Tax Free Allowance Northern Ireland Find information on a range of tax matters including tax refunds self assessment Income Tax HRMC savings and investments Includes Income Tax Inheritance Tax Capital Gains Tax

You still get your tax free allowance called your Personal Allowance which is 12 570 so you won t pay national insurance on anything before you earn that amount After Attendance Allowance is a tax free benefit You may get it if you are State Pension age or over and need help with personal care because you have a physical or mental disability

Tax Free Allowance Northern Ireland

Tax Free Allowance Northern Ireland

https://juruss.net/wp-content/uploads/2021/03/tax_uk.jpg

Petition Raise The Tax Free Allowance On Fuel Mileage For Business

https://assets.change.org/photos/5/dk/mq/qpDKmQTQYSczofk-1600x900-noPad.jpg?1648497090

Petition Increase Tax Free Allowance On Gift Cards To 500

https://assets.change.org/photos/2/of/qc/kiOFQccxwoYlkGz-1600x900-noPad.jpg?1595236212

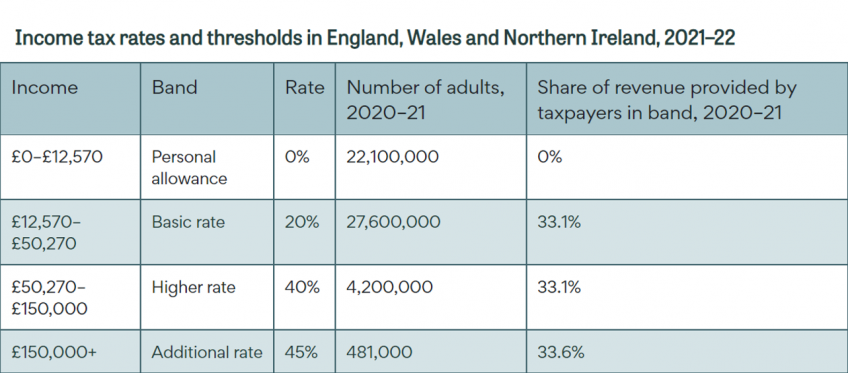

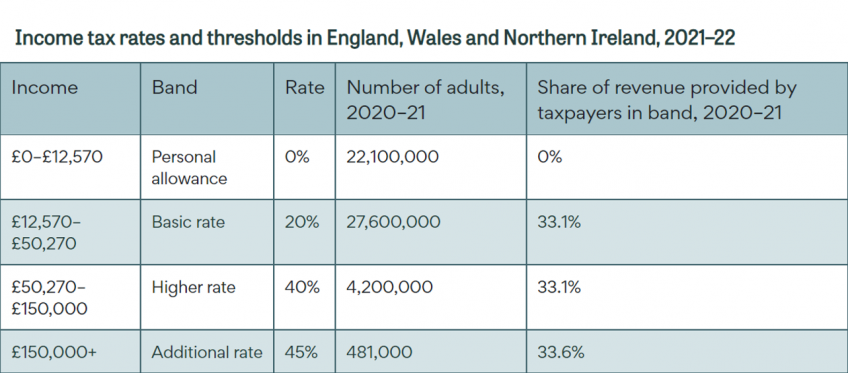

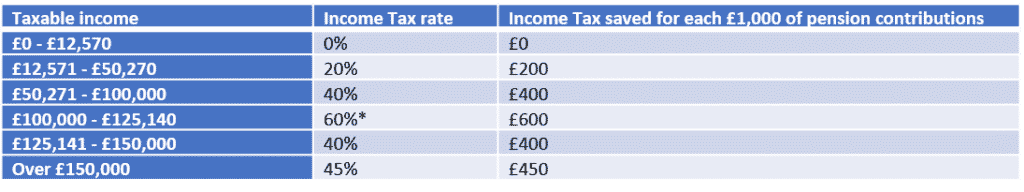

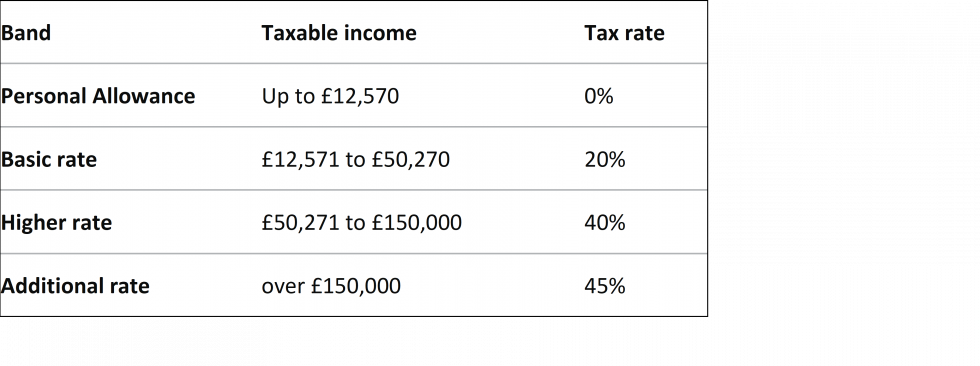

The following rates are for the 2024 to 2025 tax year and the previous 3 years England Northern Ireland and Wales For the 2024 25 tax year if you live in England Wales or Northern Ireland there are three marginal income tax bands which set the rate of tax you pay the 20 basic rate the 40 higher rate and the 45 additional rate

Your personal allowance is the amount of money you can earn in a tax year before you need to pay income tax The standard Personal Allowance for 2021 2022 is 12 570 More Most people in the UK have a 12 570 tax free personal allowance If you live in England Wales or Northern Ireland there are three income tax bands and rates above the tax free personal allowance that apply depending on your

Download Tax Free Allowance Northern Ireland

More picture related to Tax Free Allowance Northern Ireland

Tax free Allowance For Non UK Residents Could Go Wealth And Finance

https://www.wealthandfinance-news.com/wp-content/uploads/2018/06/40ac6aec-41e5-4c73-a20f-a0107a8265ce.jpg

How Does Maternity Allowance Work In Northern Ireland McPartland

https://hmcpartlandandsons.co.uk/wp-content/uploads/2020/11/Maternity-Allowance.png

6 Methods To Reduce Your Tax In Ireland Cronin Co

https://croninco.ie/wp-content/uploads/2022/10/Reduce-your-Tax-in-Ireland-min-1-1-scaled.jpg

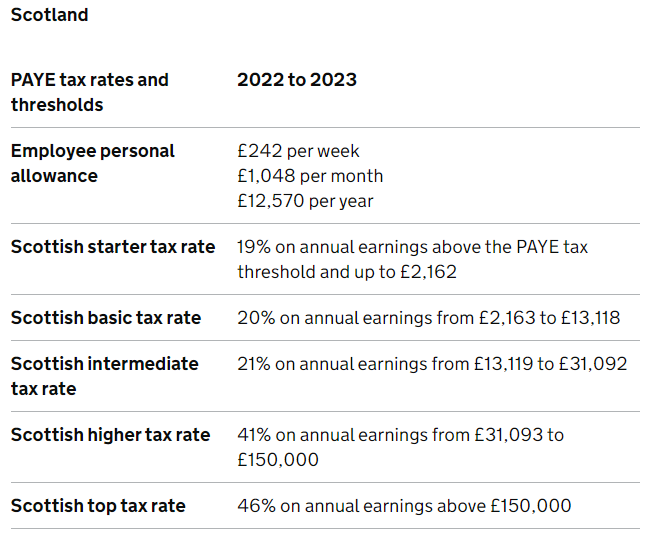

The Income tax rates and personal allowances in Northern Ireland are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below include the tax rates thresholds and allowances If you live in England Wales or Northern Ireland there are three income tax bands and rates above the tax free personal allowance the basic rate 20 the higher rate 40 and the additional rate 45

Learn about taxes in Northern Ireland including income tax corporate tax VAT and more Use our tax calculators to estimate your tax liability in Northern Ireland A personal allowance gives an individual an annual amount of income free from income tax Income above the personal allowances is subject to income tax The personal allowance will

Tax Free Allowances Income Tax Act IndiaFilings

https://www.indiafilings.com/learn/wp-content/uploads/2018/04/Tax-Free-Allowances.jpg

Cardata s Tax Free Auto Allowances

https://welcome.cardata.co/hubfs/Admin Total Mileage@2x-1.png

https://www.nidirect.gov.uk › articles › tax-information

Find information on a range of tax matters including tax refunds self assessment Income Tax HRMC savings and investments Includes Income Tax Inheritance Tax Capital Gains Tax

https://www.nutsaboutmoney.com › take-home-pay-calculator

You still get your tax free allowance called your Personal Allowance which is 12 570 so you won t pay national insurance on anything before you earn that amount After

What Is The Inheritance Threshold Rules And Allowances

Tax Free Allowances Income Tax Act IndiaFilings

The Charts That Show The Global Scale Of Britain s Inheritance Tax Shame

A Guide To Tax Codes Shape Payroll

2023 24 Free School Meals Uniform Allowance NI SMU

Income Tax Rates And Thresholds In England Wales And Northern Ireland

Income Tax Rates And Thresholds In England Wales And Northern Ireland

How Can Pension Contributions Reduce Your Tax Bill Origen Financial

A Simple Guide To Taxation In Australia

Your Guide To 2022 2023 Tax Allowances Magenta Financial Planning

Tax Free Allowance Northern Ireland - Most people in the UK have a 12 570 tax free personal allowance If you live in England Wales or Northern Ireland there are three income tax bands and rates above the tax free personal allowance that apply depending on your