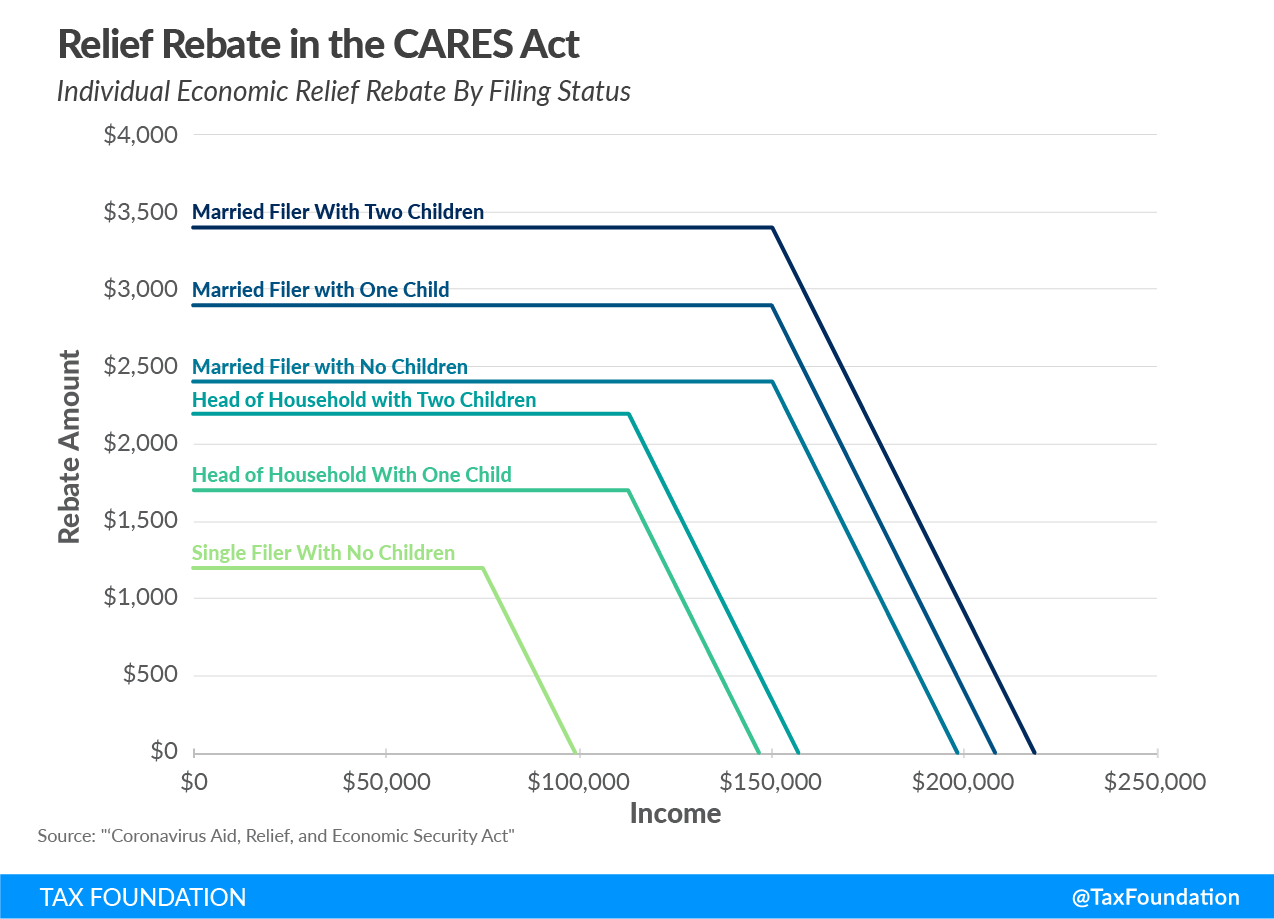

Tax Foundation Rebate Chart Web 24 juil 2023 nbsp 0183 32 We estimate the rebate would decrease federal revenue by about 301 billion in 2020 according to the Tax Foundation General Equilibrium Model House

Web 30 ao 251 t 2023 nbsp 0183 32 In tax year 2020 taxpayers claimed more than 159 million tax credits on their individual income tax returns worth a total of more than 277 billion That was an increase of 35 3 billion from tax year 2019 Web 18 mars 2020 nbsp 0183 32 Tracking the latest coronavirus tax developments during the coronavirus pandemic Stay informed on the latest coronavirus tax news and information

Tax Foundation Rebate Chart

Tax Foundation Rebate Chart

http://www.bls.gov/cex/chart_rebate.gif

Total Value Of Rates Rebates Granted By Selwyn District Council New

https://figure.nz/chart/E7XXux3iz8RIMPln-tL3syA6F5HI5V0Am/download

At Last The Truth About Stimulus Checks Headline Health

https://files.taxfoundation.org/20200406151352/TF-CARESActRebate.png

Web 30 mars 2020 nbsp 0183 32 The rebate phases out at 75 000 for singles 112 500 for heads of household and 150 000 for joint taxpayers at 5 percent per dollar of qualified income Web 24 juil 2023 nbsp 0183 32 Conventional Distributional Effect of Direct Payments in the Proposed Biden American Rescue Plan Income level Percent Change in After Tax Income Share of

Web 10 ao 251 t 2022 nbsp 0183 32 Using the Tax Foundation s General Equilibrium Model we estimate that the Inflation Reduction Act taxes would reduce long run economic output by about 0 2 percent and eliminate about 29 000 full time equivalent jobs in the United States Web The Tax Foundation accepts grants from foundations corporations and individuals It does not solicit or accept funds from government sources The Tax Foundation has earned a 3 out of 4 star financial rating and 4 out of

Download Tax Foundation Rebate Chart

More picture related to Tax Foundation Rebate Chart

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

https://1.bp.blogspot.com/-qh1AR8nq79Y/XSdFFK--RCI/AAAAAAAAJ88/-dhKKjr_UCce2k6QpcrxXwK6TKpllSbuACLcBGAs/s640/Tax%2BSlab%2Bfor%2BA.Y.%2B20120-21.jpg

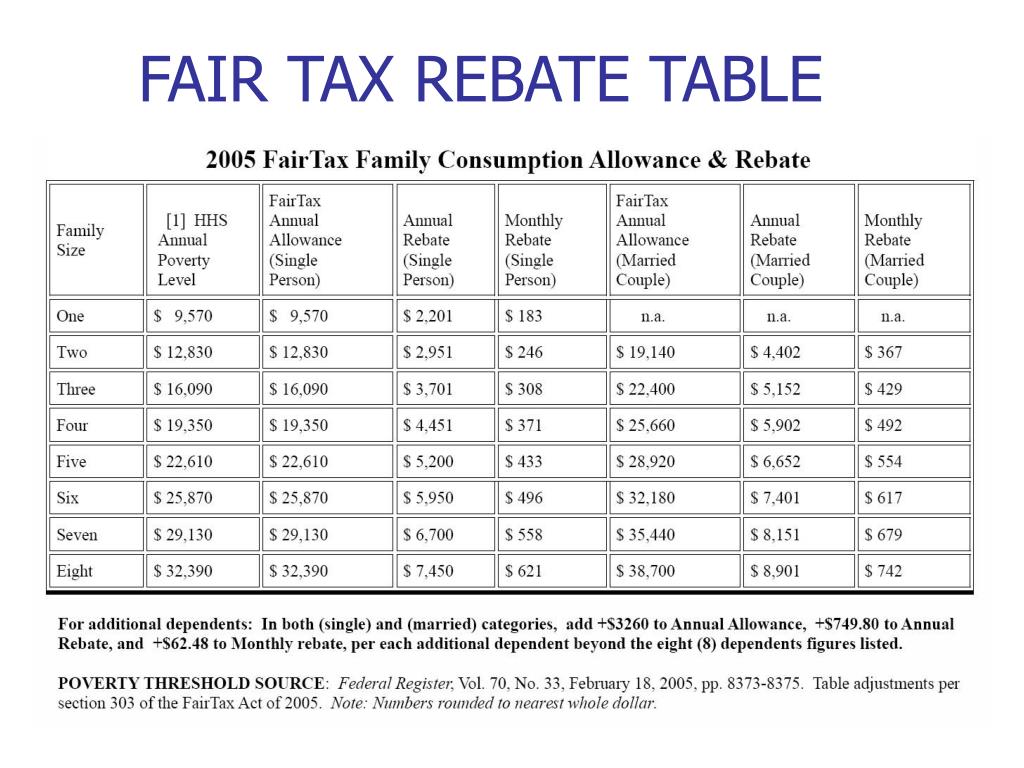

PPT The FairTax Plan HR 25 S25 PowerPoint Presentation Free Download

https://image.slideserve.com/966187/fair-tax-rebate-table-l.jpg

Income Tax Deductions List FY 2019 20

https://www.relakhs.com/wp-content/uploads/2019/02/Revised-Section-87A-Tax-Rebate-impact-on-Income-tax-liability-calculation-FY-2019-20-AY-2020-21.jpg

Web 2 d 233 c 2021 nbsp 0183 32 regime effective for tax years beginning after December 31 2022 including Reduce the deduction for GILTI to5 percent resulting in a tax rate of 15 percent Web 24 janv 2023 nbsp 0183 32 Download Data Forty four states levy a corporate income tax Rates range from 2 5 percent in North Carolina to 11 5 percent in New Jersey Four

Web Who We Are The Tax Foundation is the world s leading nonpartisan tax policy 501 c 3 nonprofit For over 80 years our mission has remained the same to improve lives through tax policies that lead to greater economic Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

Mientras Los Dem cratas Presionan Por Un impuesto A La Riqueza Aqu

https://mises-media.s3.amazonaws.com/styles/max_full/s3/Jun-25-19-Tax-Foundation-Chart.jpg?itok=TuGWTQEV

https://taxfoundation.org/blog/tax-rebate-during-economic-downturns

Web 24 juil 2023 nbsp 0183 32 We estimate the rebate would decrease federal revenue by about 301 billion in 2020 according to the Tax Foundation General Equilibrium Model House

https://taxfoundation.org

Web 30 ao 251 t 2023 nbsp 0183 32 In tax year 2020 taxpayers claimed more than 159 million tax credits on their individual income tax returns worth a total of more than 277 billion That was an increase of 35 3 billion from tax year 2019

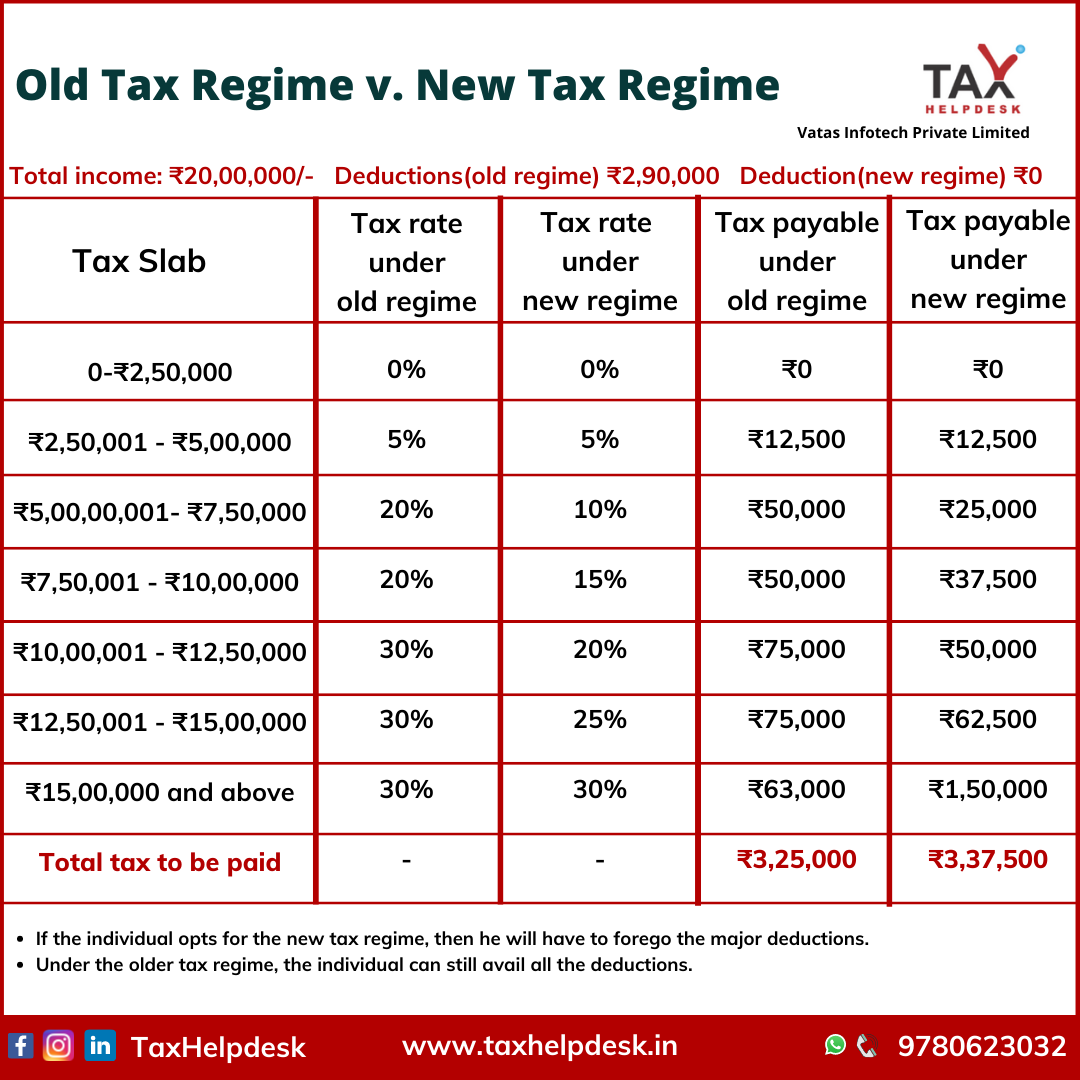

Income Tax Return Which Tax Regime Suits You Old Vs New

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Tax Tables 2021 Learngross

The CARES Act Who Will Get A Rebate And How Much American

House Ways And Means Coronavirus Relief Legislation Tax Foundation

Are You Making The Most Of Your Tax Refund For Employees Caring

Are You Making The Most Of Your Tax Refund For Employees Caring

Help Property Taxes Payment Program Halifax

2022 Tax Brackets JeanXyzander

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

Tax Foundation Rebate Chart - Web 10 ao 251 t 2022 nbsp 0183 32 Using the Tax Foundation s General Equilibrium Model we estimate that the Inflation Reduction Act taxes would reduce long run economic output by about 0 2 percent and eliminate about 29 000 full time equivalent jobs in the United States