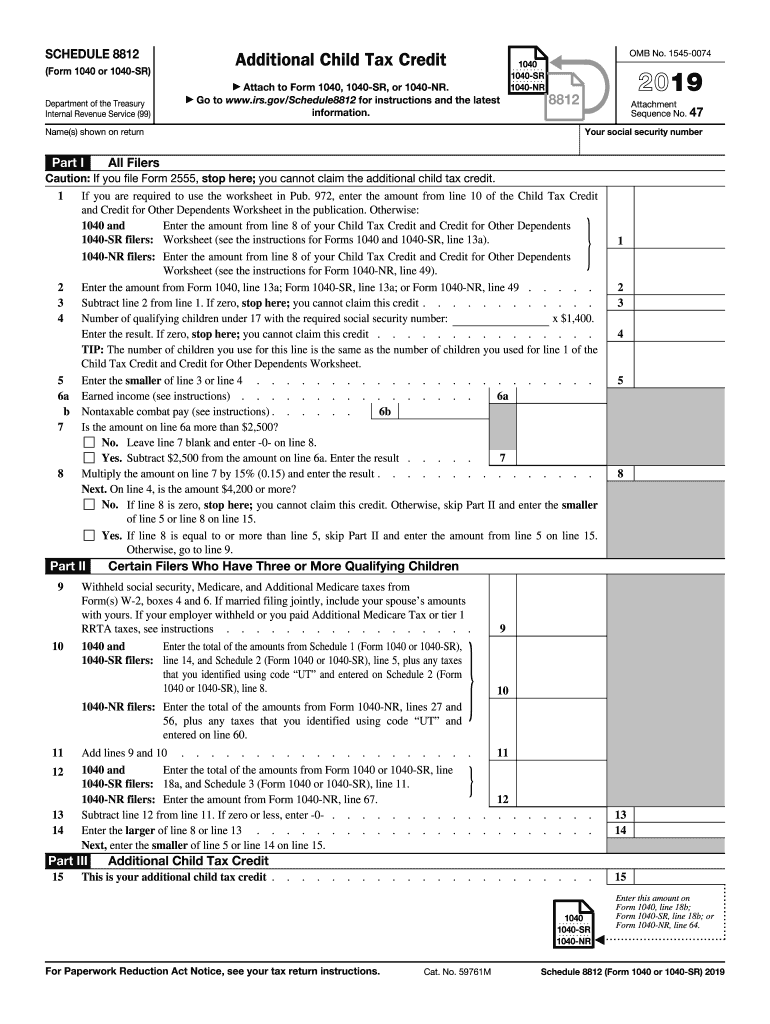

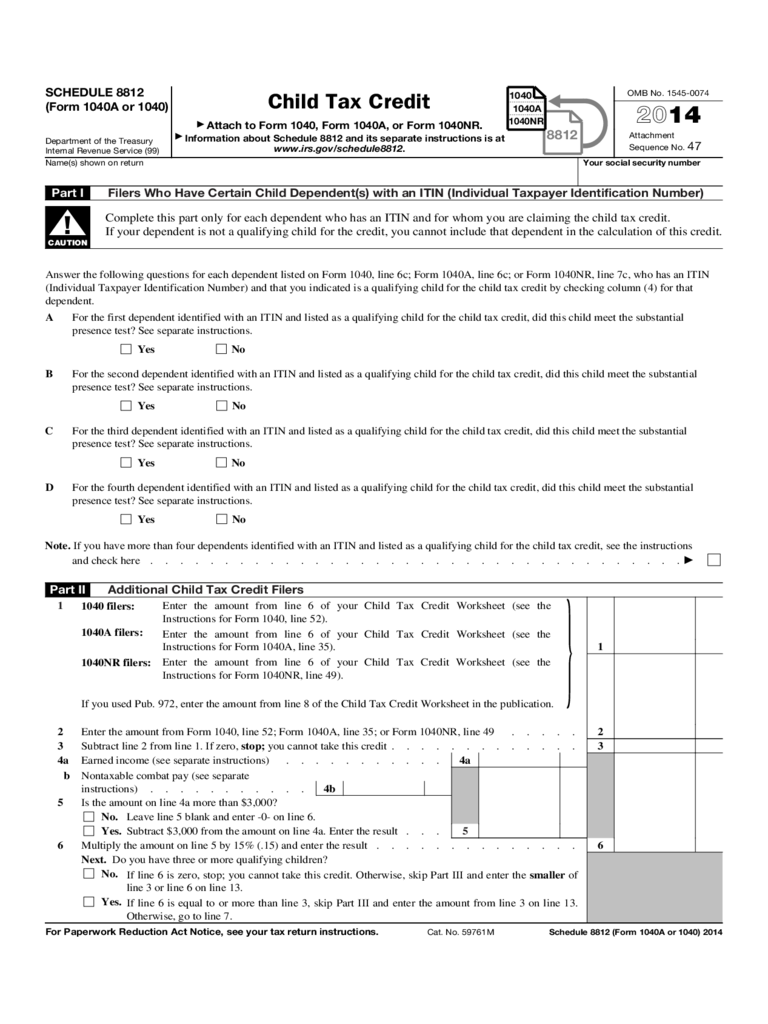

Tax Form Child Tax Credit Use Schedule 8812 Form 1040 to figure the additional child tax credit The additional child tax credit may give you a refund even if you do not owe any tax Use Schedule 8812 Form 1040 to figure your child tax credits to report advance child tax credit payments you received in 2021 and to figure any additional tax owed if you

Determining who may claim the child tax credit the additional child tax credit and the credit for other dependents as well as other tax benefits See the instructions and Pub 501 for details Purpose of Form If you are the custodial parent you can use this form to do the following Release a claim to exemption for your child The Child Tax Credit is a 2 000 per child tax benefit claimed by filing Form 1040 and attaching Schedule 8812 to the return To qualify for the credit the taxpayer s dependent must

Tax Form Child Tax Credit

Tax Form Child Tax Credit

https://handypdf.com/resources/formfile/images/fb/source_images/child-tax-credits-form-irs-d1.png

Live In N J You ll Pay More In Taxes Over A Lifetime Than Anywhere

https://www.nj.com/resizer/3002Ih90r6BDrXqjjIph_w4A_Ec=/700x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/GLZ6DCHYWZBQPLR6K7FIKPZCTI.png

Additional Tax Credit Carfare me 2019 2020

https://image.slidesharecdn.com/1273367/95/form-8812additional-child-tax-credit-1-728.jpg?cb=1239373125

What is Child Tax Credit The Child Tax Credit program can reduce the Federal tax you owe by 1 000 for each qualifying child under the age of 17 Important changes to the Child Tax Credit will help many families receive advance payments of the credit starting in For the 2024 tax year tax returns filed in 2025 the child tax credit will be worth 2 000 per qualifying child with 1 700 being potentially refundable through the additional

How to claim You can only make a claim for Child Tax Credit if you already get Working Tax Credit If you get Working Tax Credit To claim Child Tax Credit update your existing tax The Child Tax Credit CTC can reduce the amount of tax you owe by up to 2 000 per qualifying child If you end up owing less tax than the amount of the CTC you may be able to get a refund using the Additional Child Tax Credit ACTC

Download Tax Form Child Tax Credit

More picture related to Tax Form Child Tax Credit

Form 8812 Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/489/68/489068422/large.png

Monthly Child Tax Credit Payments Start Thursday Here s What To Know

https://www.courier-journal.com/gcdn/-mm-/a75b61cdf29c924e642301138dcb5b5b73c5e5d5/c=0-30-1998-1159/local/-/media/2018/01/31/Louisville/Louisville/636530052069237063-IMG-3796.jpg?width=1998&height=1129&fit=crop&format=pjpg&auto=webp

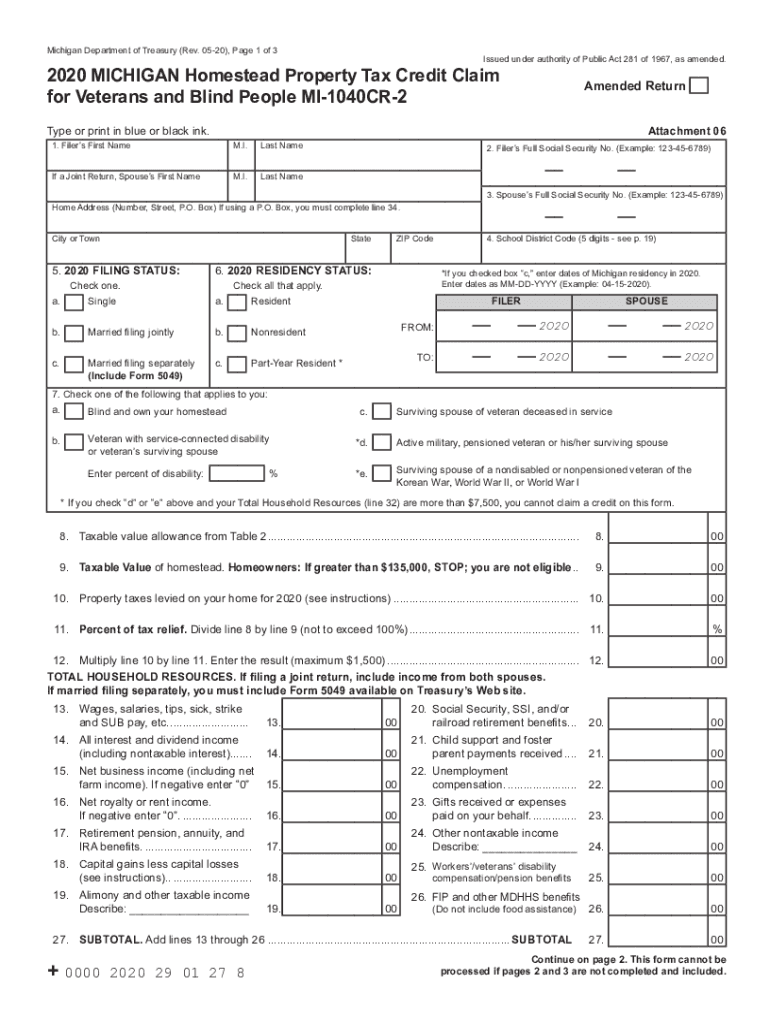

2020 Form MI DoT MI 1040CR 2 Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/540/440/540440856/large.png

File your taxes to get your full Child Tax Credit now through April 18 2022 Get help filing your taxes and find more information about the 2021 Child Tax Credit ChildTaxCredit gov In addition the American Rescue Plan extended the full Child Tax Credit permanently to Puerto Rico and the U S Territories The Child Tax Credit CTC is designed to give an income boost to the parents or guardians of children and other dependents This credit applies to dependents who are 17 or younger as of the last day of the The child tax credit is limited to 2 000 for every you have who s under age 17 1 600 being refundable for the 2023 tax year

The Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever and as of July 15 th most families are The Child Tax Credit is a federal support program for Americans who are raising kids Claiming the credit lowers your tax bill by up to 2 000 per qualifying child under age 17 who is under your care So if you owe 2 000 in federal income tax and qualify for a credit worth 2 000 your tax bill could be wiped out

2018 2022 Form Mi Mi 1040cr 7 Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/465/679/465679973/large.png

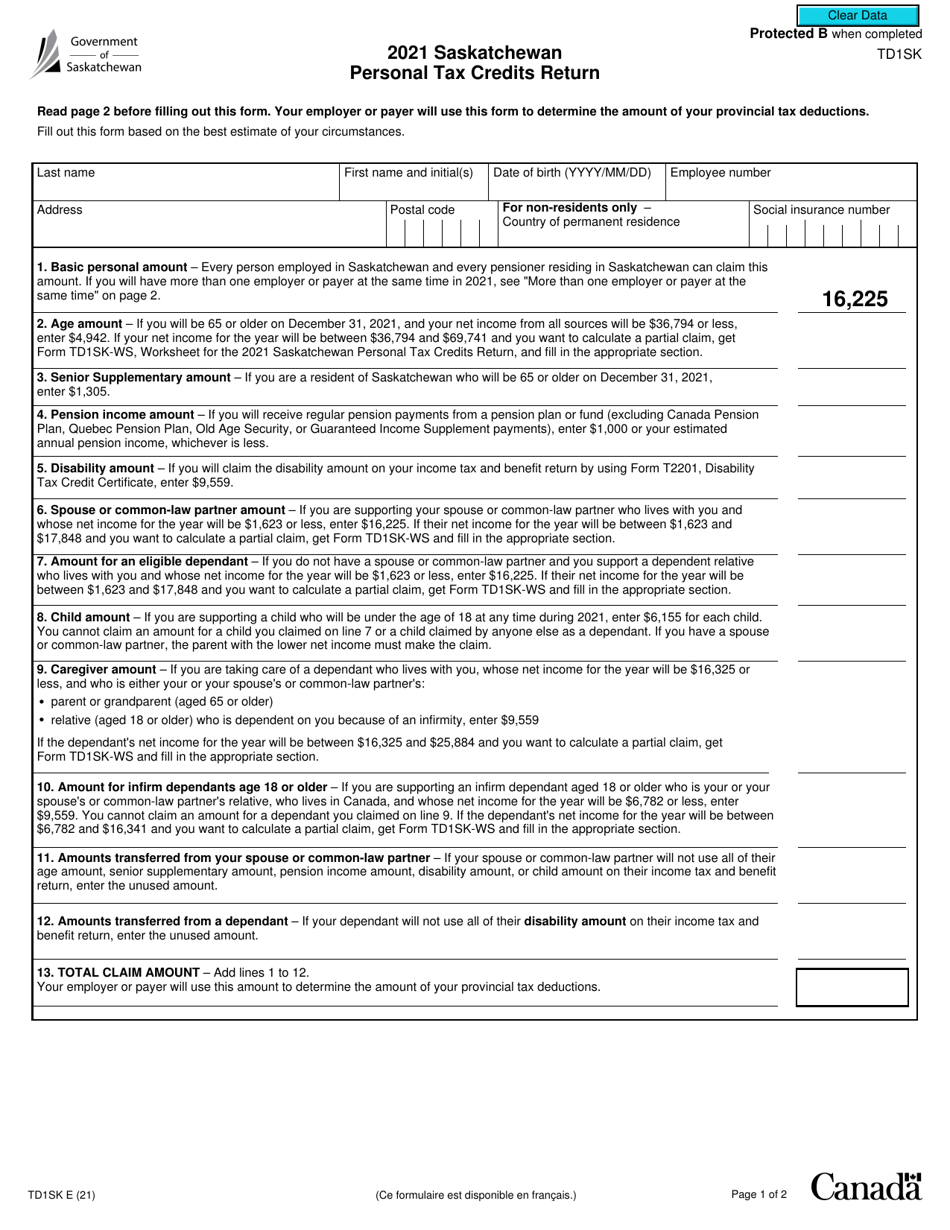

Form TD1SK Download Fillable PDF Or Fill Online Saskatchewan Personal

https://data.templateroller.com/pdf_docs_html/2119/21192/2119298/form-td1sk-saskatchewan-personal-tax-credits-return-canada_print_big.png

https://www.irs.gov/forms-pubs/about-schedule-8812-form-1040

Use Schedule 8812 Form 1040 to figure the additional child tax credit The additional child tax credit may give you a refund even if you do not owe any tax Use Schedule 8812 Form 1040 to figure your child tax credits to report advance child tax credit payments you received in 2021 and to figure any additional tax owed if you

https://www.irs.gov/pub/irs-pdf/f8332.pdf

Determining who may claim the child tax credit the additional child tax credit and the credit for other dependents as well as other tax benefits See the instructions and Pub 501 for details Purpose of Form If you are the custodial parent you can use this form to do the following Release a claim to exemption for your child

Child Tax Credit Don t Throw Away This Letter Before Filing Taxes WSET

2018 2022 Form Mi Mi 1040cr 7 Fill Online Printable Fillable Blank

How To Claim Child Benefit And Tax Credit Playandesign

Child Tax Credit

Publication 972 2018 Child Tax Credit And Credit For Other

Child Tax Credits 2021 And 2022 What To Do If You Didn t Get Your

Child Tax Credits 2021 And 2022 What To Do If You Didn t Get Your

The Expanded Child Tax Credit The Life Financial Group Inc

2022 Form IRS 1040 Schedule 8812 InstructionsFill Online Printable

23 Latest Child Tax Credit Worksheets Calculators Froms With

Tax Form Child Tax Credit - For the 2024 tax year tax returns filed in 2025 the child tax credit will be worth 2 000 per qualifying child with 1 700 being potentially refundable through the additional