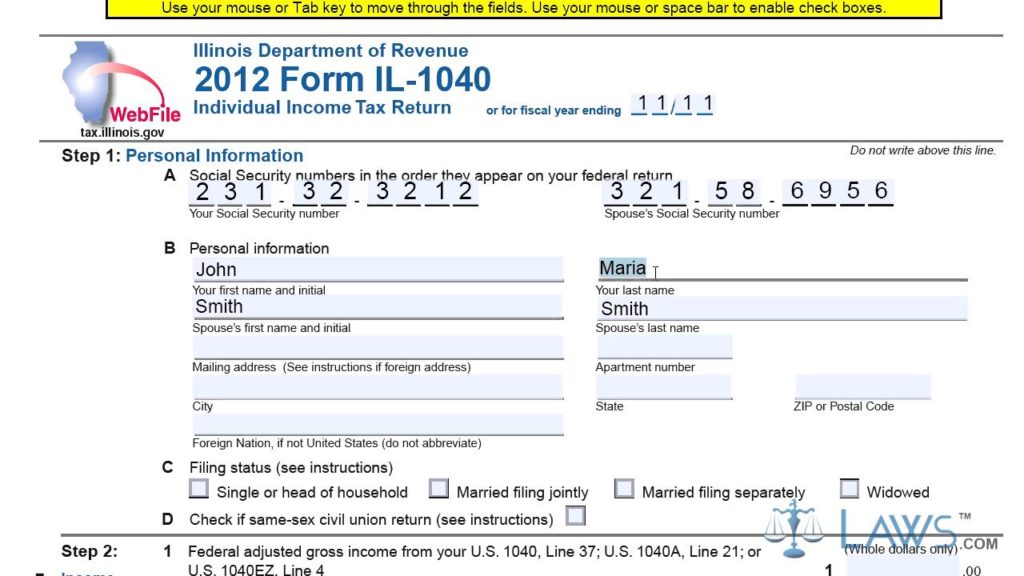

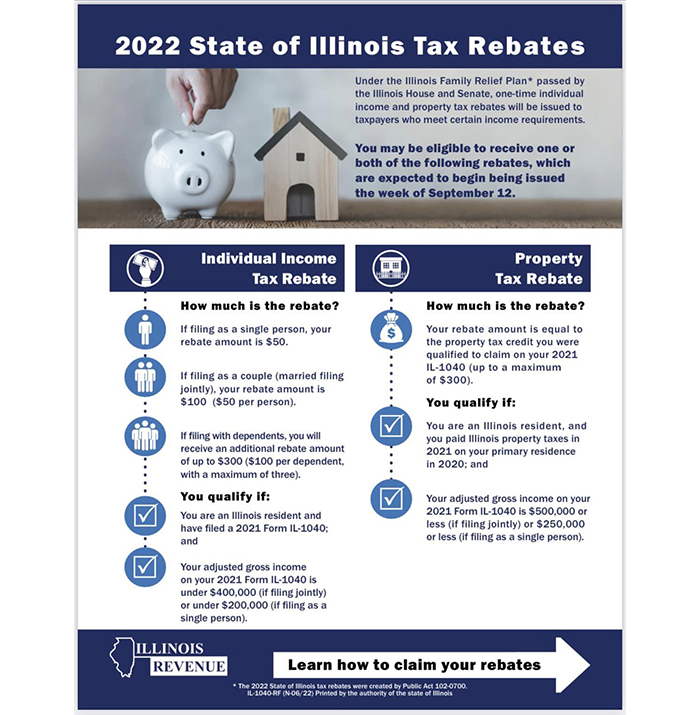

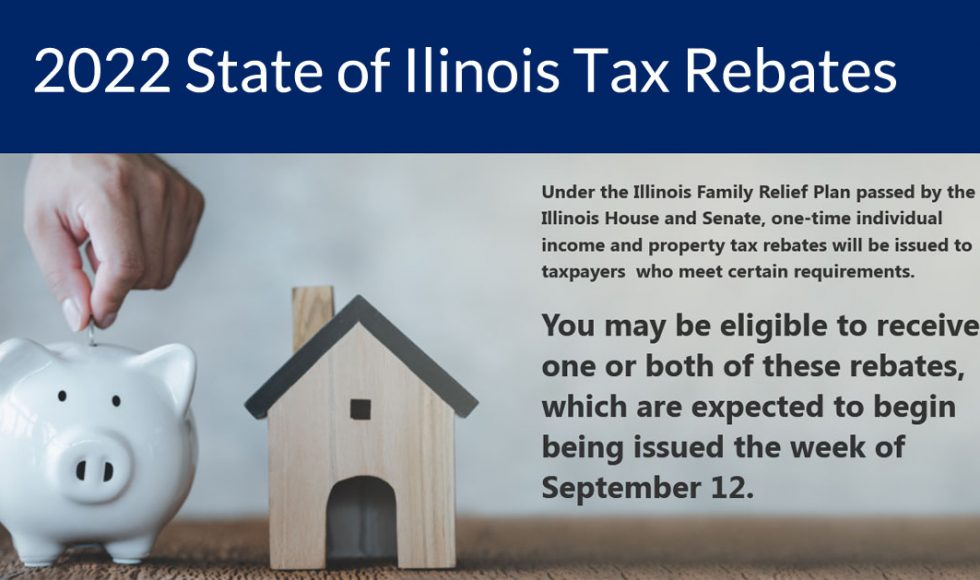

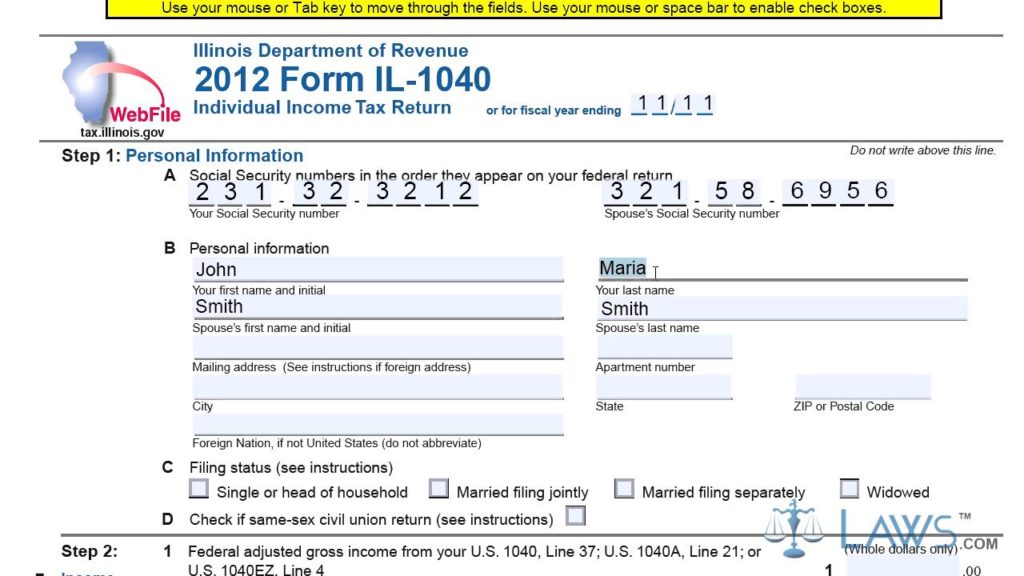

Tax Illinois Gov Rebate Web If filing as a single person your rebate amount is 50 If filing as a couple married filing jointly your rebate amount is 100 50 per person If filing with dependents you will

Web Filing Help for Requesting Individual Income Tax Rebate and Property Tax Rebate By law Monday October 17 2022 was the last day to submit information to receive the Illinois Web 9 sept 2022 nbsp 0183 32 How much is the rebate Taxpayers who filed their tax returns as a single person will be eligible to receive 50 Couples who

Tax Illinois Gov Rebate

Tax Illinois Gov Rebate

https://repsnessil66.com/wp-content/uploads/2022/09/2022-State-Tax-Rebate-Info_1-post.jpg

Retirees Need To Take Action For Latest Property Tax Rebate NPR Illinois

https://npr.brightspotcdn.com/dims4/default/759130d/2147483647/strip/true/crop/758x413+0+0/resize/880x479!/quality/90/?url=http:%2F%2Fnpr-brightspot.s3.amazonaws.com%2Fcf%2F92%2Fc1613a8b4b4ba9b8b28ebd901285%2Ftaxrebate.png

2022 State Of Illinois Tax Rebates EzTaxReturn Blog

https://www.eztaxreturn.com/blog/wp-content/uploads/2022/08/Screenshot-2022-08-29-at-17-11-37-2022-State-of-Illinois-Tax-Rebates.png

Web 27 sept 2022 nbsp 0183 32 Residents with dependents will receive a rebate of up to 300 100 per dependent with a maximum of three Income limits of 200 000 per individual taxpayer Web Tax Rebate Individual Income Tax Rebate How much is the rebate If filing as a single person your rebate amount is 50 If filing as a couple married filing jointly your

Web 30 sept 2022 nbsp 0183 32 Those with an income of 400 000 or less jointly or under 200 000 single will receive a 50 rebate if filing as single or 100 if filing as a couple With Web 8 d 233 c 2022 nbsp 0183 32 The 2022 Illinois property tax rebate is equal to the property tax credit claimed on your 2021 Illinois tax return up to a maximum of 300 To qualify for the

Download Tax Illinois Gov Rebate

More picture related to Tax Illinois Gov Rebate

REMINDER Illinois Tax Rebate Program Filing Due Date Is October 17

https://content.govdelivery.com/attachments/fancy_images/ILDOR/2022/08/6364888/tax-rebates-082922-facebook_original.jpg

Illinois Property Tax Rebate Form 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/Illinois-Property-Tax-Rebate-Form-2023-768x668.jpg

Illinois Tax Rebate Tracker Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/illinois-tax-rebate-2022-cray-kaiser-1.png

Web 12 sept 2022 nbsp 0183 32 Residents with dependents will receive a rebate of up to 300 100 per dependent with a maximum of three Income limits of 200 000 per individual taxpayer Web 17 oct 2022 nbsp 0183 32 The income tax rebate is for Illinois residents who filed individually in 2021 and earned under 200 000 or filed jointly and made under 400 000 To be eligible for the income tax

Web 23 ao 251 t 2022 nbsp 0183 32 If filing jointly 500 000 is the maximum income permitted to receive the property tax rebate while 400 000 is the limit for income tax rebates Single filers can Web 30 juin 2022 nbsp 0183 32 Rebate amounts will vary based on qualification if you made less than 200 000 in 2021 you will see 50 income tax rebate checks automatically issued to

Monday Is Deadline To Submit Additional Paperwork For Illinois Tax

https://dehayf5mhw1h7.cloudfront.net/wp-content/uploads/sites/1690/2022/10/16075416/Form-IL-1040-1024x576.jpg

2022 Illinois Tax Rebates Suzanne Ness State Rep Illinois 66

https://repsnessil66.com/wp-content/uploads/2022/09/2022-IL-Tax-Rebates_post.jpg

https://tax.illinois.gov/content/dam/soi/en/web/tax/program…

Web If filing as a single person your rebate amount is 50 If filing as a couple married filing jointly your rebate amount is 100 50 per person If filing with dependents you will

https://tax.illinois.gov/programs/rebates/rebates-filing-guide.html

Web Filing Help for Requesting Individual Income Tax Rebate and Property Tax Rebate By law Monday October 17 2022 was the last day to submit information to receive the Illinois

Tax Rebate FAQs Rep Thaddeus Jones

Monday Is Deadline To Submit Additional Paperwork For Illinois Tax

Illinois Unemployment 941x Fill Out Sign Online DocHub

2022 State Of Illinois Tax Rebates Scheffel Boyle

Up To 700 For IL Residents How To Get Your Tax Rebate Check WIBQ

Unsure If You ll Receive Illinois Tax Rebate Checks Here s What Steps

Unsure If You ll Receive Illinois Tax Rebate Checks Here s What Steps

Il 1040 Fill Out Sign Online DocHub

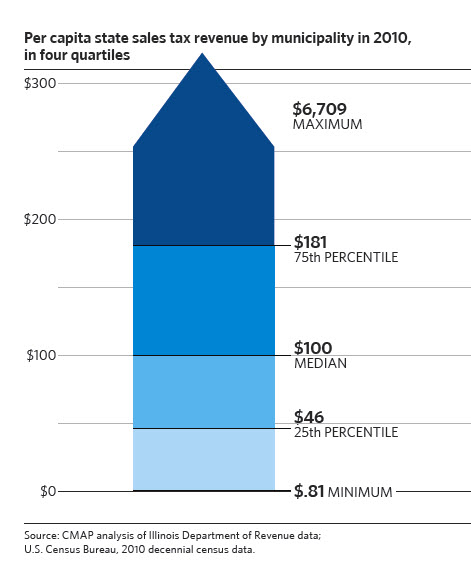

Sales Tax Rebates And Access To Information CMAP

2022 State Of Illinois Tax Rebates Kakenmaster Tax Accounting

Tax Illinois Gov Rebate - Web 8 d 233 c 2022 nbsp 0183 32 The 2022 Illinois property tax rebate is equal to the property tax credit claimed on your 2021 Illinois tax return up to a maximum of 300 To qualify for the