Tax Free Dividend Allowance For 2022 23 Published 21 November 2022 Who is likely to be affected Individuals with taxable dividend income above 1 000 in the tax year 2023 to 2024 and above 500 from the tax year 2024 to 2025 General

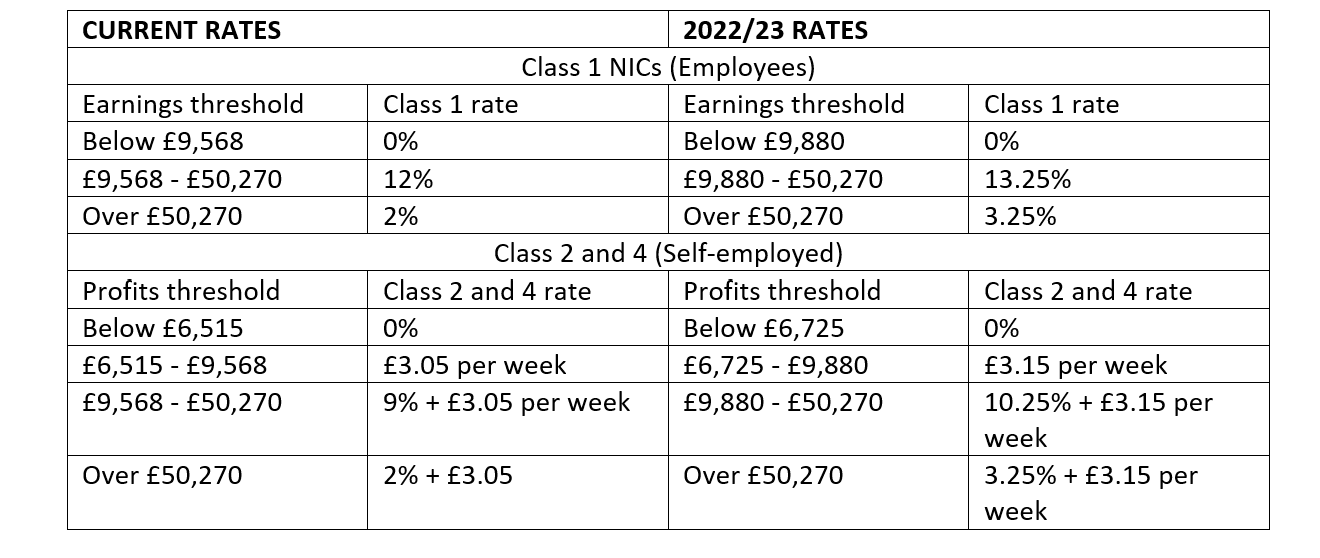

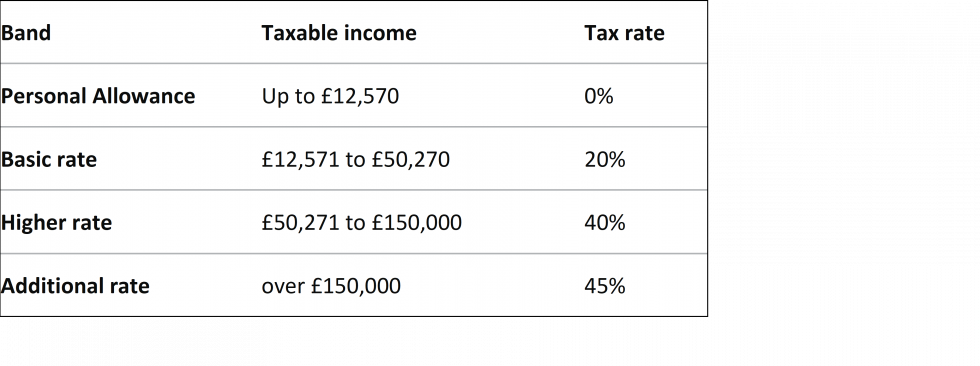

Income Tax Reducing the Dividend Allowance HTML Details This measure reduces the tax free allowance for dividend income the dividend allowance from 2 000 to 1 000 from 6 The tax free dividend allowance for the 2022 23 tax year is 2 000 Dividend income is subject to tax above the tax free dividend allowance The dividend tax rate varies depending on your tax band Tax rates for the 2023 24 tax year will merge dividend income tax rates with income tax rates

Tax Free Dividend Allowance For 2022 23

Tax Free Dividend Allowance For 2022 23

https://media.product.which.co.uk/prod/images/original/gm-4db67e3a-8b28-4439-86bb-6feb026a6f03-council-tax-claims-june-2020.jpeg

EPF Dividend Declaration And Withdrawal Allowance For 2022 Guyub

https://www.guyub.co/wp-content/uploads/2022/03/EPF-dividend-declaration-and-withdrawal-allowance-for-2022-scaled.jpg

How Much Is The Tax Free Dividend Allowance In 2024 25

https://www.itcontracting.com/wp-content/uploads/2017/11/dividend-allowance-2018.jpg

For the 2022 23 tax year the dividend tax free allowance is 2 000 This means that you can receive income of up to 2 000 from shares and some equity based collective investment funds without paying any tax Dividend allowance Dividends have their own tax free allowance the dividend allowance All taxpayers are entitled to a dividend allowance regardless of the rate at which they pay tax The dividend allowance is available in addition to the personal allowance It is set at 2 000 for 2022 23

In the 2024 25 tax year you won t need to pay any tax on the first 500 of dividend income you receive This is called the tax free dividend allowance The allowance was cut from 1 000 in the 2023 24 tax year and was 5 000 as recently as The dividend allowance for the fiscal year 2022 23 remains unchanged from the previous year It stands at 2 000 meaning individuals can receive up to 2 000 in dividends tax free However it is crucial to stay updated with any future changes or adjustments that may be announced by the government

Download Tax Free Dividend Allowance For 2022 23

More picture related to Tax Free Dividend Allowance For 2022 23

Dividend Allowance And Tax Rates

https://www.pattersonhallaccountants.co.uk/wp-content/uploads/2022/11/Dividend-Allowance-1024x576.jpg

Tax Changes You Need To Know In 2022 Shenward

https://shenward.com/wp-content/uploads/2022/02/Screenshot-2022-02-03-075620.png

What Is The Tax Free Dividends Allowance

https://realbusinessda.s3.eu-west-2.amazonaws.com/wp-content/uploads/2023/12/21075902/tax-free-dividend-allowance.png

But how do these rates apply in reality Well that largely depends on your personal income allowance and how it s used in conjunction with your dividends For the 2022 23 tax year personal allowance is 12 570 this means an individual can earn up to 12 570 tax free within the current tax year Get the newsletter What are the dividend tax rates for 2023 24 and 2024 25 Above the dividend tax free allowance you pay dividend tax based on the rate you pay on your other income known as your tax band So for 2023 24 and 2024 25 you ll pay unchanged from 2022 23 Basic rate taxpayers pay 8 75 on dividends

UK dividend tax rates for the 2022 23 tax year The tax free dividend allowance for this tax year 2022 23 is 2 000 You only have to pay tax on dividends above that amount Once you exceed this allowance and your personal income tax allowance 12 570 dividends you receive will be taxed The tax free dividend allowance also known as the rate band aims to ease the tax burden on small investors It s designed to be tax efficient for basic and higher rate taxpayers This allowance applies individually allowing couples to combine their allowances for tax savings

Understanding Your Tax Free Dividend Allowance 2022 23

https://www.gaffneyzoppi.com/_next/image?url=https:%2F%2Fcms.gaffneyzoppi.com%2Fwp-content%2Fuploads%2F2023%2F09%2Ftax-free-dividend-allowance-202223.jpg&w=1920&q=75

The Challenges For Entrepreneurs Under The New Tax Rules

https://uploads-ssl.webflow.com/614319dc0f4ef132363f9dfe/6418210e92ce461b2e85e142_hmrc-large.jpg

https://www.gov.uk/.../income-tax-reducing-the-dividend-allowance

Published 21 November 2022 Who is likely to be affected Individuals with taxable dividend income above 1 000 in the tax year 2023 to 2024 and above 500 from the tax year 2024 to 2025 General

https://www.gov.uk/government/publications/...

Income Tax Reducing the Dividend Allowance HTML Details This measure reduces the tax free allowance for dividend income the dividend allowance from 2 000 to 1 000 from 6

Dividend Certificate Template Goselfemployed co

Understanding Your Tax Free Dividend Allowance 2022 23

Tax Free Dividend Allowance Personal Tax Planning

The Tax Free Dividend Allowance Is Worth 2 000 Per Year In The 2022

Your Guide To 2022 2023 Tax Allowances Magenta Financial Planning

Budget 2017 Tax Free Dividend Allowance Slashed From 5k To 2k

Budget 2017 Tax Free Dividend Allowance Slashed From 5k To 2k

Speculation Over Jeremy Hunt Cutting Tax Free Dividend Allowance

Tax Free Dividend Allowance Save More On Dividends

Dividend Tax Increase From 6 April 2022 Prime Numbers

Tax Free Dividend Allowance For 2022 23 - 3 Apply to dividend income received above the 5 000 tax free Dividend Allowance the new Dividend Allowance means that individuals will not have to pay tax on the first 2020 21 2021 22 2022 23 0 N A 0 1 2 1 50 130 2 2