Tax Incentives For Charitable Giving Abstract Many of America s top corporate donors share a common feature the bulk of their giving is in the form of in kind products not cash This phenomenon is

The individual income tax deduction for charitable giving provides a substantial incentive to give by reducing the economic cost of making donation In The report finds that encouragingly that there is a growing global consensus around the need for tax incentives for giving with 77 percent of government offering tax

Tax Incentives For Charitable Giving

Tax Incentives For Charitable Giving

https://butterflies.org/wp-content/uploads/2020/06/taxbenefits-01.png

Tax Incentives Free Of Charge Creative Commons Financial 3 Image

https://pix4free.org/assets/library/2021-04-28/originals/tax_incentives.jpg

Charity Charitable Giving Rises To Record Philanthropy Report Says

https://www.gannett-cdn.com/-mm-/67fef463a39005624a78a2069990821231cf35ec/c=0-125-2045-1280&r=x1683&c=3200x1680/local/-/media/2018/06/12/USATODAY/USATODAY/636643942202141206-GettyImages-515836063.jpg

This article explores a long standing research and policy question on whether tax incentives for charitable giving are desirable from legal and economic The UK has one of the most generous tax environments for giving anywhere in the world something of which we can be justifiably proud and which reflects our long

In this paper we examine a model of inventory choice under uncertainty and demonstrate that enhanced tax deductions not only promote giving they also notably Taxpayers for instance might be allowed to claim charitable deductions greater than 1 or 2 percent of their adjusted gross income regardless of whether they itemize A

Download Tax Incentives For Charitable Giving

More picture related to Tax Incentives For Charitable Giving

Tax Incentives A Guide To Saving Money For U S Small Businesses

https://www.freshbooks.com/wp-content/uploads/2022/04/tax-incentives-examples.jpg

Charitable Giving Gervais Wealth Management

http://static.fmgsuite.com/media/images/27e02f7d-1405-439b-9acb-71126484c59b.png

Charitable Tax Incentives For 2020 Patient Airlift Services

https://palservices.org/wp-content/uploads/elementor/thumbs/Charitable_Contributions-p0jnezqnyoj661i9xgylg1esd7a48dv11ke1w6v9mw.jpg

The individual income tax deduction for charitable giving provides a substantial incentive to give by reducing the economic cost of making a donation In Summary By substantially expanding the standard deduction the Tax Cuts and Jobs Act reduced the incentive to make charitable contributions We make use of

The increase in charitable giving caused by the increase in tax incentives was actu ally smaller than the foregone revenue for the government We also find evidence that the Making charitable donations provides an array of tax benefits Learn about the tax benefits of giving estate planning more with our free guide today

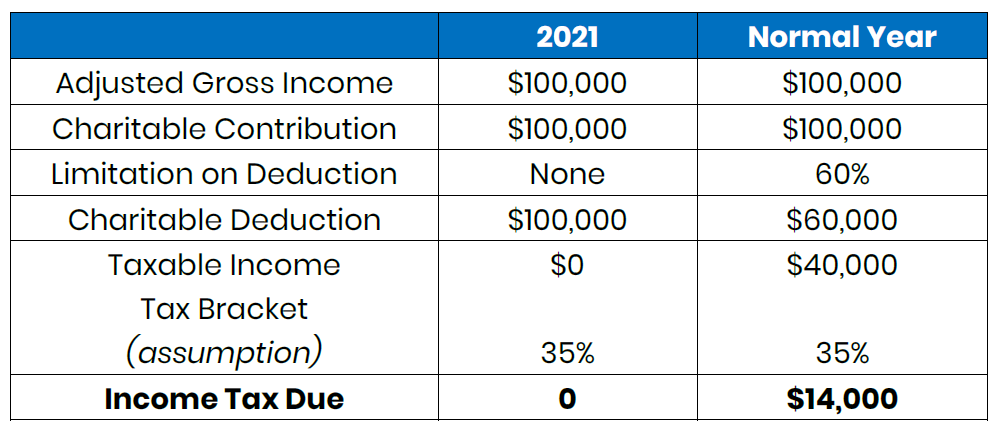

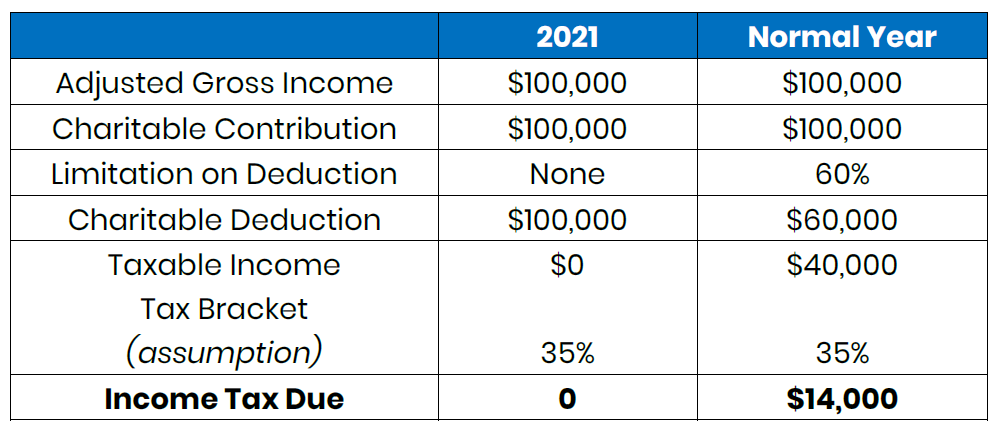

2021 Giving Tax Incentives Judi s House

https://judishouse.org/wp-content/uploads/2021/11/Charitable-Giving-Incentives-2021-Table.png

Tax Tips For Charitable Givers Provident Oak Financial LLC

https://www.providentoakfinancial.com/wp-content/uploads/2021/03/Tax-Tips-Charit-1300x867.png

https://link.springer.com/article/10.1007/s11142-023-09818-0

Abstract Many of America s top corporate donors share a common feature the bulk of their giving is in the form of in kind products not cash This phenomenon is

https://www.taxpolicycenter.org/sites/default/...

The individual income tax deduction for charitable giving provides a substantial incentive to give by reducing the economic cost of making donation In

/tax-deduction-for-charitable-donations-57a5e46a3df78cf459cd2099.jpg)

Charitable Giving Take Advantage Of The Tax Deduction

2021 Giving Tax Incentives Judi s House

Charitable Contributions Guide

Top Strategies For Charitable Giving Financial Planning And Advice Blog

Charitable Tax Deductions By State Tax Foundation

Charitable Giving

Charitable Giving

How Large Are Individual Income tax Incentives For Charitable Giving

5 Effective Charitable Giving Tax Strategies For High Net Worth

Developing Your Estate Plan And Wealth Transfer

Tax Incentives For Charitable Giving - In this paper we examine a model of inventory choice under uncertainty and demonstrate that enhanced tax deductions not only promote giving they also notably