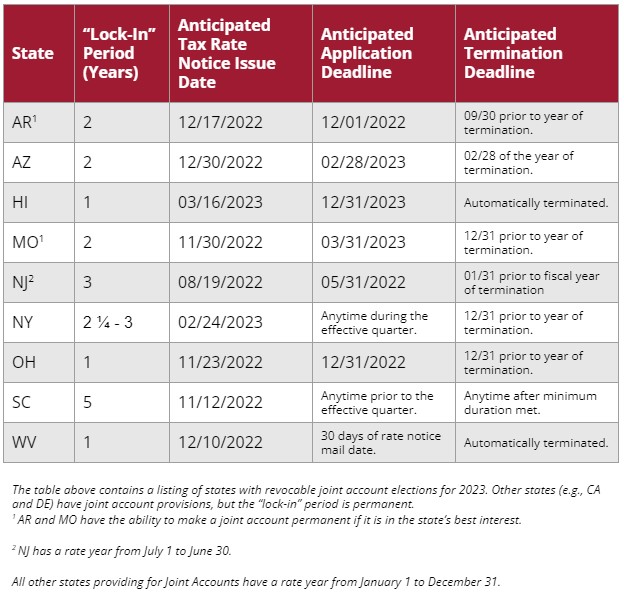

https://assets.equifax.com/wfs/workforce/blog/wfs-revocable-joint-account-options-for-2023.jpg

Federal Income Tax Filing Threshold 2023 Printable Forms Free Online

https://www.taxestalk.net/wp-content/uploads/a-reader-asks-im-dying-to-vote-in-the-u-s-prez-election-but-will.jpeg

Last Date To File Income Tax Return ITR For FY 2022 23 AY 2023 24

https://academy.tax4wealth.com/public/storage/uploads/1681121464-last-date-to-file-income-tax-return-itr-for-fy-2022-23-ay-2023-24.jpg

See current federal tax brackets and rates based on your income and filing status You pay tax as a percentage of your income in layers called tax brackets As your income The income limits for every 2023 tax bracket and all filers will be adjusted for inflation and will be as follows Table 1 There are seven federal income tax rates in 2023 10 percent 12 percent 22 percent

As part of its annual adjustments based on inflation the IRS increased the income thresholds for its tax brackets by thousands of dollars These changes are The IRS has released higher federal tax brackets for 2023 to adjust for inflation The standard deduction is increasing to 27 700 for married couples filing

Download Tax Filing Income Threshold 2023

More picture related to Tax Filing Income Threshold 2023

2023 Social Security Income Limit Social Security Intelligence 2023

http://www.socialsecurityintelligence.com/wp-content/uploads/2016/11/annual-update-charts-1024x576.jpg

2022 Tax Tables Married Filing Jointly Printable Form Templates And

https://images.axios.com/Ker5wAavgxDK0S7kOs1MY-vJkQM=/0x0:1280x720/1920x1080/2022/10/19/1666195709283.png

Due Date ITR Fiing For AY 2023 24 Is July 31st 2023 Academy Tax4wealth

https://academy.tax4wealth.com/public/storage/uploads/1686567553-file-income-tax-return-for-ay-2023-24-by-july-31st-2023.jpg

In 2023 the lowest income tax rate of 10 will apply to the first 11 000 a single filing individual earns This is up from a 10 275 cutoff in 2022 The top earning single filers will pay the highest rate of 37 on The Internal Revenue Service adjusts federal income tax brackets annually to account for inflation and the new brackets can help you estimate your tax obligation

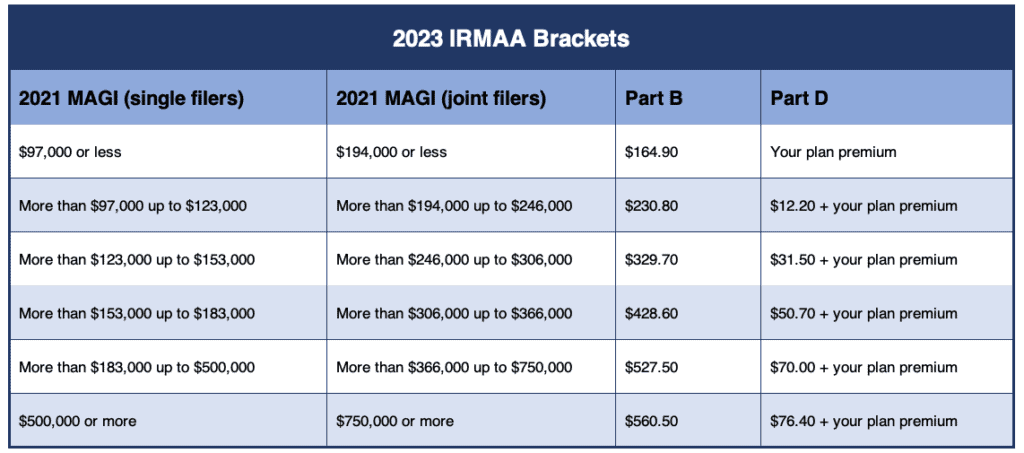

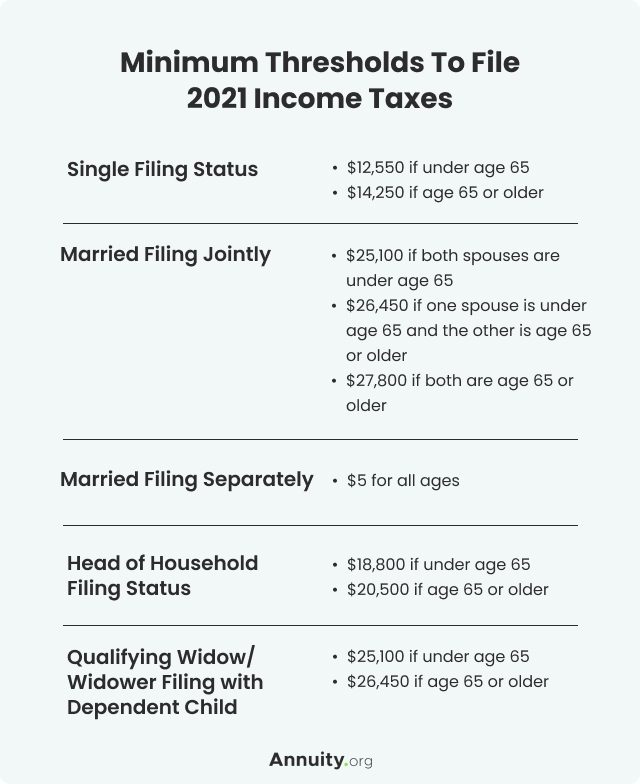

New income thresholds are in effect for 2023 and 2024 tax brackets Your effective tax rate is the total amount of tax you pay divided by your taxable income The Alternative Minimum Tax AMT exemption is 81 300 for single filers 126 500 for married filing jointly 63 250 for married filing separately and 28 400 for

2022 Us Tax Brackets Irs

https://imageio.forbes.com/specials-images/imageserve/618be39f8dd74be3a7c319d4/Married-Separately-tax-rates-2022/960x0.jpg?height=440&width=711&fit=bounds

IRS Here Are The New Income Tax Brackets For 2023 Bodybuilding

https://image.cnbcfm.com/api/v1/image/107136825-1666125851699-6clBX-marginal-tax-brackets-for-tax-year-2023-single-individuals_1.png?v=1666125859

https://www.irs.gov/individuals/check-if-you-need-to-file-a-tax-return

Generally you need to file if Your income is over the filing requirement You have over 400 in net earnings from self employment side jobs or other independent work You

https://www.nerdwallet.com/article/tax…

You probably have to file a tax return in 2024 if your gross income in 2023 was at least 13 850 as a single filer 27 700 if married

2022 Income Tax Brackets And The New Ideal Income

2022 Us Tax Brackets Irs

Income Tax Rates 2022 23 Scotland Ozella Runyon

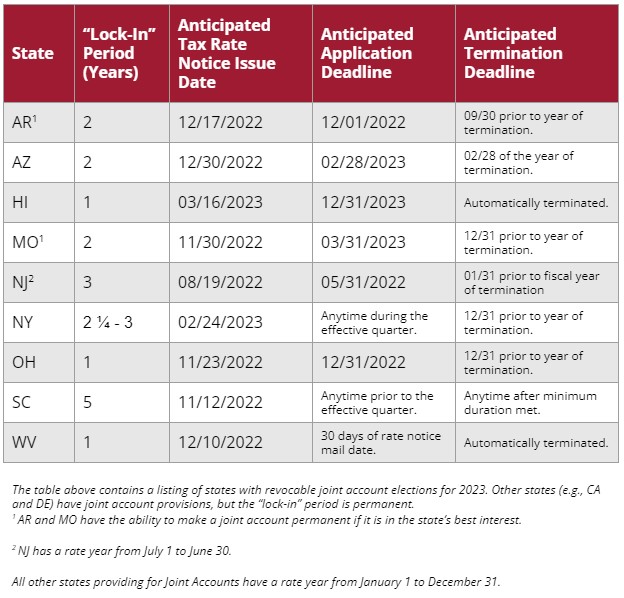

7 Reasons Why You File Your Income Tax Return In India TaxHelpdesk

Child Tax Credit

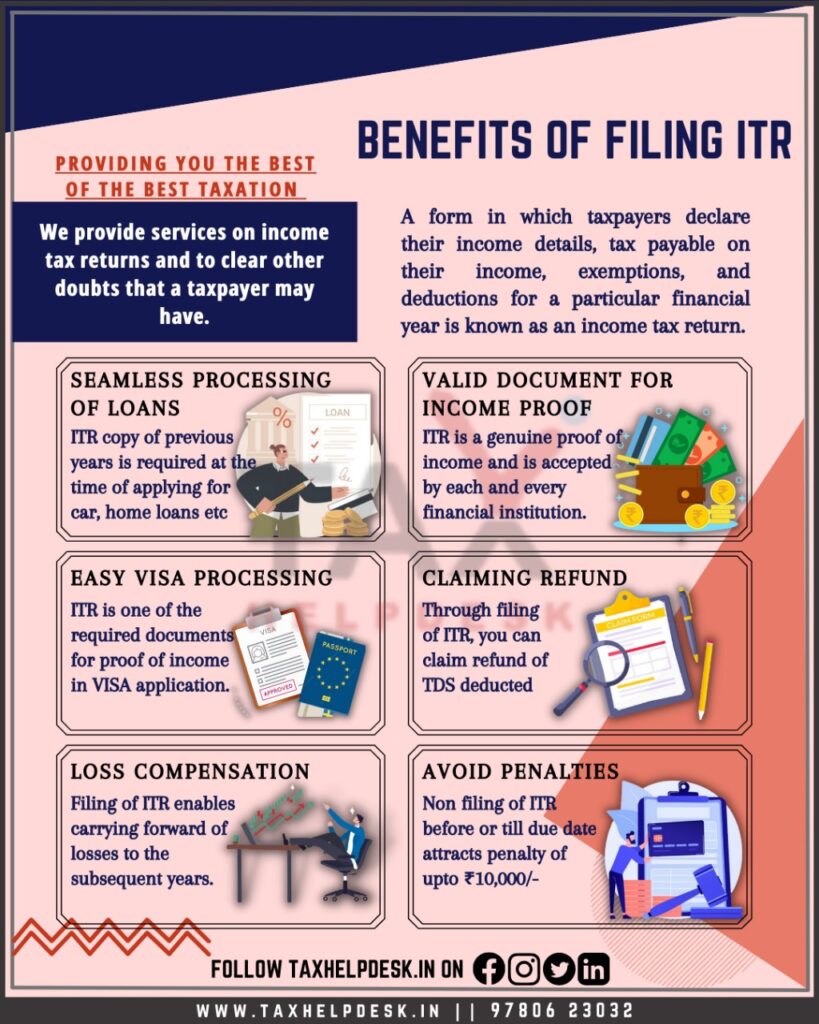

Irmaa 2023 c T nh Nh Th N o

Irmaa 2023 c T nh Nh Th N o

2022 Filing Taxes Guide Everything You Need To Know

Irs Tax Table 2022 Married Filing Jointly Latest News Update

2022 Us Tax Brackets Irs

Tax Filing Income Threshold 2023 - Let s say for the 2023 tax year filing for 2024 you earned a taxable income of 90 000 and you filed as Single Based on the tax brackets you ll fall under