Tax Free Redundancy Payments Redundancy pay is treated differently to income and up to 30 000 of it is tax free But some other parts of your redundancy package such as holiday pay and pay in lieu of

Redundancy payments are a type of employment termination payment ETP Your genuine redundancy payment is tax free up to a limit depending on your If employees are facing redundancy or considering voluntary redundancy they need to know exactly how much money they will receive within their redundancy payments

Tax Free Redundancy Payments

Tax Free Redundancy Payments

https://www.davisgrant.co.uk/wp-content/uploads/2020/06/redundancies-blog-featured-image-880x360.jpg

Redundancy Notice Sample Template Word PDF

https://www.wonder.legal/Les_thumbnails/redundancy-notice.png

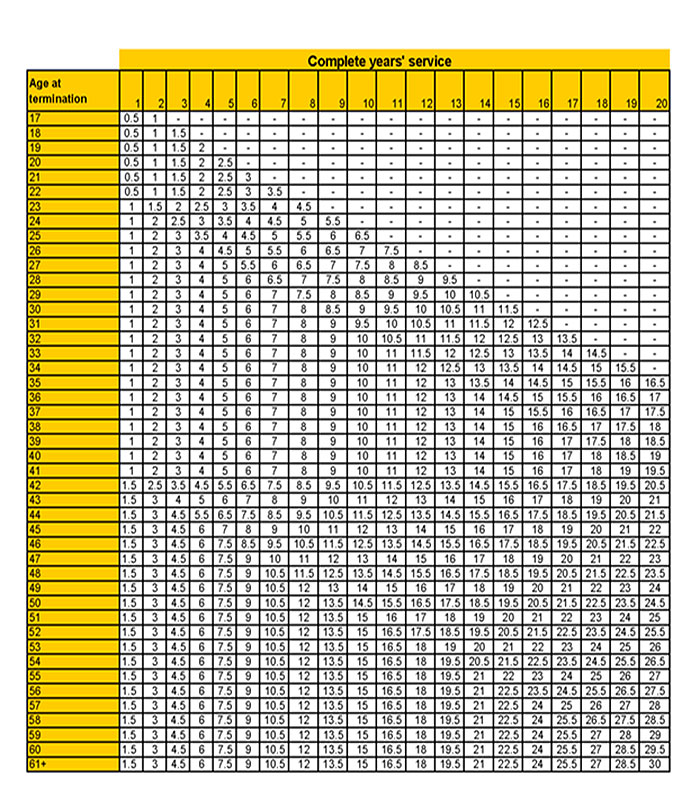

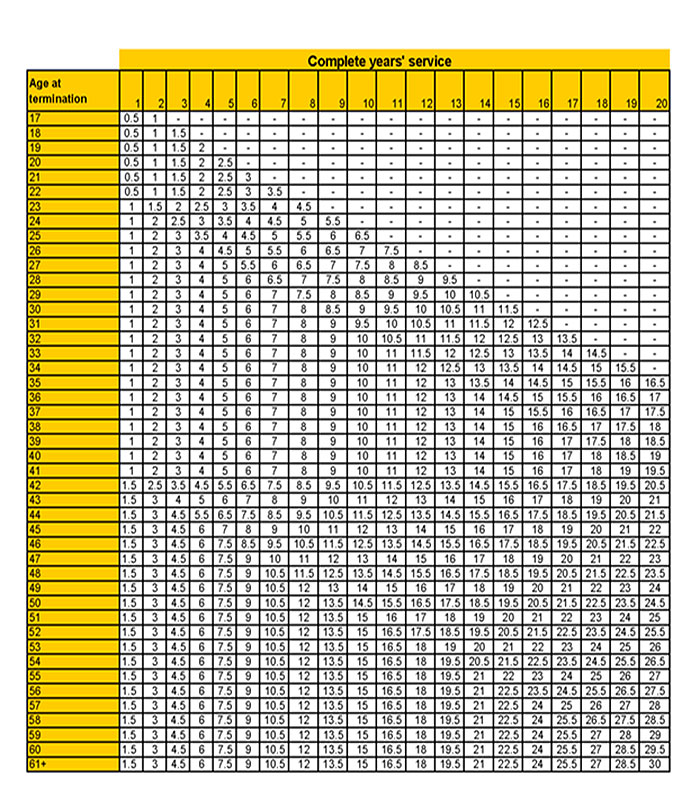

Redundancy Pay Calculations

https://select.org.uk/images/COVID-19/IMAGE-Redundancy-Calculation-Table-e1593768389477-832x1024.jpg

Mutual agreement procedure The new decision provides a detailed explanation of the taxation of redundancy payments in a cross border situation The The tax free part of a genuine redundancy payment or an early retirement scheme payment The amount up to the ETP cap amount will be taxed at a concessional rate

A new draft ATO ruling clarifies when a genuine redundancy payment can be tax free up to the relevant limit The limit is worked out under section 83 170 of the Income Tax Genuine redundancy and early retirement scheme payments are tax free up to a limit based on the employee s years of service The tax free amount is not part of

Download Tax Free Redundancy Payments

More picture related to Tax Free Redundancy Payments

What Tax Do I Pay On Redundancy Payments CruseBurke

https://cruseburke.co.uk/wp-content/uploads/2022/12/tax-on-redundancy-payments-768x509.png

Tax On Redundancy Payments

https://media.licdn.com/dms/image/C4E12AQEFQCDwhmYSkg/article-cover_image-shrink_600_2000/0/1530029252368?e=2147483647&v=beta&t=XyUFbv4quPN_NezA4_tfWX8fBQxZAnsNRkJ3TnC3Jb4

HOW REDUNDANCY PAYMENTS ARE TAXED

https://s3.studylib.net/store/data/008235229_1-43bc4650635de2de8c53ef7caa1696a0-768x994.png

One easy way to pay less tax on severance pay is to contribute the money to a tax deferred account such as an individual retirement account IRA The contribution Up to 30 000 of redundancy pay is tax free You may not be eligible for statutory redundancy pay if your employer offers you a suitable alternative job and you turn it

Employers can always pay the first 30 000 of any severance payment tax free Busted The general position is that it is only the first 30 000 of any non contractual payment The following payments are tax free The statutory redundancy lump sum A payment made on account of death injury or disability subject to a maximum lifetime tax free limit of

Letter Of Termination Of Employment Redundancy

https://www.wonder.legal/Les_thumbnails/letter-of-termination-of-employment-redundancy.png

Suspension Of Employer s Obligation On Redundancy Payments Lifted

https://www.crowe.com/ie/-/media/Crowe/Firms/Europe/ie/Crowe-Ireland/Images/Posts/Redundancy-payments.jpg?h=521&w=750&la=en-GB&modified=20211005083413&hash=549BAB541337142C297F7FD1003D1A24CC78C7A6

https://www.moneyhelper.org.uk/en/work/losing-your...

Redundancy pay is treated differently to income and up to 30 000 of it is tax free But some other parts of your redundancy package such as holiday pay and pay in lieu of

https://www.ato.gov.au/.../redundancy-payments

Redundancy payments are a type of employment termination payment ETP Your genuine redundancy payment is tax free up to a limit depending on your

What Tax Do I Pay On Redundancy Payments Accounting Firms

Letter Of Termination Of Employment Redundancy

Redundancy Payment What To Do With It

Is My Redundancy Payment Tax Free

How To Accept Payments Online STICPAY

Pay Tax Redundancy Pay Tax Calculator Uk

Pay Tax Redundancy Pay Tax Calculator Uk

Redundancy Payments PDF Pension Tax Exemption

Redundancy Letter Template Uk Why Is Redundancy Letter Template Uk So

How Redundancy Payments Will Be Affected By Tax FTAdviser

Tax Free Redundancy Payments - A new draft ATO ruling clarifies when a genuine redundancy payment can be tax free up to the relevant limit The limit is worked out under section 83 170 of the Income Tax